Natural Dyes Market Size USD 18.9B & 9.5% CAGR Outlook

Global Natural Dyes Market Size, Share & Sustainability Analysis By Source (Plant-Based, Animal-Based, Mineral), By Application (Textiles, Food & Beverages, Cosmetics, Pharmaceuticals), By Extraction Method, End Use Industry, Regional Dynamics, Key Players, Green Trends & Forecast 2025–2034

Report Overview

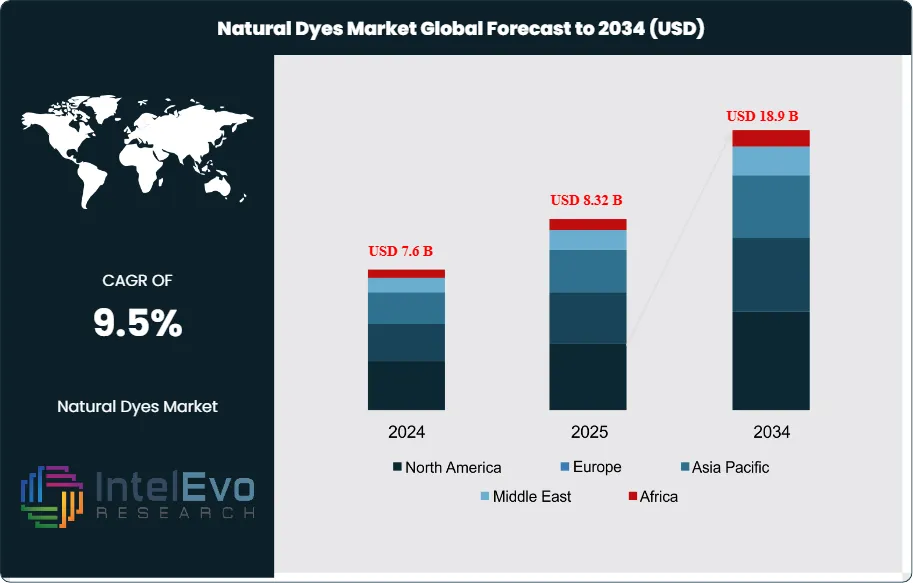

The Natural Dyes Market is estimated at USD 7.6 billion in 2024 and is projected to reach approximately USD 18.9 billion by 2034, registering a CAGR of about 9.5% during 2025–2034. This sustained growth is driven by rising consumer preference for eco-friendly, non-toxic colorants across textiles, food & beverages, cosmetics, and packaging industries. Increasing regulatory pressure against synthetic dyes, combined with brand commitments toward clean-label and sustainable sourcing, is accelerating adoption globally. Additionally, advancements in extraction technologies and improved color fastness are enhancing the commercial viability of natural dyes, positioning the market for steady long-term expansion.

Get More Information about this report -

Request Free Sample ReportThe push for earth-friendly options is changing how companies buy supplies - particularly in textiles, groceries, and beauty products. Consequently, colors made from nature – like those coming from indigo, turmeric, madder, and annatto plants – are becoming more popular because both rules and shoppers dislike artificial chemicals. Right now, indigo-based dyes lead the way, owing to their use in jeans together with lasting color.

Natural dyes largely come from plants - a result of tradition alongside well-established production in places such as India, Peru, and areas of Africa. In 2024, fabrics and leather used more than half of all natural dyes. However, their use expands into foods and beauty items, especially favored by higher-end companies wanting colors that break down easily while being safe for sensitivities. In 2024, North America captures the biggest piece of the sales pie - 35% worldwide - thanks to strict rules about what goes on product labels alongside shoppers wanting simpler ingredients. Yet, the Asia Pacific area is growing at a quicker rate, fueled by strong manufacturing networks, low costs, plus increasing help from governments.

Most natural dye purchases still happen at retail shops, benefiting both customers and smaller businesses. Nevertheless, more companies are now getting dyes directly from farms or via online marketplaces - especially when they need a lot. Getting consistent color plus dealing with when materials are available remains tricky. Getting products onto shelves quickly while keeping colors true is still a big hurdle for widespread use. Because of this, people are putting more money into how things are made - specifically better recipes alongside automated systems. Teams in both South Korea and Germany are experimenting with using living organisms for production together with precise digital adjustments to color, aiming to cut down on wasted materials and ensure consistent results.

Money’s moving toward places offering good work at reasonable prices, especially Vietnam and Indonesia - they’re becoming major production centers as expenses rise everywhere else. What happens next hinges on making textiles greener, following new rules, then creating dyes that are dependable, affordable, yet don’t harm the environment?

Key Takeaways

- Market Growth: The global Natural Dyes Market reached USD 7.6 billion in 2024 and is projected to grow to USD 18.9 billion by 2034, registering a CAGR of 9.5%. Demand is rising due to regulatory pressure on synthetic dyes and increased consumer preference for sustainable materials across textiles, food, and personal care.

- By Source: Plant-based dyes accounted for the largest share in 2024, supported by established supply chains and broad applicability across end-use sectors. Key sources include indigo, turmeric, and madder, widely used in textile and cosmetic manufacturing.

- By Chemical Constitution: Indigoid dyes led the market by chemical class, driven by strong demand from the denim and casual apparel industries. Indigo accounted for a significant portion of global plant-based dye exports in 2024.

- By Application: Textiles and leather remained the primary application, contributing over 60% of total demand. Global apparel brands are shifting procurement toward low-impact dyeing methods to meet ESG targets and reduce wastewater emissions.

- By Distribution Channel: Retail stores captured the largest share of natural dye distribution, especially among small-scale textile producers and artisans. B2B platforms are expanding but remain secondary in terms of volume.

- Driver: Sustainability-led procurement policies and consumer preference for clean-label products are accelerating adoption. Over 18% of new textile product launches in 2025 featured natural dyes or plant-based pigment claims.

- Restraint: High production costs and limited colorfastness restrict mass-market scalability. Natural dyes are priced 30%–45% higher than synthetic alternatives, driven by labor-intensive extraction and raw material seasonality.

- Opportunity: Asia Pacific, led by India and Vietnam, is emerging as a supply and processing hub. The region is expected to grow at over 12% CAGR through 2030, supported by local sourcing, low-cost labor, and rising exports.

- Trend: Biofermentation and AI-based extraction techniques are gaining traction in R&D pipelines. Early pilots in South Korea and the Netherlands show promise in reducing waste and improving batch consistency.

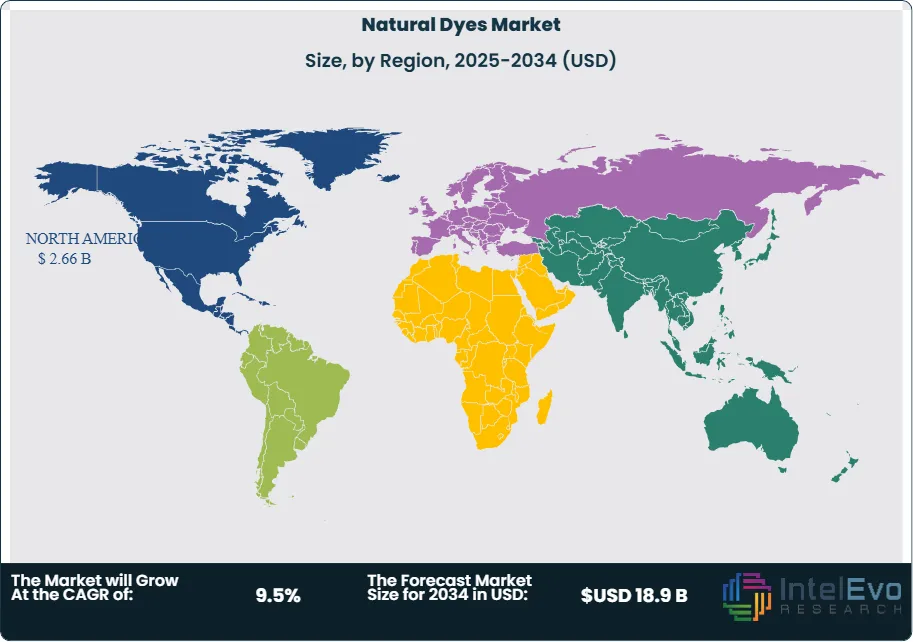

- Regional Analysis: North America held 35% of global revenue in 2024, driven by clean-label trends and strict chemical regulations. Asia Pacific is the fastest-growing region, while Europe remains key for premium, traceable dye applications.

Source Analysis

As of 2025, plant-based sources continue to lead the global natural dyes market, accounting for the majority share across industrial applications. Their dominance is rooted in the widespread use of botanicals like indigo, madder, turmeric, and annatto across the textile, food, and personal care sectors. These sources are favored for their non-toxic properties and alignment with sustainability goals. Improved extraction processes and processing technologies have enhanced pigment quality and production consistency, reinforcing plant-based dyes as the default choice in large-scale natural dyeing.

Animal-derived dyes, though limited in market share, hold cultural and artisanal value. Products such as cochineal and lac are used in traditional textiles and niche cosmetic formulations. Meanwhile, mineral and microbial sources, grouped under the "others" category, are gaining attention in research and specialty applications. However, they currently lag in volume due to limited scalability and higher processing costs.

Distribution Channel Analysis

Retail stores remain the dominant distribution channel in 2025, capturing the largest share of the natural dyes market. This segment benefits from its accessibility, product variety, and ability to serve small-scale manufacturers, designers, and craft-based buyers. In-person retail continues to play a central role in markets where direct product evaluation and customer interaction influence purchasing decisions.

Online platforms are rapidly expanding, supported by the growth of e-commerce and increased interest in sustainable products from global consumers. These channels are particularly important for small dye manufacturers reaching international buyers. Specialty stores serve a niche but loyal segment of the market, offering premium or rare dye varieties to professional users. Alternative channels, including local markets and direct-to-consumer sales, remain relevant in developing regions, although they represent a smaller share overall.

Chemical Constitution Analysis

Indigoid dyes lead the market in 2025, driven by their continued relevance in the textile sector, especially denim. Extracted primarily from indigo plants, these dyes are valued for their deep blue color, natural origin, and long-standing application in commercial fashion. Their stable performance and scalability contribute to their sustained dominance within natural dye classes.

Anthraquinone-based dyes follow closely, offering vibrant red and orange hues, commonly used in apparel and printing. Flavonoids, Alpha Naphthoquinones, and carotenoids have found applications in cosmetics and food, where their antioxidant properties and botanical sources add functional appeal. While some categories such as di-hydropyrans and anthocyanidins remain smaller in market size, they are drawing attention for their color diversity and potential integration into premium product lines.

Application Analysis

Textiles and leather remain the largest application segment, generating more than 60% of total demand for natural dyes in 2025. This is supported by regulatory shifts away from hazardous synthetic dyes and increasing procurement standards across global fashion and home textile brands. Natural dyes now appear in mainstream production lines, particularly in sustainable apparel collections and artisanal leather goods.

The food and beverage sector continues to expand its use of natural dyes, particularly in plant-based and organic product ranges. Carotenoids, anthocyanins, and beet-based pigments are widely adopted for coloring confectionery, dairy, and functional beverages. In cosmetics, the clean label movement has led to increased incorporation of natural pigments in lip care, skin tints, and hair dyes. Pharmaceutical use remains relatively niche but steady, focusing on dyes for tablet coatings and pH indicators. Additional applications, including craft materials and eco-conscious household products, contribute to the long-tail demand across smaller categories.

Regional Analysis

North America held the leading position in 2025, with approximately 35% of the global market share. Regulatory support for sustainable product sourcing, combined with a mature textile and cosmetics industry, has driven strong regional adoption. U.S.-based suppliers and dye processors continue to invest in technology upgrades to meet traceability and performance requirements.

Europe follows closely, contributing around 30% to global revenues. The region benefits from strict environmental compliance frameworks and strong consumer preferences for organic and biodegradable ingredients. Brands operating in Germany, France, and the Nordics are especially active in integrating natural dyes into both food and personal care product lines.

Asia Pacific is the fastest-growing region, with an estimated 25% share in 2025. India and China play dual roles as major suppliers of raw materials and expanding end-use markets. Government-backed initiatives supporting organic textile manufacturing and chemical-free processing are helping accelerate growth. Latin America and the Middle East & Africa remain smaller contributors but are registering steady gains, particularly in textiles, crafts, and plant-based cosmetics driven by local sourcing and regional preferences for natural products.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Source

- Plants

- Animals

- Others

By Distribution Channel

- Retail Stores

- Online Channels

- Specialty Stores

- Others

By Chemical Constitution

- Indigoid Dyes

- Anthraquinone Dyes

- Alpha Naphthoquinones

- Flavonoids

- Di-Hydropyrans

- Anthocyanidins

- Carotenoids

By Application

- Textiles & Leather

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 7.6 B |

| Forecast Revenue (2034) | USD 18.9 B |

| CAGR (2024-2034) | 9.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Source (Plants, Animals, Others), By Distribution Channel (Retail Stores, Online Channels, Specialty Stores, Others), By Chemical Constitution (Indigoid Dyes, Anthraquinone Dyes, Alpha Naphthoquinones, Flavonoids, Di-Hydropyrans, Anthocyanidins, Carotenoids), By Application (Textiles & Leather, Food and Beverages, Cosmetics, Pharmaceuticals, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | BASF SE, DSM N.V., Archroma, Abbey Color Incorporated, Stony Creek Colors, AMA Herbal Group, GNT Group, Aura Herbal Textiles, Maiwa, NIG GmbH, Givaudan, Dohler GmbH, Couleurs DE Plantes |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date