Pet Insurance Market Size, Share, Trends, Growth Drivers | CAGR 16.2%

Global Pet Insurance Market Size, Share, Analysis Report Technology (Digital Platforms, AI-Powered Solutions, Mobile Apps, Cloud-Based Services), Component (Policy Management Software, Claims Management Software, Customer Portals, Services), Verticals (Dogs, Cats, Exotic Pets, Multi-Pet Households), Enterprise Size (SMEs, Large Enterprises), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

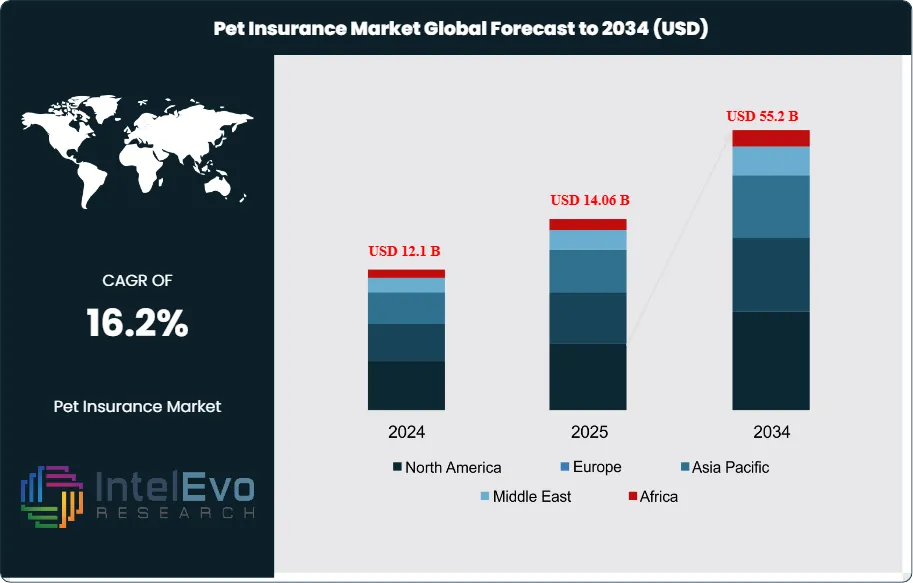

The Pet Insurance Market is projected to be worth around USD 55.2 Billion by 2034, up from USD 12.1 Billion in 2024, growing at a CAGR of 16.2% during the forecast period from 2024 to 2034. The pet insurance market encompasses a wide range of insurance products designed to cover veterinary expenses for pets, including accident, illness, routine care, and wellness plans. This market includes policy providers, underwriters, digital platforms for policy management, and integrated services for claims processing and customer support.

Get More Information about this report -

Request Free Sample ReportThe pet insurance ecosystem serves diverse pet owners, veterinary clinics, and animal welfare organizations, enabling financial protection, improved access to veterinary care, and enhanced pet health outcomes worldwide. The pet insurance market is experiencing robust growth driven by rising pet ownership, increasing awareness of pet health, and the growing cost of veterinary care. Key growth catalysts include the integration of digital technologies such as AI-powered claims processing, telemedicine, and mobile apps that enable seamless policy management and customer engagement. The market benefits from the expansion of product offerings, including multi-pet policies, exotic pet coverage, and wellness add-ons, as well as the entry of new players and partnerships with veterinary networks.

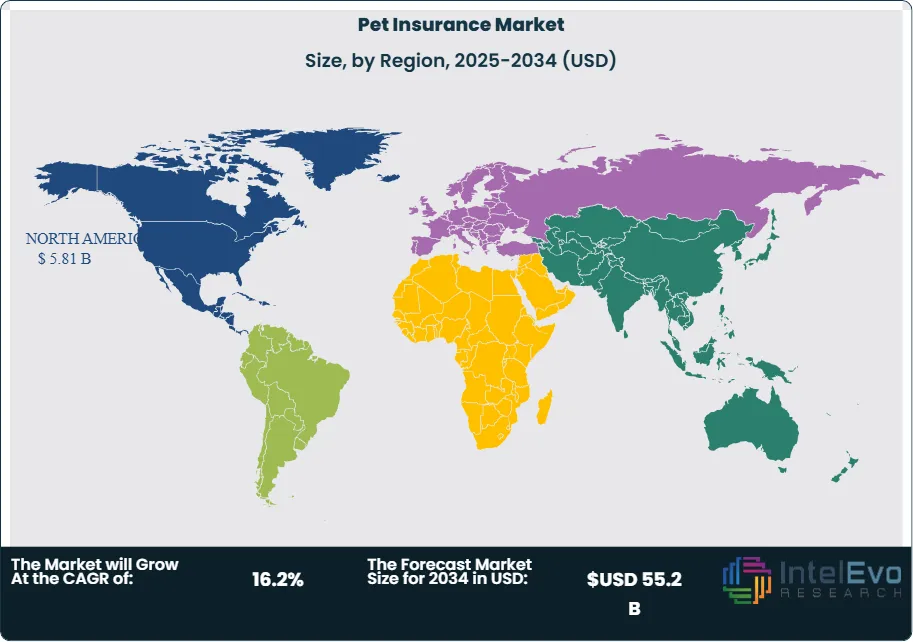

North America maintains its position as the leading regional market for pet insurance, commanding the largest global market share and generating the highest revenues within the sector. This dominance is attributed to high pet ownership rates, advanced veterinary infrastructure, and significant investments in digital transformation by major insurers. The United States serves as the primary contributor to North America's market leadership, with substantial revenue generation and strong growth projections. Meanwhile, the Asia-Pacific region emerges as the most rapidly expanding market segment, propelled by rising disposable incomes, urbanization, and increasing awareness of pet health and insurance benefits.

The COVID-19 pandemic accelerated pet adoption and heightened awareness of pet health, driving demand for insurance products that offer financial security and access to quality veterinary care. The crisis highlighted the importance of digital platforms for remote policy management, telehealth consultations, and contactless claims processing. While initial economic uncertainty affected discretionary spending, the long-term impact has been positive, with increased recognition of pet insurance as a valuable risk management tool. Rising veterinary costs, regulatory changes, and evolving consumer expectations are influencing product innovation and market competition. Insurers are investing in digital platforms, AI-driven underwriting, and personalized policy offerings to enhance customer experience and operational efficiency. Additionally, the increasing focus on preventive care and wellness is driving demand for comprehensive insurance plans that cover routine check-ups, vaccinations, and chronic disease management.

Key Takeaways

- Market Growth: The Pet Insurance Market is expected to reach USD 55.2 Billion by 2034, fueled by growing pet ownership, rising veterinary costs, and digital transformation in insurance services.

- Technology Dominance: Digital platforms and AI-powered solutions lead the segment, due to their foundational role in policy management, claims automation, and customer engagement.

- Component Dominance: Policy and claims management software dominate, driven by the need for efficient, scalable, and user-friendly solutions.

- Enterprise Size Dominance: Large insurers lead the segment, primarily due to higher investment capacity, brand recognition, and extensive distribution networks.

- Verticals Dominance: Dogs and cats hold the largest share, owing to their high ownership rates and frequent veterinary care needs.

- Driver: Key drivers accelerating growth include rising pet adoption and increasing veterinary costs, which boost market expansion through enhanced demand for financial protection.

- Restraint: Growth is hindered by low awareness in emerging markets and policy exclusions, which create barriers to adoption and customer satisfaction.

- Opportunity: The market is poised for expansion due to opportunities like digital health integration and emerging market penetration, which enable new product offerings and geographic diversification.

- Trend: Emerging trends including telemedicine, wellness coverage, and personalized policies are reshaping the market by enabling proactive pet health management and improved customer experience.

- Regional Analysis: North America leads owing to high pet ownership and advanced insurance infrastructure. Asia-Pacific shows high promise due to rising incomes and growing awareness.

Technology Analysis:

Digital platforms and AI-powered solutions have become the foundation of the modern pet insurance market, revolutionizing how policies are managed and claims are processed. Digital platforms enable seamless customer experiences, from onboarding and policy selection to renewals and customer support, often through intuitive mobile apps and web portals. AI technologies further enhance these platforms by automating claims assessment, detecting fraudulent activities, and providing personalized policy recommendations based on pet profiles and historical data. The integration of telehealth services allows policyholders to access veterinary consultations remotely, improving access to care and reducing unnecessary clinic visits. Continuous advancements in data analytics, cloud computing, and mobile technology are driving innovation, enabling insurers to offer more responsive, efficient, and customer-centric services that meet the evolving needs of pet owners.

Component Analysis:

Policy and claims management software are at the heart of operational efficiency in the pet insurance sector. These software solutions streamline the entire insurance lifecycle, from policy issuance and premium collection to claims submission and settlement. Customer portals and mobile apps empower pet owners to manage their policies, submit claims, and track reimbursements with ease, while backend systems automate administrative tasks, reducing manual errors and operational costs. Integration with veterinary networks allows for direct billing and real-time claims processing, further enhancing the customer experience. The demand for scalable, flexible, and user-friendly software is growing as insurers seek to differentiate themselves in a competitive market and cater to the diverse needs of pet owners, including multi-pet households and exotic pet coverage.

Enterprise Size Analysis:

Large insurance companies are the primary drivers of growth and innovation in the pet insurance market. Their substantial financial resources, established brand reputation, and extensive distribution networks enable them to invest heavily in digital transformation and product development. These organizations are often the first to adopt advanced technologies, such as AI-driven underwriting and automated claims processing, to streamline operations and enhance customer engagement. Large insurers are also better equipped to navigate complex regulatory environments, manage diverse risk portfolios, and offer a wide range of policy options. Their leadership is further reinforced by strategic partnerships with veterinary clinics, pet retailers, and technology providers, allowing them to deliver comprehensive and integrated insurance solutions that set industry standards.

Verticals Analysis:

Dogs and cats dominate the pet insurance market, accounting for the majority of policies sold worldwide. This is largely due to their high ownership rates, frequent veterinary care needs, and the broad availability of tailored insurance products. Insurance for dogs and cats typically covers accidents, illnesses, surgeries, and sometimes routine wellness care, addressing the most common health concerns faced by pet owners. The prominence of these verticals is supported by ongoing investments in product innovation, targeted marketing campaigns, and collaborations with veterinary clinics and pet retailers to raise awareness and facilitate policy adoption. As pet owners increasingly view their animals as family members, the demand for comprehensive insurance coverage for dogs and cats continues to grow, driving market expansion and encouraging further innovation in policy design and service delivery.

Region Analysis:

North America Leads With Over 40% Market Share in the Pet Insurance Market

North America stands as the clear leader in the global pet insurance market, supported by high pet ownership, advanced veterinary care, and strong digital infrastructure. The United States, in particular, plays a pivotal role in shaping industry trends through investments in digital platforms, product innovation, and regulatory compliance. Asia-Pacific is the fastest-growing region, fueled by rising incomes, urbanization, and increasing awareness of pet health and insurance benefits. Countries such as China, Japan, Australia, and India are at the forefront of this expansion, with many insurers launching localized products and digital distribution channels to capture market share. Europe maintains a substantial presence through established insurance markets, high pet ownership, and a strong focus on animal welfare. The region’s adoption of pet insurance is influenced by regulatory frameworks, consumer preferences, and active participation by leading insurers.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Technology

- Digital Platforms

- AI-Powered Solutions

- Mobile Apps

- Cloud-Based Services

Component

- Policy Management Software

- Claims Management Software

- Customer Portals

- Services

Verticals

- Dogs

- Cats

- Exotic Pets

- Multi-Pet Households

Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 14.06 B |

| Forecast Revenue (2034) | USD 55.2 B |

| CAGR (2025-2034) | 16.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Technology (Digital Platforms, AI-Powered Solutions, Mobile Apps, Cloud-Based Services), Component (Policy Management Software, Claims Management Software, Customer Portals, Services), Verticals (Dogs, Cats, Exotic Pets, Multi-Pet Households), Enterprise Size (Small and Medium Enterprises, Large Enterprises) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Trupanion, Nationwide, Fetch by The Dodo (Petplan), Embrace Pet Insurance, Healthy Paws, ASPCA Pet Health Insurance, Figo Pet Insurance, PetFirst, MetLife Pet Insurance, Lemonade |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Pet Insurance Market?

Global pet insurance market is set to grow from USD 12.1 Bn in 2024 to USD 55.2 Bn by 2034, expanding at a CAGR of 16.2%. Explore key drivers, trends, and opportunities.

Who are the major players in the Pet Insurance Market?

Trupanion, Nationwide, Fetch by The Dodo (Petplan), Embrace Pet Insurance, Healthy Paws, ASPCA Pet Health Insurance, Figo Pet Insurance, PetFirst, MetLife Pet Insurance, Lemonade

Which segments covered the Pet Insurance Market?

Technology (Digital Platforms, AI-Powered Solutions, Mobile Apps, Cloud-Based Services), Component (Policy Management Software, Claims Management Software, Customer Portals, Services), Verticals (Dogs, Cats, Exotic Pets, Multi-Pet Households), Enterprise Size (Small and Medium Enterprises, Large Enterprises)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date