Personal AI Assistant Market to Hit USD 69.29 Bn by 2034 | CAGR 39.68%

Global Personal AI Assistant Market Size, Share, Analysis Report By Product (Smart Speaker, Chatbot, Others) Technology (Machine Learning (ML), Natural Language Processing (NLP), Text-Based) Deployment Model (On-premise, Cloud-based) Application (Customer Service, Productivity) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

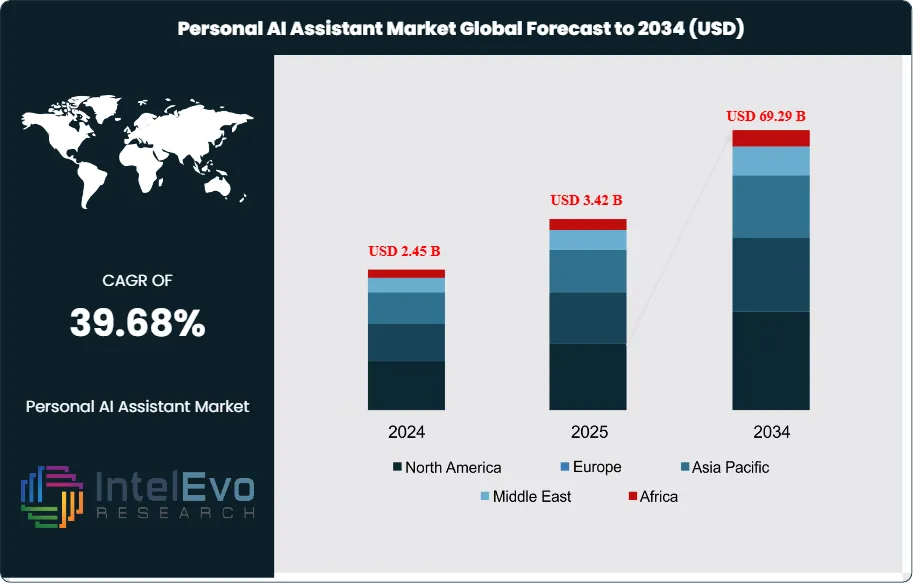

The Personal AI Assistant Market size is expected to be worth around USD 69.29 Billion by 2034, from USD 2.45 Billion in 2024, growing at a CAGR of 39.68% during the forecast period from 2024 to 2034. The Personal AI Assistant Market comprises AI-powered solutions that automate day-to-day digital interactions, streamline information retrieval, and intelligently assist users with scheduling, messaging, customer service, and specialized productivity tasks through platforms such as chatbots and smart speakers.

Get More Information about this report -

Request Free Sample ReportGrowth in this market is driven by rapid advancements in natural language processing (NLP), increasing integration of voice and text-based assistants across consumer devices and business applications, and rising demand for 24/7 automated support. The proliferation of smartphones, IoT devices, and cloud computing has expanded the reach of AI assistants, allowing them to deliver personalized, context-aware services for both businesses and individuals. Additionally, major technology vendors are continuously enhancing their AI capabilities through large-scale investments in machine learning and conversational AI, resulting in increasingly sophisticated, intuitive user experiences.

However, several challenges influence market dynamics. Data privacy concerns, regulatory changes (such as GDPR and CCPA), and inconsistencies in AI performance across languages and cultural contexts pose hurdles to adoption. Resistance within organizations regarding the replacement of human roles, high integration costs for enterprises, and sporadic reliability of speech and language recognition in complex environments continue to limit market growth. Furthermore, the industry faces ongoing pressure to improve the transparency, security, and ethical governance of AI systems, especially as assistants gain deeper access to personal and corporate data.

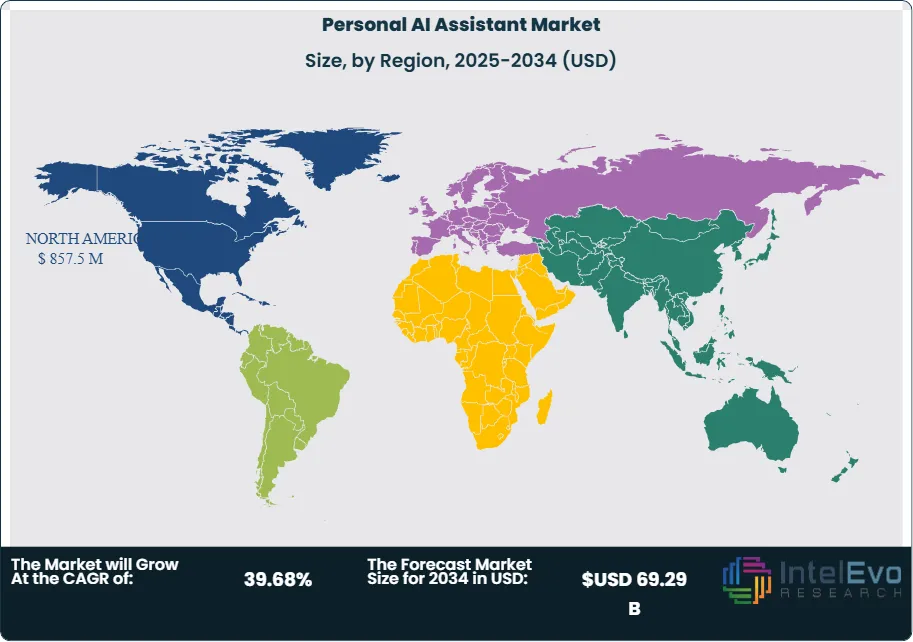

Regionally, North America maintains the largest market share due to a mature digital infrastructure, presence of leading AI vendors, and strong consumer adoption of smart devices. Europe follows with significant market activity driven by digital transformation initiatives and investments in AI ethics and multilingual support. The Asia-Pacific region demonstrates the fastest growth, propelled by massive smartphone penetration, regional language innovations, and expanding enterprise digitalization in countries such as China, India, and Japan.

The COVID-19 pandemic accelerated AI assistant market adoption worldwide, as organizations and consumers sought efficient, contactless interaction tools for remote work, healthcare information, and online customer service. Businesses leveraged AI-powered chatbots and voice assistants to manage surges in digital inquiries, automate basic tasks, and maintain customer engagement while minimizing physical contact. This shift established AI assistants as essential tools in both enterprise operations and daily life post-pandemic.

Rising geopolitical tensions and tariff impositions between major economies have affected the market landscape. Tariffs on electronic components and cloud computing infrastructure—particularly between the U.S., China, and the EU—have led to higher production costs for smart speakers, servers, and edge devices, raising barriers for new entrants and small vendors. Supply chain disruptions, component shortages, and fluctuating exchange rates have compelled companies to diversify suppliers, localize production, and adjust deployment strategies. These countermeasures, while resilience-building, have slowed overall market expansion and limited rapid integration in cost-sensitive regions.

In response, new and existing free trade agreements among major economies have facilitated cross-border technology transfer, regulatory harmonization, and access to global talent. Agreements like the USMCA, RCEP, and the EU-Japan Economic Partnership have promoted collaboration in AI research, eased trade restrictions on digital products, and fostered joint ventures in AI development. Such frameworks help companies scale personal AI assistant solutions across regions while ensuring compliance with emerging international standards for data privacy and interoperability.

Key Takeaways

- Market Growth: The Personal AI Assistant Market is expected to reach USD 69.29 Billion by 2034, driven by advancing natural language processing, increasing smart device adoption, growing demand for hands-free interaction, and expanding integration with IoT ecosystems across consumer and enterprise segments.

- Product Dominance: Chatbots dominate the Personal AI Assistant market due to their versatility, cost-effectiveness, and seamless integration across multiple digital platforms, making them the most widely adopted AI assistant solution for businesses and consumers.

- Technology Dominance: Natural Language Processing leads the Personal AI Assistant technology segment because it enables human-like communication and understanding, forming the foundational capability that makes AI assistants truly useful and accessible to users.

- Deployment Model Dominance: Cloud-based deployment dominates the Personal AI Assistant market due to superior scalability, continuous updates, and access to powerful computing resources that enable sophisticated AI processing without requiring local infrastructure investments.

- Application Dominance: Customer service leads the Personal AI Assistant application segment because it addresses critical business needs for cost reduction, 24/7 availability, and consistent service quality while managing high-volume inquiries efficiently.

- Drivers: Key growth drivers include improving voice recognition accuracy, expanding smart home adoption, increasing consumer comfort with AI technologies, integration with mobile ecosystems, and the development of more natural conversational interfaces.

- Restraints: Growth is challenged by privacy and data security concerns, limitations in understanding accents and dialects, integration complexity across different platforms, and varying consumer acceptance levels across different demographic segments.

- Opportunities: Significant opportunities exist in enterprise productivity applications, healthcare and elderly care assistance, automotive integration, multilingual capabilities, and emerging markets with expanding smartphone and internet penetration.

- Trends: Key trends include multimodal interaction capabilities, proactive assistance features, emotional intelligence integration, seamless cross-device continuity, and the emergence of specialized assistant capabilities for specific industries and use cases.

- Regional Leader: North America leads with advanced infrastructure and major technology companies, while Asia-Pacific demonstrates the highest growth potential driven by smartphone expansion and increasing AI technology investments.

Product Analysis

Chatbots lead this segment because they offer unparalleled accessibility and deployment flexibility across websites, mobile applications, messaging platforms, and social media channels without requiring additional hardware investments. Their ability to handle diverse tasks ranging from customer inquiries to transaction processing, combined with 24/7 availability and scalable operations, makes them indispensable for modern digital interactions. Unlike smart speakers, which are limited to voice-only interactions and specific physical locations, chatbots can operate wherever users have digital access. Smart speakers, while popular for home automation and entertainment, represent a smaller market share due to privacy concerns, location constraints, and dependence on internet connectivity. Other AI assistant products, including wearable devices and automotive assistants, serve specialized niches but lack the broad applicability and cost advantages that drive chatbot adoption across industries and consumer segments.

Technology Analysis

NLP dominates this market because it bridges the critical gap between human communication and machine understanding, enabling AI assistants to interpret context, sentiment, and intent from natural speech and text inputs. This technology powers the conversational abilities that define modern AI assistants, allowing them to process complex queries, maintain dialogue context, and provide relevant responses that feel intuitive to users. Machine Learning complements NLP by enabling continuous improvement and personalization, but it serves as a supporting technology rather than the primary interface mechanism. Text-based technologies, while important for written communications and data processing, represent a narrower scope of interaction compared to NLP's comprehensive language understanding capabilities. The convergence of NLP with voice recognition and speech synthesis has created the seamless, multimodal experiences that users expect from personal AI assistants, establishing NLP as the cornerstone technology driving market growth and user adoption.

Deployment Model Analysis

Cloud-based solutions lead this segment because they offer several critical advantages that align with the computational demands of AI assistants. The ability to leverage massive cloud computing resources enables real-time processing of complex natural language queries, machine learning model updates, and seamless integration with various online services and databases. Cloud deployment also facilitates automatic software updates, ensuring users always have access to the latest AI capabilities and security patches without manual intervention. Additionally, cloud-based assistants can access vast knowledge repositories and maintain synchronized user preferences across multiple devices and platforms. On-premise deployment, while offering greater data control and security for sensitive applications, represents a smaller market share due to higher implementation costs, maintenance complexity, and limited scalability. Most consumers and businesses prefer cloud-based solutions for their convenience, cost-effectiveness, and the ability to benefit from continuous AI model improvements developed by major technology providers.

Application Analysis

Customer Service Automation Leads With more than 65% Market Share In Personal AI Assistant Market, Customer service dominates this market because AI assistants provide immediate value by automating routine inquiries, reducing operational costs, and improving customer satisfaction through instant response times. Organizations across industries deploy AI assistants to handle frequently asked questions, process simple transactions, provide product information, and escalate complex issues to human agents when necessary. This application generates substantial return on investment by reducing staffing requirements while maintaining service quality standards. The ability to handle multiple customer interactions simultaneously and provide consistent responses makes AI assistants particularly valuable for customer service operations. Productivity applications, while growing rapidly, represent a secondary market segment focused on personal task management, scheduling, and workflow optimization. These productivity use cases serve individual users rather than enterprise-scale operations, resulting in lower overall market value despite strong user engagement and adoption rates among knowledge workers and business professionals.

Regional Analysis

North America Leads With More Than 35% Market Share In Personal AI Assistant Market, North America leads the global Personal AI Assistant market with a commanding market share, driven by its mature consumer technology ecosystem, high adoption rates of smart devices, early investment in AI research and development, and strong consumer spending on premium digital services. The region benefits from established technology companies including Amazon, Apple, Google, and Microsoft that continuously innovate personal AI assistant capabilities while maintaining extensive distribution networks and marketing reach. Major technology corporations maintain their primary research and development centers in North America, driving continuous advancement in voice recognition, natural language understanding, and conversational AI technologies.

Asia-Pacific represents the fastest-growing regional market, fueled by massive smartphone adoption, expanding internet connectivity, growing middle-class populations with increasing disposable income, and significant government and private investments in AI technology development. Countries like China and India are experiencing rapid growth in personal AI assistant adoption, supported by local technology companies developing culturally and linguistically appropriate solutions. The region's growth is supported by increasing urbanization, rising consumer comfort with AI technologies, and expanding smart device manufacturing capabilities.

Europe maintains a stable market position with steady growth driven by stringent data privacy regulations that build consumer trust, strong adoption of premium consumer electronics, and increasing integration of AI assistants with automotive systems. Latin America and the Middle East & Africa regions show moderate growth potential, supported by expanding smartphone penetration and increasing consumer awareness of AI assistant capabilities.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product

- Smart Speaker

- Chatbot

- Others

Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Text-Based

Deployment Model

- On-premise

- Cloud-based

Application

- Customer Service

- Productivity

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 3.42 B |

| Forecast Revenue (2034) | USD 69.29 B |

| CAGR (2025-2034) | 39.68% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product (Smart Speaker, Chatbot, Others) Technology (Machine Learning (ML), Natural Language Processing (NLP), Text-Based) Deployment Model (On-premise, Cloud-based) Application (Customer Service, Productivity) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Amazon Inc., Apple Inc., Google LLC, Microsoft Corporation, Samsung Electronics Co. Ltd., Baidu Inc., Alibaba Group Holding Limited, Xiaomi Corporation, Huawei Technologies Co. Ltd., IBM Corporation, Meta Platforms Inc., OpenAI, Anthropic, Nuance Communications Inc., SoundHound Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Personal AI Assistant Market?

Rising demand for smart assistants drives the Personal AI Assistant Market to USD 69.29 Billion by 2034, expanding at a CAGR of 39.68%.

Who are the major players in the Personal AI Assistant Market?

Amazon Inc., Apple Inc., Google LLC, Microsoft Corporation, Samsung Electronics Co. Ltd., Baidu Inc., Alibaba Group Holding Limited, Xiaomi Corporation, Huawei Technologies Co. Ltd., IBM Corporation, Meta Platforms Inc., OpenAI, Anthropic, Nuance Communications Inc., SoundHound Inc.

Which segments covered the Personal AI Assistant Market?

Product (Smart Speaker, Chatbot, Others) Technology (Machine Learning (ML), Natural Language Processing (NLP), Text-Based) Deployment Model (On-premise, Cloud-based) Application (Customer Service, Productivity)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Personal AI Assistant Market

Published Date : 26 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date