Predictive AI Animation Market Size, Share & Growth | CAGR of 18.8%

Global Predictive AI Animation Market Size, Share, Analysis Report By Component (Services, Solution) By Application (Scene Generation, Character Animation, Voice and Dialogue Synthesis, Others) By End User (Game Development, Advertising and Marketing Agencies, Film and Television Studios, Educational Content Providers, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

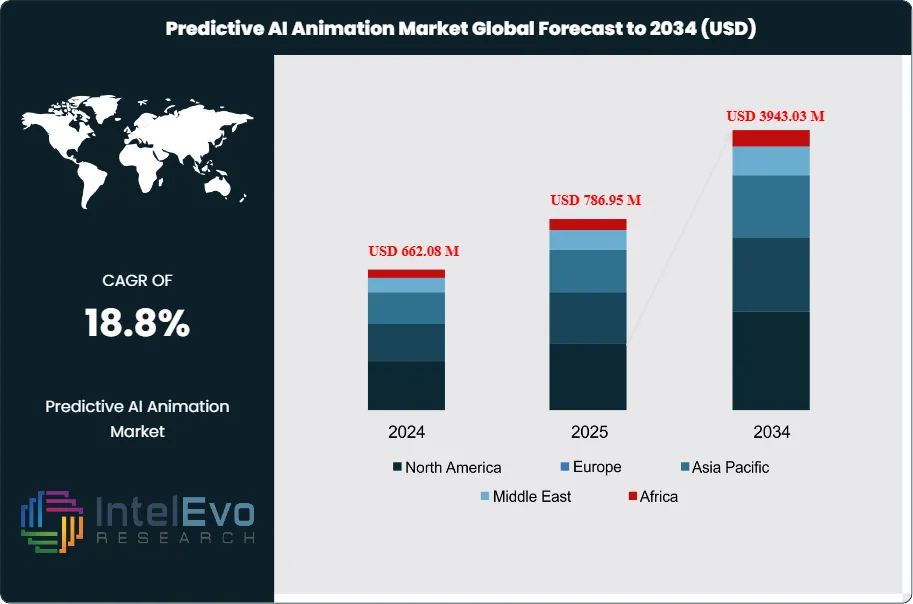

The Predictive AI Animation Market size is expected to be worth around USD 3943.03 Million by 2034, from USD 662.08 Million in 2024, growing at a CAGR of 18.8% during the forecast period from 2024 to 2034. The Predictive AI Animation Market refers to advanced software and solutions that employ artificial intelligence and machine learning algorithms to automate, enhance, and anticipate the creation of animated content—encompassing character motion, scene development, and dialogue synthesis.

Get More Information about this report -

Request Free Sample ReportCore market growth factors include the rising demand for high-quality, scalable, and cost-efficient animation in entertainment, gaming, advertising, and online education, as well as continuous improvements in deep learning, natural language processing, and motion capture technologies. The integration of predictive AI enables producers to significantly reduce production timelines, lower operational costs, and unlock creative possibilities by automating complex animation sequences and enabling real-time content adaptation.

Market expansion is further propelled by the rapid adoption of cloud-based animation tools, increased investment in gaming and interactive content, and the demand for hyper-personalized digital experiences. However, significant challenges persist—such as the high initial cost of AI solution integration, concerns around intellectual property protection, a shortage of AI-specific creative talent, and lingering uncertainties about quality control versus creative oversight. Additionally, issues surrounding data privacy, interoperability among platforms, and the evolving regulatory landscape may impact broader adoption.

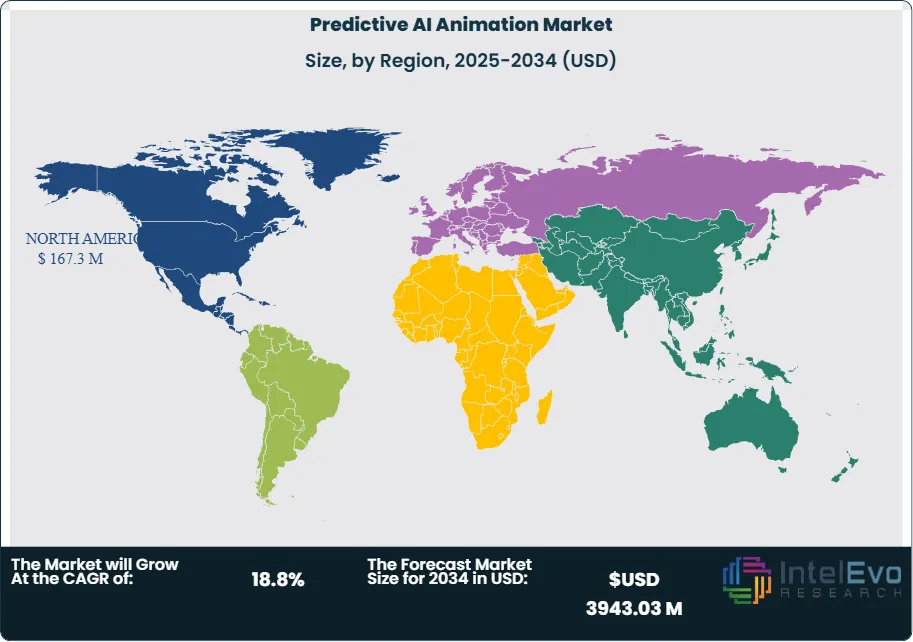

Regionally, North America maintains a leading position in the Predictive AI Animation Market, driven by its concentration of major technology companies, robust media and entertainment sectors, and strong investment in research and development. Europe follows closely due to its creative industries and innovation policies, while the Asia-Pacific region is witnessing the fastest growth, fueled by booming gaming, anime production, and increasing digitalization in emerging markets.

The COVID-19 pandemic accelerated investment in AI-powered animation solutions as production studios, content creators, and educators shifted toward remote workflows and digital-first content delivery. With traditional production hampered, predictive AI tools enabled teams to automate manual tasks, ensure business continuity, produce animated assets remotely, and respond rapidly to surges in online content consumption, establishing AI animation as a post-pandemic standard

Rising geopolitical tensions and tariff impositions—especially between the U.S., China, and the European Union—have increased the cost of critical hardware, cloud services, and AI-development tools required for predictive animation workflows. Tariffs on GPUs, servers, and other computing components have amplified operational expenses, especially for smaller studios and independent creators. Additionally, supply chain disruptions, heightened protectionism, and stricter cross-border data regulations have impeded collaboration on international co-productions, delayed technology imports, and forced greater reliance on local suppliers, collectively dampening market efficiency and innovation.

To counterbalance these challenges, major trade agreements such as RCEP, the USMCA, and key bilateral EU-Asia partnerships have aimed to lower digital trade barriers, harmonize AI and copyright standards, and promote shared research programs. Such frameworks facilitate global distribution of AI animation solutions, streamline content co-production, and encourage technology transfer, supporting the steady international growth and standardization of the Predictive AI Animation Market.

Key Takeaways

- Market Growth: The Predictive AI Animation Market is expected to reach USD 3943.03 Million by 2034, driven by advancing neural network technologies, increasing demand for animated content, digital transformation in entertainment industries, and growing adoption of AI-powered creative tools across gaming and media production.

- Component Dominance: Solutions dominate the Predictive AI Animation market because they provide the core AI algorithms, software platforms, and integrated tools that enable automated animation creation, making them the essential foundation for all predictive animation workflows.

- Application Dominance: Character animation leads the Predictive AI Animation market because it addresses the most complex and time-intensive aspect of animation production, where AI can deliver significant efficiency gains and creative value through automated motion generation and behavioral prediction.

- End User Dominance: Game development leads the Predictive AI Animation market due to the industry's high demand for scalable content creation, real-time animation requirements, and the need for cost-effective solutions to produce vast amounts of animated content for interactive experiences.

- Drivers: Key growth drivers include rising demand for animated content, cost reduction pressures in production, technological advances in AI and machine learning, expanding gaming markets, and increasing consumer expectations for high-quality visual experiences.

- Restraints: Growth is challenged by high initial implementation costs, concerns about creative control and artistic authenticity, integration complexity with existing workflows, and the need for specialized technical expertise to operate advanced AI animation systems.

- Opportunities: Significant opportunities exist in real-time animation generation, personalized content creation, educational and training applications, virtual and augmented reality experiences, and emerging markets with expanding digital content industries.

- Trends: Key trends include real-time rendering integration, cloud-based animation platforms, collaborative AI-human workflows, motion capture enhancement, and the development of user-friendly interfaces that democratize access to advanced animation capabilities.

- Regional Leader: North America leads with established entertainment industries and technology companies, while Asia-Pacific demonstrates the highest growth potential driven by gaming expansion and increasing animation production investments.

Component Analysis

Solutions lead this segment due to their central role in delivering the fundamental AI capabilities that power predictive animation technologies. These software platforms incorporate machine learning models, neural networks, and predictive algorithms that can automatically generate smooth motion sequences, anticipate character behaviors, and create realistic animations based on input parameters. Solutions include comprehensive software suites, APIs, and development frameworks that enable creators to implement AI-driven animation without building underlying technology from scratch. The scalability and continuous innovation potential of solution-based products make them the primary revenue drivers in this market. Services, while important for implementation support, consulting, and customization, represent a smaller market share as they are typically project-based engagements that support solution deployment. Services focus on helping organizations integrate AI animation tools into existing workflows, provide training, and offer technical support, but their growth is inherently limited by human resource constraints rather than the scalable product licensing that drives solution adoption.

Application Analysis

Character Animation Leads With Over 40% Market Share In Predictive AI Animation Market, Character animation dominates this segment because it represents the most challenging and resource-intensive aspect of animation production, where AI provides the greatest value proposition. Predictive AI can automate complex character movements, facial expressions, and behavioral patterns while maintaining consistency across scenes and sequences. This application enables animators to focus on creative direction while AI handles time-consuming technical execution, significantly reducing production timelines and costs. The complexity of realistic character motion makes this the most compelling use case for AI investment. Scene generation, while growing rapidly, serves as a supporting application that creates environments and backgrounds but typically requires less sophisticated AI processing than character animation. Voice and dialogue synthesis represents a specialized but valuable niche, focusing on automated lip-syncing and speech animation that complements character animation work. Other applications include special effects, crowd simulation, and procedural content generation, which contribute to market growth but lack the broad applicability and immediate value proposition that drives character animation adoption across the entertainment industry.

End User Analysis

Game development dominates this market because the gaming industry faces unique challenges that make predictive AI animation particularly valuable. Games require extensive animated content for characters, environments, and interactive elements, often with real-time performance requirements that traditional animation methods cannot efficiently address. AI-powered animation tools enable game developers to generate diverse character behaviors, procedural animations, and adaptive responses to player actions while maintaining performance optimization. The iterative nature of game development, combined with tight deadlines and budget constraints, makes automated animation solutions essential for competitive advantage. Film and television studios represent a significant secondary market, utilizing AI for high-quality cinematic content and special effects, though their adoption is more selective due to established workflows and quality standards. Advertising and marketing agencies leverage AI animation for rapid campaign creation and personalized content at scale. Educational content providers use these tools for interactive learning materials and instructional animations. Other end users include architectural visualization, medical simulation, and virtual reality applications, contributing to steady market growth through specialized use cases.

Regional Analysis

North America Leads With nearly 35% Market Share In Predictive AI Animation Market, North America led the global landscape in 2024, commanding over 33.5% share with USD 167.3 million in revenue, driven by its mature entertainment industry ecosystem, high concentration of major animation studios and gaming companies, early adoption of AI technologies in creative workflows, and substantial investment in research and development by leading technology corporations. The region benefits from established companies including Disney, Pixar, DreamWorks, and major gaming studios that continuously push the boundaries of animation technology while maintaining extensive distribution networks and global market reach. Major technology companies including Adobe, NVIDIA, and Autodesk maintain their primary development centers in North America, driving continuous innovation in AI-powered creative tools.

Asia-Pacific represents the fastest-growing regional market, fueled by rapidly expanding gaming industries, increasing government investments in digital content creation, growing animation production capabilities, and rising consumer demand for animated entertainment across mobile and digital platforms. China's animation industry is experiencing significant growth with the debut of its first AI-produced animated series, while Japan and South Korea continue to lead in animation innovation and technology adoption. The region's growth is supported by increasing internet connectivity, expanding mobile gaming markets, and growing middle-class populations with rising disposable income for digital entertainment.

Europe maintains a stable market position with steady growth driven by strong creative industries, government support for digital innovation, and increasing adoption of AI technologies in animation and gaming sectors. Latin America and the Middle East & Africa regions show moderate growth potential, supported by expanding digital content markets and increasing recognition of AI animation technologies as competitive necessities.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Component

- Services

- Solution

By Application

- Scene Generation

- Character Animation

- Voice and Dialogue Synthesis

- Others

By End User

- Game Development

- Advertising and Marketing Agencies

- Film and Television Studios

- Educational Content Providers

- Others

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 786.95 M |

| Forecast Revenue (2034) | USD 3943.03 M |

| CAGR (2025-2034) | 18.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Services, Solution) By Application (Scene Generation, Character Animation, Voice and Dialogue Synthesis, Others) By End User (Game Development, Advertising and Marketing Agencies, Film and Television Studios, Educational Content Providers, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Adobe Inc., NVIDIA Corporation, Autodesk Inc., Unity Technologies, Epic Games Inc., Maxon Computer GmbH, SideFX Software, Foundry Visionmongers Ltd., Reallusion Inc., Toon Boom Animation Inc., Blender Foundation, Pixologic Inc. (ZBrush), The Foundry Visionmongers, Chaos Group, Blackmagic Design |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Predictive AI Animation Market?

The Predictive AI Animation Market is projected to reach USD 3943.03M by 2034, growing at a CAGR of 18.8% from 2024 to 2034. Explore insights, trends, and forecasts.

Who are the major players in the Predictive AI Animation Market?

Adobe Inc., NVIDIA Corporation, Autodesk Inc., Unity Technologies, Epic Games Inc., Maxon Computer GmbH, SideFX Software, Foundry Visionmongers Ltd., Reallusion Inc., Toon Boom Animation Inc., Blender Foundation, Pixologic Inc. (ZBrush), The Foundry Visionmongers, Chaos Group, Blackmagic Design

Which segments covered the Predictive AI Animation Market?

By Component (Services, Solution) By Application (Scene Generation, Character Animation, Voice and Dialogue Synthesis, Others) By End User (Game Development, Advertising and Marketing Agencies, Film and Television Studios, Educational Content Providers, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Predictive AI Animation Market

Published Date : 26 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date