PET & PBT Resins Market to Reach USD 75.6 Billion by 2034 | 8.9% CAGR

Global Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market Size, Share, Analysis Report By PET Type (Recycled PET, Transparent & Non-Transparent PET), PET Application (Films, Cosmetics, Bottles, Food Packaging, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

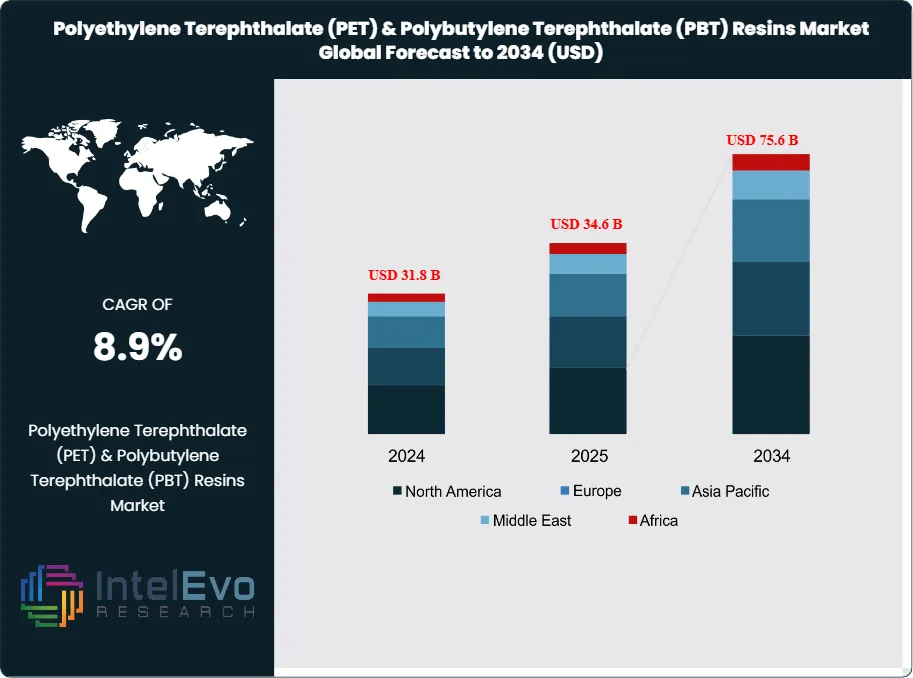

The Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market size is projected to be worth around USD 75.6 billion by 2034, rising from USD 31.8 billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. Driven by increasing demand for lightweight, durable, and recyclable polymers across packaging, automotive, and electronics industries, PET and PBT resins continue to gain global traction. The market is also benefiting from technological advancements in polymer processing and the growing shift toward sustainable and bio-based resin alternatives. As manufacturers move toward circular economy practices, the PET & PBT segment is set to play a pivotal role in shaping the future of green plastics.

Get More Information about this report -

Request Free Sample ReportPolyethylene Terephthalate (PET) and Polybutylene Terephthalate (PBT) are two versatile thermoplastic resins belonging to the polyester family, each offering unique benefits across different industries. PET is widely known for its use in packaging materials such as beverage bottles and food containers due to its strength, clarity, and excellent moisture resistance. It is also used in textile applications as polyester fibers and is highly favored for its recyclability, making it a popular choice in sustainable packaging solutions. On the other hand, PBT is more suited for engineering applications that require high performance under stress. It is valued for its dimensional stability, good electrical insulation, and heat resistance, making it ideal for use in automotive components, electrical connectors, and household appliances. While both resins share chemical similarities, PET tends to be more flexible and transparent, whereas PBT offers greater rigidity and thermal resistance. These characteristics make them essential materials in their respective domains, supporting a wide range of modern manufacturing needs.

The demand for Polyethylene Terephthalate (PET) and Polybutylene Terephthalate (PBT) resins has been steadily rising as industries look for strong, lightweight, and efficient materials. PET is widely recognized for its role in packaging—especially in bottles and containers—thanks to its clarity, recyclability, and strength. With growing concerns around environmental impact and waste, more businesses are turning to PET for sustainable packaging solutions. Beyond packaging, PET’s use in textiles and automotive components is also growing, making it a versatile choice for manufacturers. On the other hand, PBT is gaining attention in sectors that require materials with higher thermal stability and electrical resistance. This includes the automotive and electronics industries, where PBT is used to create durable connectors, switches, and components that must withstand heat and stress. As vehicles become more electrified and electronic devices more compact, the role of PBT in product design is becoming more critical.

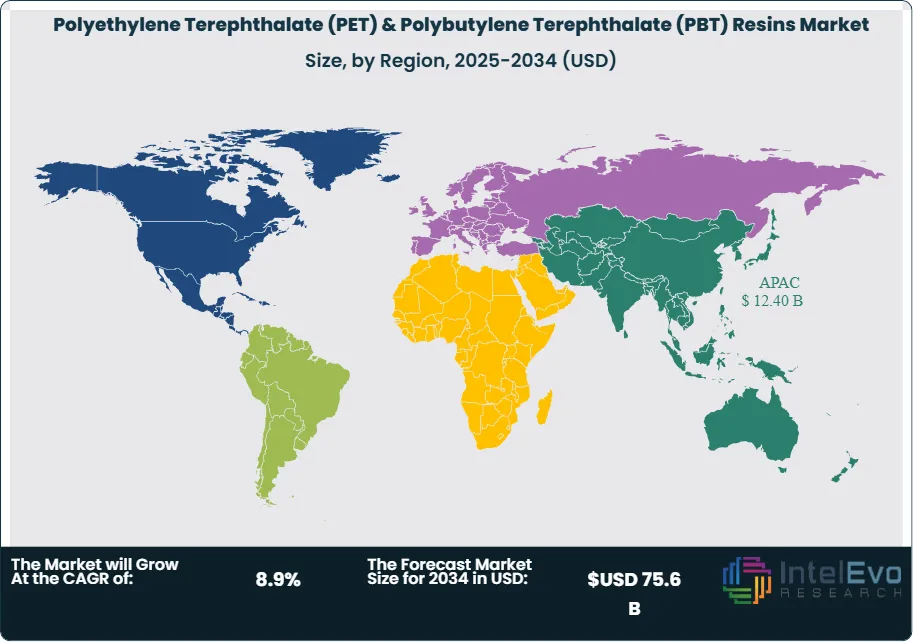

The Asia-Pacific region has emerged as a leading hub for both PET (Polyethylene Terephthalate) and PBT (Polybutylene Terephthalate) resin markets, largely due to rapid industrial growth, rising consumer demand, and an expanding manufacturing base. Countries like China, India, South Korea, and Japan have seen increasing consumption of PET in packaging—especially for beverages, food containers, and consumer goods—due to its lightweight, durable, and recyclable properties. At the same time, PBT has found a strong foothold in automotive, electronics, and electrical industries across the region, thanks to its excellent thermal stability and mechanical strength. Government initiatives supporting sustainable packaging and the surge in electric vehicles have also added momentum. Local availability of raw materials and cost-effective labor give the region a significant edge in global production and export. As the need for high-performance materials grows, Asia-Pacific is expected to maintain its dominance in these resin markets in the foreseeable future.

During the initial stages of the COVID-19 pandemic, the PET market experienced disruptions due to lockdowns and restrictions that affected manufacturing operations and supply chains. However, the demand for PET surged in specific sectors, notably in packaging for food, beverages, and medical supplies. The increased need for hygienic and single-use packaging solutions to prevent virus transmission led to a rise in PET consumption. While the pandemic posed initial challenges to the PET and PBT resins market, the increased emphasis on health, safety, and hygiene has driven demand, particularly for PET in packaging applications. The markets are poised for recovery and growth as industries adapt to the new normal and consumer preferences evolve.

Key Takeaways:

- Market Growth: The Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) resins market is expected to reach USD 75.6 billion by 2034, growing at a robust CAGR of 8.9%, indicating strong market expansion.

- PET Type Segment Dominance: The PET type segment is dominated by transparent & non-transparent PET, accounting for over 56% of the market share. The transparent & non-transparent PET segment is growing due to rising demand for lightweight, durable packaging in the food and beverage industry, especially for frozen and processed foods.

- PET Application Segment Insights: Bottles is anticipated to hold the largest market share. The bottles segment is expected to grow rapidly, driven by rising demand and consumption of PET bottles in food & beverages, consumer goods, and related sectors.

- Driver: The growing need for strong yet lightweight materials in packaging, automotive, and electronics is fueling demand for PET and PBT resins. These materials offer excellent durability, chemical resistance, and versatility, making them ideal for modern product designs and sustainable packaging.

- Restraint: Despite being recyclable, PET and PBT resins still face criticism due to plastic pollution and low recycling rates in some regions. Growing environmental regulations and public pressure are pushing industries to shift toward alternative, biodegradable materials, which could hinder growth.

- Opportunity: The rise of electric vehicles is opening new applications for PBT in under-the-hood components, thanks to its thermal stability and electrical insulation properties. Additionally, the push for sustainable and recyclable packaging solutions is driving innovation and wider adoption of PET in food and beverage sectors.

- Trend: Manufacturers are increasingly investing in bio-based and recycled PET/PBT to align with sustainability goals and consumer preferences. This trend is reshaping production strategies and boosting the adoption of circular economy practices across industries.

- Regional Analysis: Asia-Pacific leads the PET and PBT resins market due to strong demand from packaging, automotive, and electronics industries. Rapid industrialization, cost-effective manufacturing, and growing use of sustainable materials in countries like China and India drive this regional dominance.

PET Type Analysis:

The PET type segment is divided into recycled PET and transparent & non-transparent PET. The transparent & non-transparent PET segment dominated the market, with a market share of around 56% accounting for 16.9 billion 2024. The growth of the PET segment is largely fueled by the rising demand for PET containers, especially within the food and beverage industry. As consumer lifestyles continue to shift toward convenience, the need for lightweight, durable, and recyclable packaging solutions has surged. Additionally, the growing popularity of frozen and processed foods has further boosted the use of PET packaging, due to its excellent barrier properties and suitability for preserving freshness. These factors combined are driving consistent growth in the PET resins market.

PET Application Analysis:

The PET application segment is divided into films, cosmetics, bottles, food packaging, and others. The bottles segment dominated the market, with a market share of around 28% accounting for 8.4 billion 2024. The bottles segment within the PET & PBT resins market is witnessing significant growth due to the increasing use of PET bottles across various industries, especially food and beverages. As consumers lean towards convenient and lightweight packaging solutions, PET bottles are becoming the preferred choice for storing water, soft drinks, juices, and other beverages. Their durability, recyclability, and ability to maintain product freshness have made them a go-to option for manufacturers. Additionally, the growing demand for bottled products in emerging economies and the rise in on-the-go consumption patterns are further propelling the segment’s expansion.

Region Analysis:

Asia pacific leads with 39% Market Share in the Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market. The Asia-Pacific region has emerged as a dominant force in the Polyethylene Terephthalate (PET) and Polybutylene Terephthalate (PBT) resins market, mainly because of its rapid industrial expansion and strong consumer base. Countries like China, India, Japan, and South Korea have seen significant growth in industries that rely heavily on these materials—such as packaging, automotive, consumer electronics, and textiles. PET is widely used in the packaging sector, especially for beverages and food products, due to its lightweight, durability, and recyclability. Meanwhile, PBT resins are essential in automotive and electronic components because of their high thermal stability and mechanical strength. The shift towards eco-friendly materials and increased government support for sustainable manufacturing are also boosting demand in the region. Furthermore, Asia-Pacific benefits from lower production costs and an established supply chain network, making it an ideal hub for global PET and PBT resin production.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

By PET Type

- Recycled PET

- Transparent & Non-Transparent PET

By Grade

- Fiber Grade

- Film Grade

- Bottle Grade

- Engineering Grade

By Application

- Packaging (Bottles, Containers, Films)

- Automotive Components

- Electrical & Electronics

- Industrial Machinery

- Consumer Goods

By End-use Industry

- Food & Beverage

- Automotive & Transportation

- Electrical & Electronics

- Textiles & Apparel

- Industrial Applications

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 34.6 B |

| Forecast Revenue (2034) | USD 75.6 B |

| CAGR (2025-2034) | 8.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT)), By PET Type (Recycled PET, Transparent & Non-Transparent PET), By Grade (Fiber Grade, Film Grade, Bottle Grade, Engineering Grade), By Application (Packaging (Bottles, Containers, Films), Automotive Components, Electrical & Electronics, Industrial Machinery, Consumer Goods), By End-use Industry (Food & Beverage, Automotive & Transportation, Electrical & Electronics, Textiles & Apparel, Industrial Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Mitsubishi Chemical, BASF, Nan Ya Plastics, Reliance Industries, Indorama Ventures Limited, SABIC, Alpek, DuPont, Far Eastern New Century, Koninklijke DSM N.V., Jiangsu Sanfangxiang Group Co. Ltd., M&G Chemicals SA, Toray Industries Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Polyethylene Terephthalate and Polybutylene Terephthalate Resins Market

Published Date : 18 Jun 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date