Nephrostomy Bags Market Size 2024–2034 | CAGR 6.3%

Global Nephrostomy Bags Market Size, Share & Medical Devices Analysis By Product Type, By Material, By Usage (Short-Term, Long-Term), By End User (Hospitals, Homecare), Urology Trends, Regional Healthcare Demand & Forecast 2025–2034

Report Overview

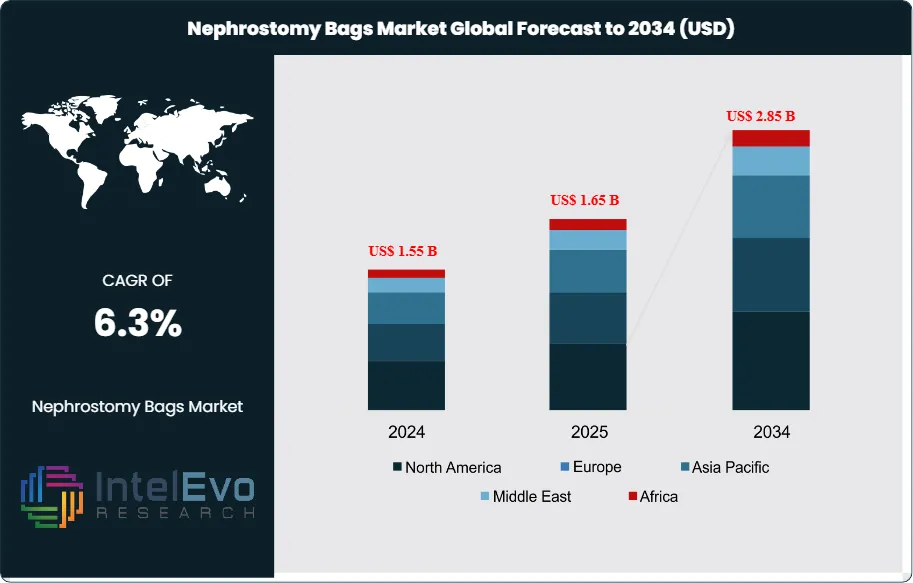

The Nephrostomy Bags Market is estimated at US$ 1.55 billion in 2024 and is projected to reach approximately US$ 2.85 billion by 2034, registering a CAGR of about 6.3% during 2025–2034. Growth is driven by the rising prevalence of chronic kidney disease, urological cancers, and obstructive uropathy, alongside increasing volumes of minimally invasive nephrostomy procedures. Expanding geriatric populations, longer post-operative care durations, and growing adoption of home healthcare are sustaining recurring demand for drainage accessories. In addition, product innovations focused on anti-reflux valves, improved patient comfort, and infection control are enhancing replacement cycles and supporting steady market expansion over the forecast period.

Get More Information about this report -

Request Free Sample ReportSteady procedure volumes in urology and oncology, an older patient base, and longer survival with chronic disease keep demand stable. The market expanded at an estimated 3 to 4% annually from 2019 to 2023; hospitals normalized purchasing after pandemic-era deferrals and home care gained share. You should plan for incremental unit growth and modest price uplift tied to premium features.

Prevalence trends support uptake. About 10% of adults globally live with chronic kidney disease; in the United States more than 37 million adults have CKD. Diabetes and hypertension drive obstruction and infection risk; the global diabetes population exceeded 500 million adults in 2021 and continues to rise. Stone disease remains common; roughly 1 in 10 people in the United States will form a kidney stone in their lifetime. Infection control is central to product selection. The CDC’s National Healthcare Safety Network reports urinary tract infections account for about 32% of all healthcare-associated infections in U.S. hospitals, many linked to catheter use including nephrostomy tubes.

Manufacturers differentiate on comfort and safety. Anti-reflux valves, odour filtration, kink-resistant tubing, soft backings, and skin-friendly adhesives raise adherence in home settings. Antimicrobial coatings and closed-system connectors reduce manipulation. Material shifts to PVC-free and DEHP-free designs are underway to meet hospital sustainability goals. In hospitals, digital purchasing and barcoding support lot traceability; in critical care, connected urine output monitors interface with standard drainage systems to log volumes in electronic records.

Regulatory and cost factors shape supply. Products are typically Class II devices in the United States cleared via 510(k); in Europe, MDR tightening increases documentation costs. Ethylene oxide sterilization limits and emissions controls can strain throughput. Public tenders compress pricing; reimbursement caps limit premium mix in some markets. Complications such as leakage, skin breakdown, and infection remain practical risks.

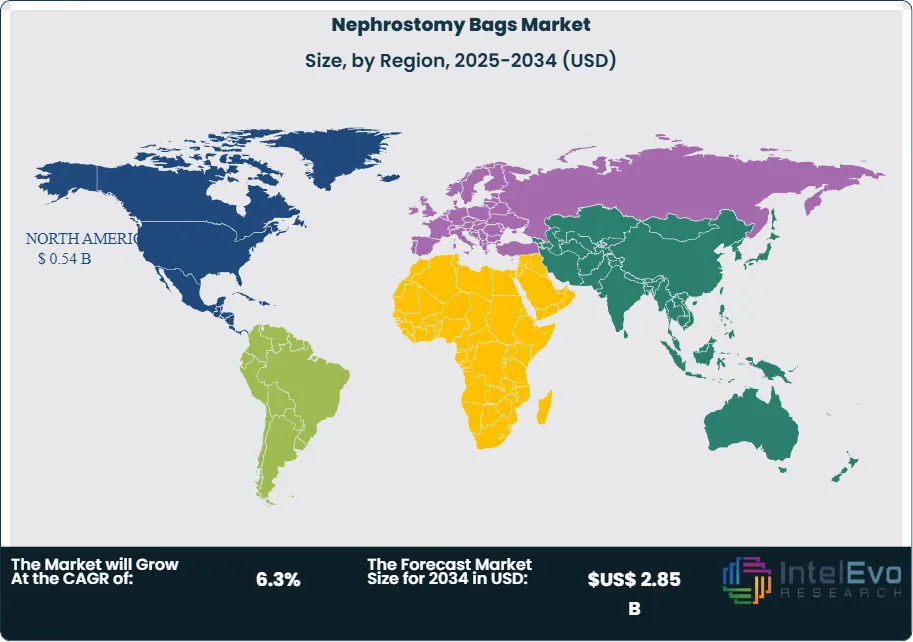

North America leads with an estimated 35% revenue share, supported by high procedure rates and broad reimbursement. Western Europe follows at about 28%. Asia Pacific is the fastest growing at roughly 5 to 6% CAGR, with China and India expanding urology capacity and home care distribution. Watch investment in outpatient urology centers, home health channels, and PVC-free product lines if you target above-market growth.

Key Takeaways

- Market Growth: The market reached US$ 1.55 billion in 2024 and will rise to US$ 2.85 billion by 2034 at 6.3% CAGR. Growth tracks CKD prevalence, aging populations, diabetes and stone procedures, and the shift to home care.

- Sterility: Sterile bags held 85.02% revenue share in 2024. Hospital protocols and infection reduction targets keep sterile use the default in acute and post-acute settings.

- End Use: Hospitals and clinics accounted for 56.22% of revenue in 2024. Centralized purchasing, reimbursement coverage, and higher procedure volumes sustain this lead.

- Driver: CKD affects about 10% of adults globally and over 37 million adults in the United States. The CDC’s network reports UTIs make up 32% of hospital-acquired infections, reinforcing demand for anti-reflux, closed systems, and sterile disposables.

- Restraint: Public tenders and GPO contracts compress average selling prices by 5–10%. EU MDR documentation and ethylene oxide sterilization limits increase compliance costs and lengthen release cycles.

- Opportunity: Asia Pacific is set to grow at 5–6% CAGR through 2034, adding an estimated USD 150–180 million. You can target China and India outpatient urology centers and home health distributors for above-market gains.

- Trend: Disposables dominate at 78.12% share, while 500–1000 ml bags lead capacity with 55.55%. Vendors are scaling antimicrobial coatings, anti-reflux valves, and connected urine output monitoring; BD, Teleflex, Smiths Medical, Coloplast, ConvaTec, and B. Braun expanded portfolios and 510(k) clearances.

- Regional Analysis: North America leads with about 35% revenue share; Western Europe follows at roughly 28%. Asia Pacific is the fastest growing; Latin America and the Middle East and Africa expand with tender-backed procurement and rising urology capacity.

Type Analysis

Sterile systems remain the default standard in 2025. They accounted for an estimated 85–86% of global revenue, up marginally from 85.02% in 2024. Hospitals and payers tie purchasing to infection control metrics; you see sterile-only protocols across perioperative and post-acute pathways. The CDC reports urinary tract infections comprise about 32% of hospital-acquired infections in the United States. That keeps sterile collections embedded in order sets for nephrostomy tube care.

Non-sterile products retain a role in low-risk exchanges and select home settings, but their share continues to narrow. Aging demographics and higher stone and oncology caseloads shift volume to sterile kits with anti-reflux valves and closed connectors. Vendors such as BD, Coloplast, ConvaTec, Teleflex, B. Braun, and Hollister emphasize sterile configurations with barcoded components for traceability.

Usage Analysis

Disposable bags lead with an estimated 78–79% share in 2025 versus 78.12% in 2024. They lower cross-contamination risk, reduce handling, and remove reprocessing costs. Purchasing data in tenders shows single-use products win on total cost where labor, utilities, and validation for sterilization add 20–30 minutes per cycle per item. This aligns with infection prevention targets in high-volume centers.

Reusable systems serve long-term users in constrained budgets and select homecare programs. Silicone-based designs extend life, but adherence hinges on training and cleaning compliance. Where group purchasing contracts squeeze average selling prices by 5–10%, disposables still hold the economic edge for short stays and transitions to home.

Capacity Analysis

The 500–1000 ml range remains the most utilized configuration with about 55–56% share in 2025, matching 55.55% in 2024. It balances mobility and dwell time; fewer emptying events improve caregiver efficiency. Typical urine output targets of 0.5–1.0 ml per kg per hour translate to 840–1680 ml per day for a 70 kg adult. That makes mid-capacity bags suitable for most ward and home scenarios.

Bags of 100–500 ml support ambulatory patients and short ambulatory procedures. Above 1000 ml suits overnight use, high-output states, and limited mobility. Providers standardize on mixed inventories to match acuity and mobility, but mid-capacity SKUs anchor formularies due to broad clinical fit.

Material Analysis

PVC and PU-based bags retain the largest material share at about 45% in 2025, in line with 45.15% in 2024. These polymers deliver clarity, weld strength, and reliable seals for single-use applications. Hospitals still procure PVC for price and performance, while shifting to DEHP-free formulations to meet internal safety policies.

Silicone gains incremental share on biocompatibility and softness, especially in reusable lines and premium disposables. Sustainability programs in Europe and parts of North America encourage PVC-free alternatives; you should expect silicone and TPE variants to add 150–200 basis points of mix by 2030. Supply chains continue to adjust to sterilization capacity limits and emissions rules for ethylene oxide, which influence material and packaging choices.

End-User Analysis

Hospitals and clinics accounted for roughly 56–57% of revenue in 2025, consistent with 56.22% in 2024. Higher procedure volumes, centralized procurement, and reimbursement coverage sustain their lead. Acute settings prefer sterile, disposable systems to meet audit requirements and reduce device-associated infection rates.

Homecare is the fastest-growing end-user channel as health systems expand hospital-at-home and post-acute programs. You see rising demand for discreet designs, skin-friendly adhesives, and secure connectors to cut leakage events. Ambulatory surgical centers add share in the United States as payers shift appropriate urology cases to outpatient sites, improving throughput with single-use kits.

Regional Analysis

North America holds the top revenue position at about 35% in 2025, supported by high CKD prevalence, strong reimbursement, and broad access to urology services. The United States reports kidney stone prevalence near 8.8% in adults, or about 1 in 11, and over 600,000 new stone cases annually. These clinical loads support steady device utilization in inpatient and outpatient settings.

Western Europe follows at roughly 27–28% with stable replacement demand and strict procurement tied to MDR documentation. Asia Pacific is the fastest-growing region with a projected 5–6% CAGR through 2030. China and India expand urology capacity and home health distribution, adding meaningful volumes in tier 2 and tier 3 cities. Latin America and the Middle East and Africa grow from a lower base through public tenders and private hospital investments; price sensitivity favors PVC-based disposables, while leading private chains pilot PVC-free lines to meet sustainability goals.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Type

- Sterile

- Non-sterile

Usage

- Disposable

- Reusable

Capacity

- 100-500 ml

- 500-1000 ml

- Above 1000 ml

Material

- PVC and PU

- Silicone

- Others

End-User

- Hospitals & Clinics

- Homecare

- Ambulatory Surgical Centers

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | US$ 1.55 B |

| Forecast Revenue (2034) | US$ 2.85 B |

| CAGR (2024-2034) | 6.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Sterile, Non-sterile), Usage (Disposable, Reusable), Capacity (100-500 ml, 500-1000 ml, Above 1000 ml), Material (PVC and PU, Silicone, Others), End-User (Hospitals & Clinics, Homecare, Ambulatory Surgical Centers, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Urocare Products, Inc., Teleflex Incorporated, TERUMO Corporation, Cardinal Health, Inc., Merit Medical, Coloplast A/S, Becton, Dickinson and Company, Remington Medical, B. Braun SE, UreSil, LLC |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date