Potassium 2-Ethylhexanoate Market Size, Share & Forecast 2034 | 7.2% CAGR

Global Potassium 2-Ethylhexanoate Market Size, Share, Analysis Report By Type (<80% Purity, 80% to 85% Purity, 90% to 95% Purity, Above 95% Purity), Form (Solution, Powder), Application (Adhesives and Sealants, Paints and Coatings, Plastics, Rubber, Metalworking Fluids, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

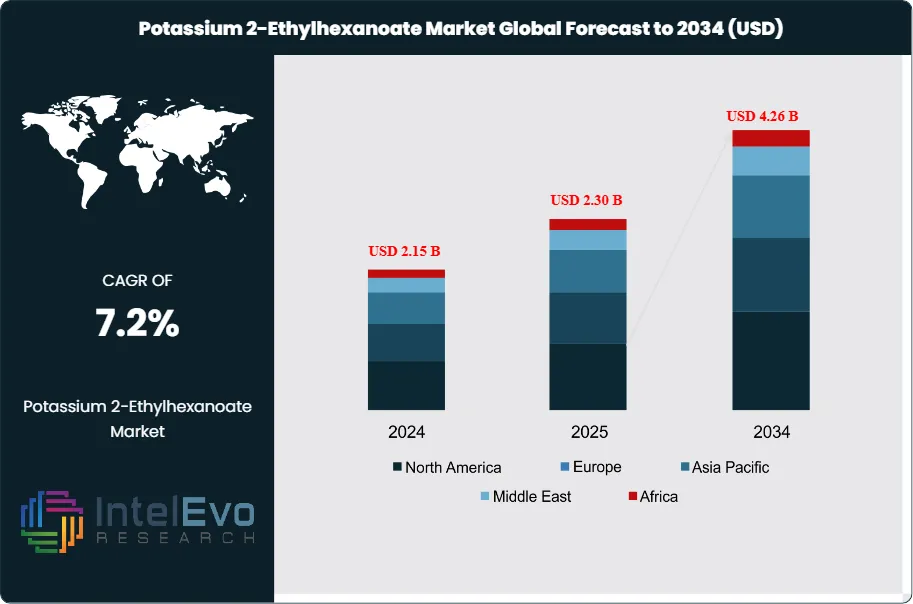

The Potassium 2-Ethylhexanoate Market size is projected to reach approximately USD 4.26 Billion by 2034, up from USD 2.15 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. The market growth is fueled by increasing applications of potassium 2-ethylhexanoate as a catalyst and additive in coatings, paints, and polymer manufacturing. Rising demand from the construction, automotive, and chemical industries, coupled with the push for eco-friendly and efficient catalysts, is accelerating adoption worldwide. The trend toward sustainable and high-performance materials continues to create strong opportunities for manufacturers in the coming decade.

Get More Information about this report -

Request Free Sample ReportPotassium 2-Ethylhexanoate, the potassium salt of 2-ethylhexanoic acid, plays a crucial role in a wide range of industrial applications due to its distinctive chemical characteristics. It is widely appreciated for its effectiveness as a catalyst, stabilizer, and corrosion inhibitor. Its usage spans across industries such as automotive, electronics, plastics, construction, and metalworking. Its high solubility in organic solvents and compatibility with a variety of systems makes it an indispensable additive in the production of coatings, adhesives, rubber formulations, and metalworking fluids. This compound enhances product performance by improving adhesion, thermal stability, and corrosion resistance, contributing to longer-lasting and more efficient end-products.

The global demand for Potassium 2-Ethylhexanoate is primarily driven by the expansion of high-performance industries. As automotive, construction, and electronics sectors continue to evolve, the need for advanced and efficient chemical agents grows. This chemical is especially valued in polyurethane applications, such as insulating foams and sealants, where it serves as a key catalyst. Additionally, the global push towards sustainability and stricter environmental policies has led manufacturers to seek alternatives that comply with environmental safety standards. Potassium 2-Ethylhexanoate, being low in toxicity and effective in low concentrations, aligns well with these regulations, increasing its adoption worldwide.

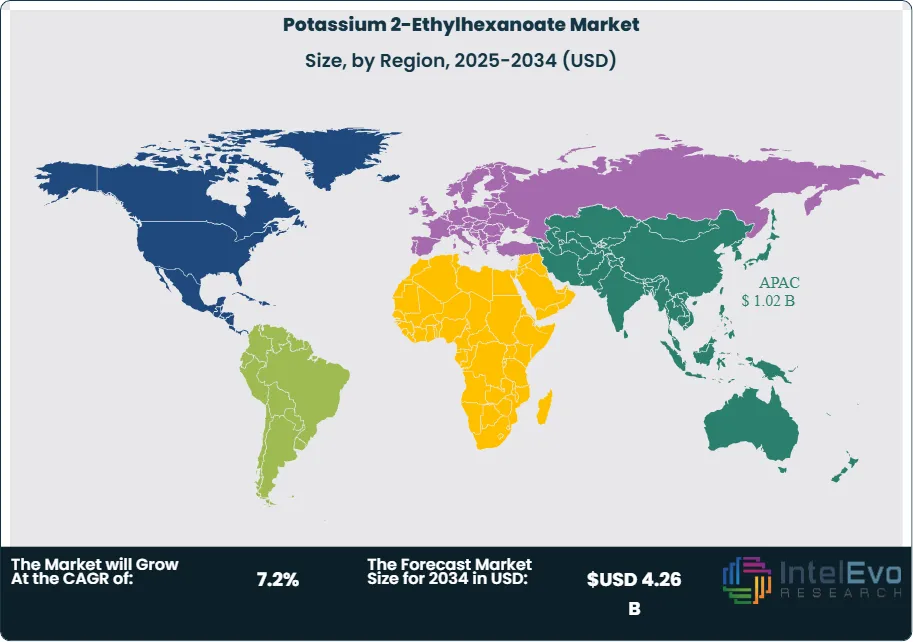

Regionally, the Asia-Pacific dominates the Potassium 2-Ethylhexanoate market. Countries such as China, India, South Korea, and Japan are central to this growth due to their rapid industrialization, expanding construction activities, and strong presence in electronics and automotive manufacturing. The availability of raw materials, cost-effective labor, and government initiatives to boost domestic manufacturing further enhance the region’s leading position.

North America and Europe also contribute significantly to the market. These regions benefit from advanced manufacturing practices, strong R&D capabilities, and a focus on innovation and environmental sustainability. The automotive and aerospace sectors in the United States, Germany, and France, in particular, rely heavily on high-performance materials, thus supporting the consistent demand for Potassium 2-Ethylhexanoate.

The COVID-19 pandemic temporarily disrupted industrial operations and supply chains, leading to a short-term decline in demand. However, as industries recover and adapt to new safety and sustainability standards, the market has shown signs of steady resurgence. Increased emphasis on eco-friendly solutions and growing infrastructure investments are expected to further drive the demand for Potassium 2-Ethylhexanoate in the coming years.

Key Takeaways:

- Market Growth: The Potassium 2-Ethylhexanoate Market is expected to reach USD 4.26 Billion by 2034, growing at a robust CAGR of 7.2%, indicating strong growth in industries related to rubber and plastic.

- Type Dominance: The "Above 95% Purity" segment leads the market due to its suitability for high-end applications requiring superior quality.

- Form Dominance: The "Solution" form is preferred for its ease of handling and uniform application in various industrial processes.

- Application Dominance: Among applications, "Paints and Coatings" hold a significant market share, driven by the demand for durable and high-performance finishes.

- Driver: The escalating demand for efficient and high-performance chemical agents in various industries drives the market for Potassium 2-Ethylhexanoate. Its role as a catalyst and stabilizer enhances product quality and process efficiency.

- Restraint: Volatility in raw material prices and potential supply chain disruptions can hinder market growth, affecting production costs and availability.

- Opportunity: The expansion of industrial activities in emerging economies offers lucrative opportunities for market players to tap into new customer bases and applications.

- Trend: The industry is witnessing a trend towards sustainable practices, with a focus on developing eco-friendly chemical solutions that meet environmental regulations and consumer preferences.

- Regional Analysis: Asia-Pacific currently leads the market due to cost-effective production and high demand. Future growth is expected in Latin America and the Middle East & Africa, driven by industrialization and infrastructure development.

Type Analysis:

Above 95% Purity Leads With over 50% Market Share In Potassium 2-Ethylhexanoate Market. The "Above 95% Purity" segment leads the Potassium 2-Ethylhexanoate market, primarily due to its critical role in high-end applications that demand exceptional quality and consistency. Industries such as pharmaceuticals, electronics, and specialty chemicals require chemicals with minimal impurities to ensure product safety, efficacy, and regulatory compliance. This high-purity grade supports advanced manufacturing processes, making it the preferred choice for sectors where performance and reliability are non-negotiable. As a result, this segment consistently captures the largest market share and is expected to maintain its dominance as these industries continue to expand.

Form Analysis:

Solution holds over 60% Market Share In Potassium 2-Ethylhexanoate Market. The "Solution" form is the preferred choice in the market because it offers significant advantages in handling, storage, and application. Solutions are easier to measure, mix, and distribute evenly in industrial processes, reducing the risk of dosing errors and improving operational efficiency. This format is especially valued in large-scale manufacturing environments, where consistency and process control are essential. The convenience and uniformity provided by the solution form have led to its widespread adoption across various end-use industries, solidifying its position as the dominant form in the market

Application Analysis:

Within applications, the "Paints and Coatings" segment holds a significant share of the Potassium 2-Ethylhexanoate market. This is driven by the increasing demand for durable, high-performance finishes in construction, automotive, and industrial sectors. Potassium 2-Ethylhexanoate enhances the stability, dispersion, and longevity of coatings, making it indispensable for manufacturers seeking to deliver superior products. The ongoing growth in infrastructure and consumer goods is expected to further boost this segment, ensuring its continued market leadership.

Region Analysis:

Asia-Pacific dominates the global Potassium 2-Ethylhexanoate market in terms of both production and consumption. Countries like China, India, and South Korea drive growth through their booming construction and automotive industries. Additionally, low production costs and rising domestic demand make this region the market leader. China's role as a chemical manufacturing hub further cements the region’s dominance.

North America, particularly the United States, represents a mature but steady market. The region benefits from established industrial infrastructure, demand in polyurethane foam applications, and regulations that promote high-performance chemical catalysts. However, stringent environmental standards can sometimes slow down production flexibility, driving reliance on imports or eco-certified suppliers.

Europe holds a significant share due to advanced manufacturing technologies and strong emphasis on environmentally friendly catalysts. The EU’s regulatory frameworks push industries toward more sustainable options, increasing demand for Potassium 2-Ethylhexanoate in paints, coatings, and insulating foams. Germany, France, and the UK lead in consumption due to their developed chemical sectors.

Latin America is an emerging market, with Brazil and Mexico showing increasing industrial activity. While the current market size is small compared to Asia or Europe, infrastructure growth and rising demand in consumer goods offer potential.

This region remains in the early stages of market development. However, expansion in construction and industrial activity in GCC countries could drive moderate future growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- <80% Purity

- 80% to 85% Purity

- 90% to 95% Purity

- Above 95% Purity

By Form

- Solution

- Powder

By Grade

- Industrial Grade

- Technical Grade

- High Purity Grade

By Distribution Channel

- Direct Sales

- Distributors and Traders

- Online Retail

By End-Use Industry

- Construction

- Automotive

- Industrial Manufacturing

- Chemical Processing

- Consumer Goods

- Others

By Application

- Paints and Coatings

- Polymer and Plastics Manufacturing

- Catalysts and Additives

- Rubber and Adhesives

- Lubricants and Greases

- Others (Chemical Intermediates, Construction Compounds)

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.30 B |

| Forecast Revenue (2034) | USD 4.26 B |

| CAGR (2025-2034) | 7.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (<80% Purity, 80% to 85% Purity, 90% to 95% Purity, Above 95% Purity), By Form (Solution, Powder), By Grade (Industrial Grade, Technical Grade, High Purity Grade), By Distribution Channel (Direct Sales, Distributors and Traders, Online Retail), By End-Use Industry (Construction, Automotive, Industrial Manufacturing, Chemical Processing, Consumer Goods, Others), By Application (Paints and Coatings, Polymer and Plastics Manufacturing, Catalysts and Additives, Rubber and Adhesives, Lubricants and Greases, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | American Elements, Milliken & Company, Haihang Industry Co. Ltd., Glindia Chemicals, Capot Chemical, Nihon Kagaku Sangyo Co. Ltd., Shandong Lanhai Industry Co. Ltd, Chemwill Asia, Ningbo Inno Pharmchem Co. Ltd., ADEG S.R.L., Ferguson Chemicals, Mofan Polyurethane Co. Ltd., SincereChemical, Actylis, Ivy Fine Chemicals, Ronak Chemicals |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Potassium 2-Ethylhexanoate Market

Published Date : 03 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date