Partial Discharge Monitoring Systems Market Size & Forecast 2034 | 5.3% CAGR

Global Partial Discharge Monitoring Systems Market Size, Share, Analysis Report By Type (Temporary Monitoring System, Permanent Monitoring System), Application (Power Cables, Transformers, GIS, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

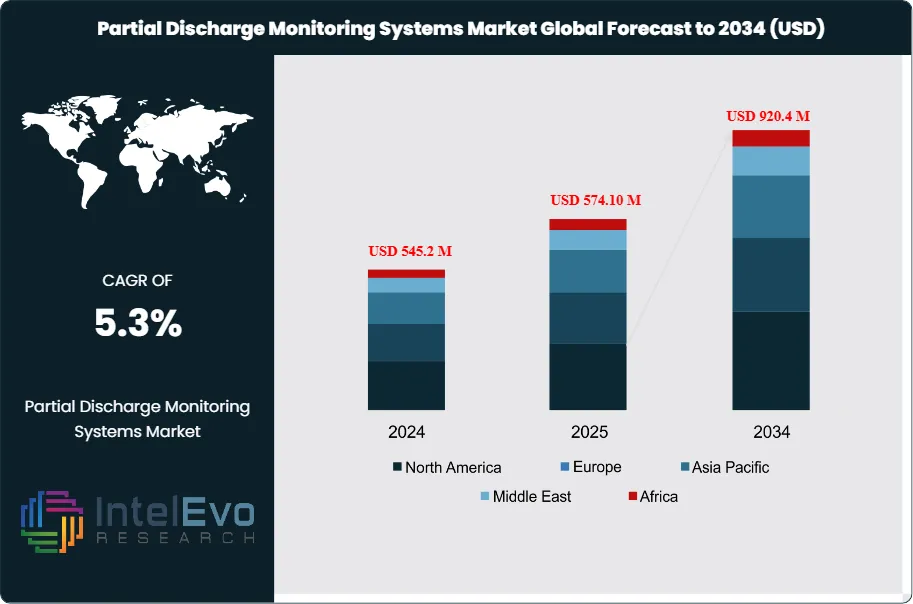

The Partial Discharge Monitoring Systems Market size is projected to reach approximately USD 920.4 million by 2034, up from USD 545.2 million in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. The market growth is driven by the increasing need for high-voltage equipment monitoring, predictive maintenance, and power grid reliability. Rising adoption in utilities, industrial, and renewable energy sectors is accelerating demand. Advanced monitoring technologies, coupled with growing awareness about asset lifespan optimization and operational safety, and are expected to fuel market expansion globally.

Get More Information about this report -

Request Free Sample ReportPartial discharge monitoring systems are essential tools used in high-voltage electrical equipment to detect and assess partial discharges—small, localized electrical sparks that occur within insulation due to defects or stress. While these discharges do not immediately cause equipment failure, they can gradually deteriorate the insulation, potentially leading to significant breakdowns if left unmonitored. These systems utilize various sensors, such as ultrasonic or electromagnetic types, to continuously monitor and collect data on PD activity. The information gathered helps maintenance teams evaluate the severity and location of the issue, enabling timely intervention. Widely used in power plants, substations, and industrial settings, these systems play a crucial role in improving equipment reliability, preventing unexpected failures, and reducing operational downtime by facilitating predictive maintenance strategies.

The growth dynamics of the partial discharge (PD) monitoring systems market are driven by the increasing demand for reliable and uninterrupted power supply across industries. As power infrastructures age and the global energy sector expands—especially with rising renewable energy integration—there is a heightened need to monitor the condition of high-voltage equipment like transformers, switchgear, and cables. Partial discharge monitoring systems are gaining traction because they help detect insulation faults early, thereby preventing costly failures and unplanned outages.

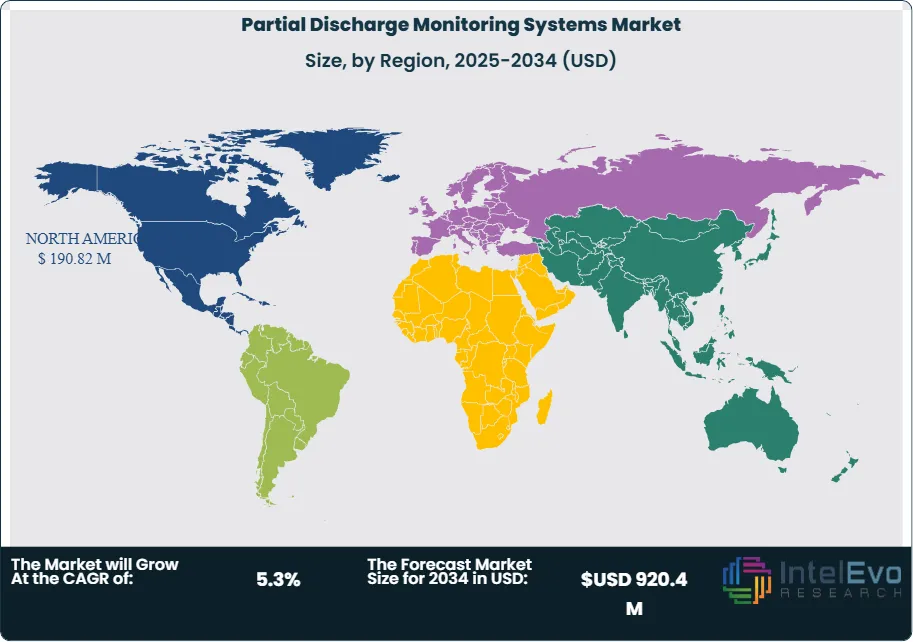

North America’s leadership in the partial discharge (PD) monitoring systems market is largely attributed to its well-established power infrastructure, advanced industrial base, and ongoing emphasis on energy efficiency and system reliability. Industries such as power generation, utilities, aerospace, and manufacturing are actively incorporating PD monitoring to reduce downtime and enhance equipment performance. The aging grid infrastructure in the U.S. and Canada necessitates continuous condition monitoring to avoid unexpected failures, while strict regulations further push the need for such systems.

The COVID-19 pandemic had a mixed impact on the partial discharge monitoring systems (PDMS) market. On one hand, the demand for PDMS systems saw some disruptions due to delayed project timelines, reduced industrial activity, and supply chain challenges during the lockdowns. Many industries faced temporary shutdowns, which delayed the installation and maintenance of power infrastructure. On the other hand, the pandemic also highlighted the importance of reliable and continuous monitoring of critical infrastructure, driving the adoption of PDMS for remote monitoring and predictive maintenance. With the increasing shift toward automation and the need for minimal on-site interventions, the pandemic accelerated the demand for digital and remote monitoring solutions, including PDMS, to ensure uninterrupted operation of energy systems.

Key Takeaways:

- Market Growth: The partial discharge monitoring systems market is expected to reach USD 920.4 million by 2034, growing at a robust CAGR of 5.3%, indicating strong market expansion.

- Type Segment Dominance: The type segment is dominated by permanent monitoring system, accounting for over 57% of the market share. Permanent monitoring systems are integrated into electrical infrastructure like transformers and cables, offering continuous health assessments. They provide real-time alerts for potential issues, helping operators maintain system reliability and prevent failures.

- Application Segment Insights: GIS is anticipated to hold the largest market share. Gas Insulated Switchgear (GIS) plays a crucial role in modern energy networks by efficiently controlling electrical flow with minimal risk of outages. Their popularity in urban and industrial areas, where space is limited and reliability is essential, has driven demand. Partial discharge monitoring enhances GIS performance by detecting early signs of potential failures, ensuring safe and reliable operation, and preventing service interruptions.

- Driver: A key driver for the partial discharge monitoring systems market is the rising demand for reliable and uninterrupted power supply. As aging electrical infrastructure and high-voltage equipment require constant monitoring to avoid failures, industries are increasingly investing in these systems to enhance safety, reduce downtime, and support preventive maintenance strategies.

- Restraint: A major restraint in the partial discharge monitoring systems market is the high initial investment and installation complexity. These systems often require specialized equipment and technical expertise, making them less accessible for smaller utilities or companies with limited budgets. Additionally, integrating them into existing infrastructure can be challenging, especially in older systems.

- Opportunity: A key opportunity in the partial discharge monitoring systems market lies in the growing investments in renewable energy and smart grids. As utilities modernize their infrastructure to support cleaner energy and digital transformation, the demand for reliable, real-time monitoring solutions increases. This creates strong potential for partial discharge systems to be integrated into next-generation power systems to enhance safety, efficiency, and equipment lifespan.

- Trend: The integration of AI and machine learning is transforming PD monitoring systems by enhancing their predictive maintenance capabilities. These technologies allow for the analysis of large datasets, helping to predict potential equipment failures, reduce downtime, and improve operational efficiency.

- Regional Analysis: Partial discharge monitoring systems detect small electrical faults in high-voltage equipment that can lead to insulation failure. By identifying early signs of wear or damage, these systems help prevent costly breakdowns, improve equipment reliability, and support predictive maintenance in industries like energy, utilities, and aerospace.

Type Analysis:

The type segment is divided into temporary monitoring system and permanent monitoring system. The permanent monitoring system segment dominated the market, with a market share of around 57% accounting for 305.2 million 2024. Permanent monitoring systems are embedded directly into key electrical infrastructure such as transformers, switchgear, and power cables, offering continuous health assessments without requiring manual inspections. This real-time monitoring is vital for maintaining the integrity of critical power systems. By providing immediate alerts for potential problems, these systems enable operators to address issues promptly, reducing the risk of unexpected failures and improving overall system reliability and efficiency.

Application Analysis:

The application segment is divided into power cables, transformers, GIS, and others. The GIS segment dominated the market, with a market share of around 32% accounting for 171.3 million 2024. Gas Insulated Switchgear (GIS) is a critical component in modern electrical grids, offering efficient and reliable control of electrical flow while minimizing the risk of outages. Its compact design and ability to operate in challenging urban and industrial environments, where space is limited and reliability is paramount, have led to its widespread adoption. Partial discharge monitoring systems play an essential role in enhancing GIS performance. These systems detect early signs of insulation degradation or potential failures, enabling preventive maintenance and helping avoid catastrophic breakdowns. By integrating partial discharge monitoring, GIS units can operate more safely and reliably, minimizing service interruptions and extending their operational lifespan, which is especially crucial in critical infrastructure.

Region Analysis:

North America Leads With 35% Market Share in the Partial Discharge Monitoring Systems Market. Partial discharge monitoring systems are used to detect tiny electrical discharges that occur within the insulation of high-voltage equipment, such as transformers, switchgear, and cables. These discharges—called partial discharges—happen when insulation begins to degrade, often due to stress, contamination, or defects. If left unchecked, they can grow over time and eventually cause equipment failure, leading to costly downtime or even dangerous accidents. Partial discharge monitoring systems work by continuously observing electrical signals, ultrasonic noise, or electromagnetic waves emitted during these discharges. By identifying early warning signs, these systems allow engineers and operators to take preventive action before serious damage occurs. This is especially valuable in industries where high-voltage equipment is critical, such as energy, utilities, manufacturing, and aerospace. Ultimately, partial discharge monitoring helps extend equipment life, improve safety, and reduce maintenance costs by shifting from reactive to predictive maintenance strategies.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- Temporary Monitoring System

- Permanent Monitoring System

By System Type

- Online Partial Discharge

- Offline Partial Discharge

By Equipment Type

- Transformers

- Switchgear

- Cables & Terminations

- Generators

- Rotating Machines

By Application

- Power Utilities

- Industrial

- Renewable Energy

- Research & Testing Laboratories

By End User

- Electrical Utilities

- Industrial Plants

- OEMs

- Testing & Certification Agencies

- Others

By Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 574.10 M |

| Forecast Revenue (2034) | USD 920.4 M |

| CAGR (2025-2034) | 5.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Temporary Monitoring System, Permanent Monitoring System), By System Type (Online Partial Discharge , Offline Partial Discharge), By Equipment Type (Transformers, Switchgear, Cables & Terminations, Generators, Rotating Machines), By Application (Power Utilities, Industrial, Renewable Energy, Research & Testing Laboratories), By End User (Electrical Utilities, Industrial Plants, OEMs, Testing & Certification Agencies, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Qualitrol, Siemens, Prysmian Group, Meggitt Sensing Systems, Eaton, Megger, Doble Engineering Company, LS Cable & System, Mitsubishi Electric, HVPD Ltd., EA Technology, OMICRON, APM Technologies, Rugged Monitoring, PMDT, PowerPD Inc., IPEC Limited, Dynamic Ratings, Altanova Group, Dimrus, Innovit Electric |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Partial Discharge Monitoring Systems Market

Published Date : 18 Jun 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date