Online Dating Market Size, Share & Forecast | 8.00% CAGR

Global Online Dating Market Size, Share & Analysis By Platform Type (Mobile Apps, Websites, Social Media), By Subscription Model (Free, Freemium, Paid, By User, Younger Adults, Older Adults), By Service Features (Video Dating, Chat Services, Matching Algorithms), Industry Outlook, Monetization Trends & Forecast 2025–2034

Report Overview

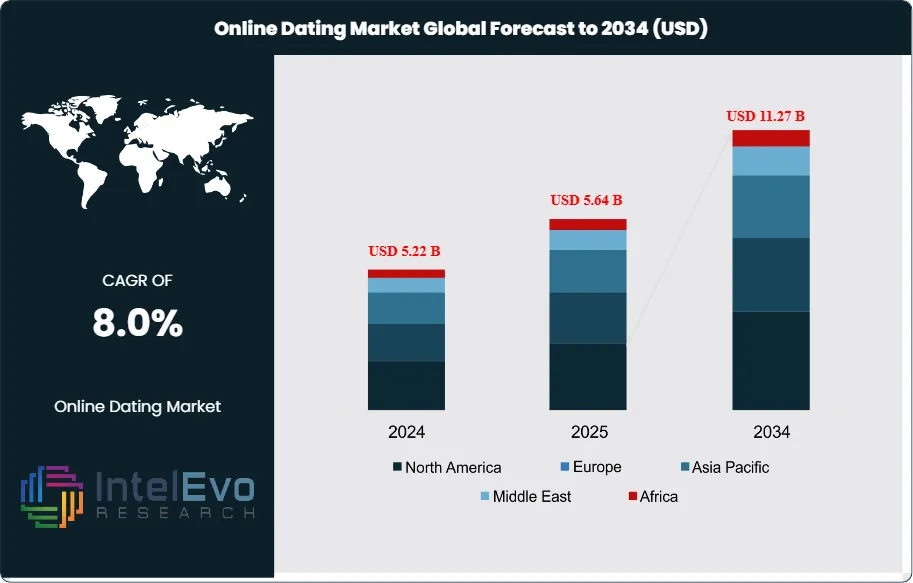

The Online Dating Services Market is estimated at USD 5.64 billion in 2025 and is on track to reach roughly USD 11.27 billion by 2034, implying a compound annual growth rate of 8.00% over 2025–2034. With rising smartphone penetration, AI-driven matchmaking, and increasing global acceptance of digital relationships, the industry is entering a new phase of premium monetization and user expansion. The rise of video-first interactions, safety verification tools, and hyper-personalized recommendations continues to redefine modern dating behavior. As Gen Z and Millennials dominate the digital relationship landscape, online dating platforms are set to become one of the fastest-evolving segments of the global social tech ecosystem.

Get More Information about this report -

Request Free Sample ReportThe market saw renewed growth, with revenue increasing from USD 5.22 billion in 2024 to USD 5.64 billion in 2025, a gain of USD 420 million. This signals healthier monetization after several years of stabilizing the user base. Between 2025 and 2034, the industry is expected to add nearly USD 5.63 billion in value, driving total market growth to nearly USD 10.45 billion by 2034. This represents almost a 99 to 100% increase in overall market size, showing strong demand fundamentals and improving platform economics.

Several key factors are shaping the growth path. Increased smartphone use is expanding the reachable user base in both established and emerging markets. At the same time, consumers are more willing to pay for better safety, personalization, and verification features, leading to greater adoption of premium subscriptions and in-app purchases. Platforms now combine revenue streams, including membership tiers, boost packages, and targeted ads, to maximize ARPU. These demand-side shifts support the market’s continued growth through 2034.

On the supply side, machine learning and recommendation systems have significantly improved operating efficiency. AI-driven ranking, natural language models, and behavioral prediction systems shorten the time to first match and increase session engagement, resulting in better retention and recurring revenue. New features like video interaction and real-time identity checks make conversion funnels shorter, improving trust and reducing churn. Additionally, automated moderation and AI fraud detection have boosted onboarding efficiency, though this comes with increased operational costs.

Regulatory conditions are becoming more complicated, especially in Europe and Asia Pacific. Digital services laws, data localization rules, and tougher privacy enforcement are raising compliance costs for platforms managing cross-border user flows by mid-single-digit percentages. While these rules enhance data governance and consumer safety, they also slow market entry and increase operational risk for new and expanding firms. Platforms need to balance fast growth with compliance to regional laws to avoid penalties and disruptions.

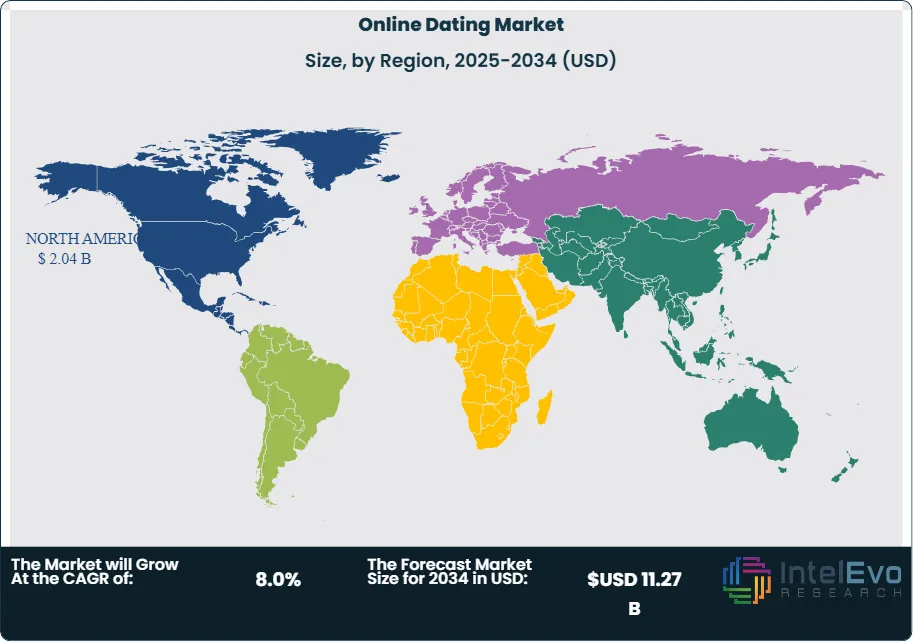

North America continues to be the largest revenue source due to high ARPU and widespread use of premium features. In contrast, Asia Pacific is the fastest-growing area, driven by mobile-first adoption, a growing youth population, and lower customer acquisition costs. Markets such as India, Indonesia, and the Philippines are attracting significant venture and strategic investment, as investors are drawn to high engagement and large potential audiences. Competitive pressure is rising as established players consolidate and niche platforms—like faith-based matching, professional networks, and identity-first services—gain popularity.

Looking forward, organizations should focus on ongoing product investment in AI-driven matching, trust and safety features, and dynamic pricing tools. The industry’s expected 8.0% CAGR from 2025 to 2034 highlights the need for continued innovation in user verification, personalization, fraud prevention, and ARPU growth strategies. Investment strategies should emphasize expansion in the APAC market while preparing for stricter compliance requirements in regulated areas. Stakeholders who invest early in scalable AI infrastructure and trust initiatives are best poised to lead the next phase of market growth.

Key Takeaways

- Market Growth: The online dating services market measured USD 5.22 billion in 2024 and USD 5.64 billion in 2025; it is projected to reach USD 11.27 billion by 2034 at an 8.00% CAGR from 2025–2034, adding roughly USD 5.63 billion in incremental revenue over the forecast period.

- Platform Type: Mobile apps: Mobile applications led platform usage in 2024 and accounted for the largest share of sessions and downloads; app-led engagement supported the USD 0.42 billion year-on-year increase from 2024 to 2025.

- Revenue Model: Paid subscriptions: The paid subscription model generated the largest revenue share in 2024, supplying the primary recurring ARPU; this model drives monetization through tiered pricing and verification features.

- Driver: Younger cohorts: Younger users led market participation in 2024, with under-35 cohorts supplying the bulk of new signups and higher conversion rates to paid tiers; this demographic underpins advertising inventory and subscription growth.

- Restraint: Regulation and compliance costs: Data protection and regional digital services rules raised compliance spend for EU-facing operators by mid-single-digit percent, increasing onboarding friction and marginal unit costs.

- Opportunity: Asia Pacific expansion: APAC is the fastest growth region; conservative estimates point to a regional CAGR near 10.0% through 2034, driven by mobile-first users in India and Southeast Asia and lower customer acquisition costs compared with developed markets.

- Trend: Video and trust features: Video dating is the fastest growing service feature; in several APAC markets video engagement exceeds 40% of active sessions, and firms such as Match Group and Bumble are scaling video and ID verification investments.

- Regional Analysis: North America led with a 39% market share in 2024 and delivers the highest ARPU; APAC shows stronger user growth and lower CAC; Europe grows slower due to compliance headwinds. You should prioritize APAC market entries while budgeting for elevated EU compliance costs.

Platform Type Analysis

Mobile applications remain the primary access point for online dating in 2025. Apps capture the bulk of user sessions and downloads due to always-on connectivity and push-driven engagement; continuous UX updates and integrated security checks have raised daily active user rates and improved retention. Free app tiers sustain scale while paid upgrades lift average revenue per user; major operators such as Match Group, Bumble and Hinge invest heavily in app experience and video features to protect share.

Websites continue to serve as a stable complement. Desktop and mobile-web channels deliver broader accessibility for older demographics and corporate audiences; they account for steady traffic and conversion among users who prefer longer-form profiles and search filters. Expect measured growth in website usage as smartphone penetration rises across secondary markets.

Subscription Model Analysis

Paid subscriptions generated the largest revenue share in 2024 and remain the dominant monetization engine in 2025. Recurring plans, including monthly and annual tiers, drive predictable cash flow and supported the market’s increase from USD 5.22 billion in 2024 to USD 5.64 billion in 2025. You should expect companies to refine tiering and add verification services to protect ARPU.

Freemium models will expand fastest among business models. Basic free access widens the funnel while in-app purchases and time-limited boosts convert high-intent users; conversion improvements of a few percentage points can materially raise lifetime value. Platforms use targeted promotions and trial periods to lift single-digit conversion rates into paid tiers.

User Analysis

Younger cohorts continue to account for the largest share of new signups in 2025. Users under 35 register most frequently and show higher conversion to paid tiers; this group supplies ad inventory and fuels feature A/B testing. Niche verticals that target interests or professions also grow within this base.

Older adults represent the fastest-growing demographic segment. Services that add simplified onboarding, safety controls, and concierge-style matching report faster uptake among 50-plus users. Examples include SilverSingles and eHarmony, which tailor communications and verification to reduce friction and raise retention.

Service Feature Analysis

Text chat remained the most used interaction mode in 2024 and still anchors early-stage engagement in 2025. Chat features support initial rapport building and permit scalable moderation workflows; improvements in automated moderation have cut harmful content incidents and improved time-to-first-safe-interaction.

Video dating shows the highest growth rate. In several APAC markets video now represents more than 40% of active sessions; platforms such as Bumble and Hinge have rolled out native video calls and short-form video uploads to increase match confidence and shorten conversion cycles.

Regional Analysis

North America led with roughly 39% share in 2024 and delivers the highest ARPU in 2025; incumbents benefit from mature payment markets and strong advertiser demand. Asia Pacific records the fastest user growth and the largest runway for expansion; conservative estimates indicate regional CAGR near 10% through the next decade driven by India and Southeast Asia.

Europe offers steady revenue but higher compliance costs due to data protection rules; you should budget for mid-single-digit increases in compliance spend when planning EU entries. Latin America and Middle East & Africa show selective pockets of rapid adoption, making them tactical targets for region-specific product and pricing experiments.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Platform Type

- Mobile Apps

- Websites

- Social Media

By Subscription Model

- Free

- Freemium

- Paid

By User

- Younger Adults

- Older Adults

By Service Features

- Video Dating

- Chat Services

- Matching Algorithms

By Regional

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 5.22 B |

| Forecast Revenue (2034) | USD 11.27 B |

| CAGR (2024-2034) | 8.0% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Platform Type (Mobile Apps, Websites, Social Media), By Subscription Model (Free, Freemium, Paid, By User, Younger Adults, Older Adults), By Service Features (Video Dating, Chat Services, Matching Algorithms) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | OkCupid, Hinge, Pure, Tantan, Badoo, Tinder, eHarmony, Coffee Meets Bagel, Bumble, Grindr, Plenty of Fish, Zoosk, Happn, Match Group |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date