Photo Paper Market Size USD 3.6B & 3.4% CAGR Forecast 2034

Global Photo Paper Market Size, Share & Printing Industry Analysis By Type (Inkjet, Laser), By Surface Finish, By Application (Commercial Printing, Home Printing, Professional Photography), Distribution Channel Trends, Regional Outlook, Competitive Landscape & Forecast 2025–2034

Report Overview

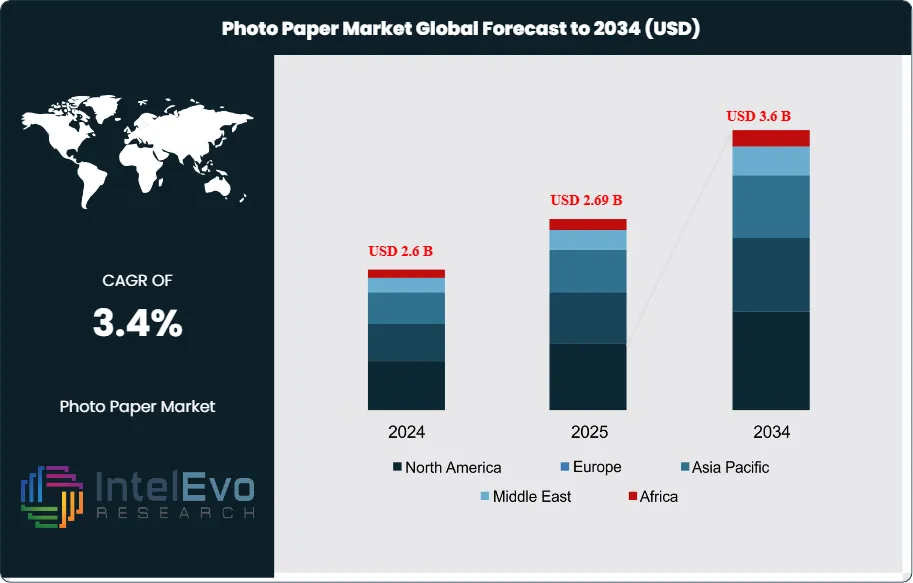

The Photo Paper Market is estimated at USD 2.6 billion in 2024 and is projected to reach approximately USD 3.6 billion by 2034, registering a CAGR of about 3.4% during 2025–2034. While digital media continues to dominate everyday photography, steady demand persists from professional printing, personalized photo products, commercial advertising, and fine-art applications. Growth is further supported by rising interest in premium photo books, customized gifts, and archival-quality prints, particularly in emerging markets. In addition, advancements in inkjet and dye-sublimation printing technologies are improving print longevity and color accuracy, sustaining the relevance of photo paper in high-value visual applications.

Get More Information about this report -

Request Free Sample ReportMarket expansion reflects both steady demand for traditional photographic applications and the growing role of photo paper in advertising, publishing, and consumer printing. Historical demand has been shaped by the transition from analog to digital photography, which initially reduced consumption volumes. However, the rise of online photo printing services, personalized merchandise, and premium advertising formats has stabilized the market and positioned it for moderate but sustained growth.

Photo paper remains a preferred medium for high-resolution image reproduction. Its ability to deliver sharp contrast and vivid color output supports applications in magazines, hoardings, and promotional materials. In 2023, online photo printing accounted for more than 35% of global demand, reflecting consumer preference for tangible prints in an increasingly digital environment. On the supply side, manufacturers face challenges from fluctuating raw material costs, particularly silver halide and resin coatings, as well as environmental regulations governing chemical processing. Despite these pressures, the market continues to expand as demand for premium printed communication materials offsets declines in low-cost consumer printing.

Technology is reshaping adoption patterns. Advances in emulsion chemistry, resin-coated substrates, and digital printing compatibility are improving durability and print quality. Automation in photo labs and integration with AI-driven editing platforms are streamlining production and reducing costs. Black-and-white papers, which remain essential for artistic and archival uses, are complemented by chromogenic color papers that dominate commercial applications. This versatility ensures relevance across both consumer and professional segments.

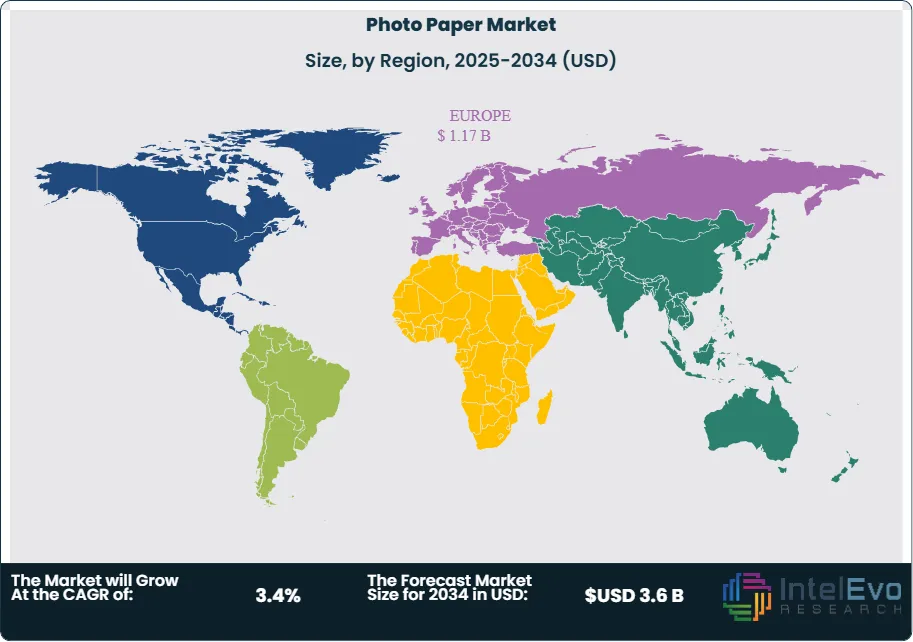

Regional performance highlights clear investment hotspots. Asia Pacific leads the market, accounting for over 40% of global revenue in 2024, supported by strong consumer demand in China, India, and Japan. North America and Europe remain mature markets, with growth driven by advertising and specialty printing. Emerging opportunities are visible in Latin America and the Middle East, where rising disposable incomes and expanding retail photo services are creating new demand pockets. For investors, the combination of stable global growth, technological upgrades, and expanding applications in advertising and entertainment makes photo paper a resilient segment within the broader printing industry.

Key Takeaways

- Market Growth: The global photo paper market is projected to grow from USD 2.6 billion in 2024 to USD 3.6 billion by 2034, reflecting a CAGR of 3.4%. Growth is supported by rising demand for high-quality advertising prints, online photo printing services, and premium consumer applications.

- Product Type: Inkjet photographic paper accounted for 57.2% of global revenue in 2024. Its dominance is driven by compatibility with home and commercial printers, as well as superior image resolution compared with traditional alternatives.

- Size Format: The 4×6 inch format captured 47.2% of the market in 2024. This size remains the global standard for consumer photo printing, supported by its use in retail kiosks and online print orders.

- Application: Civil field applications, including consumer and commercial photography, represented 62.1% of total demand in 2024. The segment benefits from continued consumer preference for tangible prints and the use of photo paper in promotional materials.

- Distribution Channel: Offline sales channels held 68.1% of the market in 2024. Retail outlets and specialty stores remain critical for bulk purchases and professional-grade paper, despite the rise of online platforms.

- Driver: The expansion of online photo printing services, which grew by more than 12% annually between 2020 and 2023, is a key demand driver. These platforms increase accessibility and encourage repeat purchases of consumer-grade photo paper.

- Restraint: Volatility in raw material costs, particularly silver halide and resin coatings, continues to pressure margins. Price fluctuations of up to 15% annually have constrained profitability for leading producers.

- Opportunity: Asia Pacific presents the strongest growth potential, with projected CAGR above 5% through 2034. Rising disposable incomes and expanding retail photo services in India and China are expected to add over USD 300 million in new market value.

- Trend: Manufacturers are investing in advanced emulsion chemistry and eco-friendly coatings. Companies such as Fujifilm and Kodak are introducing recyclable substrates to align with tightening environmental regulations and consumer sustainability preferences.

- Regional Analysis: Europe led the market in 2024 with a 47.3% share, valued at approximately USD 0.5 billion, supported by strong advertising and publishing demand. Asia Pacific is emerging as the fastest-growing region, while North America remains stable with steady adoption in professional and commercial printing.

Type Analysis

Inkjet photographic paper continues to dominate the global market in 2025, accounting for more than 57% of total revenue. Its growth is supported by the widespread adoption of digital printing technologies and the rising popularity of home-based and small-scale professional printing. Inkjet paper offers versatility across matte, glossy, and semi-gloss finishes, making it the preferred choice for both consumer and commercial applications. The segment is also benefiting from advances in printer hardware, with companies such as Canon, Epson, and HP expanding their portfolios of high-resolution inkjet printers that require premium-grade paper.

Silver halide photographic paper, while still valued for its superior tonal range and archival quality, has seen a gradual decline in share as film-based photography continues to contract. However, the segment retains importance in professional studios, fine art printing, and archival preservation. Demand is expected to remain steady in niche markets, particularly in regions where traditional photography retains cultural or artistic significance.

Paper Size Analysis

The 4×6 inch format remains the most widely used size in 2025, representing nearly half of global demand. Its dominance is tied to consumer photo printing, as it fits standard albums and frames and is the default size for retail and online photo printing services. The format’s affordability and convenience ensure its continued relevance, particularly in emerging markets where consumer printing volumes are rising.

Larger formats such as 5×7 inches and 8×10 inches are gaining traction, especially among professional photographers and consumers seeking higher-value prints. These sizes are commonly used for framed portraits, event photography, and premium photo merchandise. A4 and A3 formats, while smaller in share, are critical in professional and exhibition contexts. They are increasingly used for high-quality portfolios, gallery displays, and advertising visuals, where larger prints enhance visual impact.

Application Analysis

Civil applications dominate the market in 2025, accounting for more than 62% of total consumption. Growth is driven by consumer demand for personal photo printing, including family albums, travel photography, and social media-driven prints. The proliferation of smartphones with advanced cameras has expanded the base of casual photographers, many of whom continue to seek tangible prints despite the prevalence of digital storage.

The professional field, while smaller in scale, is expanding steadily. This segment includes commercial studios, advertising agencies, and photo labs that require premium-grade paper for marketing campaigns, exhibitions, and fine art. Demand is supported by industries such as media, publishing, and retail, where high-quality printed visuals remain a critical communication tool.

Distribution Channel Analysis

Offline sales continue to dominate in 2025, accounting for more than two-thirds of global revenue. Traditional retail outlets, including photography stores, supermarkets, and electronics retailers, remain the primary purchase channels for consumers seeking immediate availability and trusted brands. Bulk purchases by professional users also sustain offline demand.

Online distribution, however, is expanding at a faster pace, with e-commerce platforms and direct-to-consumer sales gaining traction. Online channels are particularly important for niche paper types and specialty formats that may not be widely available in physical stores. The segment is expected to grow at a CAGR above 5% through 2030, supported by the global expansion of online photo printing services and the convenience of doorstep delivery.

Regional Analysis

Europe remains the largest regional market in 2025, holding more than 45% of global revenue, valued at approximately USD 0.55 billion. Strong consumer demand for high-quality prints, combined with a mature base of professional photographers and established e-commerce infrastructure, underpins the region’s leadership. Germany, the UK, and France are the key contributors, with steady demand from both consumer and professional segments.

North America continues to show stable growth, led by the United States. The region benefits from a strong culture of personalized photo products, including photo books, calendars, and merchandise. Online printing services such as Shutterfly and Snapfish are expanding their offerings, further supporting demand for premium-grade photo paper.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR above 5% through 2030. Rising disposable incomes, rapid smartphone adoption, and the growth of e-commerce platforms are fueling demand for personalized photo products in China, India, and Southeast Asia. Latin America and the Middle East & Africa are smaller but steadily growing markets, supported by increasing digital adoption and the expansion of retail photo services.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Silver Halide Photographic Paper

- Inkjet Photographic Paper

By Paper Size

- 4×6 inches

- 5×7 inches

- 8×10 inches

- A4 & A3

- Large Format

By Application

- Civil Field

- Professional Field

By Distribution Channel

- Online

- Offline

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 2.6 B |

| Forecast Revenue (2034) | USD 3.6 B |

| CAGR (2024-2034) | 3.4% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Silver Halide Photographic Paper, Inkjet Photographic Paper), By Paper Size (4×6 inches, 5×7 inches, 8×10 inches, A4 & A3, Large Format), By Application (Civil Field, Professional Field), By Distribution Channel (Online, Offline) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Fujifilm, Brother, Ilford, Shantou Xinxie, HP, ADOX, Polaroid, Fantac, Hahnemühle, Kodak, Epson, China Lucky Group, HYMN, FOMA BOHEMIA, Canon |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date