Payment Processing Solution Market Size, Share & Forecast 2034

Global Payment Processing Solution Market Size, Share & Analysis By Payment Method (Card Payments, e-Wallets, Account-to-Account Transfers, Others), By End-user Industry (Retail & E-commerce, BFSI, Healthcare, Government and Public Sector, Travel & Hospitality, Other industries), By Transaction Type Industry Regions & Key Players – Digital Payments Evolution, Security Trends & Forecast 2025–2034

Report Overview

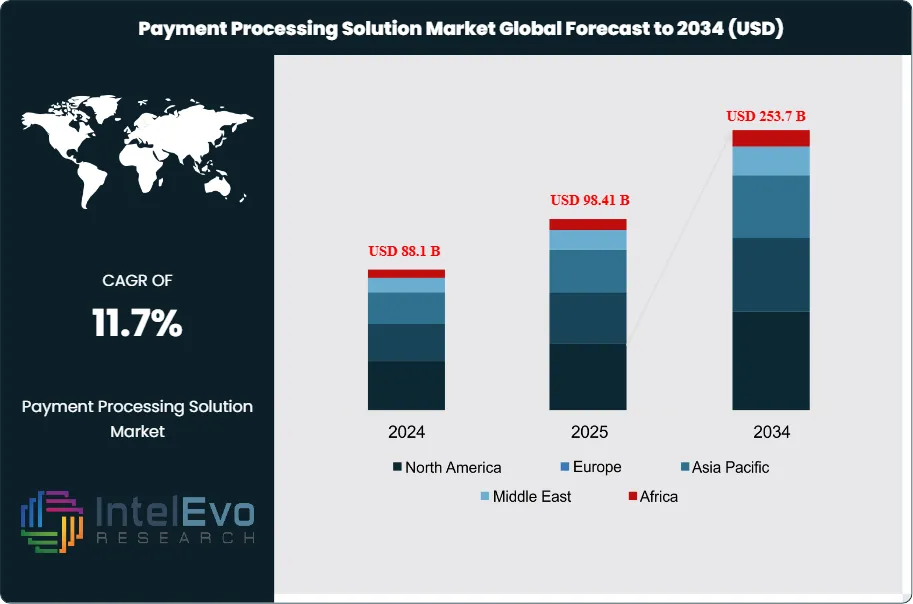

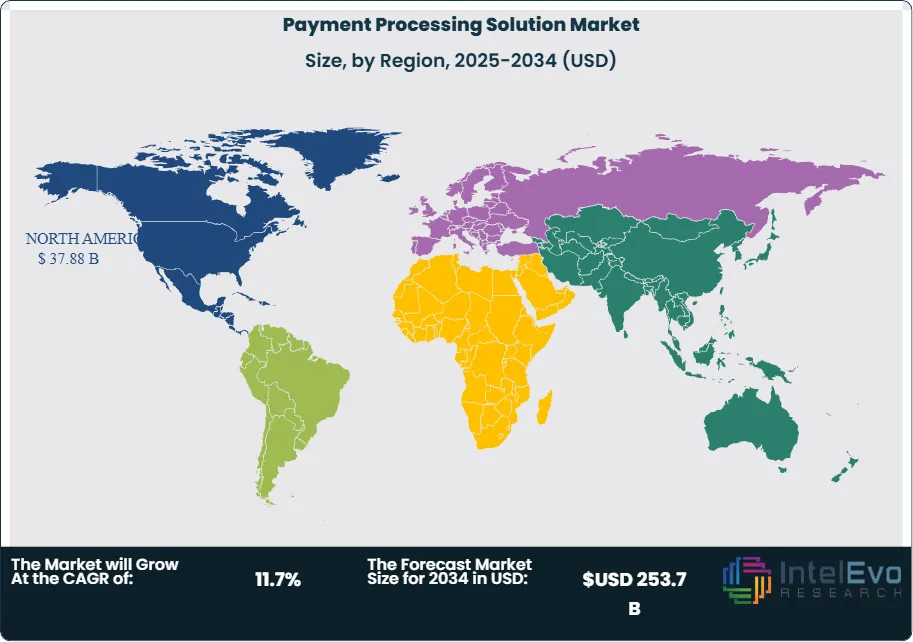

The Payment Processing Solution Market is expected to reach about USD 253.7 billion by 2034, rising from an estimated USD 88.1 billion in 2024. This growth will occur at a CAGR of around 11.7% from 2025 to 2034. In 2024, North America is projected to dominate the market with a share of about 43.2%, which equals a regional market size of nearly USD 38.1 billion. This growth comes from the region's strong digital payment infrastructure, the wide use of contactless and mobile-first payment systems, and the increasing use of AI-driven fraud detection solutions.

Get More Information about this report -

Request Free Sample ReportPayment processing solutions serve as the backbone of digital commerce, enabling the secure transfer of funds between customers and merchants through gateways, authorization mechanisms, and settlement systems. These platforms support multiple transaction modes—including debit and credit cards, mobile wallets, and online banking—ensuring efficiency, convenience, and trust in both physical and online environments. The industry’s role has expanded beyond basic transactions to encompass real-time analytics, fraud prevention, and consumer engagement, making it a cornerstone of modern business operations.

Market growth is being propelled by the rapid rise of e-commerce and mobile commerce, coupled with consumers’ strong preference for quick, seamless, and secure digital transactions. The surge in smartphone penetration, combined with the global shift toward cashless economies, has accelerated the adoption of digital wallets, QR-based payments, and contactless methods. At the same time, businesses are increasingly integrating AI, machine learning, and blockchain into payment systems to reduce fraud, streamline operations, and deliver personalized financial experiences.

The competitive landscape is marked by constant innovation. In July 2024, Paytm introduced the NFC Card Soundbox, blending QR code payments with NFC-enabled card functionality to simplify small merchant transactions. Similar advances underscore how providers are combining hardware, software, and AI-driven intelligence to expand digital payment ecosystems. Beyond consumer-facing innovation, opportunities also exist in emerging markets where digital infrastructure is still evolving, creating space for financial inclusion initiatives and localized solutions.

Industry-wide, payment volumes reflect the sector’s significance: in 2023, the global payments industry processed roughly 3.5 trillion transactions valued at USD 1.9 quadrillion, generating approximately USD 2.4 trillion in revenue. While growth is expected to moderate to about 5% annually through 2028, the industry will still add nearly USD 700 billion in new revenues, reaching USD 3.2 trillion. This steady expansion highlights the sector’s critical role in shaping global commerce, with investments increasingly concentrated in AI-enabled fraud detection, real-time payments, and cross-border solutions.

Key Takeaways:

- Market Growth: The Global Payment Processing Solution Market is projected to reach USD 253.7 billion by 2034, rising from USD 88.1 billion in 2024, at a CAGR of 11.7% during 2025–2034. Growth is fueled by expanding e-commerce, rising mobile payments, and increasing global adoption of digital transaction channels.

- Payment Method (Card Payments): Card-based transactions accounted for approximately 45% of the market in 2023, driven by consumer reliance on debit and credit cards. The segment remains resilient due to widespread infrastructure support and consistent adoption across retail, travel, and hospitality sectors.

- End Use (Retail & E-commerce): Retail and e-commerce led with a 33.7% market share in 2023, reflecting rapid digitalization of shopping platforms and rising consumer preference for seamless online checkout experiences. The surge in cross-border e-commerce further strengthens this segment’s outlook.

- Driver: The global shift toward contactless payments and mobile-first commerce, enabled by rising smartphone penetration and NFC-enabled devices, is accelerating demand for fast, secure, and frictionless transaction solutions.

- Restraint: Cybersecurity risks, including data breaches and fraud, remain a significant barrier. High compliance costs associated with regulatory frameworks such as PCI DSS also pose operational challenges for providers.

- Opportunity: Emerging markets present untapped potential as financial inclusion and digital payment infrastructures continue to develop. Solutions integrating AI-driven fraud prevention and real-time analytics are expected to gain rapid adoption in these regions.

- Trend: Innovation in hybrid payment solutions is reshaping the competitive landscape. For instance, Paytm’s July 2024 launch of the NFC Card Soundbox demonstrates growing demand for integrated devices that combine QR codes, mobile wallets, and card functionality for small merchants.

- Regional Analysis: North America dominated the global market in 2023 with 43.2% share (USD 34.5 billion), supported by advanced infrastructure and early adoption of digital wallets and mobile payments. Asia-Pacific is projected to be the fastest-growing region, fueled by government-backed cashless initiatives in India, China, and Southeast Asia, alongside booming e-commerce ecosystems.

Payment Method Analysis

Card payments remain the leading transaction channel in the global payment processing solution market, holding more than 45% of total share in 2025. Their dominance is underpinned by strong global acceptance, ease of use, and well-established infrastructure that supports both in-store and digital commerce. Despite the rise of alternative payment options such as digital wallets and account-to-account transfers, consumers and businesses continue to favor card-based methods due to their reliability and ubiquity across industries.

The segment has also benefited from continuous improvements in transaction security and user authentication. Technologies such as EMV chip cards, tokenization, and biometric verification have strengthened fraud protection, reassuring both merchants and end-users. Furthermore, the credit card industry is expanding into underserved markets, aided by regulatory support and improved digital banking frameworks, creating opportunities for financial inclusion. Enhanced features, such as built-in budget tracking and personalized financial analytics, are further increasing consumer adoption. As a result, card payments not only sustain high transaction volumes but also remain a critical enabler of global commerce and financial systems.

End-user Industry Analysis

In 2025, the retail and e-commerce sector continues to account for the largest share of the payment processing market, with more than 33.7% of total revenue. This leadership is a direct outcome of rapid digitalization in global retail, coupled with increasing consumer reliance on online and mobile shopping platforms. Seamless checkout processes, secure digital transactions, and flexible payment options have become essential to improving customer experience and driving repeat purchases.

Advancements in technology have further reinforced this sector’s growth. Retailers and e-commerce platforms are increasingly deploying solutions such as NFC-enabled payments, QR-based systems, and blockchain-backed verification to streamline payment flows. In parallel, the rise of omnichannel commerce is creating demand for integrated solutions that ensure consistency across physical stores, websites, and mobile apps. While the segment faces persistent challenges around cybersecurity and compliance with international payment regulations, these hurdles are also spurring investments in more robust digital security frameworks. As retailers adapt to shifting consumer expectations and adopt emerging fintech innovations, the segment is set to maintain its dominant market position throughout the forecast horizon.

Regional Analysis

North America remains the leading region in the payment processing solution market in 2025, capturing over 43% of global revenue. The United States and Canada benefit from a mature financial infrastructure, advanced digital adoption, and strong consumer confidence in electronic payment systems. The region’s dominance is further supported by the presence of global leaders such as PayPal, Stripe, and Block (Square), which continue to innovate with AI-powered fraud detection, blockchain integration, and scalable cloud-based processing platforms.

The regional regulatory environment is another critical enabler of growth. Clear fintech policies, combined with strong data security standards, encourage both incumbents and new entrants to expand operations. Meanwhile, consumer behavior in North America has shifted decisively toward e-commerce and mobile-first payments, a trend amplified by widespread smartphone penetration and growing demand for contactless transactions. Together, these factors ensure North America’s continued leadership, even as Asia-Pacific and Europe show accelerating growth driven by digital inclusion initiatives and government-backed cashless economy programs.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Payment Method

- Card Payments

- e-Wallets

- Account-to-Account Transfers

- Others

By End-user Industry

- Retail & E-commerce

- BFSI

- Healthcare

- Government and Public Sector

- Travel & Hospitality

- Other industries

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 98.41 B |

| Forecast Revenue (2034) | USD 253.7 B |

| CAGR (2025-2034) | 11.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Payment Method (Card Payments, e-Wallets, Account-to-Account Transfers, Others), By End-user Industry (Retail & E-commerce, BFSI, Healthcare, Government and Public Sector, Travel & Hospitality, Other industries) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | PayPal Holdings, Inc., Visa Inc., Mastercard Incorporated, Square, Inc. (Block, Inc.), Stripe, Inc., Adyen N.V., Fiserv, Inc., Global Payments Inc., FIS (Fidelity National Information Services, Inc.), Alipay (Ant Group), Amazon Pay, Apple Pay, PayU |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Payment Processing Solution Market?

The Payment Processing Solution Market is set to reach USD 253.7 Billion by 2034, growing at an 11.7% CAGR. North America leads with strong digital payment adoption and AI-powered fraud detection.

Who are the major players in the Payment Processing Solution Market?

PayPal Holdings, Inc., Visa Inc., Mastercard Incorporated, Square, Inc. (Block, Inc.), Stripe, Inc., Adyen N.V., Fiserv, Inc., Global Payments Inc., FIS (Fidelity National Information Services, Inc.), Alipay (Ant Group), Amazon Pay, Apple Pay, PayU

Which segments covered the Payment Processing Solution Market?

By Payment Method (Card Payments, e-Wallets, Account-to-Account Transfers, Others), By End-user Industry (Retail & E-commerce, BFSI, Healthcare, Government and Public Sector, Travel & Hospitality, Other industries)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Payment Processing Solution Market

Published Date : 05 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date