Predictive Analytics in EdTech Market Size & 25.4% CAGR

Global Predictive Analytics in EdTech Market Size, Share & Digital Learning Insights By Solution Type, By Application (Student Performance, Retention, Curriculum Design), By End User (K-12, Higher Education, Corporate Training), Regional Adoption Trends, Key Vendors & Forecast 2025–2034

Report Overview

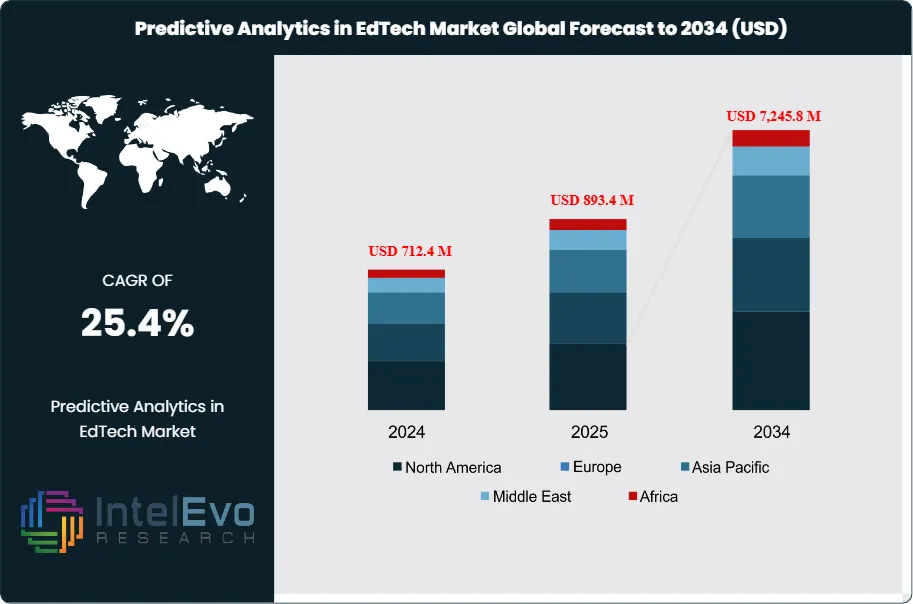

The Predictive Analytics in EdTech Market is estimated at USD 712.4 million in 2024 and is projected to reach approximately USD 7,245.8 million by 2034, registering a strong CAGR of about 25.4% during 2025–2034. This rapid expansion is driven by accelerating adoption of data-driven decision-making across K–12, higher education, and corporate learning platforms. Institutions are increasingly leveraging predictive analytics to personalize learning paths, improve student retention, and optimize academic outcomes. The integration of AI, machine learning, and real-time learning management system data is further transforming predictive analytics into a core component of next-generation digital education ecosystems.

Get More Information about this report -

Request Free Sample ReportThe sector has transitioned from early adoption to accelerated growth, fueled by the rapid expansion of digital learning environments and data-driven education models. Between 2019 and 2024, spending on education technology more than doubled as institutions moved toward hybrid and online learning. This created a robust foundation for analytics tools capable of turning student performance data into actionable insights.

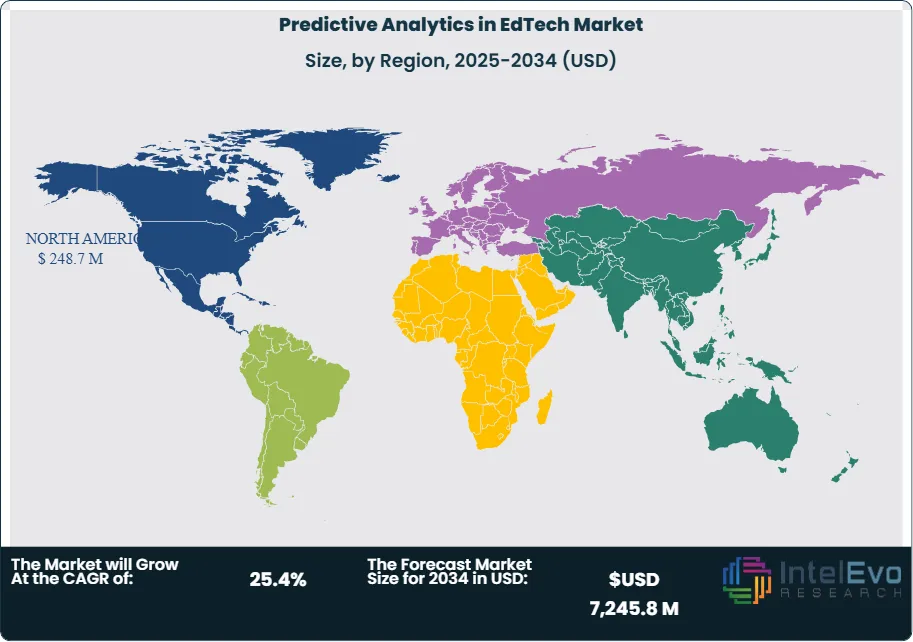

In 2024, North America accounted for over 34.8% of global revenues, led by major implementations across the United States and Canada. Europe followed with strong adoption in the United Kingdom and Germany, while Asia-Pacific is emerging as the fastest-growing region, supported by expanding enrollment in online universities and national digital education programs in India, China, and Southeast Asia. These markets are expected to present high-return opportunities for investors seeking early-stage growth potential.

The expansion of predictive analytics in education is largely demand-driven. Institutions seek to improve retention, forecast learner outcomes, and manage resources more efficiently. As educational data volumes increase—from learning management systems, adaptive platforms, and assessment tools—analytics solutions help administrators and instructors anticipate student needs. On the supply side, falling costs of cloud infrastructure and AI modeling have lowered adoption barriers, while policy support for digital transformation strengthens long-term market stability. However, unresolved challenges remain. Data privacy concerns and the uneven digital readiness of institutions continue to limit uptake in developing economies.

Technology is at the center of the market’s evolution. Machine learning models now enable real-time tracking of student engagement, while natural language processing improves grading accuracy and feedback efficiency. Automation is streamlining routine academic administration, freeing instructors to focus on pedagogy. The next growth phase will depend on integrating these tools into holistic decision-making frameworks—systems where educators, administrators, and technology providers use analytics collaboratively to deliver measurable learning gains. As predictive analytics become standard practice, the market’s growth trajectory points toward deeper institutional integration and sustainable long-term adoption across the global EdTech sector.

Key Takeaways

- Market Growth: The global Predictive Analytics in EdTech market is valued at USD 712.4 million in 2024 and is projected to reach approximately USD 7,245.8 million by 2034, growing at a compound annual rate of 25.4%. Growth is supported by increased adoption of data-driven learning tools and institutional demand for improved student retention and performance insights.

- Component: The Software segment holds the largest share, accounting for 67.4% of market revenue in 2024. This dominance is driven by widespread use of predictive learning platforms and AI-enabled analytics suites that integrate with existing education management systems.

- Deployment Model: The Cloud-Based segment leads with 58.2% of total adoption in 2024. Institutions are moving toward cloud infrastructure to reduce maintenance costs and enable real-time data processing for adaptive learning environments.

- Application: Student Performance Management represents the largest application area, capturing 47.3% of the market share in 2024. Schools and universities use predictive analytics to identify at-risk students, personalize learning paths, and boost completion rates.

- End Use: The Higher Education segment holds 26.2% of total market share in 2024, reflecting extensive adoption in universities focused on institutional efficiency and research-based performance analytics.

- Driver: Rising digital learning activity and expanding data volume from learning management systems are key growth drivers. Over 70% of higher education institutions now use analytics to inform student success strategies, supporting continued market expansion.

- Restraint: Data privacy and compliance regulations, particularly around student data protection, limit analytics deployment. Legal constraints under frameworks such as GDPR and FERPA raise implementation costs and slow adoption across regions with stricter standards.

- Opportunity: The Asia-Pacific region presents untapped growth potential with forecasted CAGRs exceeding 26% through 2034. Expanding e-learning adoption in India, China, and Southeast Asia positions the region as a priority target for foreign investment and analytics software providers.

- Trend: Integration of artificial intelligence and natural language processing is accelerating predictive accuracy and automated course feedback. Companies such as IBM Watson Education and Civitas Learning are advancing adaptive algorithms to support personalized instruction and institutional analytics.

- Regional Analysis: North America leads with 34.9% of global revenue in 2024, valued at USD 237 million. Europe shows strong policy-backed adoption, while Asia-Pacific is the fastest-growing region, driven by national digital education programs and rapid scaling of online learning platforms.

Component

As of 2025, software solutions maintain a commanding presence in the global Predictive Analytics in EdTech market, accounting for over 67% of total revenue. This dominance reflects the integral role of predictive analytics software in transforming educational data into measurable intelligence. Advanced software platforms now incorporate machine learning and artificial intelligence algorithms that can assess vast datasets in real time, guiding educators and administrators in identifying performance trends and improving operational efficiency. The market has evolved from basic analytics dashboards to fully integrated decision-making systems used across K-12, higher education, and corporate learning institutions.

The continued strength of the software segment is supported by rising adoption of cloud-based analytics platforms and modular learning management system (LMS) integrations. These systems enable scalability and interoperability, making them suitable for institutions handling complex data structures and large online student populations. Leading vendors such as IBM, Oracle, and Civitas Learning have expanded their focus on education-specific solutions that offer predictive capabilities for both learning outcomes and institutional performance. Service-based components are also gaining ground as institutions seek consulting and implementation support, but software remains the core driver of market expansion through 2034.

Application

Student Performance Management continues to represent the largest application area, contributing nearly half of the market’s total share in 2025. The focus on data-informed teaching is accelerating as institutions prioritize student retention, engagement, and personalized instruction. Analytics tools now identify early signs of academic risk using attendance records, submission patterns, and behavioral data. These insights enable intervention strategies that directly impact graduation rates and institutional rankings.

Curriculum Development and Resource Allocation are also expanding applications. Institutions are shifting toward predictive course planning, using analytics to forecast enrollment trends and design flexible curriculums aligned with market demand. Resource Allocation analytics allow universities to improve spending efficiency across staffing, digital tools, and physical infrastructure. Between 2025 and 2034, these applications are projected to grow at a CAGR exceeding 22%, driven by tighter education budgets and the need for performance accountability in both private and public education systems.

End-User

Higher Education remains the largest end-user segment, accounting for roughly 26% of total market share in 2025. Universities rely on predictive analytics to evaluate student outcomes, forecast enrollment, and anticipate academic risks. Competitive pressures are pushing institutions to adopt data-backed retention models, with large-scale implementations across North American and European universities. The segment’s sustained growth is supported by strong investments in digital infrastructure and analytics partnerships with major technology providers.

Corporate Training represents a fast-growing opportunity within the market. Organizations are using predictive analytics to measure training effectiveness and align learning programs with workforce performance targets. Platforms such as Coursera for Business and LinkedIn Learning are integrating predictive capabilities to customize learning pathways and track skills progression. K–12 and online learning platforms also continue to benefit as governments and private operators invest in adaptive learning models, enabling individualized content delivery for millions of remote learners worldwide.

Regional

North America maintains its leadership position in 2025, representing approximately 34.8% of global market share and generating an estimated USD 270 million in revenue. This dominance stems from strong institutional adoption, high data literacy, and advanced education technology infrastructure. U.S. universities and school districts are expanding predictive analytics programs to enhance performance accountability and evidence-based policy development. Canada continues to report high adoption of AI-backed learning analytics, supported by provincial funding for digital transformation in education.

Europe follows as the second major region, with the United Kingdom, Germany, and the Nordics leading through government investments in education analytics and digital assessment systems. The Asia Pacific region, however, is poised for the highest growth, projected to record a CAGR above 26% through 2034. Countries including India, China, and South Korea are investing heavily in national e-learning frameworks that prioritize analytics integration. Meanwhile, Latin America and the Middle East & Africa are emerging as key expansion zones as online education and cloud connectivity improve. Growing awareness of personalized learning and performance-based metrics in these regions will continue to create strong commercial opportunities for EdTech analytics providers over the next decade.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Student Performance Management

- Curriculum Development

- Resource Allocation

- Others

By End-User

- K-12 Education

- Higher Education

- Corporate Training

- Online Learning Platforms

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 712.4 M |

| Forecast Revenue (2034) | USD 7,245.8 M |

| CAGR (2024-2034) | 25.4% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premises), By Application (Student Performance Management, Curriculum Development, Resource Allocation, Others), By End-User (K-12 Education, Higher Education, Corporate Training, Online Learning Platforms) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Oracle Corporation, Instructure, Inc., SAS Institute Inc., IBM Corporation, Blackboard Inc., Salesforce, Google LLC, D2L Corporation, Microsoft Corporation, Other Major Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Predictive Analytics in EdTech Market

Published Date : 24 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date