Predictive & Personalized Medicine Market Size | 9.4% CAGR

Global Predictive & Personalized Medicine Market Size, Share & Analysis By Product (Personalized Medicine Therapeutics, Personalized Medicine Diagnostics, Personalized Medical Care, Personalized Nutrition & Wellness), By Application (Oncology, Infectious disease, Neurology or Psychiatry, Cardiovascular), By End-User (Diagnostic Centers, Hospitals & Clinics) Industry Regions & Key Players – Precision Healthcare Trends, Clinical Outcomes & Forecast 2025–2034

Report Overview

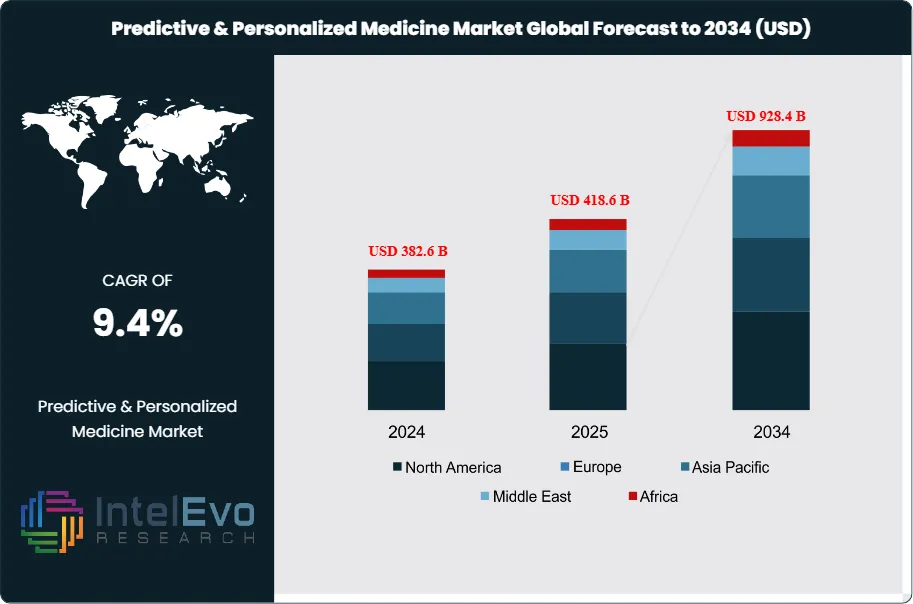

The Predictive & Personalized Medicine Market is valued at approximately USD 382.6 billion in 2024 and is projected to reach nearly USD 928.4 billion by 2034, growing at a strong CAGR of about 9.4% from 2025–2034. This expansion is fueled by rapid adoption of genomic profiling, AI-driven diagnostics, liquid biopsies, and targeted therapeutics across global healthcare systems. As hospitals shift from reactive treatment to precision-based prevention, demand for personalized care pathways is rising sharply. With biopharma companies accelerating investments in biomarker-based drug development and governments supporting national genomics programs, the sector is gaining massive visibility across healthcare, biotech, and innovation platforms.

Get More Information about this report -

Request Free Sample ReportThis growth trajectory reflects a fundamental transformation in healthcare delivery, driven by the increasing adoption of tailored therapeutic approaches that integrate genomics, data analytics, and precision diagnostics. Over the past decade, personalized medicine has moved from concept to practice, with a marked acceleration in the deployment of genomic profiling tools, companion diagnostics, and patient-specific therapies. In particular, oncology, neurology, and rare disease treatments have witnessed significant breakthroughs powered by predictive analytics and individualized intervention models.

Key drivers fueling this market expansion include rising patient demand for more accurate, efficient, and minimally invasive treatments, coupled with an upsurge in chronic disease prevalence globally. On the supply side, advancements in next-generation sequencing (NGS), biomarker discovery, and bioinformatics are enabling more refined patient stratification and faster drug development cycles. Furthermore, healthcare systems are increasingly embracing value-based care, wherein personalized medicine plays a pivotal role in improving clinical outcomes and reducing long-term treatment costs.

Nonetheless, market growth faces notable challenges, such as high implementation costs, regulatory complexities, and data privacy concerns. Ensuring interoperability among healthcare platforms and securing patient genomic data remain critical hurdles for widespread adoption. In addition, disparities in access across emerging economies may limit the global scalability of personalized medical interventions.

Technological innovations continue to reshape the landscape, particularly through AI-driven diagnostic platforms, machine learning-based risk prediction models, and CRISPR gene-editing technologies. These tools are enhancing early disease detection, therapy customization, and real-time treatment monitoring, positioning predictive and personalized medicine as a cornerstone of next-generation healthcare.

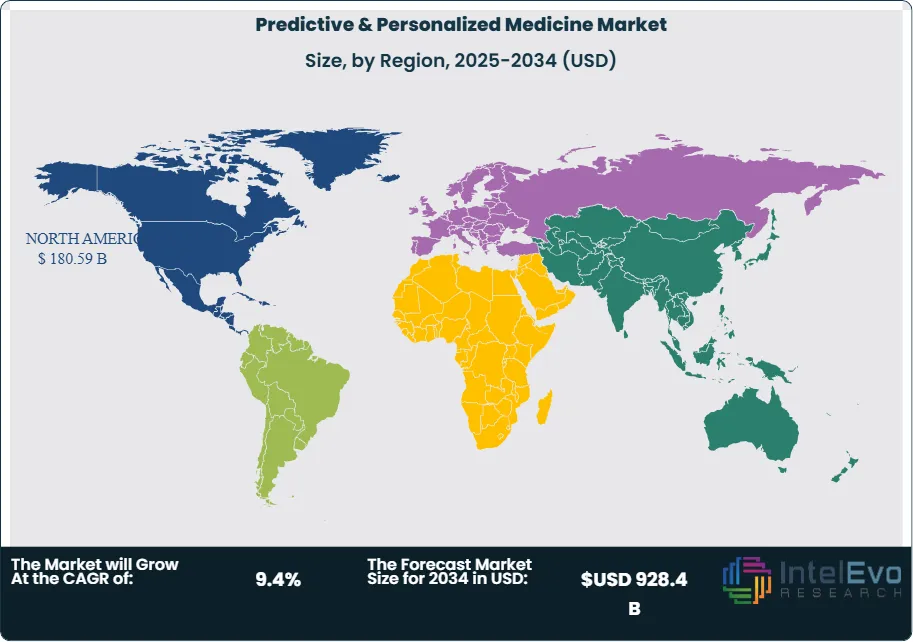

Regionally, North America dominates the market due to its robust R&D infrastructure, favorable reimbursement frameworks, and strong presence of biopharmaceutical giants. Europe follows closely, while Asia-Pacific emerges as the fastest-growing region, propelled by increasing healthcare investments in China, India, and Japan. Investors are closely watching biotechnology hubs, academic-industry collaborations, and digital health startups that promise scalable, cost-efficient personalized care solutions.

Key Takeaways

- Market Growth: The global Predictive & Personalized Medicine market was valued at USD 382.6 billion in 2024 and is projected to reach USD 928.4 billion by 2034, expanding at a CAGR of 9.4% driven by rising demand for precision diagnostics and individualized therapies.

- Product Type: The personalized nutrition & wellness segment captured the largest share in 2023, supported by strong consumer adoption of DNA-based diet planning, wearable health monitoring, and lifestyle-driven preventive healthcare solutions.

- Application: Oncology accounted for the leading application segment, propelled by the widespread use of genomic profiling and companion diagnostics in cancer treatment, with personalized oncology therapies representing one of the fastest-growing therapeutic areas.

- End Use: Hospitals & clinics generated the highest revenue share, owing to high procedural volumes, integration of genomic testing into routine care, and expanding use of AI-driven diagnostic tools in clinical workflows.

- Driver: Rapid advances in next-generation sequencing (NGS) and biomarker discovery have significantly reduced turnaround times and costs, enabling faster drug development cycles and more refined patient stratification.

- Restraint: High implementation costs and data privacy concerns remain barriers to adoption, particularly in emerging markets where healthcare infrastructure and regulatory frameworks are less developed.

- Opportunity: The Asia-Pacific region is the fastest-growing market, with healthcare investments in China, India, and Japan projected to accelerate adoption, positioning the region for double-digit CAGR growth through 2032.

- Trend: Integration of AI-powered diagnostics, machine learning-based risk prediction models, and CRISPR gene-editing technologies is reshaping personalized medicine, with leading biopharma players forming cross-sector partnerships to scale innovation.

- Regional Analysis: North America led the market with a 47.2% share in 2022, supported by strong R&D infrastructure and reimbursement policies, while Europe follows closely. Asia-Pacific is emerging as the fastest-growing region, driven by biotechnology hubs and digital health adoption.

Type Analysis

The personalized nutrition & wellness segment continues to command the largest share of the predictive and personalized medicine market as of 2025. Growing consumer demand for lifestyle-focused interventions, combined with advances in genomics and digital health monitoring, has positioned this category as a key revenue driver. DNA-based diet plans, microbiome analysis, and wearable-enabled health tracking are increasingly being integrated into mainstream healthcare and preventive medicine, creating strong market momentum.

Looking forward, personalized medicine therapeutics is expected to capture an expanding proportion of overall market revenues. The segment is benefiting from significant advancements in targeted cancer treatments, immunotherapies, and companion diagnostics. Regulatory approvals such as the FDA’s clearance of Gallium 68 PSMA-11 for prostate cancer PET imaging highlight the sector’s rapid progress. With major pharmaceutical players investing heavily in biomarker-driven drug development and precision oncology pipelines, therapeutics are projected to lead the market in value generation over the next decade.

Application Analysis

Oncology remains the dominant application area, accounting for the highest share of market revenues in 2025. The global burden of cancer, coupled with a surge in genomic profiling, liquid biopsy adoption, and nuclear medicine imaging, is fueling demand. Oncology-related diagnostic procedures, particularly PET and molecular imaging, represent some of the most frequently performed personalized medicine applications worldwide.

Beyond oncology, applications in infectious diseases, neurology, and cardiovascular care are gaining traction. The COVID-19 pandemic accelerated adoption of personalized diagnostic tools, particularly in infectious disease management, while neurology and psychiatry are seeing increased focus on predictive analytics for conditions such as Alzheimer’s and depression. A strong pipeline of targeted therapies and companion diagnostics across multiple disease areas is expected to diversify application demand and reduce the historical dominance of oncology over the long term.

End-Use Analysis

Hospitals and clinics are projected to remain the largest end-use segment, supported by their role in managing high procedural volumes, integrating genomic sequencing into patient care, and adopting AI-powered diagnostic systems. With healthcare providers shifting toward value-based care models, hospitals are increasingly embedding precision medicine into treatment pathways, improving both patient outcomes and cost efficiency.

Diagnostic centers are expected to record the fastest CAGR through 2032. Growth is being fueled by the rapid expansion of imaging and molecular diagnostic facilities, particularly in Europe and Asia-Pacific. The surge in outpatient testing, coupled with advancements in NGS-based diagnostics, has made diagnostic centers pivotal to the scaling of personalized medicine. As payers and health systems push for cost-effective diagnostic solutions, specialized diagnostic providers are expected to gain strategic importance in the market ecosystem.

Regional Analysis

North America leads the global market, holding nearly half of total revenues in 2025, driven by robust R&D infrastructure, favorable reimbursement policies, and strong penetration of personalized oncology therapies. The United States in particular benefits from a mature biopharmaceutical ecosystem and extensive clinical adoption of predictive diagnostics. Strategic collaborations between industry and academic institutions further reinforce the region’s leadership.

Europe follows as the second-largest market, supported by strong regulatory frameworks for companion diagnostics and growing investments in genomic research across Germany, the U.K., and France. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, with healthcare investments in China, India, and Japan accelerating adoption of personalized medicine technologies. Government initiatives in genomics, rising prevalence of chronic diseases, and the scaling of biotechnology hubs are positioning the region for double-digit CAGR growth through 2032.

In contrast, Latin America and the Middle East & Africa present gradual but steady adoption opportunities. While high treatment costs and limited infrastructure remain barriers, increasing private investment in diagnostic capabilities and expanding access to advanced therapeutics are expected to drive incremental growth in these emerging markets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product

- Personalized Medicine Therapeutics

- Personalized Medicine Diagnostics

- Personalized Medical Care

- Personalized Nutrition & Wellness

By Application

- Oncology

- Infectious disease

- Neurology or Psychiatry

- Cardiovascular

- Other Applications

By End-User

- Diagnostic Centers

- Hospitals & Clinics

- Other End-Users

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 382.6 B |

| Forecast Revenue (2034) | USD 928.4 B |

| CAGR (2024-2034) | 9.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Personalized Medicine Therapeutics, Personalized Medicine Diagnostics, Personalized Medical Care, Personalized Nutrition & Wellness), By Application (Oncology, Infectious disease, Neurology or Psychiatry, Cardiovascular, Other Applications), By End-User (Diagnostic Centers, Hospitals & Clinics, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Illumina, Inc., Abbott, QIAGEN, Decode Genetics, Inc., GE Healthcare, Danaher Corporation, Exact Sciences Corporation, ASURAGEN, INC., Dako A/S, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Predictive & Personalized Medicine Market

Published Date : 04 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date