Pasta and Noodles Market Size, Growth & Forecast | 4.65% CAGR

Global Pasta and Noodles Market Size, Share & Analysis By Type (Pasta, Noodles), By Category (Dried, Fresh/Instant, Canned or Frozen), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By End-User Consumption Patterns Industry Overview, Pricing Dynamics, Brand Competition, Regional Demand & Forecast 2025–2034

Report Overview

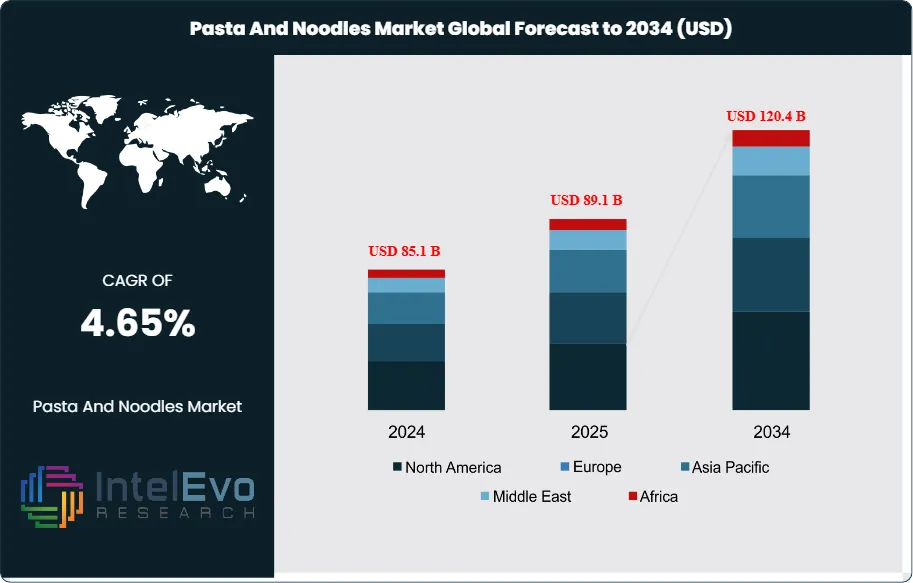

The Pasta and Noodles Market size is expected to be worth around USD 120.4 billion by 2034, from USD 85.1 billion in 2024, growing at a CAGR of 4.65% during the forecast period from 2025 to 2034. Building on centuries of culinary adoption, the category has transitioned from pantry staple to a dynamic, innovation-led segment of the packaged foods industry. Over the last decade, market expansion has been underpinned by rising urbanization, time-pressed households, and widening availability across modern retail and e-commerce. In 2024, supply-side conditions are broadly supportive, with global wheat output approaching 770 million tonnes, ensuring adequate raw material availability even as producers manage quality differentials and price volatility. On the demand side, convenience remains a central driver: ready-to-cook and ready-to-eat formats continue to outpace the broader category, with urban sell-through rising by roughly 5% per year. Cultural convergence is also expanding the addressable base, as consumption of Italian and Asian cuisines grows at about 7% annually in North America and Europe, catalyzing cross-over innovation (e.g., Italian pasta with Asian flavors and vice versa).

Get More Information about this report -

Request Free Sample ReportThe product mix is tilting toward higher-value attributes—high-protein, fiber-enriched, gluten-free, and clean-label offerings—supported by the rapid uptake of plant-based and alternative-grain lines, a subsegment expected to grow near 6% CAGR over the next five years. Digitalization and automation are reshaping manufacturing and route-to-market: smart dosing and drying technologies improve yield and consistency; advanced packaging lines enable portion-controlled, microwaveable, and recyclable formats; and data-driven promotions are lifting online penetration, particularly in direct-to-consumer bundles and subscription packs. Key challenges include exposure to agricultural commodity swings, energy costs, and regulatory tightening on labeling, sodium reduction, and sustainability mandates; players with hedged procurement, flexible formulations, and recyclable packaging are better positioned to defend margins.

Regionally, Europe remains a volume and premiumization anchor, while North America benefits from robust ethnic and better-for-you adoption. Asia Pacific is the principal growth engine—led by China’s large base in instant formats and accelerating demand in India and Southeast Asia—supported by expanding cold chains and modern trade. Emerging opportunities are also visible in the Middle East & Africa and parts of Latin America, where per-capita consumption is low but rising alongside incomes. For investors, the most attractive hotspots combine scale and premium trade-up: Asia Pacific for volume-led growth, and developed markets for margin-accretive innovation and private-label partnerships.

Key Takeaways

- Market Growth: The global Pasta & Noodles market is projected to rise from USD 85.1 Bn in 2024 to USD 129.4 Bn by 2034, at a 4.6% CAGR, driven by convenience-led demand, cross-cultural cuisine adoption, and wider modern retail/e-commerce reach.

- Product Type: Pasta leads with 58.7% value share in 2024, supported by broad household penetration, premiumization (high-protein, fiber-enriched, gluten-free lines), and strong brand depth from multinationals (e.g., Barilla) and private labels.

- Distribution Channel: Hypermarkets & Supermarkets account for 47.2% of category sales, reflecting their role in price discovery, private-label expansion, and promotional intensity; however, online and convenience formats are capturing incremental trips in urban corridors.

- Driver: Rising preference for time-saving meals is boosting ready-to-cook/ready-to-eat formats, with urban sell-through rising ~5% YoY; robust wheat availability (~770 million tonnes in 2024) underpins stable upstream supply, limiting major volume disruptions.

- Restraint: Exposure to agricultural and energy cost volatility compresses margins, with historical commodity swings of 10–20% translating to 100–150 bps EBIT pressure in unhedged portfolios; tightening sodium-reduction and labeling rules in the EU/NA add ~2–3% in reformulation/packaging costs through 2028.

- Opportunity: Plant-based/alternative-grain SKUs (chickpea, lentil, brown rice) are forecast to expand at ~6% CAGR (2025–2030), aided by flexitarian adoption and premium price realization; players that pair nutrition claims with recyclable, portion-controlled packaging can outgrow the market by 200–300 bps.

- Trend: Format innovation is shifting toward dried and shelf-stable options (still 52.3% share) with microwaveable cups/bowls and instant kits showing high-single- to low-double-digit growth; leaders (e.g., Nissin, Maggi/ Nestlé, Indofood) are scaling AI-informed flavor launches and automated packaging for faster rotation.

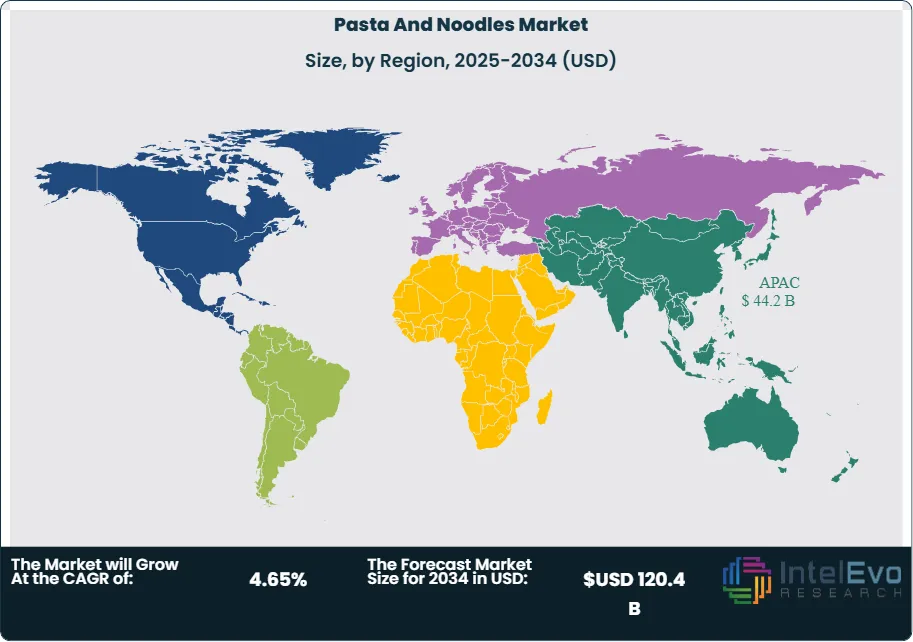

- Regional Analysis: APAC dominates with 53.2% share (USD 44.2 Bn in 2024), propelled by China’s instant segment and accelerating demand in India and Southeast Asia; Europe remains a premiumization anchor, while North America benefits from ethnic-cuisine adoption. Fastest growth is expected in APAC (≈4–5% CAGR) and selected Middle East/Africa markets from a low per-capita base.

Type Analysis

Pasta continues to anchor category value in 2025, retaining an estimated ~58.7% revenue share on the back of entrenched household penetration, culinary versatility, and sustained premiumization. Trade-up is visible in high-protein, fiber-enriched, whole-grain, and gluten-free SKUs, with leading brands (e.g., Barilla) and private labels expanding differentiated ranges that command 10–20% price premiums versus standard lines. Innovation in shapes, sauces, and ready-meal pairings is also nudging average selling prices upward, helping pasta outgrow volume in developed markets.

Noodles remain the scale growth engine, particularly across Asia Pacific, where instant, ramen, and stir-fry formats benefit from strong convenience cues and flavor localization. As urban working households expand, single-serve cups and bowls show high-single-digit volume gains, while better-for-you noodle variants (reduced sodium, air-dried, alternative grains) are widening the addressable consumer base. Together, these dynamics position noodles to capture a rising share of incremental category growth through 2030, even as pasta sustains value leadership.

Application Analysis

Dried formats lead the product mix with ~52.3% share, supported by long shelf life, ease of storage, and broad recipe compatibility. Pantry-stocking behavior that intensified during recent supply disruptions has normalized at a higher baseline, and value-for-money positioning keeps dried SKUs central to both retail baskets and foodservice back-of-house menus. Operationally, higher line speeds and improved drying controls are lifting yield and consistency, supporting margins despite input-cost volatility.

Fresh/instant offerings are the fastest to rotate at point of sale, propelled by microwaveable cups, ready-to-heat trays, and chef-inspired broths and sauces. Convenience retail and e-commerce bundles are sustaining high-single- to low-double-digit growth, with major players (Nissin, Nestlé/Maggi, Indofood) using rapid flavor testing to localize portfolios. Canned or frozen niches remain smaller but strategically important for premium and seasonal occasions; flash-frozen filled pasta and frozen noodle kits are gaining traction in North America and Europe as retailers expand freezer space and meal-kit adjacencies.

End-Use Analysis

Household consumption (retail) accounts for roughly ~70% of global demand in 2025, buoyed by multi-pack promotions, private-label expansion, and digital coupons that improve price-per-serve economics. At-home cooking trends—especially weeknight pasta dishes and instant noodle meals—continue to anchor repeat purchases, while subscription boxes and D2C bundles are lifting retention.

Foodservice represents ~25–28% of category volumes and is recovering on-premise traffic alongside delivery growth. Quick-service restaurants and cloud kitchens are introducing regionally tailored noodle bowls and pasta entrees, supporting menu innovation cycles and premium price points. Institutional channels (education, healthcare, workplace) comprise the remainder, emphasizing cost-stable dried SKUs and nutrition-forward formulations to meet procurement standards.

Regional Analysis

Asia Pacific remains the demand center with ~53.2% share (valued at USD 44.2 Bn in 2024) and is set to outpace the global market through 2030, underpinned by large base consumption, rapid urbanization, and continuous flavor localization. China leads in instant formats, while India and Southeast Asia are expanding distribution into Tier-2/3 cities via modern trade and convenience formats, reinforcing double-digit growth pockets for noodles and value dried SKUs.

Europe sustains premium value density through authentic durum pasta, artisanal cues, and health-led innovation, while North America benefits from cross-cuisine adoption and better-for-you positioning. Latin America and the Middle East & Africa present catch-up opportunities from a low per-capita base; as cold-chain and modern retail improve, these regions are expected to deliver above-market CAGRs (≈4–6%), particularly in value dried pasta and flavor-forward instant noodles. For investors, the most attractive near-term hotspots pair APAC’s scale with developed-market premiumization, balancing volume growth with margin accretion.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Pasta

- Noodles

By Category

- Dried

- Fresh/Instant

- Canned or Frozen

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 85.1 B |

| Forecast Revenue (2034) | USD 120.4 B |

| CAGR (2024-2034) | 4.65% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Pasta, Noodles), By Category (Dried, Fresh/Instant, Canned or Frozen), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Acecook Vietnam Co., Ltd., General Mills, Inc., ITC Limited, Nissin Foods, TreeHouse Foods Inc., Nestlé S.A., Conagra Brands, Inc., Ebro Foods SA, Barilla Group, Campbell Soup Company, Jinmailang Foods Co., Ltd, Del Monte Foods, Unilever, Bambino Agro Industries Ltd, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date