Predictive AI in Robotics: $28.7B by 2034 with 16.2% CAGR!

Global Predictive AI in Robotics Market Size, Share, Analysis Report By Product Type (Predictive Maintenance Solutions, Autonomous Navigation Systems, Process Optimization Platforms, Human-Robot Collaboration Tools) Application Type (Industrial Automation, Healthcare Robotics, Logistics & Warehousing, Defense & Security, Consumer Robotics) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

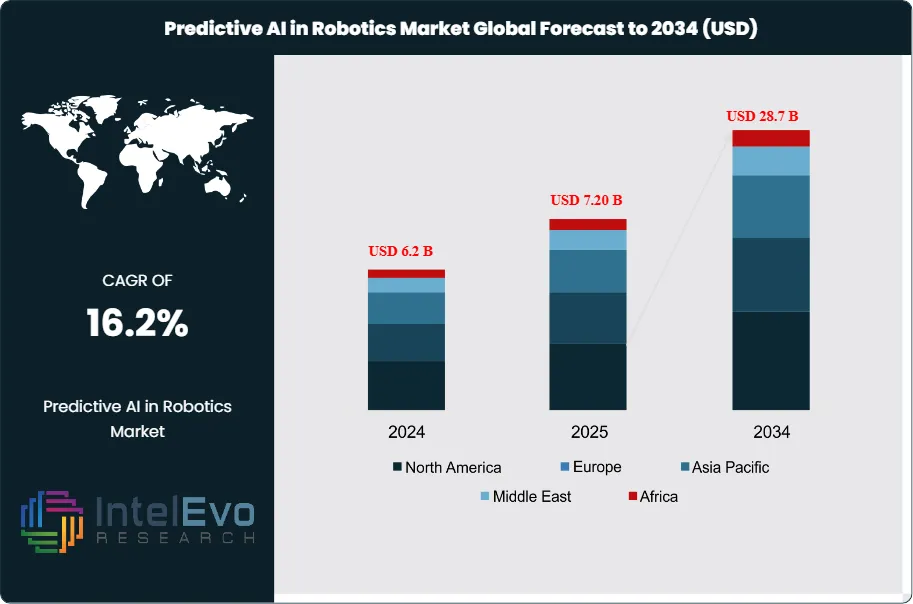

The Predictive AI in Robotics Market is projected to reach approximately USD 28.7 billion by 2034, rising from USD 6.2 billion in 2024, and expanding at a CAGR of 16.2% during the forecast period from 2024 to 2034. This growth is driven by increasing deployment of predictive maintenance, real-time decision-making, and autonomous optimization capabilities across industrial, healthcare, logistics, and defense robotics. Advancements in machine learning, sensor fusion, and edge AI are further enhancing robotic efficiency and reliability, positioning predictive AI as a core technology for next-generation intelligent and self-learning robotic systems worldwide.

Get More Information about this report -

Request Free Sample ReportPredictive AI in robotics refers to the integration of advanced artificial intelligence algorithms—particularly those focused on predictive analytics, machine learning, and deep learning—into robotic systems. This enables robots to anticipate outcomes, optimize operations, and adapt to dynamic environments across industries such as manufacturing, healthcare, logistics, defense, and consumer electronics. The market encompasses predictive maintenance, autonomous navigation, process optimization, human-robot collaboration, and real-time decision-making, serving a diverse range of end-users from industrial enterprises to service providers and research institutions.

The market’s rapid growth is fueled by the increasing adoption of Industry 4.0, the proliferation of IoT-connected devices, and the demand for intelligent automation to enhance productivity and reduce operational costs. Key drivers include advancements in edge AI, real-time data processing, and the integration of cloud-based analytics, which collectively enable robots to predict failures, optimize workflows, and deliver higher value in mission-critical applications. The expansion of collaborative robots (cobots) and the growing need for predictive maintenance in industrial settings are further accelerating market adoption.

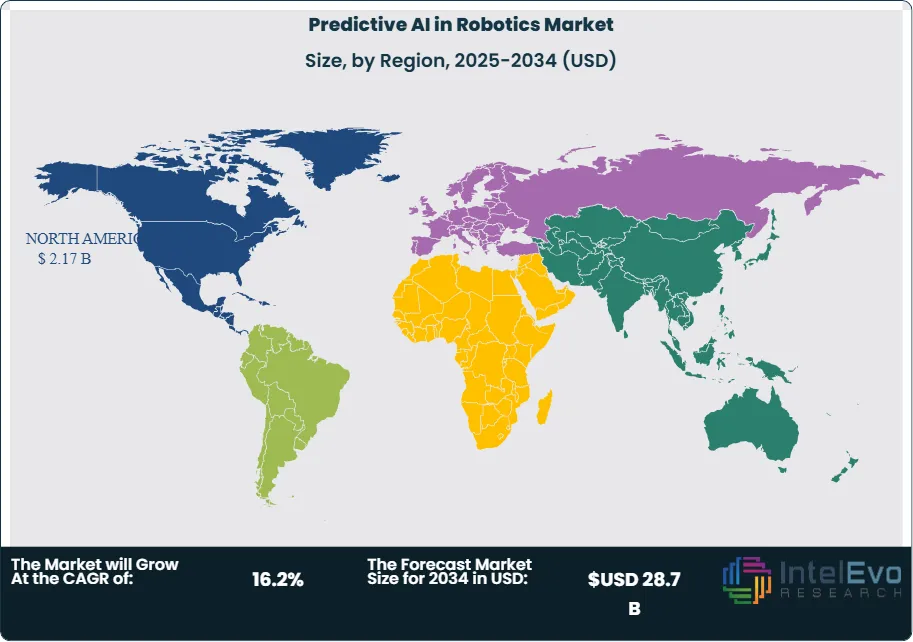

North America leads the global predictive AI in robotics market, driven by robust R&D investments, a strong presence of technology giants, and early adoption across manufacturing and healthcare. The Asia-Pacific region is the fastest-growing market, propelled by rapid industrialization, government initiatives supporting smart manufacturing, and the expansion of electronics and automotive sectors. Europe maintains a significant market share due to its advanced manufacturing base, focus on automation, and regulatory support for AI-driven innovation.

The COVID-19 pandemic underscored the importance of automation and predictive intelligence, as organizations sought to minimize human intervention, ensure business continuity, and optimize supply chains. This led to accelerated investments in AI-powered robotics for remote monitoring, predictive maintenance, and autonomous operations, driving long-term market growth.

Rising geopolitical tensions and supply chain disruptions have highlighted the need for resilient, self-optimizing robotic systems. Predictive AI enables organizations to anticipate risks, adapt to changing conditions, and maintain operational efficiency, making it a strategic asset in uncertain environments.

Key Takeaways

- Market Growth: The Predictive AI in Robotics Market is expected to reach USD 28.7 Billion by 2034, driven by Industry 4.0 adoption, IoT proliferation, and the need for intelligent automation.

- Product Type Dominance: Predictive Maintenance Solutions lead the segment, owing to their ability to reduce downtime and optimize asset utilization.

- Application Dominance: Industrial Automation holds the largest share, supported by manufacturing, logistics, and automotive sectors.

- Driver: Key growth drivers include the demand for operational efficiency, real-time analytics, and the expansion of collaborative robotics.

- Restraint: High implementation costs and data privacy concerns pose challenges to widespread adoption.

- Opportunity: The market is poised for growth through advancements in edge AI, cloud robotics, and the expansion of AI-powered service robots in emerging markets.

- Trend: Integration of generative AI, digital twins, and autonomous learning systems is reshaping the market landscape.

- Regional Analysis: North America leads due to technological maturity and investment, while Asia-Pacific is the fastest-growing region, and Europe maintains a strong presence in industrial automation.

Product Type Analysis

Predictive Maintenance Solutions dominate the market, as manufacturers and service providers increasingly rely on AI-driven analytics to forecast equipment failures, schedule maintenance, and minimize unplanned downtime. These solutions leverage sensor data, machine learning, and cloud analytics to deliver actionable insights, reducing costs and extending asset lifespans. The adoption of predictive maintenance is particularly strong in sectors with high-value assets, such as automotive, aerospace, and energy. Autonomous Navigation Systems are gaining traction, especially in logistics, warehousing, and healthcare, where robots must navigate complex, dynamic environments. Predictive AI enables real-time path optimization, obstacle avoidance, and adaptive decision-making, enhancing safety and efficiency. Process Optimization Platforms utilize predictive analytics to streamline workflows, allocate resources, and optimize production schedules. These platforms are integral to smart factories and digital supply chains, supporting just-in-time manufacturing and agile operations.

Application Analysis

Industrial Automation is the leading application segment, accounting for over 45% of the market share. Predictive AI enhances robotic arms, AGVs (Automated Guided Vehicles), and assembly line robots by enabling them to anticipate process bottlenecks, optimize throughput, and ensure quality control. The automotive, electronics, and food & beverage industries are major adopters. Healthcare Robotics is rapidly expanding, with predictive AI powering surgical robots, rehabilitation devices, and hospital logistics systems. These solutions improve patient outcomes, reduce errors, and optimize resource allocation. Logistics & Warehousing benefit from predictive AI in fleet management, inventory optimization, and autonomous delivery robots, driving efficiency and reducing operational costs. Defense & Security applications leverage predictive AI for surveillance, threat detection, and autonomous mission planning, enhancing situational awareness and response capabilities.

Region Analysis

North America leads with more than 35% market share, supported by a mature technology ecosystem, strong R&D investments, and early adoption in manufacturing and healthcare. The presence of leading AI and robotics companies, along with government support for innovation, reinforces regional dominance. Asia-Pacific is the fastest-growing region, driven by rapid industrialization, government initiatives for smart manufacturing (notably in China, Japan, and South Korea), and the expansion of electronics and automotive sectors. The region’s large manufacturing base and increasing adoption of automation solutions create significant growth opportunities. Europe maintains a substantial market presence, leveraging its advanced manufacturing sector, regulatory support for AI, and focus on sustainable automation. Germany, France, and the UK are key contributors, with strong adoption in automotive and industrial robotics. Latin America and Middle East & Africa are emerging markets, with growth driven by infrastructure development, increasing automation, and investments in smart cities and logistics.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Predictive Maintenance Solutions

- Autonomous Navigation Systems

- Process Optimization Platforms

- Human-Robot Collaboration Tools

Application Type

- Industrial Automation

- Healthcare Robotics

- Logistics & Warehousing

- Defense & Security

- Consumer Robotics

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 7.20 B |

| Forecast Revenue (2034) | USD 28.7 B |

| CAGR (2025-2034) | 16.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Predictive Maintenance Solutions, Autonomous Navigation Systems, Process Optimization Platforms, Human-Robot Collaboration Tools) Application Type (Industrial Automation, Healthcare Robotics, Logistics & Warehousing, Defense & Security, Consumer Robotics) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Siemens AG, ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Universal Robots, Rockwell Automation, NVIDIA Corporation, IBM Corporation, Microsoft Corporation, Amazon Robotics, Boston Dynamics |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Predictive AI in Robotics Market?

Explore the booming Predictive AI in Robotics Market, expected to surge to USD 28.7B by 2034, driven by innovation and a 16.2% CAGR from 2024–2034.

Who are the major players in the Predictive AI in Robotics Market?

Siemens AG, ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Universal Robots, Rockwell Automation, NVIDIA Corporation, IBM Corporation, Microsoft Corporation, Amazon Robotics, Boston Dynamics

Which segments covered the Predictive AI in Robotics Market?

Product Type (Predictive Maintenance Solutions, Autonomous Navigation Systems, Process Optimization Platforms, Human-Robot Collaboration Tools) Application Type (Industrial Automation, Healthcare Robotics, Logistics & Warehousing, Defense & Security, Consumer Robotics)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Predictive AI in Robotics Market

Published Date : 05 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date