Onion Salt Market Size, Share & Growth Forecast 2025–2034

Global Onion Salt Market Size, Share & Industry Analysis by Type (Organic, Conventional), by Packaging (Jars, Bottles, Bulk Packaging, Pouches, Others), by Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C, Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Retail), by End User (Household, HoReCa, Food Processing), Regional Outlook & Key Players – Market Dynamics, Supply Chain Analysis, Competitive Landscape, Emerging Trends and Forecast, 2025–2034

Report Overview

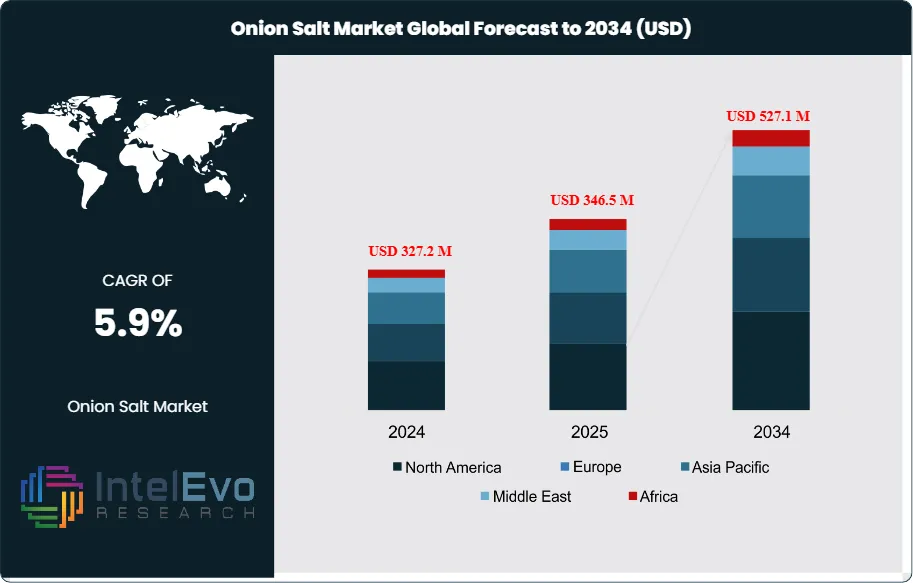

The Onion Salt Market is estimated at USD 327.2 million in 2024 and is on track to reach roughly USD 527.1 million by 2034, implying a compound annual growth rate of 5.9% over 2025–2034. This steady expansion reflects the rising demand for convenient, ready-to-use seasonings that align with evolving consumer food habits and the growing packaged food sector worldwide. Onion salt, a blend of dried onion and table salt, has become a staple in both household and commercial kitchens. Its ability to deliver consistent flavor without preparation has positioned it as a preferred ingredient across meats, snacks, soups, sauces, and ready-to-eat meals. Historically, demand was concentrated in developed markets, but recent years have seen strong uptake in emerging economies where urbanization and rising disposable incomes are reshaping dietary patterns. The market has grown from a niche seasoning category into a mainstream flavor enhancer, supported by the global shift toward convenience-driven consumption.

Get More Information about this report -

Request Free Sample ReportSeveral demand-side factors are driving growth. Consumers are increasingly seeking natural flavoring agents that reduce reliance on artificial additives. Onion salt meets this need by offering a versatile, plant-based seasoning that enhances taste without complexity. The surge in home cooking during and after the COVID-19 pandemic further accelerated adoption, with online recipe sharing and digital food communities reinforcing its popularity. On the supply side, manufacturers are expanding product formats, including powdered, granulated, and coarse blends, to serve retail, foodservice, and industrial channels. However, risks such as fluctuating raw material prices, supply chain disruptions, and regulatory scrutiny on sodium content remain key challenges for producers.

Technology is also shaping the market. Advances in food processing and packaging are extending shelf life and improving product consistency. Automation in blending and distribution is enabling producers to scale efficiently, while digital retail platforms are expanding consumer access to branded and private-label offerings.

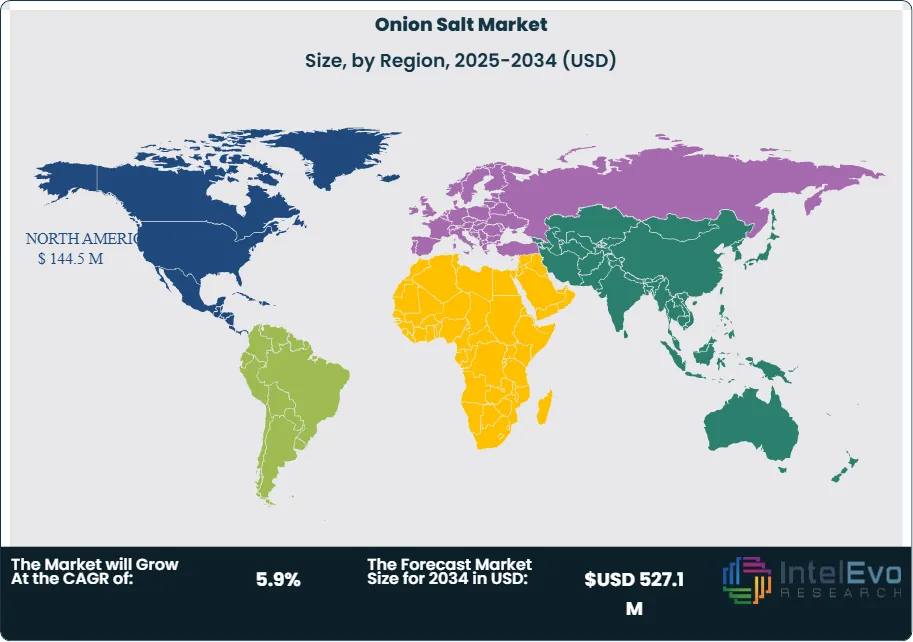

Regionally, North America accounted for 44.6% of global sales in 2024, supported by strong demand from retail and foodservice sectors. Europe follows closely, driven by established packaged food industries and consumer preference for seasoning blends. Asia-Pacific is emerging as the fastest-growing region, with rising urban populations and expanding modern retail infrastructure creating new opportunities. For investors, growth hotspots lie in Asia-Pacific and Latin America, where rising middle-class consumption and foodservice expansion are expected to sustain long-term demand.

Key Takeaways

- Market Growth: The global onion salt market was valued at USD 327.2 million in 2024 and is projected to reach USD 527.1 million by 2034, expanding at a CAGR of 5.9% from 2025 to 2034. Growth is supported by rising demand for convenient seasonings and the expansion of packaged food consumption worldwide.

- Product Type: Conventional onion salt accounted for 73.4% of total sales in 2024, reflecting its cost advantage and wide availability compared with organic variants.

- Packaging: Bulk packaging captured 33.6% of global share in 2024, driven by strong uptake in foodservice and industrial applications where large-volume procurement reduces unit costs.

- Distribution Channel: Indirect sales through B2C channels represented 67.3% of global distribution in 2024, highlighting the importance of supermarkets, hypermarkets, and online retail in reaching household consumers.

- End Use: Household consumption contributed 43.3% of market revenue in 2024, supported by the rise of home cooking and recipe sharing platforms that encourage seasoning use.

- Driver: Increasing consumer preference for natural flavor enhancers in processed and ready-to-eat foods is a key growth driver. Onion salt provides a clean-label alternative to artificial additives, aligning with global demand for transparent ingredient lists.

- Restraint: High sodium content remains a regulatory and health concern. Stricter labeling requirements and consumer awareness of salt intake could limit adoption, particularly in developed markets where sodium reduction initiatives are advancing.

- Opportunity: Asia-Pacific presents the strongest growth potential, with rising urban populations and expanding modern retail channels expected to deliver double-digit gains in onion salt consumption over the forecast period.

- Trend: Food manufacturers are diversifying product formats, including granulated and coarse blends, to cater to both retail and industrial buyers. Digital retail platforms are accelerating brand visibility and consumer access, reshaping competitive dynamics.

- Regional Analysis: North America generated USD 144.5 million in 2024, accounting for 44.6% of global revenue, supported by strong retail and foodservice demand. Asia-Pacific is projected to record the fastest CAGR through 2034, driven by changing dietary habits and growing packaged food penetration.

Type Analysis

As of 2025, conventional onion salt continues to dominate the global market, accounting for more than 72% of total sales. Its strong position reflects widespread consumer familiarity, cost efficiency, and consistent availability across both retail and industrial supply chains. Conventional variants remain the preferred choice for households, restaurants, and large-scale food processors due to their stable flavor profile and extended shelf life.

The segment’s resilience is further supported by its integration into packaged foods, savory snacks, and instant meal categories, where manufacturers prioritize affordability and uniformity in taste. In price-sensitive regions, conventional onion salt maintains a clear advantage over organic alternatives, which often carry higher certification and production costs. Established sourcing channels and standardized production practices also ensure that conventional products can meet rising demand at competitive price points.

Looking ahead, the conventional category is expected to retain its leadership through 2034, supported by scale efficiencies and broad consumer acceptance. However, organic onion salt is projected to gain incremental traction, particularly in North America and Europe, where clean-label and natural ingredient claims are becoming more influential in purchasing decisions.

Packaging Analysis

Bulk packaging represented 33.6% of global onion salt sales in 2024 and remains the leading format in 2025. This dominance is driven by strong demand from foodservice operators, catering businesses, and industrial buyers who require large volumes for consistent use in high-capacity kitchens and automated production lines. Bulk formats deliver cost savings through reduced per-unit pricing and lower packaging waste, making them highly attractive for commercial applications.

The segment’s strength also lies in its compatibility with distribution networks that prioritize efficiency. Warehousing and redistribution centers prefer bulk packaging for streamlined handling, while snack manufacturers and spice blenders rely on it to maintain ingredient standardization. As global food processing expands, bulk packaging is expected to remain a critical enabler of scale and operational efficiency.

Although bulk formats dominate, smaller retail-oriented packaging such as jars, bottles, and pouches are gaining traction in B2C channels. These formats cater to households seeking convenience and portion control, while premium packaging designs are increasingly used to differentiate organic and specialty blends.

Distribution Channel Analysis

Indirect sales through B2C channels accounted for 67.3% of global onion salt distribution in 2024 and remain the primary route to market in 2025. Supermarkets, hypermarkets, and grocery stores continue to drive household purchases, supported by strong product visibility and consumer trust in established retail outlets. Online platforms are also expanding their role, particularly in urban markets where digital grocery adoption is accelerating.

The strength of indirect sales reflects consumer preference for convenient spice purchases during routine shopping trips. Retailers are reinforcing this trend by offering onion salt in multiple formats and price points, often supported by recipe-based marketing and promotional campaigns. E-commerce platforms further enhance accessibility, enabling manufacturers to reach new demographics and expand beyond traditional retail boundaries.

Direct sales, while smaller in share, remain important for B2B clients such as food processors and institutional buyers. This channel is expected to grow steadily as manufacturers strengthen partnerships with industrial clients seeking consistent, large-volume supply.

End-Use Analysis

Households accounted for 43.3% of onion salt consumption in 2024 and remain the largest end-use segment in 2025. The product’s convenience, versatility, and ability to enhance flavor without preparation have made it a pantry essential for urban consumers. Rising interest in home cooking, coupled with time-saving needs, continues to support household adoption across both developed and emerging markets.

The HoReCa (hotels, restaurants, and catering) sector represents another significant demand driver, with onion salt widely used in quick-service restaurants and institutional kitchens. Its role in standardizing flavor across large-scale meal preparation ensures consistent demand from this segment. Food processing companies also represent a growing end-user base, incorporating onion salt into packaged snacks, sauces, and ready-to-eat meals to meet consumer expectations for flavor consistency.

Over the forecast period, household consumption will remain the anchor of market demand, while foodservice and industrial applications are expected to expand at a faster pace, supported by rising global consumption of processed and convenience foods.

Regional Analysis

North America led the global onion salt market in 2024 with a 44.6% share, valued at USD 144.5 million, and continues to hold its leadership in 2025. Strong demand from households and foodservice operators, combined with mature retail infrastructure, underpins the region’s dominance. The United States remains the largest contributor, supported by high per-capita consumption of packaged and convenience foods.

Europe maintains steady growth, with demand concentrated in markets such as Germany, the UK, and France, where spice blends are integral to daily cooking. Organic onion salt is gaining traction in this region, reflecting consumer preference for natural and clean-label products. Asia Pacific, however, is emerging as the fastest-growing region, supported by rapid urbanization, rising disposable incomes, and expanding modern retail networks in countries such as India and China.

Latin America and the Middle East & Africa are showing gradual adoption, primarily in processed food and snack applications. These regions remain price-sensitive, favoring conventional onion salt over premium variants. While North America will continue to generate the highest revenue, Asia Pacific is expected to record the strongest CAGR through 2034, making it a key growth hotspot for investors and manufacturers.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Organic

- Conventional

By Packaging

- Jars

- Bottles

- Bulk Packaging

- Pouches

- Others

By Distribution Channel

- Direct Sales/B2B

- Indirect Sales/B2C

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By End-user

- Household

- HoReCa

- Food Processing

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 327.2 M |

| Forecast Revenue (2034) | USD 527.1 M |

| CAGR (2024-2034) | 5.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Organic, Conventional), By Packaging (Jars, Bottles, Bulk Packaging, Pouches, Others), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C, Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail), By End-user (Household, HoReCa, Food Processing) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | San Francisco Salt Company, Badia Spices, Mars, Incorporated, Hoyts Food Manufacturing Industries Pty Ltd, Aloha Spice Company, McCormick & Company, Inc., Woodland Foods, Schwartz, Redmond Life, The Kroger Co., Starlight Herb & Spice Company, B&G Foods, Inc., Aum Agri Freeze Foods, Tantara Farms, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date