Ophthalmic Equipment Market Size, Growth, Driver & Forecast | CAGR 6.0%

Global Ophthalmic Equipment Market Size, Share, Analysis Report By Type(Diagnostic & Monitoring Devices, Surgical Devices, Vision Care Products), Deployment(Hospital-based, Ambulatory Surgical Centers), Application(Cataract Surgery, Glaucoma Treatment), End-User(Hospitals, Ophthalmic Clinics, Ambulatory Surgical Centers, Research & Academic Institutes) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview:

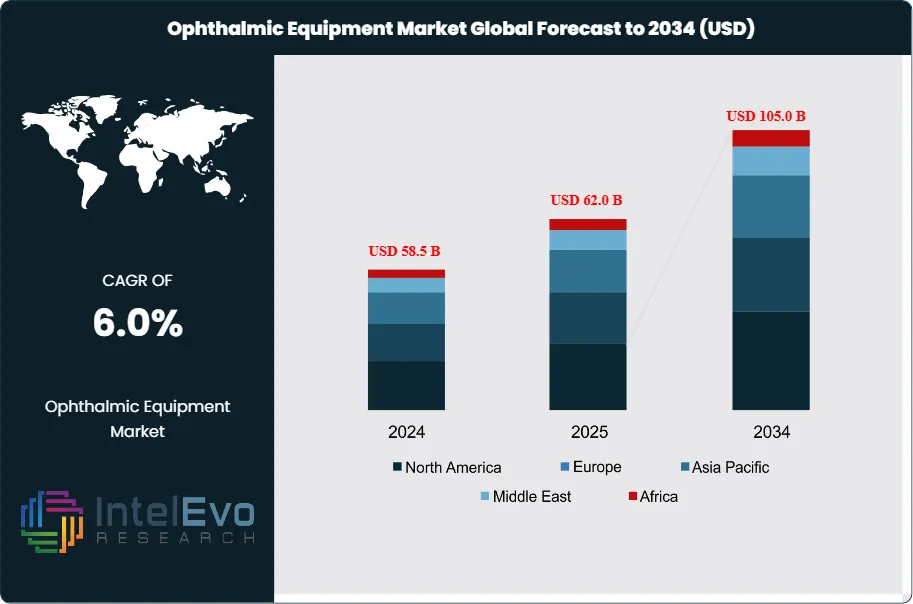

The Ophthalmic Equipment Market size is expected to be worth around USD 105.0 Billion by 2034, from USD 58.5 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2024 to 2034. The ophthalmic equipment market encompasses a wide range of medical devices and instruments used for the diagnosis, treatment, and management of various eye conditions and vision disorders. This rapidly expanding market includes diagnostic devices like ophthalmoscopes, refractometers, and OCT scanners, as well as surgical instruments such as phacoemulsification systems, ophthalmic lasers, and vitreoretinal instruments. It also covers vision care products like contact lenses and eyeglasses manufacturing equipment.

Get More Information about this report -

Request Free Sample ReportThis market is characterized by continuous technological advancements, increasing prevalence of eye diseases globally, and a growing aging population. The demand for advanced diagnostic and surgical solutions is on the rise, driven by factors such as the increasing incidence of cataracts, glaucoma, diabetic retinopathy, and refractive errors. The market is further influenced by the rising adoption of minimally invasive surgical techniques, the integration of artificial intelligence and telemedicine in ophthalmology, and the expanding healthcare infrastructure in emerging economies.

Several key factors are driving the growth of the ophthalmic equipment market, including the rising awareness about eye health, the availability of advanced treatment options, and increasing healthcare expenditure. The market is estimated to reach USD 105.0 Bn By 2034, riding on a strong 6.0% CAGR during the forecast period. The market is further influenced by the rising importance of early disease detection, the implementation of advanced imaging technologies, and the growing necessity for precise surgical interventions. Additionally, the integration of ophthalmic equipment with digital platforms for remote diagnostics and patient management is creating new opportunities for market expansion.

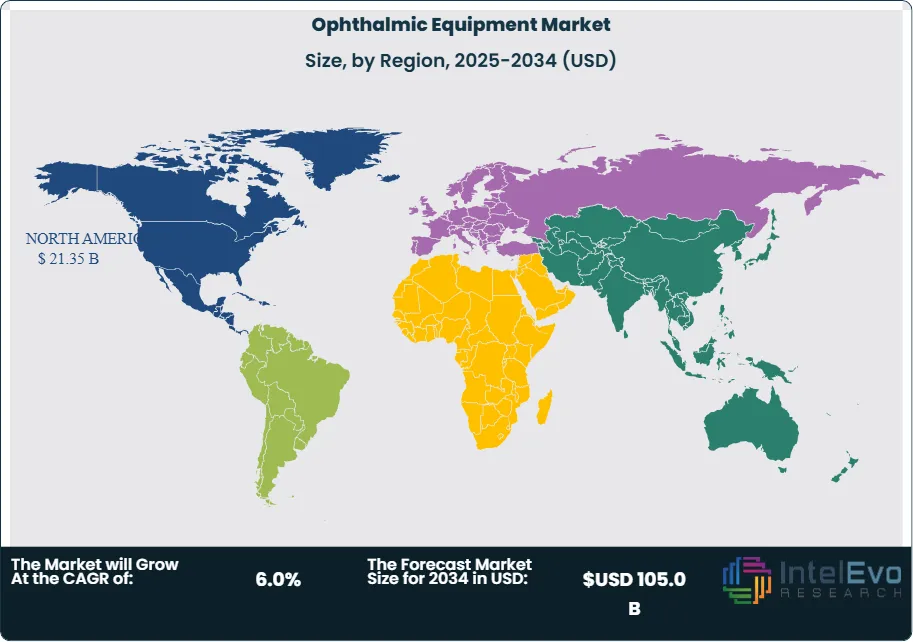

Regional Analysis: North America currently dominates the global ophthalmic equipment market, driven by the presence of major industry players, high adoption rates of advanced technologies, and a well-established healthcare infrastructure. The region benefits from significant investments in R&D, favorable reimbursement policies, and a high prevalence of age-related eye disorders. Asia-Pacific is emerging as a significant growth region, particularly due to the large patient pool, increasing healthcare expenditure, improving access to eye care services, and the rapid adoption of advanced medical technologies in countries like China and India.

COVID-19 Impact: The COVID-19 pandemic initially disrupted the ophthalmic equipment market due to deferred elective procedures, supply chain interruptions, and reduced patient visits. However, it also accelerated the adoption of telemedicine and remote diagnostic solutions, prompting a shift towards digital ophthalmology. The pandemic highlighted the importance of robust healthcare systems and spurred investments in diagnostic capabilities, leading to a rebound in market growth post-initial shock. This chart shows us clearly the initial dip in sales followed by a strong recovery as healthcare systems adapted.

Regional Conflicts and Trade Tensions: Regional conflicts and trade tensions can impact the global ophthalmic equipment market by disrupting supply chains, increasing raw material costs, and creating geopolitical uncertainties. Restrictions on trade and technology transfer may affect the availability and pricing of advanced equipment. However, these tensions can also lead to increased domestic manufacturing and diversification of supply chains, fostering local innovation and production capabilities in certain regions. Companies might invest in regional hubs to mitigate risks associated with global trade instability.

Key Takeaways:

- Market Growth: The Global Ophthalmic Equipment Market is expected to reach USD 105.0 Billion by 2034, driven by the increasing global burden of eye diseases, technological advancements, and rising healthcare expenditure.

- Product Type Dominance: Diagnostic Equipment holds a significant market share due to the increasing emphasis on early detection and monitoring of eye conditions, facilitating timely intervention and better patient outcomes.

- Technology Dominance: Advanced imaging technologies, particularly Optical Coherence Tomography (OCT), lead the market due to their non-invasive nature, high-resolution imaging capabilities, and crucial role in diagnosing retinal disorders and glaucoma.

- Application Dominance: Cataract treatment is the most prominent application segment, driven by the high global prevalence of cataracts, increasing surgical volumes, and the continuous innovation in phacoemulsification and intraocular lens (IOL) technologies.

- End-User Dominance: Ophthalmic Clinics and Ambulatory Surgical Centers (ASCs) constitute the largest end-user group, offering specialized eye care services, often at a lower cost than hospitals, and benefiting from the shift towards outpatient procedures.

- Driver: The rising global prevalence of chronic and age-related ophthalmic diseases, such as cataracts, glaucoma, and diabetic retinopathy, is a primary driver fueling the demand for advanced diagnostic and surgical equipment.

- Restraint: The high cost associated with advanced ophthalmic equipment, coupled with limited reimbursement policies in some regions, poses a significant restraint, particularly for smaller clinics and developing countries.

- Opportunity: The integration of Artificial Intelligence (AI) and Machine Learning (ML) into ophthalmic equipment offers vast opportunities for enhanced diagnostic accuracy, personalized treatment planning, and automated screening, leading to improved patient care.

- Trend: The increasing adoption of minimally invasive surgical techniques across various ophthalmic procedures is a key trend, driving demand for specialized instruments that offer faster recovery times and reduced patient discomfort.

- Regional Analysis: North America leads the market due to its advanced healthcare infrastructure and high adoption of innovative technologies. Asia-Pacific is projected to exhibit the fastest growth, driven by a large patient pool and improving access to eye care.

Product Type Analysis

With a market share of more than 40%, diagnostic and monitoring devices rule the ophthalmic equipment industry. This is mostly because of the growing need for instruments like visual field analyzers, slit lamps, and optical coherence tomography (OCT). These tools make it possible to identify and track long-term eye disorders early on, enabling prompt treatment. While vision care items like lenses continue to rise in the retail and consumer segments, surgical devices—particularly phacoemulsification systems and femtosecond lasers—are being used more frequently in cataract and refractive procedures.

Application Analysis

The largest application sector in the global market for ophthalmic equipment is cataract surgery. The high frequency of cataracts worldwide, along with ongoing developments in intraocular lenses (IOLs) and laser-assisted surgery, are the reasons for this dominance. Retinal disease management, refractive error correction, and glaucoma treatment are some other well-known uses. Robotic-assisted systems and sophisticated imaging technologies are increasingly supporting these treatments.

End-User Analysis

The main end users are hospitals and eye clinics, which together generate more than 60% of market revenue. These hospitals have the sophisticated equipment and knowledgeable staff required for thorough diagnosis and care. The distribution of lenses and diagnostic equipment is increasingly being influenced by optical centers and retail chains, particularly in developed nations where consumer awareness is growing.

Region Analysis

Due to its robust network of eye care specialists, early acceptance of technology, and high healthcare spending, North America dominates the global industry. Due to its well-established healthcare system and advantageous reimbursement systems, Europe comes in second. The rising prevalence of myopia, diabetic retinopathy, and cataracts, along with rising investments in teleophthalmology and healthcare infrastructure, are making Asia-Pacific the fastest-growing area.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Product Type:

- Diagnostic Equipment

- Surgical Equipment

- Vision Care Devices

Application:

- Cataract Treatment

- Glaucoma Treatment

- Refractive Error Correction

- Retinal Disorder Treatment

- Corneal Diseases

- Other Ophthalmic Conditions

End-User:

- Hospitals

- Ophthalmic Clinics

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

- Optometry Clinics

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 58.5 B |

| Forecast Revenue (2034) | USD 105.0 B |

| CAGR (2025-2034) | 6.0% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type: (Diagnostic Equipment , Surgical Equipment , Vision Care Devices), Application: (Cataract Treatment, Glaucoma Treatment, Refractive Error Correction, Retinal Disorder Treatment , Corneal Diseases, Other Ophthalmic Conditions), End-User: (Hospitals, Ophthalmic Clinics, Ambulatory Surgical Centers (ASCs), Research & Academic Institutes, Optometry Clinics) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Carl Zeiss Meditec AG, Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb (Bausch Health Companies Inc.), Topcon Corporation, EssilorLuxottica, Haag-Streit AG, NIDEK CO., LTD., Hoya Corporation, Canon Inc. (Medical Equipment Division), Heidelberg Engineering GmbH, Ziemer Ophthalmic Systems AG, Quantel Medical (Lumibird Group), Reliance Vision (part of Reliance Industries, India), Light Medical (China), Optovue, Inc. (acquired by Leica Microsystems), Lumenis Ltd., Iridex Corporation, Glaukos Corporation, STAAR Surgical Company |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date