Organic Milk Powder Market Forecast 2024–2034 | Growth, Trends & Global Outlook

Global Organic Milk Powder Market Size, Share & Analysis By Form (Liquid, Powder), By Type (Full Cream, Low-fat), By End Use (Household, Commercial), By Distribution Channel, Industry Regions & Key Players – Clean-Label Trends & Forecast 2025–2034

Report Overview

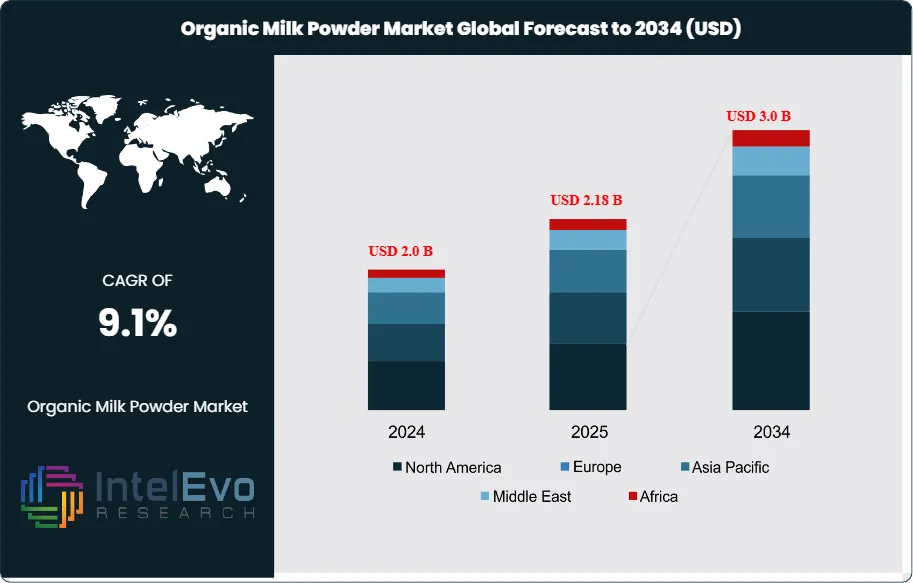

The Semi-Skim Organic Milk Powder market is estimated at USD 2.0 billion in 2024 and is projected to reach approximately USD 3.0 billion by 2034, reflecting a CAGR of 9.1% during 2024–2034. Rising consumer interest in clean-label nutrition, protein-rich ingredients, and sustainably sourced dairy products is fueling market momentum. Demand is also accelerating across infant nutrition, functional foods, and sports supplements, where organic dairy powders are becoming a preferred formulation base. As health-conscious lifestyles continue to expand globally, Semi-Skim Organic Milk Powder is emerging as a core premium ingredient in next-generation food and beverage innovation.

Get More Information about this report -

Request Free Sample ReportDemand for semi-skim organic milk powder has steadily increased, supported by growing interest in balanced nutrition and shelf-stable dairy solutions. This product, typically containing 1–1.5% fat, retains the essential nutrients of organic milk while offering reduced caloric density. As dietary preferences shift toward cleaner labels and functional ingredients, food processors are incorporating semi-skim milk powder into infant formula, bakery mixes, nutraceuticals, and convenience foods. The product’s appeal lies in its balance of protein, calcium, and low fat content, making it suitable for health-conscious consumers.

From a supply-side perspective, policy-led investments in dairy infrastructure are playing a critical role, particularly in India. Central government initiatives such as the Dairy Entrepreneurship Development Scheme (DEDS) and the Animal Husbandry Infrastructure Development Fund (AHIDF), with a combined capital outlay of over INR 15,000 crore, have accelerated processing capacity and private sector participation. In Jharkhand, the commissioning of a 20 MT/day milk powder plant at an investment of INR 80 crore underscores the momentum toward regional self-sufficiency in milk processing.

The market is also responding to innovation in product formats and consumer demands. Manufacturers are developing instant powders, lactose-reduced formulations, and fortified variants with added probiotics. These features align with rising demand in functional nutrition and specialty diet segments. Packaging improvements and formulation flexibility are helping producers address both institutional and retail buyers more effectively. Skimmed milk powder production in India is projected to reach 0.8 million metric tons by 2025, supported by stable raw milk availability and processing incentives.

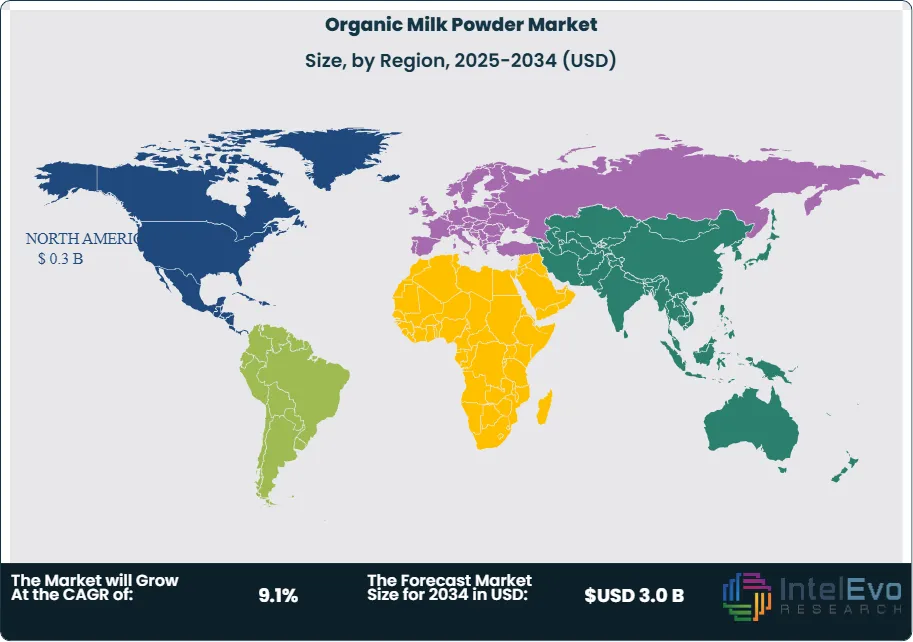

Regionally, Asia is emerging as a key growth engine, led by India and China, where demand for affordable, nutritious, and long-shelf-life dairy is expanding. At the same time, mature markets in Europe and North America continue to show steady uptake, particularly in organic and wellness-oriented product lines. With structural support from government schemes, capacity expansion, and consumer preference shifts, the semi-skim organic milk powder market is positioned for long-term growth and investment opportunities through 2034.

Key Takeaways

- Market Growth: The global organic milk powder market is projected to grow from USD 2.0 billion in 2024 to USD 3.0 billion by 2034, registering a CAGR of 9.1%. Growth is driven by rising demand for clean-label, low-fat dairy products and long-shelf-life nutrition across commercial food sectors.

- Product Form: Powder form accounts for over 82.3% of total market revenue, supported by its versatility in processing, ease of transport, and extended shelf stability.

- Fat Content: Low-fat organic milk powder leads the market with a 68.9% share due to increasing consumer preference for reduced-calorie, high-nutrient dairy solutions in both health and wellness applications.

- End Use: The commercial segment holds 67.1% of market share, driven by adoption in infant formula, bakery, nutraceuticals, and large-scale food manufacturing operations requiring consistent ingredient quality and volume supply.

- Distribution Channel: Supermarkets and hypermarkets dominate retail channels with 38.7% share, offering strong visibility, trusted sourcing, and broad access to both urban and semi-urban consumers.

- Driver: Rising demand for shelf-stable, nutrient-rich dairy products across health-conscious and convenience-driven consumers is fueling product adoption globally, particularly in emerging middle-income markets.

- Restraint: High production and certification costs associated with organic dairy farming limit supply scalability and contribute to a price premium that constrains mass-market penetration.

- Opportunity: Asia Pacific, led by India and China, presents strong growth potential due to increasing government support for organic farming and rising consumer spending on health-focused dairy. Regional CAGR is projected to exceed 8% through 2034.

- Trend: Manufacturers are introducing fortified variants and lactose-reduced organic powders to target niche nutritional needs, supported by improved spray-drying and packaging technologies that enhance reconstitution and shelf-life.

- Regional Analysis: North America leads with a 38.9% market share, valued at approximately USD 0.3 billion in 2024, driven by established organic certification systems and mature retail networks. Asia Pacific is emerging as the fastest-growing region, backed by expanding dairy infrastructure and dietary shifts toward functional nutrition.

Form Analysis

Powdered semi-skim organic milk continues to dominate the market, accounting for over 82.3% of total sales as of 2025. Its extended shelf life, lower transportation costs, and broad application in both food manufacturing and consumer products have reinforced its leading position. Manufacturers across sectors such as infant formula, bakery, and dairy processing rely on powdered formats for their consistency, storability, and ease of blending with other dry ingredients. These attributes make it ideal for bulk procurement, long-distance shipping, and export-driven supply chains.

This format also aligns with the operational demands of commercial food production. Powdered milk enables flexible formulation, reduces spoilage risk, and supports large-scale distribution. As international demand for organic, shelf-stable ingredients grows, powdered milk's dominance is expected to hold, particularly in emerging markets with limited cold-chain infrastructure.

Type Analysis

Low-fat variants lead the organic milk powder category with a 68.9% share in 2025, supported by increasing demand for reduced-calorie dairy products. As public health campaigns across both developed and developing countries continue to emphasize low-fat and heart-healthy diets, the segment is experiencing sustained uptake. The low-fat format is especially attractive to consumers managing weight, cholesterol, or cardiovascular health, as well as those seeking nutritious options for daily consumption.

The segment is also seeing growth in the production of functional food blends and dietary supplements. Food processors are incorporating low-fat organic milk powder into specialized products for infants, athletes, and elderly populations. This trend reflects a broader shift toward clean-label, health-focused ingredients across packaged food and nutritional categories.

End Use Analysis

Commercial applications remain the largest end-use segment, accounting for over 67.1% of the market. Food manufacturers and processors prefer semi-skim organic milk powder for its reliability in texture control, shelf life, and nutritional value. It is a key input in large-scale production of baked goods, dairy-based beverages, protein mixes, and confectionery items. The consistency of the powdered format also ensures predictable results in high-volume output, a critical factor for commercial buyers.

Organic certification further enhances the product’s appeal, particularly among brands targeting premium or health-focused market segments. As clean-label and organic product lines continue to expand across global food brands, commercial demand for semi-skim organic milk powder is projected to remain strong through the end of the decade.

Distribution Channel Analysis

Supermarkets and hypermarkets accounted for 38.7% of total distribution in 2025, making them the leading retail channel for semi-skim organic milk powder. These stores provide consumers with easy access to a wide variety of certified organic products in both large and small pack formats. The availability of multiple brands in a single location increases competition and encourages in-store promotions, while also supporting impulse purchases.

These retail outlets benefit from established logistics and high customer traffic, particularly in urban and peri-urban markets. Their ability to maintain consistent stock levels and offer trusted certifications positions them as a primary sales driver in the consumer segment.

Regional Analysis

North America continues to lead the global market, accounting for more than 38.9% of total revenue in 2025, equivalent to approximately USD 0.3 billion. The U.S. and Canada benefit from well-developed organic food supply chains, high consumer awareness, and strong institutional trust in organic labeling. Widespread use of powdered milk in health-related products such as infant nutrition, protein supplements, and diet-friendly packaged foods further contributes to regional demand.

Regulatory support and labeling standards, such as USDA Organic certification, reinforce product integrity and consumer confidence. Meanwhile, Asia Pacific is emerging as the fastest-growing region, driven by government-led dairy modernization programs, a growing urban middle class, and increasing demand for shelf-stable, health-oriented dairy formats.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Form

- Liquid

- Powder

By Type

- Full Cream

- Low-fat

By End Use

- Household

- Commercial

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 2.0 B |

| Forecast Revenue (2034) | USD 3.0 B |

| CAGR (2024-2034) | 9.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Form (Liquid, Powder), By Type (Full Cream, Low-fat), By End Use (Household, Commercial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tesco Plc., Elle & Vire, Daioni Organic, Granarolo Group, Waitrose & Partners, Yeo Valley, Arla Foods Amba, Organic Valley, Dale Farm Ltd |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date