Podcasting Market Size, Growth Outlook | 28.6% CAGR

Global Podcasting Market Size, Share & Analysis By Genre (News & Politics, Society & Culture, Comedy, Sports, Other Genres), By Format (Interviews, Panels, Solo, Repurposed Content, Conversational, Other Formats), By End-User Industry Outlook, Creator Economy Trends & Forecast 2025–2034

Report Overview

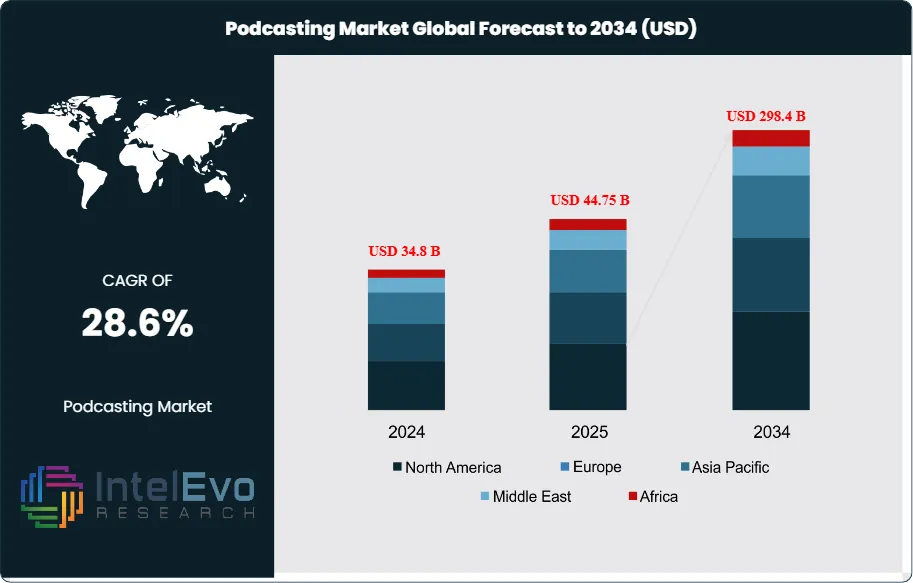

The Podcasting Market is estimated at USD 34.8 billion in 2024 and is on track to reach approximately USD 298.4 billion by 2034, implying a powerful compound annual growth rate of about 28.6% over 2025–2034. Surging global smartphone access, rapid creator-economy expansion, and rising brand investments in audio advertising continue to accelerate market momentum. With AI-driven production tools, multilingual podcasting, and personalized content feeds scaling worldwide, listenership is expanding faster than ever.

Get More Information about this report -

Request Free Sample ReportAs social platforms integrate native podcast features and streaming giants push premium audio subscriptions, podcasting is transforming into a dominant digital media channel. Viral storytelling formats, influencer-led shows, and corporate audio branding are reshaping how audiences consume content—positioning podcasting as one of the fastest-growing segments in the global entertainment economy.

The podcasting sector has evolved from a niche content format into a dominant force in digital media. Demand has accelerated as audiences prioritize convenience, personalization, and accessibility. Podcasts are now a mainstream content choice, supported by the global expansion of internet access, smartphone usage, and streaming platforms. In 2023 alone, global podcast availability exceeded 4.1 million shows, accounting for over 189 million episodes, with an average of 57 episodes per podcast. Anchor FM, a Spotify subsidiary, held the leading position in podcast hosting, with a 55.8% market share.

On the demand side, audiences are engaging with podcasts across a range of categories—from education and news to entertainment and health—often while multitasking. The shift away from linear broadcasting toward on-demand consumption has further reinforced the medium’s appeal. Supply-side factors such as low production costs and minimal distribution barriers have encouraged widespread adoption by independent creators, media companies, and enterprises alike.

Technology is reshaping how podcasts are created, discovered, and monetized. AI-generated content, real-time transcription, advanced metadata tagging, and audience analytics are improving content delivery and listener engagement. Automated translation and voice cloning are also enabling content localization at scale, opening access to non-English-speaking audiences across emerging markets.

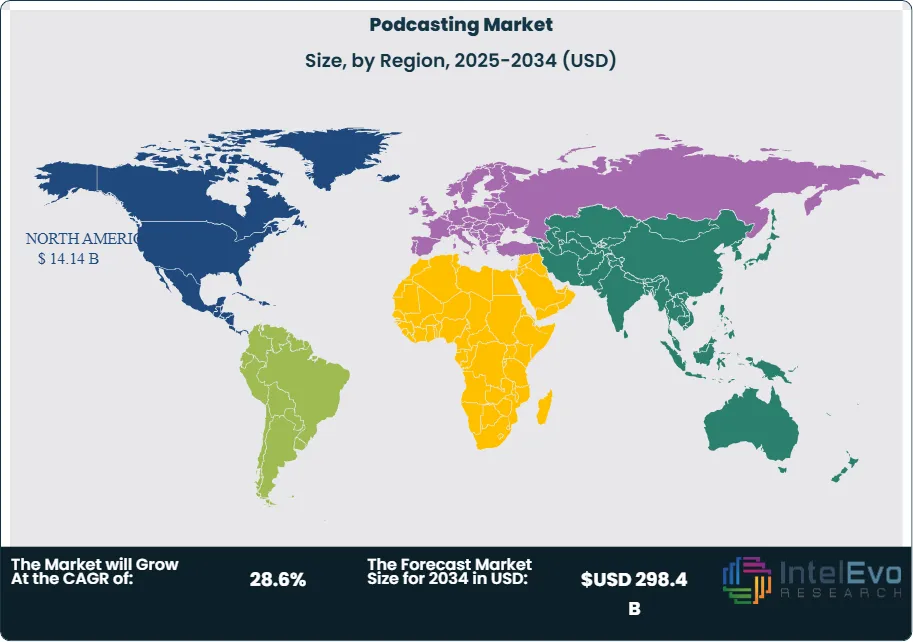

Regionally, the United States continues to lead, producing 64% of global podcasts, 61% of which are in English. By 2026, North America is projected to account for 46.3% of global listeners, followed by Europe at 32.8% and Latin America at 32.4%. Podcasts are now available in more than 100 languages, reflecting the market’s global reach and adaptability.

Investment potential is rising, especially in emerging economies and non-English segments, where listener bases are expanding and content gaps remain. As more brands integrate podcasting into broader digital strategies, the medium is becoming a viable channel for advertising, audience building, and market differentiation—positioning it for sustained long-term growth.

Key Takeaways

- Market Growth: The global podcasting market is projected to grow from USD 34.8 billion in 2024 to USD 298.4 billion by 2034, registering a robust CAGR of 28.6%. Growth is driven by rising mobile internet access, demand for on-demand audio, and widespread content diversification.

- Content Type: News & Politics holds the largest revenue share at 31.7% and is expected to grow at a CAGR of 27.2% through 2032. High engagement levels and consistent content updates contribute to its dominance.

- Format: Interview-based podcasts lead the format segment with a 30.6% market share and a CAGR of 27.8%. Audiences prefer multi-perspective discussions featuring expert guests and topical depth.

- Segment Growth – Format: Solo podcasts are the fastest-growing format, with a CAGR of 28.2% and a market share of 25.7%. The lower production complexity and stronger personal branding potential drive their expansion.

- Driver: The surge in smartphone penetration and increased audio consumption while commuting or multitasking are key growth drivers. Over 4.1 million podcasts are available globally, supported by platforms like Spotify and Apple Podcasts.

- Restraint: Market saturation and content redundancy limit user retention. With more than 189 million podcast episodes online, discoverability remains a key challenge for new entrants.

- Opportunity: Latin America offers strong upside potential, with a forecasted CAGR of 28.4%. Rising digital connectivity and demand for regional-language content position it as a key investment region.

- Trend: AI-powered tools are reshaping podcast creation and distribution. Automation in editing, transcription, and content recommendations is increasing efficiency and listener targeting, particularly among large platforms.

- Regional Analysis: North America leads the global market with a 40.6% share and a projected CAGR of 27.3%. Latin America follows as the fastest-growing region, while Europe remains a strong secondary market with increasing multilingual podcast demand.

Genre Analysis

The News & Politics genre continues to dominate the global podcasting market, accounting for the largest share of total revenue. As of 2025, this segment holds a 31.7% market share and is projected to grow at a CAGR of 27.2% through 2032. This growth is driven by rising global demand for on-demand news and analysis, especially as listeners increasingly seek timely, in-depth insights outside traditional media formats. Podcasts offer journalists and commentators a flexible platform to share long-form political discourse, contributing to the segment’s sustained popularity across developed and emerging markets alike.

Meanwhile, the Sports genre is emerging as the fastest-growing segment. From 2025 to 2032, it is expected to expand at a CAGR of 28.6%, supported by a global audience of sports enthusiasts seeking real-time commentary, interviews, and event recaps. Media platforms are increasing their investments in sports content, with companies such as SoundCloud integrating AI technologies through acquisitions like Musiio to improve content discovery. As sports franchises and athletes explore direct-to-fan podcast formats, this segment will see further acceleration in adoption and monetization.

Format Analysis

The Interview format remains the largest contributor to podcast format revenues, holding a 30.6% market share with a projected CAGR of 27.8% through 2032. The format’s appeal lies in its ability to offer diverse perspectives through guest-driven content. Interviews typically deliver consistent quality and topical relevance, especially when featuring industry experts, celebrities, or thought leaders. This structure also allows platforms to tap into the guest’s existing audience, expanding reach and engagement levels.

In contrast, the Solo podcast format is witnessing the fastest growth in the segment, expanding at a CAGR of 28.2% and accounting for a 25.7% share of the market. This format provides content creators full editorial control, making it easier to produce, publish, and maintain regular schedules. Its low production complexity and high adaptability to niche topics have made it attractive for personal branding, expert commentary, and audience-specific storytelling. The format’s scalability across language and genre further supports its rapid expansion.

Regional Analysis

North America continues to lead the global podcasting market, accounting for 40.6% of total revenue in 2025. The region is forecast to grow at a CAGR of 27.3% through 2032. High smartphone penetration, widespread access to high-speed internet, and early adoption of podcast platforms have created a mature environment for both content creators and advertisers. Investments by major media companies in exclusive podcast rights and original series further reinforce North America’s dominance. The U.S. in particular accounts for the bulk of global podcast production, contributing over 60% of content.

Latin America stands out as the fastest-growing regional market, with a projected CAGR of 28.4% over the forecast period. The expansion is supported by improving digital infrastructure, growing smartphone adoption, and rising demand for localized content in Spanish and Portuguese. Original regional productions are gaining traction among local audiences; for example, A Mulher da Casa Abandonada became the most-downloaded podcast across the region in mid-2022, with over 1.75 million weekly downloads. This signals a maturing ecosystem for both content creation and consumption, positioning Latin America as a key growth territory.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Genre

- News & Politics

- Society & Culture

- Comedy

- Sports

- Other Genres

By Format

- Interviews

- Panels

- Solo

- Repurposed Content

- Conversational

- Other Formats

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 34.8 B |

| Forecast Revenue (2034) | USD 298.4 B |

| CAGR (2024-2034) | 28.6% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2023 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Genre (News & Politics, Society & Culture, Comedy, Sports, Other Genres), By Format (Interviews, Panels, Solo, Repurposed Content, Conversational, Other Formats) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Spotify Technologies S.A., Sound Cloud Ltd., Stitcher Radio Inc., Apple Inc., Audacy Inc., Megaphone LLC, Pandora Media LLC, iHeartMedia Inc., Tune In Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date