Pilates and Yoga Studios Market Size, Share & Growth | 13.4% CAGR

Global Pilates and Yoga Studios Market Size, Share & Analysis By Activity Type (Yoga Activities, Pilates Activities, Fusion Activities, Pilates & Yoga Accreditation Training, Meditation & Mindfulness Activities, Merchandise Sale), By Service Type (Group Classes, Private Classes, Online/Virtual Sessions, Specialty Programs), By Studio Size (Small Scale, Medium Scale, Large Chain Studios, Independent Studios), By End User (Fitness Enthusiasts, Rehabilitation Clients, Professional Athletes), Wellness Trends, Subscription Models, Competitive Positioning & Forecast 2025–2034

Report Overview

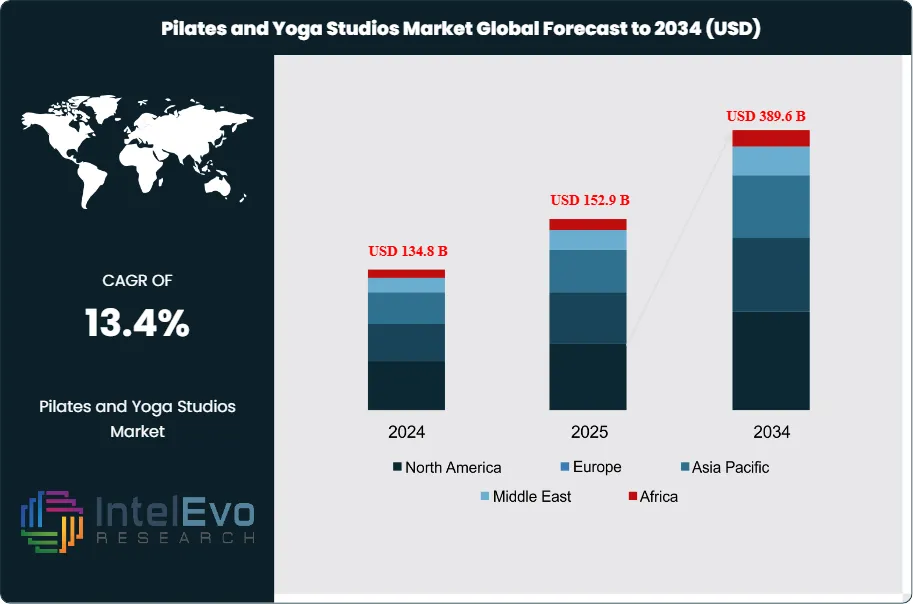

The Pilates and Yoga Studios Market is projected to grow from USD 134.8 Billion in 2024 to approximately USD 389.6 Billion by 2034, expanding at a CAGR of around 13.4% during 2025–2034. Growing global awareness of holistic wellness, mental health, and low-impact fitness is accelerating consumer participation in yoga and Pilates programs. The rise of hybrid studio models—combining in-studio sessions with AI-powered virtual classes—is reshaping the fitness experience.

Get More Information about this report -

Request Free Sample ReportAs wellness tourism, premium boutique studios, and personalized training solutions surge, the sector is entering a new era of lifestyle-driven growth. This reflecting consumers’ heightened interest in fitness practices that combine physical training with mental well-being. This surge presents new opportunities for investors, fitness professionals, and wellness-focused entrepreneurs as the industry evolves into a key segment of the health economy.

Over the past decade, studios have multiplied at a rapid pace, fueled by rising participation in health-oriented activities and the popularity of boutique fitness concepts. In the United States, more than half of all studio members now attend group sessions, with yoga and Pilates commanding a significant share of the market. Around 36 million Americans practice yoga, while over 12 million take part in Pilates. Worldwide, engagement is even greater, with an estimated 300 million people making yoga part of their routines—evidence of how deeply it has entered the mainstream of health and lifestyle.

Several underlying forces are propelling this expansion. With growing awareness of health benefits and higher disposable incomes, people are gravitating toward activities that improve flexibility, strengthen the core, and reduce stress. Governments and institutions have also recognized yoga’s value, incorporating it into wellness programs and positioning it as a preventive healthcare tool. At the same time, the rise of boutique studios and hybrid formats—offering both digital and on-site sessions—has made classes more convenient and accessible, particularly in urban settings. Despite this momentum, operators face challenges such as intense competition, a shortage of certified instructors, and pricing pressures, making innovation and differentiation essential for sustained success.

Technology is another powerful driver of change. Studios increasingly rely on digital tools, AI-based training platforms, and online classes to reach audiences beyond their physical spaces. Wearables and performance-tracking apps further enrich user experiences, allowing members to monitor progress and pursue measurable wellness outcomes.

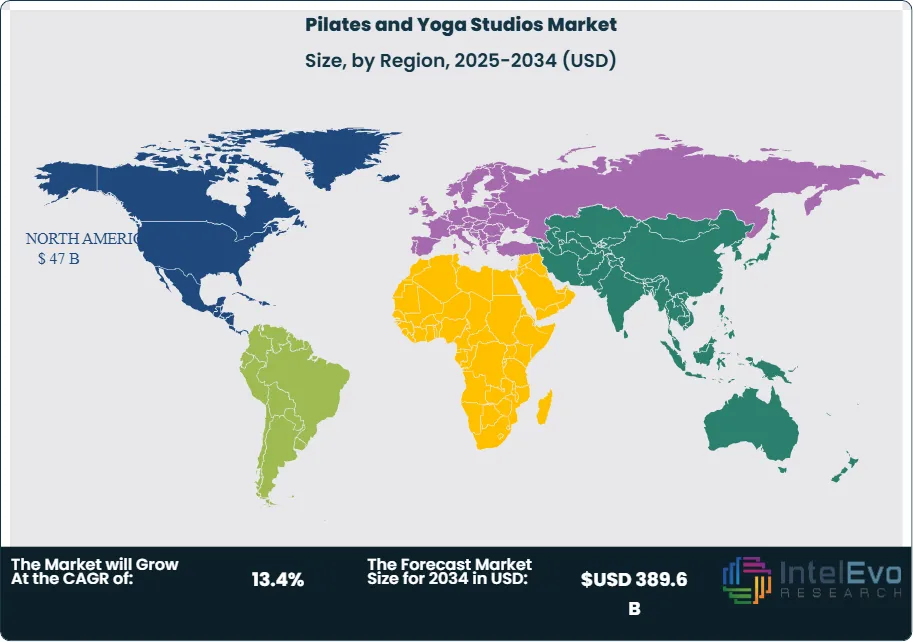

From a regional perspective, North America remains the largest market, supported by high participation levels and a willingness to spend on wellness services. Europe follows closely, with notable uptake in countries including Germany, the UK, and France, where wellness tourism also supports growth. The Asia-Pacific region, however, stands out as the fastest-expanding market. Rapid urbanization, increasing middle-class incomes, and yoga’s deep cultural roots in countries such as India are creating strong momentum. These dynamics suggest that the Pilates and yoga studio industry is set to maintain steady global growth over the next decade

Key takeaway

- Market Expansion: The global Pilates and yoga studio industry was worth USD 134.8 Billion in 2024 and is projected to reach USD 389.6 Billion by 2034, reflecting a 13.4% CAGR. Growth is fueled by greater health awareness, the mainstreaming of mind–body practices, and the success of boutique fitness formats.

- By Activity: Yoga contributed 40.7% of revenues in 2024, underscoring its widespread appeal across mature and developing markets. Its accessibility and well-documented mental health benefits continue to make it the top choice among wellness-minded consumers.

- By Service: Group sessions dominate the market, appealing to participants through their affordability and social atmosphere. These formats also help studios optimize capacity, meeting rising demand for fitness experiences built around community and engagement.

- By Studio Size: Small studios captured 46.2% of market share in 2024. Their popularity comes from offering tailored classes, more intimate environments, and flexible adoption of hybrid digital models—advantages that position them well for continued expansion.

- Growth Driver: With about 300 million people practicing yoga globally, participation continues to grow. In the United States alone, over 36 million people engage in yoga and around 12 million in Pilates, creating a steady pipeline of customers for studios.

- Market Challenge: Intense competition and rising operational expenses—particularly related to instructor certification and rental costs—are squeezing profit margins. Smaller operators are especially vulnerable in urban markets where saturation and price sensitivity are high.

- Opportunities: The Asia-Pacific region represents the strongest growth potential, forecast to achieve double-digit CAGR through 2030. Rising urbanization, higher disposable incomes, and government initiatives in India and China are accelerating demand. The expansion of hybrid business models that blend physical and digital offerings will further support growth.

- Emerging Trend: Technology is reshaping the industry. AI-powered training platforms, wearable devices, and virtual class systems are broadening access. Today, more than a quarter of studios worldwide offer hybrid memberships that combine online and in-person sessions.

- Regional Insights: North America continues to lead the market, supported by strong disposable incomes and advanced fitness infrastructure. Europe ranks second, with wellness tourism and eco-conscious consumers contributing to demand. Meanwhile, Asia-Pacific is rapidly emerging as the next high-growth investment hub for international operators.

Type Analysis

The Pilates and Yoga Studios Market is segmented into yoga activities, Pilates activities, fusion programs, accreditation training, mindfulness sessions, and merchandise sales. As of 2025, yoga activities account for the largest share, contributing more than 40% of industry revenues. This dominance reflects yoga’s accessibility across age groups and its dual role in improving physical fitness and mental well-being. With over 300 million practitioners globally and continued growth in both urban and rural communities, yoga remains the cornerstone of the industry.

Pilates activities, while more niche, are expanding steadily, particularly in rehabilitation and core-strengthening applications. Demand is reinforced by endorsements from health professionals and adoption among athletes seeking injury prevention and recovery benefits. Fusion activities, blending yoga and Pilates, are emerging as a growth niche, appealing to consumers interested in variety and holistic results, though they require specialized instructors and thus represent a smaller share. Meanwhile, accreditation training, mindfulness practices, and merchandise sales, though less dominant, contribute strategically by fostering instructor pipelines, diversifying revenue streams, and reinforcing long-term brand engagement.

Application Analysis

Service delivery in Pilates and yoga studios is segmented into group classes, private classes, virtual sessions, and specialty programs. Group classes continue to dominate due to their affordability and community-driven appeal, capturing the majority of global revenues. These formats encourage social interaction while allowing studios to maximize capacity, making them a profitable and scalable model. In 2025, group classes remain a preferred option in mature fitness markets such as North America and Europe, where consumers value both fitness outcomes and collective experiences.

Private sessions represent a smaller share but serve an important segment of clients seeking one-on-one instruction, particularly those with rehabilitation needs or advanced training goals. Online and virtual sessions, which surged during the pandemic, continue to expand at double-digit growth rates, providing accessibility to clients in remote or time-constrained settings. Specialty programs—including prenatal yoga, senior fitness, and therapeutic Pilates—cater to niche demographics, offering studios an opportunity to differentiate and deepen client loyalty despite their smaller contribution to total revenues.

End-Use Analysis

The end-user landscape is led by fitness enthusiasts, who account for the majority of demand as health consciousness and active lifestyle adoption rise globally. In 2025, this group continues to expand, supported by a younger demographic prioritizing holistic fitness routines and older age groups seeking low-impact exercises for long-term health. Fitness-focused consumers are driving consistent membership growth in both boutique and chain studios worldwide.

Rehabilitation clients form a secondary but strategically important segment, particularly for Pilates studios. The practice is increasingly prescribed for post-injury recovery and chronic pain management, aligning with healthcare and physiotherapy services. Professional athletes, though a smaller niche, contribute to demand by integrating yoga and Pilates into training regimens to enhance flexibility, improve performance, and reduce injury risk. While this segment is limited in size, it reinforces the credibility of these practices as integral to physical conditioning.

Regional Analysis

North America remains the largest regional market, holding approximately 37% share in 2025, valued at over USD 47 billion. Its dominance is underpinned by high disposable incomes, mature fitness infrastructure, and a deeply embedded wellness culture. Growth is further supported by hybrid adoption models, with studios offering both in-person and virtual classes. Europe follows closely, with countries such as Germany, the UK, and France emphasizing wellness tourism and sustainable fitness solutions.

Asia-Pacific represents the fastest-growing region, expanding at a projected CAGR above 11% through 2030. Urbanization, rising middle-class incomes, and government-led wellness initiatives in India and China are driving adoption. Pilates and yoga’s cultural integration in Asia further accelerates market penetration. Latin America is experiencing steady growth, fueled by urban wellness trends in Brazil and Mexico, though economic volatility remains a challenge. Meanwhile, the Middle East & Africa are emerging as niche but promising markets, with increasing uptake in the UAE and Saudi Arabia, where wellness-focused urban development projects are integrating boutique fitness offerings.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Activity Type

- Yoga Activities

- Pilates Activities

- Fusion Activities

- Pilates & Yoga Accreditation Training

- Meditation & Mindfulness Activities

- Merchandise Sale

By Service Type

- Group Classes

- Private Classes

- Online/Virtual Sessions

- Specialty Programs

By Studio Size

- Small Scale

- Medium Scale

- Large Chain Studios

- Independent Studios

By End User

- Fitness Enthusiasts

- Rehabilitation Clients

- Professional Athletes

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 134.8 B |

| Forecast Revenue (2034) | USD 389.6 B |

| CAGR (2024-2034) | 13.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Activity Type (Yoga Activities, Pilates Activities, Fusion Activities, Pilates & Yoga Accreditation Training, Meditation & Mindfulness Activities, Merchandise Sale), By Service Type (Group Classes, Private Classes, Online/Virtual Sessions, Specialty Programs), By Studio Size (Small Scale, Medium Scale, Large Chain Studios, Independent Studios), By End User (Fitness Enthusiasts, Rehabilitation Clients, Professional Athletes) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | The Pilates Studio, YogaWorks, SoulCycle, Club Pilates, The Bar Method, Bend + Bloom Yoga, YogaSix, Barre3, Life Time Fitness, Pure Barre, Yoga Tree, CorePower Yoga, The Yoga Institute, StretchLab, Pilates Anytime |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Pilates and Yoga Studios Market

Published Date : 13 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date