Optical Coherence Tomography Market Size & Growth Outlook 2034

Global Optical Coherence Tomography Market Size, Share & Growth Analysis By Technology (Time-Domain OCT, Spectral-Domain OCT, Swept-Source OCT), By Application (Ophthalmology, Cardiology, Oncology, Dermatology, Dentistry), By End User (Hospitals, Diagnostic Centers, Research Institutes), By Region & Key Players – Industry Trends, Clinical Advancements, AI Integration, Competitive Landscape & Forecast 2025–2034

Report Overview

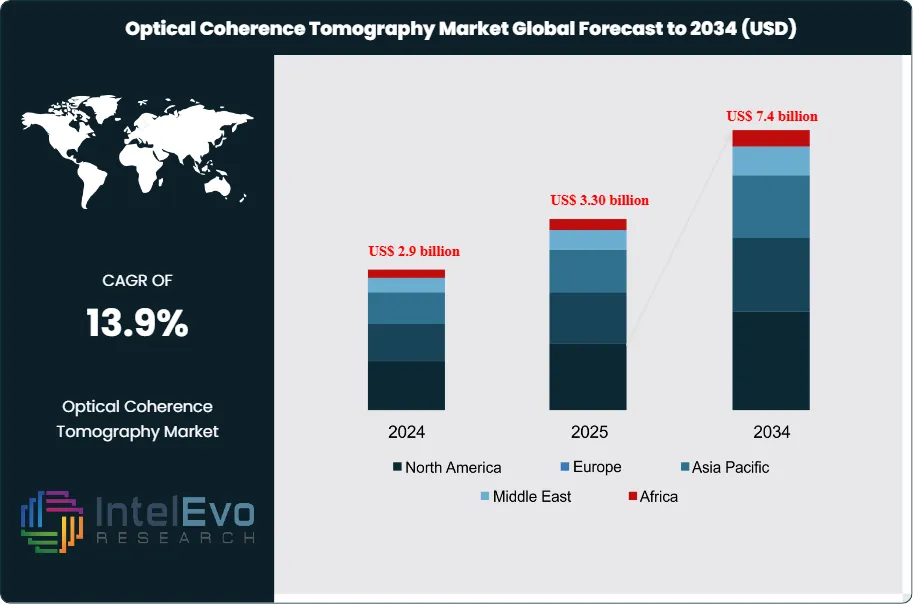

The Optical Coherence Tomography market is estimated at US$ 2.9 billion in 2024 and is on track to reach roughly US$ 7.4 billion by 2034, implying a compound annual growth rate of 13.9% over 2025–2034. This robust growth is driven by rising adoption of OCT in ophthalmology, cardiology, and oncology diagnostics, where high-resolution, non-invasive imaging is critical for early disease detection. Technological advancements such as swept-source OCT, AI-enabled image analysis, and portable OCT systems are further expanding clinical applications. In parallel, increasing investments in eye care infrastructure and growing screening programs across emerging markets are strengthening long-term market momentum and visibility.

Get More Information about this report -

Request Free Sample ReportMarket growth reflects rising retinal disease prevalence and the shift toward high-resolution imaging as a core diagnostic standard in ophthalmology. Providers rely on spectral-domain and swept-source systems that deliver micron-level visualization of retinal layers and choroidal structures, which strengthens clinical decision accuracy in diabetic retinopathy, glaucoma, and age-related macular degeneration. Expanded use in anterior segment evaluation during cataract procedures also supports steady demand across surgical centers. Adoption rates in advanced markets such as North America and Western Europe exceed 60 percent in large ophthalmology networks, while Asia Pacific shows the fastest trajectory with double-digit annual installation growth.

Government programs shape broader access. Public funding directed toward portable platforms reduces cost barriers and supports primary care integration. The ARPA-H US$ 20 million program announced in February 2024 reinforces this direction by promoting affordable handheld systems intended for early-stage disease detection in community settings. These initiatives strengthen preventive screening and expand the addressable market in regions with constrained specialist capacity.

Technology advances reinforce supply-side momentum. Engineering teams transition from benchtop consoles to chip-based engines that shrink optical assemblies without reducing image fidelity. Photonic integrated circuits enable lightweight units suited for neurology, dermatology, cardiology, and dentistry. This shift opens new revenue streams as specialty clinics adopt OCT for optic neuritis evaluation, skin lesion depth mapping, intravascular plaque assessment, and periodontal visualization. Investment activity underscores this trend. Siloton secured US$ 1.06 million in October 2024 to advance its Akepa chip for AMD management, reflecting broader movement toward compact, consumer-ready systems and remote monitoring pathways. AI-driven segmentation and automated grading further improve workflow efficiency and support higher throughput in high-volume practices.

Industry consolidation among clinical research organizations strengthens evidence generation. Mergers expand access to quantitative OCT endpoints used in oncology, refractive surgery, and neurodegenerative disease research. The May 2024 merger of Palleos Healthcare GmbH and OCT Global SA created an oncology-focused CRO with integrated imaging expertise, accelerating trial design and regulatory alignment. This consolidation improves validation standards and supports faster acceptance of OCT-derived metrics in pharmaceutical development.

These forces together position the OCT market for sustained expansion as diagnostic precision, miniaturization, and digitally supported care models advance across regions.

Key Takeaways

- Market Growth: The market reached US$ 2.9 billion in 2024 and posts a CAGR of 13.9 percent through 2034. Growth reflects rising demand for high-resolution imaging in retinal disease management and broader clinical use cases.

- Product Type: Tabletop systems held 52.8 percent of global revenue in 2024. Providers choose these platforms for stable optics and higher throughput in ophthalmology clinics.

- Technology: Spectral domain OCT accounted for 54.3 percent of the market. Faster acquisition speeds and sharper axial resolution support its use in diabetic retinopathy grading and glaucoma monitoring.

- Application: Ophthalmology controlled 61.9 percent of revenue in 2024. Strong uptake links to rising cases of AMD and diabetic retinal disease and the need for precise structural mapping.

- End User: Hospitals generated 47.2 percent of demand. Large patient volumes and higher budgets support wider adoption of advanced imaging units.

- Driver: Portable and chip-based platforms expand access beyond specialist centers. Funding such as ARPA-H’s US$ 20 million program accelerates early detection models in primary care settings.

- Restraint: High system prices and service contracts slow adoption in small clinics; acquisition costs often exceed US$ 60,000 per unit and raise replacement cycle timelines.

- Opportunity: Handheld and catheter-based systems gain traction in cardiology and dermatology. These segments post projected double-digit CAGR and add new clinical revenue streams for manufacturers.

- Trend: Photonic integrated circuits support lighter devices and remote screening. Recent investment, including Siloton’s US$ 1.06 million funding round for AMD-focused chips, signals rapid progress toward compact home-monitoring units.

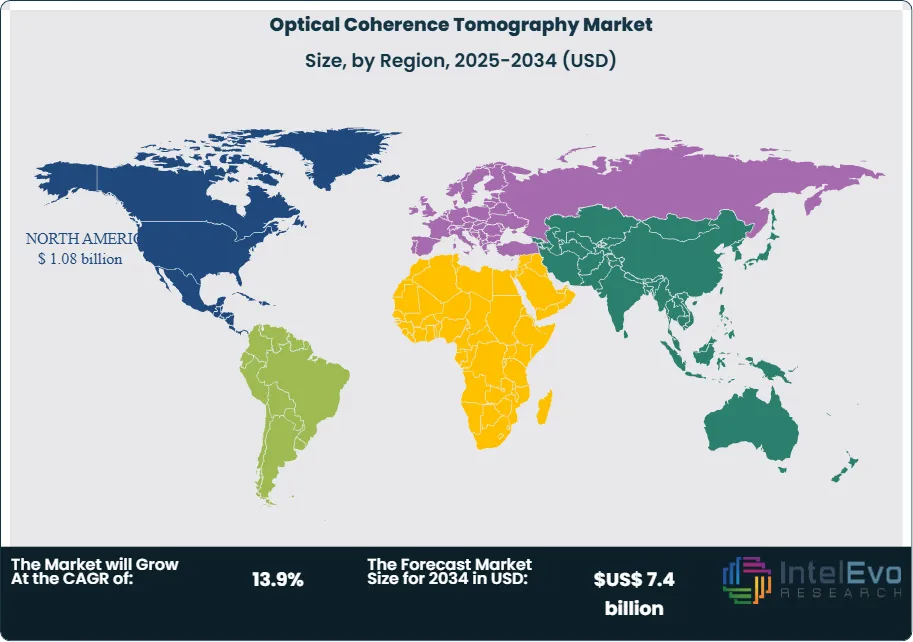

- Regional Analysis: North America held 37.2 percent of the market in 2024 due to strong reimbursement and early technology adoption. Asia Pacific records the fastest rise with projected CAGR above 14 percent as screening programs expand in China and India.

Product Type Analysis

Tabletop systems hold the strongest position in the product mix as they account for 52.8 percent of global revenue and continue to anchor clinical workflows in 2025. Providers rely on these units for consistent performance and high-resolution imaging, which supports accurate assessment of retinal layers, macular structure, and corneal integrity. Rising cases of AMD and diabetic retinopathy across Europe and Asia strengthen demand for stable diagnostic platforms that maintain image quality during high-volume screening.

Manufacturers expand the capabilities of tabletop systems through AI-assisted segmentation and automated quality control. Hospitals and research institutions use these platforms for longitudinal studies and multi-center trials that require reproducible imaging results. Integration with fundus photography and angiography streamlines diagnostics and shortens appointment times. As imaging departments upgrade infrastructure, tabletop OCT remains the preferred choice for detailed visualization and long-term disease tracking.

Handheld, Doppler, and catheter-based systems gain traction in specialized settings as clinicians seek portable units for bedside assessments or intravascular procedures. These formats advance adoption in cardiology, oncology, and dermatology, though they remain secondary in overall revenue contribution. Continued investment in compact optical engines supports wider use in community clinics and emergency departments.

Technology Analysis

Spectral domain OCT maintains the largest share at 54.3 percent and continues to lead in 2025 due to strong axial resolution and rapid scanning. Clinicians rely on this platform for early detection of microstructural changes in glaucoma, diabetic eye disease, and macular degeneration. The ongoing shift away from time-domain systems reflects the industry’s preference for higher fidelity imaging that supports precise monitoring.

Spectral domain systems extend into oncology, cardiology, and dermatology as improvements in detectors and light sources enhance penetration depth and contrast. Software integration with EMR platforms accelerates reporting and reduces administrative time. Swept-source OCT also gains momentum due to superior performance in deep choroidal imaging, which strengthens adoption in tertiary eye centers and research hospitals. These advances reinforce the position of spectral and swept-source systems as core technologies across multiple specialties.

Application Analysis

Ophthalmology remains the primary application area and accounts for 61.9 percent of global revenue. Rising screening volumes for glaucoma, macular edema, and diabetic eye disease support steady expansion in 2025. OCT functions as a standard imaging tool in retinal clinics due to its ability to reveal subtle structural changes that guide targeted therapy. Aging populations in North America, Europe, China, and Japan drive sustained use across hospital and outpatient settings.

Advanced features such as swept-source angiography and adaptive optics extend the scope of vascular imaging and support earlier disease detection. AI-enabled assessments accelerate workflow and improve consistency across large patient cohorts. Oncology, cardiology, and dermatology report rising use of OCT as clinicians adopt the technology for tumor margin analysis, intravascular plaque characterization, and skin lesion depth evaluation. These secondary segments strengthen overall market diversity and create additional revenue opportunities.

End-Use Analysis

Hospitals hold 47.2 percent of end-use revenue due to their broad diagnostic portfolios and ability to invest in advanced imaging platforms. Multispecialty centers integrate OCT across ophthalmology, neurology, dermatology, and cardiology units to support full-spectrum diagnostics. Rising cataract surgery volumes and diabetic eye disease cases reinforce demand for precise imaging tools that enhance clinical decision accuracy.

Intraoperative OCT gains momentum in neurosurgery and oncology as surgeons adopt real-time structural guidance for margin evaluation. Diagnostic imaging centers and ambulatory surgical centers expand adoption as portable and hybrid systems reduce installation barriers. Investments in digital infrastructure across Europe and Asia Pacific accelerate connectivity between OCT systems and centralized reporting hubs. These improvements strengthen efficiency and support wider use of OCT in collaborative care models.

Regional Analysis

North America maintains a 37.2 percent share and continues to lead usage in 2025 due to high demand for non-invasive imaging and strong clinical adoption in ophthalmology and cardiology. Manufacturers such as Carl Zeiss Meditec and Leica Microsystems expand their portfolios with swept-source systems that enhance visualization of choroidal structures. Research agencies support multi-modal integration programs and community screening initiatives. Health systems in major cities deploy portable units for emergency assessments, while AI-supported analysis tools improve triage and support telemedicine across rural areas.

Europe reports steady growth driven by reimbursement support for retinal imaging and increased investment in OCT-based neurological and oncology research. Regulatory pathways encourage earlier adoption of advanced probes and software modules. Asia Pacific records the fastest rise as governments scale diabetic retinopathy screening and expand imaging access in secondary cities. China and Japan invest heavily in hospital-grade systems, while India adopts handheld formats for rural outreach. Local manufacturing clusters in Vietnam and Thailand reduce component costs and expand regional supply capacity. These trends position Asia Pacific as the strongest growth engine during the forecast period.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Tabletop

- Handheld

- Doppler

- Catheter based

By Technology

- Spectral domain OCT

- Time domain OCT

- Swept-source OCT

By Application

- Ophthalmology

- Oncology

- Dermatology

- Cardiology

- Others

By End Use

- Hospitals

- Ambulatory surgical centers

- Diagnostic imaging centers

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | US$ 2.9 billion |

| Forecast Revenue (2034) | US$ 7.4 billion |

| CAGR (2024-2034) | 13.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type, (Tabletop, Handheld, Doppler, Catheter based), By Technology, (Spectral domain OCT, Time domain OCT, Swept-source OCT), By Application, (Ophthalmology, Oncology, Dermatology, Cardiology, Others), By End Use, (Hospitals, Ambulatory surgical centers, Diagnostic imaging centers, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Agfa-Gevaert, NIDEK, OPTOPOL Technology, Abbott Laboratories, Canon Medical Systems, Heidelberg Engineering, Michelson Diagnostics, Carl Zeiss Meditec, Danaher, Novacam Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Optical Coherence Tomography Market

Published Date : 08 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date