Predictive Maintenance in Maritime Market size by 2034 | 21.3% CAGR

Global Predictive Maintenance in Maritime Market Size, Share, Analysis Report Application (Communication Systems, Engine & Propulsion System Maintenance - leads, Cargo Handling Systems, Power Generation and Electrical Systems, Navigation Systems, Others)End-User (Port and Harbour Operations, Commercial Shipping - leads, Naval Defense, Oil & Gas)Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

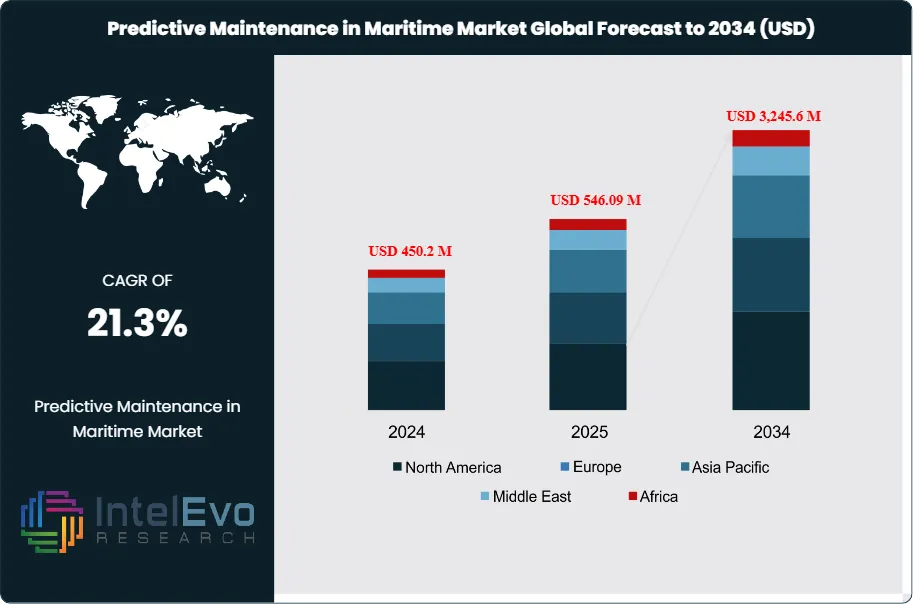

The Predictive Maintenance in Maritime Market size is projected to reach approximately USD 3,245.6 Million by 2034, up from USD 450.2 Million in 2024, growing at a CAGR of 21.3% during the forecast period from 2025 to 2034. The strong growth is fueled by the rising integration of AI, IoT, and real-time analytics in vessel maintenance operations, enabling ship operators to detect potential failures before they occur. With the maritime sector facing increasing pressure for operational efficiency, safety, and reduced downtime, predictive maintenance solutions are becoming indispensable. As global trade expands and smart port initiatives accelerate, the adoption of predictive maintenance technologies is expected to transform fleet management — steering the maritime industry toward a more data-driven and sustainable future.

Get More Information about this report -

Request Free Sample ReportPredictive maintenance in the maritime sector is an advanced approach utilizing data analytics, IoT sensors, machine learning, and remote monitoring to anticipate equipment failures before they occur. This strategy is widely implemented across communication systems, engine and propulsion maintenance, cargo handling systems, navigation systems, and power generation units. The market is primarily driven by the increasing demand for operational efficiency, reduced downtime, and improved safety standards. Factors such as the rising complexity of shipboard systems and the stringent regulations regarding emissions and safety are also pushing maritime operators to adopt predictive maintenance solutions.

The adoption of predictive maintenance in the maritime industry is further influenced by cost-saving imperatives and the need for real-time insights into vessel performance. Technological advancements, such as AI-based diagnostics and cloud-connected platforms, are fueling the growth of intelligent maintenance frameworks. Additionally, digital transformation initiatives among fleet operators, especially in commercial shipping and port operations, are accelerating the deployment of predictive maintenance platforms. However, factors such as cybersecurity concerns, high implementation costs, and integration complexity pose challenges to widespread adoption.

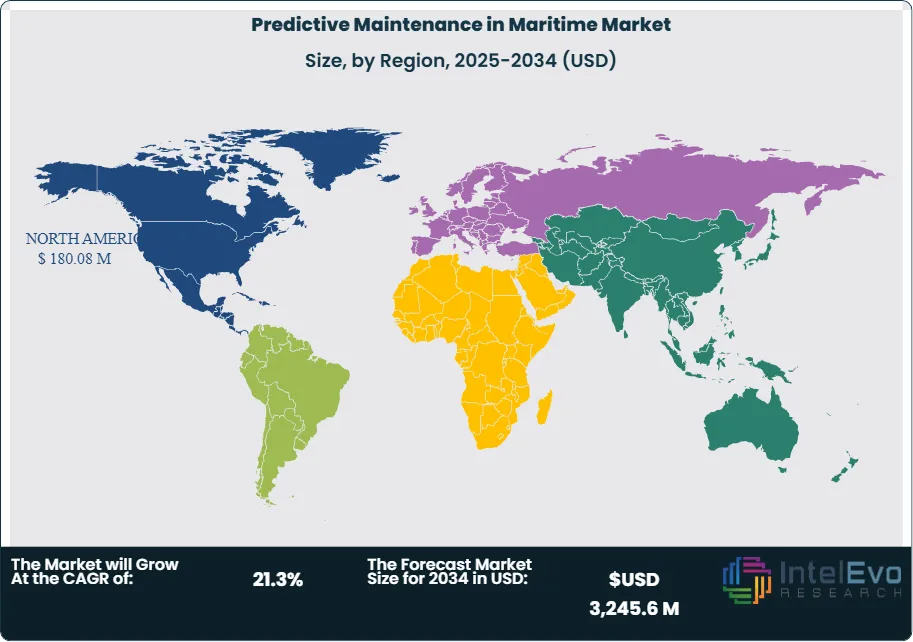

North America currently leads the global predictive maintenance in maritime market, owing to the presence of major technology providers, significant investments in port digitization, and advanced regulatory frameworks supporting innovation. Europe follows closely, benefiting from robust naval defense modernization and commercial shipping activity. The Asia-Pacific region is expected to witness strong growth driven by expanding commercial fleets and rising seaborne trade across China, Japan, and South Korea.

The COVID-19 pandemic created short-term disruptions in maritime operations due to port closures, labor shortages, and supply chain bottlenecks. However, it accelerated the shift toward digital solutions as operators sought to minimize on-site maintenance and ensure operational continuity through remote diagnostics and predictive analytics. This shift resulted in increased investment in IoT-enabled maintenance platforms and AI-driven monitoring tools to enhance asset reliability in uncertain conditions.

Key Takeaways

- Market Growth: The Predictive Maintenance in Maritime Market is expected to reach USD 3,245.6 Million by 2034, supported by technological innovation, rising awareness of asset optimization, and regulatory push for sustainable operations. Vendors are focusing on tailored solutions to address different maritime segments.

- Application Dominance: Engine and propulsion system maintenance accounts for the largest share due to the critical nature of propulsion reliability and the high costs of unplanned failures. Operators increasingly deploy advanced analytics to optimize engine performance and fuel efficiency.

- End-User Dominance: Commercial shipping leads end-user adoption, with fleet operators embracing predictive maintenance to cut operational costs, improve scheduling, and comply with international safety standards. The segment benefits from the scaling of large commercial fleets.

- Driver: The need to reduce unplanned downtime and extend the lifecycle of high-value assets is a key market driver, compelling operators to integrate predictive capabilities with maintenance workflows.

- Restraint: High upfront investment and integration complexity with legacy systems act as significant barriers, particularly for smaller operators and older vessels.

- Opportunity: The growing focus on green shipping and fuel optimization presents an opportunity to integrate predictive maintenance with emissions monitoring and efficiency improvements.

- Trend: AI-powered remote diagnostics and digital twins are emerging trends, allowing operators to simulate equipment behavior and proactively address potential issues.

- Regional Analysis: North America dominates the market due to technology leadership and regulatory support, while Asia-Pacific shows high potential growth as regional fleets expand and ports modernize operations.

Application Analysis:

Engine and propulsion system maintenance holds the largest market share because the propulsion system is the heart of maritime operations. Any failure or degradation can lead to costly downtime, regulatory fines, or catastrophic accidents. Predictive maintenance solutions in this segment involve integrating vibration analysis, thermography, oil condition monitoring, and AI-based pattern recognition to forecast engine wear, detect anomalies, and schedule proactive interventions. The adoption of these systems is growing in commercial shipping, naval fleets, and offshore vessels as operators strive to improve fuel efficiency, meet emissions regulations, and avoid unscheduled repairs that disrupt shipping schedules. The segment also benefits from strong investments by engine manufacturers in digital twins and cloud analytics platforms.

End-User Analysis:

Commercial Shipping Leads With over 50% Market Share In Predictive Maintenance in Maritime Market. Commercial shipping represents the most significant end-user segment in predictive maintenance adoption. With thousands of vessels operating globally under tight delivery timelines, shipping companies face enormous operational and maintenance costs. Predictive maintenance allows these operators to reduce unexpected failures, optimize maintenance intervals, and extend asset life. Technologies such as IoT sensors, cloud platforms, and fleet-wide analytics enable centralized monitoring and predictive modeling. Commercial shipping companies are also under pressure to comply with IMO regulations on emissions and safety, further driving the need for predictive maintenance solutions. As global trade rebounds, this segment will continue to adopt intelligent maintenance frameworks to maintain competitiveness and profitability.

Region Analysis:

North America Leads With nearly 40% Market Share In Predictive Maintenance in Maritime Market. North America leads the global predictive maintenance in maritime market, commanding a significant market share due to its advanced maritime infrastructure, technological leadership, and early adoption of digital transformation initiatives. The region benefits from a robust ecosystem of technology providers, research institutions, and maritime operators that collaborate to develop and implement cutting-edge predictive maintenance solutions. The United States, in particular, has established itself as a hub for maritime technology innovation, with numerous startups and established companies developing specialized solutions for predictive maintenance applications.

Europe represents a substantial market for predictive maintenance in maritime operations, driven by stringent regulatory frameworks, environmental compliance requirements, and a strong emphasis on maritime safety. The European Union's maritime regulations and environmental directives create a favorable environment for predictive maintenance adoption, as operators seek technologies that can help them comply with increasingly strict requirements while maintaining operational efficiency. Countries such as Norway, Germany, and the Netherlands have emerged as leaders in maritime technology development, with significant investments in research and development of predictive maintenance solutions.

The Asia-Pacific region is experiencing the fastest growth in the predictive maintenance in maritime market, fueled by rapid expansion of maritime activities, increasing port development projects, and growing awareness of predictive maintenance benefits. Countries such as China, Japan, South Korea, and Singapore are investing heavily in maritime infrastructure and technology development, creating significant opportunities for predictive maintenance solutions. The region's large shipbuilding industry and expanding commercial shipping operations are driving demand for advanced maintenance technologies. Engine and Propulsion System Maintenance is expected to see the highest growth in the Asia-Pacific region, as operators seek to optimize the performance of new vessels and extend the lifecycle of existing fleets.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Component

- Hardware (Sensors, IoT Devices, Communication Modules)

- Software (Analytics Platforms, AI Algorithms, Maintenance Systems)

- Services (Consulting, Integration, Maintenance Support)

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

By Application

- Fleet Management

- Engine and Machinery Monitoring

- Hull and Propeller Efficiency

- Cargo and Container Monitoring

- Navigation and Communication Systems

- Others

By End User

- Commercial Shipping Operators

- Naval and Defense Vessels

- Offshore Oil & Gas Vessels

- Passenger and Cruise Lines

- Port Authorities

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 546.09 M |

| Forecast Revenue (2034) | USD 3,245.6 M |

| CAGR (2025-2034) | 21.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Hardware (Sensors, IoT Devices, Communication Modules), Software (Analytics Platforms, AI Algorithms, Maintenance Systems), Services (Consulting, Integration, Maintenance Support)), By Deployment Mode (On-Premises, Cloud-Based, Hybrid), By Application (Fleet Management, Engine and Machinery Monitoring, Hull and Propeller Efficiency, Cargo and Container Monitoring, Navigation and Communication Systems, Others), By End User (Commercial Shipping Operators, Naval and Defense Vessels, Offshore Oil & Gas Vessels, Passenger and Cruise Lines, Port Authorities) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Siemens AG, Emerson Electric Co., General Electric (GE), Trimble Inc., Honeywell International Inc., Caterpillar Inc., ABB Ltd., Schneider Electric, Kongsberg Gruppen, DNV GL |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Predictive Maintenance in Maritime Market

Published Date : 09 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date