Northern Lights Tourism Market Size USD 2.37B & 9.8% CAGR

Global Northern Lights Tourism Market Size, Share & Experiential Travel Analysis By Destination (Norway, Iceland, Finland, Canada), By Travel Type (Luxury, Budget, Adventure), Seasonal Demand Trends, Climate Impact, Tour Operators, Digital Booking Trends & Forecast 2025–2034

Report Overview

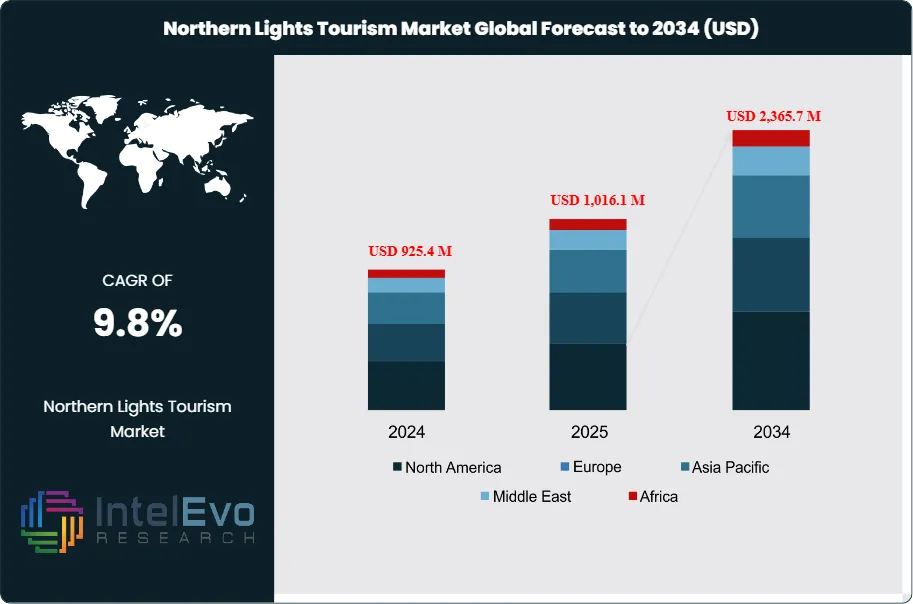

The Northern Lights Tourism Market is estimated at USD 925.4 million in 2024 and is projected to reach approximately USD 2,365.7 million by 2034, registering a CAGR of about 9.8% during 2025–2034. Growth is being fueled by rising demand for premium, experience-led travel, and increased winter air connectivity to Arctic destinations, and higher conversion rates driven by aurora forecasting technologies. Multi-night packages, glass igloos, and guarantee-backed itineraries are lifting average daily rates, while sustainability-focused infrastructure and electrified transport are expanding capacity in regulated regions. Together, these dynamics position Northern Lights tourism as one of the fastest-growing niche segments within global experiential travel.

Get More Information about this report -

Request Free Sample ReportThe market has expanded as high-latitude destinations package aurora viewing with winter activities, local culture, and distinctive lodging. Demand rebounded after 2021 and now benefits from longer booking windows and higher average trip values in premium segments. Search and booking data point to strong intent; Finland recorded a 197% surge in hotel searches for Northern Lights trips in 2023 versus 2022, while interest in Finnish Lapland rose 328% in 2023. Northern Norway welcomed 320,000 international winter visitors in the 2022–2023 season, supported by improved air links to Tromsø and Alta.

You see clear demand-side drivers. Affluent travelers seek rare natural spectacles; social media amplifies aurora content; bundled itineraries reduce perceived risk of clouded nights. Supply-side factors also help. Operators have added glass igloos, panoramic cabins, and remote lodges; airlines have increased seasonal capacity to Lapland, Iceland, and Arctic Norway. Technology improves trip success rates. Real-time Kp index alerts, AI-driven cloud cover forecasts, and sky cameras help guides move guests to clearer locations; VR and AR previews shape expectations and conversions.

Challenges remain. Weather volatility and seasonality create booking risk; short winter daylight hours constrain excursions; fragile Arctic ecosystems face overtourism pressure. You must manage carrying capacity, energy use, and waste in cold regions; regulators are raising the bar. Finland has introduced grants for sustainable tourism; operators are rolling out electric snowmobiles, dark-sky lighting, and carbon-offset options. Insurance costs and labor shortages in remote areas add pressure; currency swings affect long-haul demand from Asia and North America.

Regional hotspots lead the next wave of investment. Finnish Lapland, Northern Norway, and Iceland anchor the market; Canada’s Yukon and Northwest Territories show rising interest, with 71% of Canadian travelers expressing a desire to see the aurora. Investors should prioritize year-round revenue models through shoulder-season nature and culture products; focus on grid-tied heating, low-emission transport, and certified guides; and use data-led allocation to raise first-night sighting rates. These moves lift occupancy, protect margins, and support durable growth at a near-10% pace through 2034.

Key Takeaways

- Market Growth: The Northern Lights Tourism Market will expand from USD 925.4 million in 2024 to USD 2,365.7 million by 2034 at a 9.8% CAGR. You can expect momentum from premium experiential travel, improved Arctic air links, and data-led trip planning.

- Traveler Type: Couples led with a 48.6% share in 2023, driven by demand for private guides, glass igloos, and multi-night packages. This cohort sustains higher spend and longer stays.

- Age Group: The 18–34 segment held 32% of demand in 2023. Social media discovery and night photography tours convert this cohort effectively across budget and premium tiers.

- Driver: Search intent surged in core markets; Finland recorded a 197% jump in hotel searches for aurora trips in 2023 versus 2022, and interest in Finnish Lapland rose 328%. Northern Norway welcomed 320,000 international winter visitors in 2022–2023, signaling strong inbound demand.

- Restraint: Weather dependency and short winter daylight reduce utilization; first-night sighting odds often sit near 30–40%, rising to 70–80% over three nights. Weather-related tour cancellations can reach 15–20% in shoulder months, which pressures margins and refunds.

- Opportunity: Premium infrastructure in Lapland, Iceland, and Arctic Norway, including glass igloos and remote lodges, lifts yield; operators report 15–25% higher ADR versus standard stays. Canada’s Yukon and Northwest Territories are emerging targets, supported by 71% of Canadians expressing a desire to see the aurora.

- Trend: Operators deploy real-time Kp alerts, AI-based cloud cover forecasts, and all-sky cameras to improve hit rates; VR and AR previews aid conversions. Early adopters report higher guest satisfaction and fewer rebookings on three-night packages.

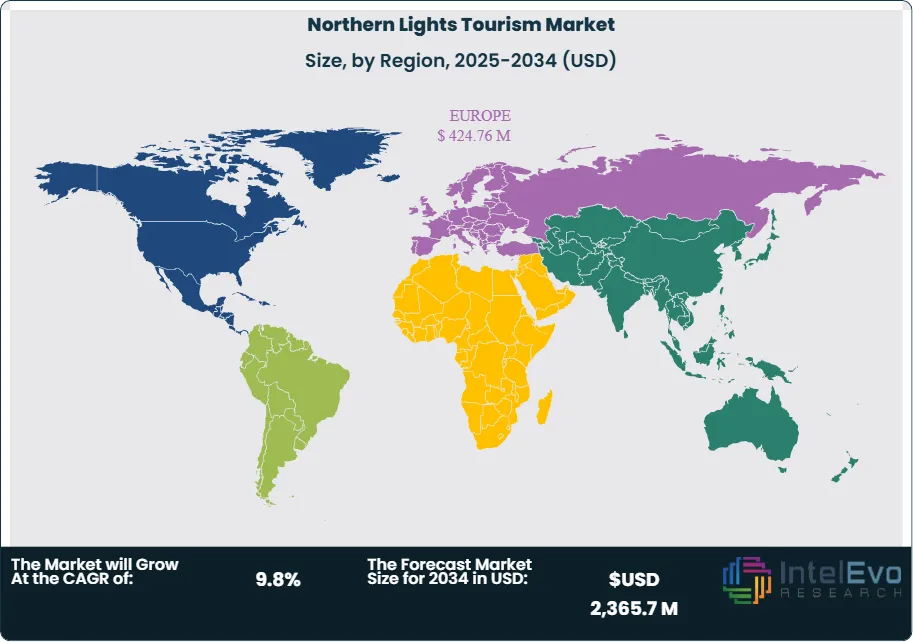

- Regional Analysis: Europe led with a 45.9% share in 2023, or about USD 409.5 million, anchored by Finland, Norway, Sweden, and Iceland; growth in Europe is expected near 8–9% CAGR. North America is set to outpace at an estimated 10–11% CAGR through 2033, with Asia Pacific outbound travel adding upside as direct winter flights expand.

Traveler Type Analysis

Couples remained the largest traveler cohort in 2023 with a 48.6% share and are set to hold the lead through 2025 as premium, privacy-focused itineraries gain traction. You see consistent demand for glass igloos, panoramic cabins, and private guiding, which lifts average daily rates by 15–25% versus standard stays. Multi-night packages dominate; operators market three- and four-night stays to raise sighting odds and stabilize margins.

Friends groups continue to expand on the back of shared experiences and photography-led tours. Families show steady uptake, supported by educational content, safer transport, and flexible evening schedules. Solo travel remains a niche but resilient segment; clear safety standards, small-group departures, and hostel-to-lodge combinations help conversion. The addressable base is growing as intent signals rise; Finland recorded a 197% jump in hotel searches for Northern Lights trips in 2023 versus 2022 and interest in Finnish Lapland rose 328%.

Age Group Analysis

Travelers aged 18–34 led with a 32% share in 2023 and will continue to shape demand in 2025. Social media discovery and night photography drive bookings; mobile-first funnels, dynamic pricing, and deposit plans improve conversion for this cohort. AI-powered cloud cover forecasts, Kp alerts, and all-sky cameras help guides reposition guests in real time, which sustains satisfaction and reviews.

The 35–49 segment follows with strong spend and preference for bundled culture and nature content. The 50–64 group values comfort and reliability; three-night packages typically lift cumulative sighting probability from 30–40% on night one to 70–80% across the stay. Travelers 65+ remain smaller in share but show clear intent when accessibility, heated viewing shelters, and shorter transfers are guaranteed. You should tailor pacing, gear, and briefing formats by cohort to raise attach rates on excursions and photography add-ons.

Regional Analysis

Europe holds the lead with a 45.9% share, or about USD 409.5 million in 2023, anchored by Finland, Norway, Sweden, and Iceland. The region benefits from prime latitudes, reliable air access, and purpose-built lodging; Northern Norway hosted about 320,000 international winter visitors in the 2022–2023 season. Finland’s search interest remains elevated into the 2024–2025 season, reinforcing a strong pipeline for Lapland.

North America is robust and rising, centered on Canada’s Yukon and Northwest Territories and Alaska. Demand is broad-based; 71% of Canadian travelers express a desire to see the aurora. Infrastructure upgrades, winter flight capacity, and certified guiding support growth through 2025.

Asia Pacific contributes on two fronts. Japan’s Hokkaido offers regional product during peak months, while outbound travel from China, South Korea, and Australia fuels Europe and North America. The Middle East and Africa and Latin America are smaller today; growth comes from outbound premium segments as operators add aurora packages to Arctic itineraries. You should watch corridors where new winter charters and visa streamlining shorten total journey time.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Traveler Type

- Couple

- Friends

- Family

- Solo

By Age Group

- 18-34 Years

- 35-49 Years

- 50-64 Years

- 65+ Years

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 925.4 M |

| Forecast Revenue (2034) | USD 2,365.7 M |

| CAGR (2024-2034) | 9.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Traveler Type (Couple, Friends, Family, Solo), By Age Group (18-34 Years, 35-49 Years, 50-64 Years, 65+ Years) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Intrepid Travels, Scott Dunn, Hurtigruten Expeditions, The Aurora Zone, Butterfield & Robinson Inc., Quark Expeditions, Abercrombie & Kent, Lindblad Expeditions, Travel Edge, Exodus Travels |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Northern Lights Tourism Market

Published Date : 25 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date