Plant-Based Energy Drink Market Size, Share & Growth Forecast to 2034

Global Plant-Based Energy Drink Market Size, Share & Analysis By Type (Organic, Natural, Regular), By Product Type (Non-Alcoholic, Alcoholic), By Ingredients (Taurine, Caffeine, Guarana, Vitamin B, L-Carnitine, Antioxidants), By End-User (Kids, Teenagers, Adults), By Distribution Channel (Supermarkets/Hypermarkets, E-commerce, Grocery Stores, Convenience Stores), By Consumer Demographics Industry Regions & Key Players – Clean-Label Trends & Forecast 2025–2034

Report Overview

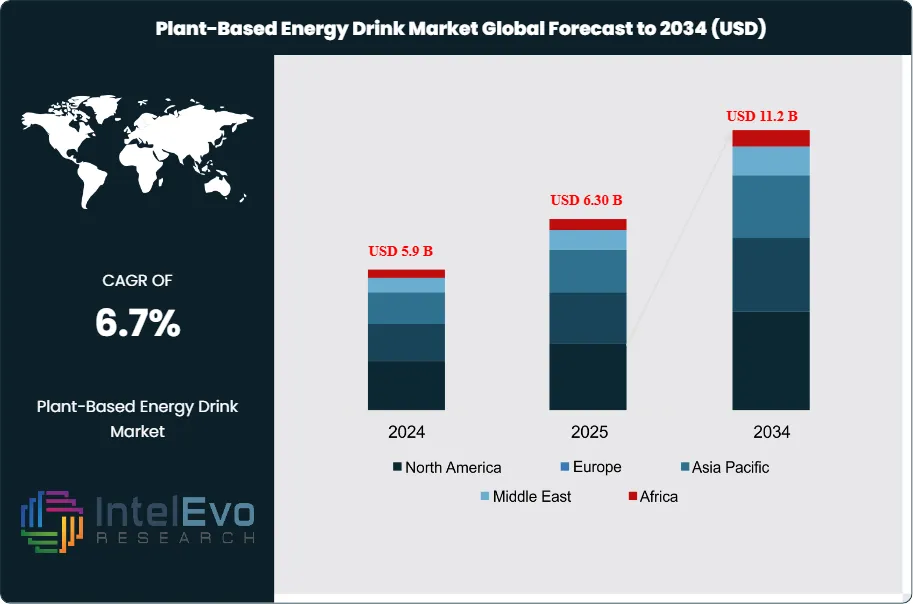

The Plant-Based Energy Drink Market size is expected to reach USD 11.2 billion by 2034, up from USD 5.9 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025–2034. This growth comes from more consumers wanting natural, clean-label, and sustainably sourced drinks. Health-conscious people are moving away from synthetic energy drinks and choosing plant-based options that contain natural caffeine, adaptogens, and antioxidants. The rising demand from millennials, athletes, and working professionals, along with more innovative flavors and useful formulas, is driving market growth.

Get More Information about this report -

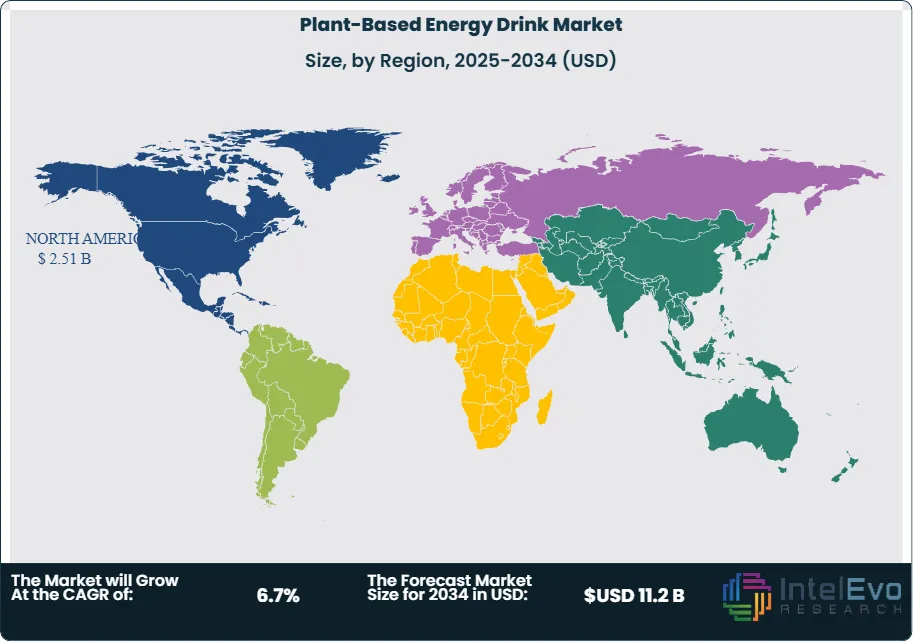

Request Free Sample ReportAlso, packaging that focuses on sustainability and eco-friendly branding is changing how consumers buy drinks around the world. This expansion underscores the accelerating shift in consumer preferences toward healthier, natural, and sustainable alternatives to conventional energy beverages. North America currently dominates the market with a 42.6% share of the USD 2.3 billion segment, while other regions are emerging as high-potential investment hotspots.

Plant-based energy drinks, formulated from natural ingredients such as ginseng, guarana, yerba mate, and botanical extracts, are positioned as functional beverages that enhance physical energy and mental alertness without relying on synthetic additives. Their increasing adoption reflects a broader wellness-driven lifestyle trend, where consumers—particularly millennials and Gen Z—prioritize health, sustainability, and clean-label products.

Several key drivers are propelling market growth. Rising health consciousness and awareness of the adverse effects of sugar-laden, artificial energy drinks are compelling consumers to switch to plant-derived alternatives. Innovations in flavor development, ingredient blends, and convenient packaging formats are further widening the appeal of these beverages across diverse demographics. Additionally, the growing alignment of plant-based consumption with sustainability and ethical consumerism adds momentum, reinforcing long-term market attractiveness.

Despite robust growth prospects, the sector faces challenges such as premium pricing compared to conventional energy drinks, limited product penetration in developing economies, and the need for consumer education regarding functional plant-based ingredients. Addressing these hurdles through targeted marketing, cost-efficient production, and wider retail accessibility will be critical for sustained expansion.

Technological advancements are also reshaping the competitive landscape. Startups and established beverage brands are leveraging innovations in plant-based formulations, natural sweeteners, and fortification with vitamins, minerals, and adaptogens to differentiate their offerings. Recent funding rounds, including Odyssey Elixir’s USD 6.3 million Series A for mushroom-based energy drinks and Imaginary Ventures’ USD 4 million seed investment in a low-calorie caffeinated beverage brand, highlight the strong investor appetite for functional, health-aligned energy drinks.

Regionally, North America remains the largest market, supported by high consumer awareness and established distribution networks. However, Asia-Pacific and Europe are emerging as promising growth centers due to rising urbanization, expanding middle-class incomes, and increasing demand for premium functional beverages. Collectively, these dynamics position the plant-based energy drink market as a high-growth segment within the global beverage industry, offering significant opportunities for innovation and investment.

Key Takeaways

- Market Growth: The Global Plant-Based Energy Drink Market is projected to reach USD 11.2 billion by 2034, rising from USD 5.9 billion in 2024 at a CAGR of 6.7% (2025–2034). Growth is fueled by rising consumer health awareness, demand for natural energy-boosting alternatives, and innovation in functional beverage formulations.

- Product Type: Organic plant-based energy drinks command a 39.7% market share, reflecting a strong consumer shift toward clean-label, natural ingredients that align with wellness-oriented lifestyles.

- Alcohol Content: Non-alcoholic plant-based energy drinks dominate with 79.7% of total sales, driven by mainstream consumer adoption and wider retail distribution compared to niche alcoholic variants.

- Ingredient Profile: Caffeine-based formulations account for 31.2% of the market, bridging the gap between traditional energy drink users and health-conscious consumers seeking plant-derived caffeine sources such as guarana and yerba mate.

- End Users: Adults represent the largest consumer group at 62.3%, as this demographic increasingly opts for healthier beverages that provide sustained energy and cognitive benefits without synthetic additives.

- Distribution Channel: Supermarkets and hypermarkets capture 44.4% of market sales, benefiting from extensive product visibility, consumer accessibility, and promotional strategies that drive higher purchase frequency.

- Driver: The surge in health consciousness, particularly among millennials and Gen Z, coupled with growing awareness of the side effects of synthetic energy drinks, is accelerating adoption of plant-based alternatives.

- Restraint: Premium pricing compared to conventional energy drinks and limited penetration in developing economies remain key barriers to broader market expansion.

- Opportunity: Emerging markets in Asia-Pacific and Latin America present strong growth potential, supported by rising disposable incomes, urbanization, and growing demand for functional beverages with natural ingredients.

- Trend: Investment activity is reshaping the market, with notable funding such as Odyssey Elixir’s USD 6.3 million Series A for mushroom-based energy drinks, highlighting the trend toward functional, adaptogen-infused formulations.

- Regional Analysis: North America leads with a USD 2.3 billion market value, accounting for 42.6% of global share, while Europe and Asia-Pacific are poised for rapid growth driven by expanding retail penetration and consumer demand for premium wellness beverages.

Type Analysis

As of 2025, organic plant-based energy drinks represent the largest share of the market, holding 39.7% of the category. Their dominance reflects growing consumer demand for beverages that are not only functional but also free from synthetic additives and aligned with sustainability values. Heightened awareness of the long-term health and environmental impacts of conventional energy drink formulations has accelerated the transition toward certified organic alternatives. Leading brands such as Guayaki and Runa continue to expand their organic lines, capitalizing on consumer trust in transparency and eco-friendly production methods.

The natural segment, accounting for 32.1% of the market, remains a strong performer as consumers increasingly prioritize minimally processed products with clean labels. Natural energy drinks that highlight ingredient integrity and sourcing transparency are appealing to wellness-focused buyers, particularly millennials and Gen Z.

The regular category, with 28.2% of the market, continues to serve a base of consumers loyal to conventional formulations or those driven by affordability. While its relevance persists, the long-term outlook suggests gradual share erosion as healthier alternatives gain traction and mainstream adoption.

Product Type Analysis

Non-alcoholic energy drinks dominate the market with a commanding 79.7% share in 2025. This category has become the default choice for consumers pursuing active lifestyles, hydration, and sustained energy without the risks associated with alcohol consumption. The segment benefits from its appeal across diverse age groups and its alignment with broader wellness trends. Companies like Red Bull Organics and Celsius Holdings are strengthening their portfolios in this space to cater to fitness enthusiasts, professionals, and everyday consumers.

In contrast, alcoholic plant-based energy drinks, though representing only 20.3% of the market, have carved out a niche segment. These beverages cater to social occasions where consumers seek a balance between the stimulating effects of energy ingredients and the recreational appeal of alcohol. Despite steady demand in urban nightlife settings, regulatory scrutiny and growing consumer health awareness are likely to limit large-scale expansion.

Ingredients Analysis

In 2025, caffeine remains the most widely used ingredient, featured in 31.2% of plant-based energy drink formulations. Its reputation as a proven stimulant makes it indispensable, with increasing reliance on natural caffeine sources such as yerba mate, guarana, and green tea extract to enhance product positioning.

Taurine, holding 21.8% of the market, continues to play a key role in supporting metabolic and neurological functions, making it a common inclusion in premium formulations. Guarana, with an 18.6% share, offers an alternative caffeine source valued for its gradual energy release and reduced likelihood of causing energy crashes, broadening its appeal among consumers sensitive to synthetic stimulants.

Other functional ingredients include Vitamin B complexes (12.4%) and L-Carnitine (9.5%), both critical in supporting energy metabolism, while antioxidants (6.5%) are increasingly marketed for their ability to reduce oxidative stress. Together, these ingredient profiles underscore how manufacturers are balancing traditional stimulants with health-focused additives to cater to a broader spectrum of consumer needs.

End-User Analysis

Adults are the primary consumer base, accounting for 62.3% of demand in 2025. This segment aligns most closely with the wellness and performance positioning of plant-based energy drinks, as working professionals, athletes, and health-conscious buyers integrate these beverages into daily routines for enhanced productivity and endurance.

Teenagers, representing 25.4% of the market, are drawn by flavor innovation, branding, and lifestyle alignment. This group remains highly trend-sensitive, offering opportunities for companies to experiment with bold flavors and targeted marketing campaigns. However, concerns about caffeine safety among younger consumers may temper future growth in this segment.

Children, at 12.3%, form the smallest segment, reflecting cautious parental attitudes and the limited number of kid-friendly formulations available. While some opportunities exist for caffeine-free or vitamin-enhanced plant-based beverages tailored to younger consumers, most manufacturers continue to focus their efforts on adult and teenage markets where growth is more scalable.

Distribution Channel Analysis

Supermarkets and hypermarkets remain the most influential distribution channel in 2025, holding 44.4% of sales. Their success is driven by broad product visibility, competitive pricing, and promotional activities that encourage both bulk and impulse purchases. Their established presence in urban and suburban areas makes them a cornerstone for large-scale consumer reach.

E-commerce, which now accounts for 27.8% of sales, is rapidly transforming the industry landscape. Digital platforms provide consumers with greater product variety, transparent ingredient information, and personalized recommendations, appealing strongly to tech-savvy and health-conscious buyers. Online-first brands are leveraging direct-to-consumer models to strengthen customer loyalty and optimize margins.

Grocery stores (13.6%) and convenience stores (9.2%) continue to serve as critical channels for everyday and last-minute purchases. Meanwhile, the “others” category (5.0%), including specialty health stores and direct sales, caters to niche segments seeking premium or highly specialized formulations. These alternative channels also play a role in introducing innovative products to early adopters.

Regional Analysis

The global market is segmented into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each reflecting unique consumption dynamics.

North America continues to dominate, representing 42.6% of the market and valued at USD 2.3 billion. The region’s leadership stems from strong consumer awareness of plant-based alternatives, high purchasing power, and the presence of leading brands. The U.S. remains a hub for innovation, with startups and established players experimenting with functional, adaptogen-infused formulations.

Europe ranks second, driven by strict food safety regulations, consumer interest in organic and sustainable products, and an expanding fitness culture. Countries like Germany, the UK, and the Nordics are particularly receptive to natural and clean-label energy drinks.

Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and growing demand for functional beverages. China and India are emerging hotspots, where both local and international brands are leveraging diverse plant-based ingredients to cater to regional flavor preferences.

Latin America and the Middle East & Africa remain smaller markets but are experiencing gradual uptake. Urbanization, lifestyle changes, and exposure to Western consumption patterns are creating new opportunities, especially in metropolitan centers. Companies entering these regions are focusing on affordability and flavor localization to build brand presence.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Organic

- Natural

- Regular

By Product Type

- Non-Alcoholic

- Alcoholic

By Ingredients

- Taurine

- Caffeine

- Guarana

- Vitamin B

- L-Carnitine

- Antioxidants

- Others

By End-User

- Kids

- Teenagers

- Adults

By Distribution Channel

- Supermarkets/Hypermarkets

- E-commerce

- Grocery Stores

- Convenience Stores

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 5.9 B |

| Forecast Revenue (2034) | USD 11.2 B |

| CAGR (2024-2034) | 6.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Organic, Natural, Regular), By Product Type (Non-Alcoholic, Alcoholic), By Ingredients (Taurine, Caffeine, Guarana, Vitamin B, L-Carnitine, Antioxidants, Others), By End-User (Kids, Teenagers, Adults), By Distribution Channel (Supermarkets/Hypermarkets, E-commerce, Grocery Stores, Convenience Stores, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | BA Sports Nutrition, LLC., Clean Cause, Garden of Life, Guayakí, Guru Energy, Muci, Nestlé, Nightwatchdrink, OCA Beverages, Ocean Beverages, PepsiCo, Proper Wild, Inc., RIOT Energy, Runa Energy Drink, Tenzing Natural Energy Ltd, Thin Energy Hydration, ToroMatcha |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Plant-Based Energy Drink Market ?

The Plant-Based Energy Drink Market is projected to grow from USD 5.9 Billion in 2024 to USD 11.2 Billion by 2034, at a CAGR of 6.7%. Rising demand for clean-label, natural caffeine, adaptogens, and sustainable packaging is boosting adoption, with North America leading the market at 42.6% share.

Who are the major players in the Plant-Based Energy Drink Market ?

BA Sports Nutrition, LLC., Clean Cause, Garden of Life, Guayakí, Guru Energy, Muci, Nestlé, Nightwatchdrink, OCA Beverages, Ocean Beverages, PepsiCo, Proper Wild, Inc., RIOT Energy, Runa Energy Drink, Tenzing Natural Energy Ltd, Thin Energy Hydration, ToroMatcha

Which segments covered the Plant-Based Energy Drink Market ?

By Type (Organic, Natural, Regular), By Product Type (Non-Alcoholic, Alcoholic), By Ingredients (Taurine, Caffeine, Guarana, Vitamin B, L-Carnitine, Antioxidants, Others), By End-User (Kids, Teenagers, Adults), By Distribution Channel (Supermarkets/Hypermarkets, E-commerce, Grocery Stores, Convenience Stores, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Plant-Based Energy Drink Market

Published Date : 10 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date