Phenol Market Size Global Growth & Industry Trends| 6.9% CAGR

Global Phenol Market Size, Share & Analysis By Manufacturing Process (Cumene Process, Dow Process, Ranching–Hooker Process), By Application (Bisphenol A, Phenolic Resins, Caprolactam, Others), By Distribution Sales (Direct Sales, Indirect Sales), By End-Use Industry, Price Trends, Capacity Expansion, Competitive Landscape & Forecast 2025–2034

Report Overview

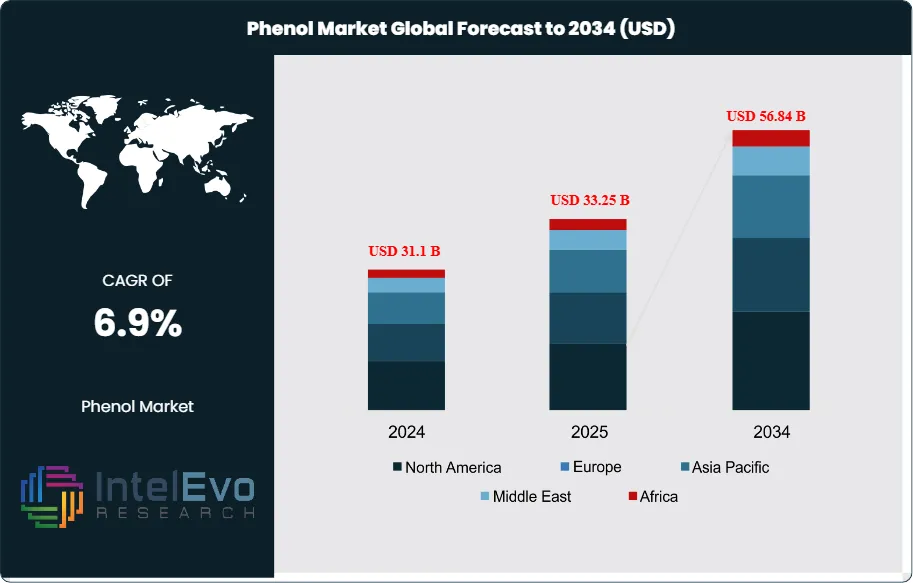

The Phenol Market was valued at approximately USD 31.1 Billion in 2024 and is projected to reach nearly USD 56.84 Billion by 2034, growing at an estimated CAGR of around 6.9% from 2025 to 2034. Rising demand from the automotive, construction, and electronics sectors is accelerating phenol consumption worldwide. Increased production of BPA, epoxy resins, and polycarbonate materials continues to strengthen market growth. With rapid industrial expansion across Asia-Pacific, the phenol industry is set for a high-demand decade, driven by manufacturing modernization and downstream chemical innovations.

Get More Information about this report -

Request Free Sample ReportMarket development is closely linked to downstream demand for bisphenol-A (BPA) and phenolic resins—together typically absorbing ~75–80% of phenol consumption—feeding polycarbonate, epoxy, laminates, and high-performance adhesives used across automotive, electronics, and construction. After pandemic-era and energy-price volatility compressed trade values in 2022 (global phenols trade fell 11.5% year over year to USD 7.57 billion), ordering patterns normalized through 2024–2025 as inventories reset and capital spending resumed in autos and infrastructure. Operating rates in integrated cumene-phenol complexes are expected to firm toward the low-80% range by mid-decade, supported by project restarts and selective debottlenecking.

Growth into 2025 is underpinned by three demand vectors: the recovery of transportation and building materials, the electronics cycle (polycarbonate lenses, housings, and films), and epoxy use in renewables and protective coatings. On the supply side, cost competitiveness favors producers integrated to benzene and propylene, especially where PDH and refinery upgrades stabilize propylene availability. Key risks include regulatory scrutiny of BPA in food-contact applications (tightening migration limits raise qualification costs), volatile aromatics spreads tied to crude and naphtha swings, and carbon-intensity expectations that elevate energy and compliance outlays. Trade data highlight shifting regional roles: Chinese Taipei has acted as a leading net exporter (about USD 0.5 billion), while China remains the principal net importer (~USD 1.0 billion), with India balancing rising domestic capacity against steady import needs.

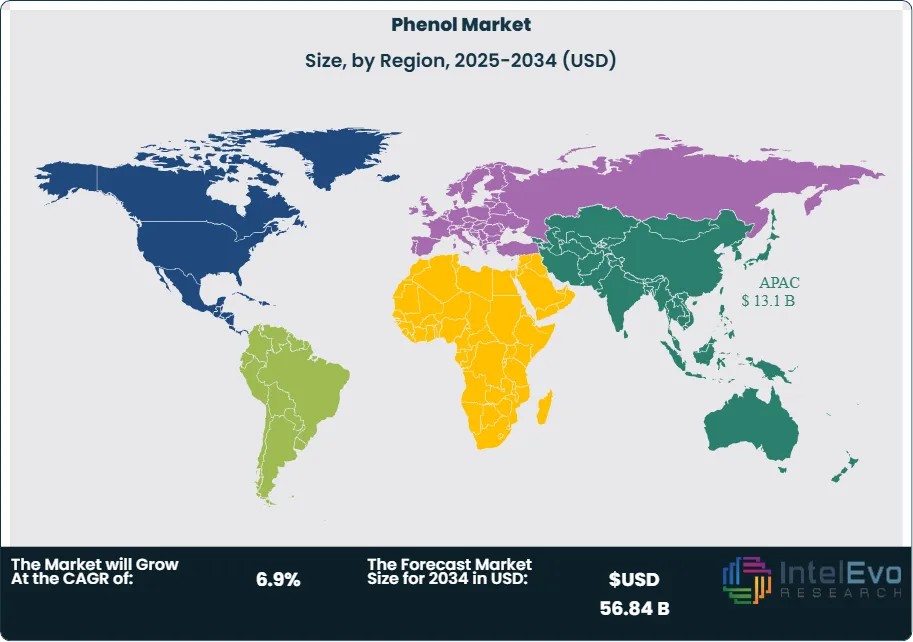

Technology and process enhancements continue to shape competitiveness. The cumene route remains dominant, but catalyst upgrades (advanced zeolites), heat-integration, and digital plant optimization are reducing unit energy by low-single-digit percentages and improving acetone co-product valorization. Early pilots in bio-based phenol and chemical recycling of phenol-rich waste streams signal a longer-term pathway to Scope 1–3 reductions and premium, low-carbon grades, particularly attractive to electronics and automotive OEMs with procurement targets. Regionally, Asia Pacific accounts for an estimated 50–55% of demand and remains the investment hotspot as China, India, and Southeast Asia expand polycarbonate and epoxy capacity. North America benefits from reliable benzene/propylene chains on the U.S. Gulf Coast, while Europe’s specialty resins and sustainability standards command higher-value niches despite tighter regulations. The Middle East is emerging with integrated aromatics platforms, and India’s resilient trade profile—exports around USD 0.3 billion against moderated imports—points to a gradual shift toward self-sufficiency.

Key Takeaways

- Market Growth: The global Phenol market was USD 31.1 Billion in 2024 and is projected to reach USD 56.84 Billion by 2034 (6.9% CAGR), propelled by downstream demand in bisphenol-A (BPA) for polycarbonates/epoxies and phenolic resins used across automotive, construction, and electronics.

- Segment Dominance – Production Route: Cumene process leads with ~45.3% share, favored for its mature technology, acetone co-product economics, and integration with benzene/propylene chains; producers with backward integration (e.g., INEOS Phenol, Kumho P&B, Mitsui) benefit from margin stability and feedstock flexibility.

- Segment Dominance – Application: Bisphenol-A (BPA) remains the largest application at ~41.3% of phenol consumption, underpinned by polycarbonate and epoxy demand in vehicle light-weighting, electronics housings, and protective coatings; cyclicality tracks capex in construction and electrical/electronics.

- Driver: Rebound in end-use manufacturing—auto builds, infrastructure coatings, and electronics—coupled with capacity debottlenecking and yield gains (1–3% efficiency improvements via catalyst/heat-integration upgrades) is lifting plant operating rates and sustaining multi-year offtake contracts.

- Restraint: Regulatory scrutiny of BPA in food-contact and consumer applications, alongside volatile aromatics spreads (benzene/propylene), is compressing margins; compliance, product re-qualification, and ESG reporting can add an estimated 50–150 bps to unit costs for exporters into the EU/US.

- Opportunity: Asia Pacific capacity additions and downstream integration present the highest incremental upside; BPA/epoxy growth and cost-advantaged cumene units position the region to outpace the global market, with select APAC projects expected to deliver mid-single-digit ROI improvements on energy-intensity cuts.

- Trend: Producers are pivoting to low-carbon and circular phenol—including bio-routes, waste-stream recovery, and digital optimization—aiming to reduce Scope 1–2 emissions and capture premium pricing in specialty resins; indirect sales models (54.3% share) are being augmented with data-driven contracting and hedging.

- Regional Analysis: Asia Pacific holds the largest share at ~46.2% (≈USD 13.1 billion of 2024 demand), supported by integrated aromatics and growing resin capacity; North America and Europe remain sizable, higher-value markets with specialty niches but tighter regulations, while the Middle East builds export-oriented phenol/acetone platforms to leverage feedstock advantages.

Manufacturing Process Analysis

As of 2025, the cumene process remains the industry workhorse, accounting for roughly 45–50% of global phenol output. Its dominance stems from mature technology, favorable co-product acetone economics, and tight integration with benzene/propylene value chains—especially in complexes linked to PDH and refinery upgrades. Ongoing catalyst and heat-integration enhancements are delivering 1–3% energy-intensity reductions and modest yield gains, while digital twins and APC (advanced process control) shorten turnaround cycles and stabilize operating rates in the low-80% range.

Legacy chlorobenzene routes—the Dow and Raschig–Hooker processes—retain niche shares where ultra-high-purity grades or site-specific feedstock synergies justify higher capex/opex and waste-handling requirements. These assets increasingly target specialty derivatives and “secure supply” contracts. Over 2025–2030, incremental capacity is expected to skew to APAC and the Middle East via new cumene lines, with selective debottlenecking of chlorobenzene plants to serve premium segments and diversify risk under tighter sustainability rules.

Application Analysis

Bisphenol-A (BPA) remains the largest outlet, representing about 41.3% of phenol consumption, anchored in polycarbonate and epoxy systems for automotive light-weighting, electronics housings/films, glazing, wind blades, and protective coatings. Despite regulatory scrutiny in food-contact uses, industrial and infrastructure demand keeps BPA volumes on a mid-single-digit growth path, supported by BPA-NI epoxy adoption in sensitive applications.

Phenolic resins are the second growth pillar, benefiting from building-efficiency codes (insulation, laminates) and safety-critical uses (brake pads, foundry binders), with suppliers pushing low free-formaldehyde and low-carbon grades. Caprolactam (via phenol → cyclohexanone routes) serves nylon-6 fibers and engineering plastics in textiles and auto components, with cyclical but resilient demand tied to apparel and tire cord. “Others” (pharma, agro, specialty solvents) provide margin diversity and niche premium pricing.

End-Use Analysis

The chemical sector leads end-use, consuming about 36% of phenol as an intermediate for BPA, phenolic resins, adipic/cyclohexanone chains, and specialty derivatives. Scale integration, multi-year offtakes, and index-linked contracts underpin utilization and margin durability.

Construction and automotive together form the next demand block, relying on phenolic resins for adhesives, insulation, and friction materials, and on BPA-derived polycarbonate/epoxies for light-weighting and corrosion protection; EV platforms add pull for flame-retardant PC and high-temperature composites. Electronics/communication consume phenolic laminates and high-purity PC/epoxy systems for PCBs and enclosures, while metallurgy uses specialty binders. “Other” end-uses (medical devices, lab reagents) expand steadily with specification-driven procurement.

Distribution Sales Analysis

Indirect sales channels hold the larger share (about 54.3%), reflecting the reach of distributors and traders in fragmented geographies, value-added services (custom packaging, finance, compliance), and rising e-procurement adoption. Distributors increasingly deploy data-driven inventory and dynamic pricing, improving service levels for SMEs and regional converters.

Direct sales remain the preference for majors and integrated buyers seeking volume reliability, logistics control, and feedstock-indexed pricing. 2025–2028 should see a hybridization of models—suppliers deepening VMI/portal links with top accounts while expanding distributor partnerships in high-growth APAC and MEA to shorten cash cycles and reduce working-capital drag.

Regional Analysis

Asia Pacific is the demand and supply anchor with about 46.2% share (≈USD 13.1 billion baseline), supported by downstream polycarbonate, epoxy, and nylon-6 expansions in China, India, and Southeast Asia. Cost-advantaged aromatics, new cumene units, and cluster infrastructure position APAC to grow faster than the global average through 2030.

North America benefits from feedstock reliability on the U.S. Gulf Coast and healthy specialty resins demand; Europe emphasizes higher-value applications under stringent carbon and product regulations, prompting selective capacity rationalization but stronger pricing power in niche grades. The Middle East & Africa is scaling export-oriented phenol/acetone platforms integrated with refinery/petrochemical hubs, while Latin America advances gradually on construction and auto supply chains. Net-net, investment hot spots align with integrated aromatics platforms and downstream resin capacity adds, with sustainability-aligned grades commanding premium lift in developed markets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Manufacturing Process

- Cumene Process

- Dow Process

- Ranching–Hooker Process

By Application

- Bisphenol A

- Phenolic Resins

- Caprolactam

- Others

By End-use

- Chemical

- Construction

- Automotive

- Electronic Communication

- Metallurgy

- Other

By Distribution Sales

- Direct Sales

- Indirect Sales

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 31.1 B |

| Forecast Revenue (2034) | USD 56.84 B |

| CAGR (2024-2034) | 6.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Manufacturing Process (Cumene Process, Dow Process, Ranching–Hooker Process), By Application (Bisphenol A, Phenolic Resins, Caprolactam, Others), By End-use (Chemical, Construction, Automotive, Electronic Communication, Metallurgy, Other), By Distribution Sales (Direct Sales, Indirect Sales) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Merck KGaA, AdvanSix, LG Chem, Cepsa, INEOS, SHENGQUAN GROUP, Sasol LTD, Prasol Chemicals Pvt. Ltd., Honeywell International Inc., TPCC, Solvay, China National Bluestar (Group) Co., Ltd., Bayer AG, Altivia, KUMHO P&B CHEMICALS, INC., Aditya Birla Group, PTT Phenol Company Limited, Shell plc, Formosa Plastics Corporation, Domo Investment Group NV., Mitsui Chemicals, Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date