Prepared Flour Mixes Market to Hit $41.2 Bn by 2034 | CAGR of 6.3%

Global Prepared Flour Mixes Market Size, Share, Analysis Report By Product Type (Bread Mixes, Cake Mixes, Pancake & Waffle Mixes, Batter Mixes, Gluten-Free & Specialty Mixes) End-Use (Foodservice, Retail/Home Baking) Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Convenience Stores, Foodservice Distributors) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

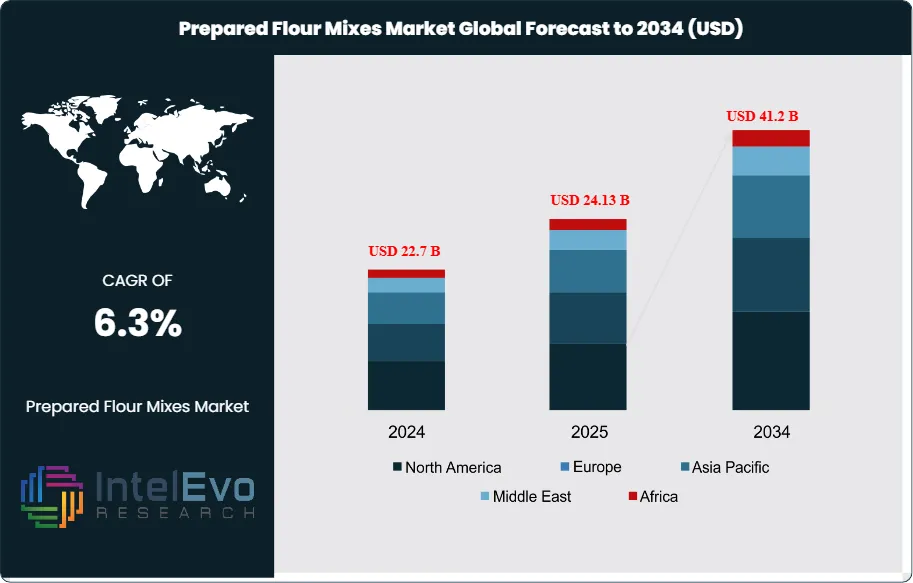

The Global Prepared Flour Mixes Market size is expected to be worth around USD 41.2 Billion by 2034, up from USD 22.7 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2024 to 2034. The prepared flour mixes market encompasses a wide range of pre-formulated dry blends used in the baking and foodservice industries, including cake mixes, bread mixes, pancake mixes, batter mixes, and specialty blends for gluten-free and health-oriented products.

Get More Information about this report -

Request Free Sample ReportThis market represents a vital segment within the global food ingredients industry, serving both commercial and household consumers seeking convenience, consistency, and quality in baked goods and ready-to-cook products. Prepared flour mixes are engineered to deliver reliable results, reduce preparation time, and minimize the need for specialized baking skills, making them indispensable for bakeries, restaurants, hotels, and home kitchens worldwide.

The prepared flour mixes market is experiencing robust growth driven by evolving consumer lifestyles, the rising demand for convenience foods, and the increasing popularity of home baking. Key growth catalysts include the expansion of the foodservice sector, the proliferation of quick-service restaurants (QSRs), and the growing trend of “bake-at-home” experiences, especially post-pandemic. The market benefits from ongoing product innovation, such as the introduction of gluten-free, organic, and fortified mixes that cater to health-conscious and specialty diet consumers. Additionally, the integration of clean label ingredients, natural flavors, and functional additives is creating substantial demand for premium and differentiated flour mix products.

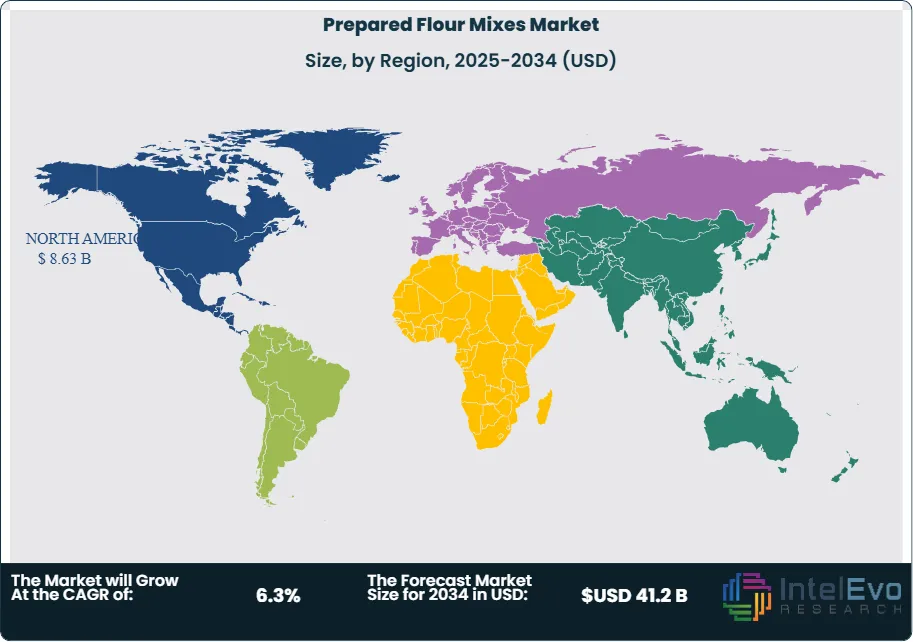

North America and Europe dominate the global prepared flour mixes market, with leadership positions stemming from high per capita consumption of baked goods, advanced food processing infrastructure, and a strong presence of leading bakery chains and foodservice operators. Asia-Pacific represents the fastest-growing regional market, driven by rapid urbanization, rising disposable incomes, and the westernization of dietary habits, which are fueling demand for convenient and high-quality bakery products.

The COVID-19 pandemic fundamentally accelerated the adoption of prepared flour mixes as consumers faced lockdowns, supply chain disruptions, and a renewed interest in home cooking and baking. The crisis created urgent demand for shelf-stable, easy-to-use products that enabled consumers to replicate bakery-quality results at home. While initial supply chain challenges temporarily constrained availability, the long-term impact has been overwhelmingly positive, with manufacturers expanding production capacity, diversifying product portfolios, and investing in e-commerce and direct-to-consumer channels.

Rising health awareness, dietary restrictions, and the demand for clean label and allergen-free products have significantly influenced prepared flour mix innovation, creating opportunities for manufacturers to develop new blends that address evolving consumer preferences. The market is also witnessing increased demand for premium, artisanal, and regionally inspired mixes that offer unique flavors and textures, reflecting the growing sophistication of global consumers.

Key Takeaways

- Market Growth: The Prepared Flour Mixes Market is expected to reach USD 41.2 Billion by 2034, fueled by the convenience food trend, home baking boom, and ongoing product innovation.

- Product Type Dominance: Bread mixes and cake mixes lead market share due to their widespread use in both commercial and household baking.

- End-Use Dominance: The foodservice sector, including bakeries, QSRs, and hotels, dominates demand, but the retail/home baking segment is growing rapidly.

- Distribution Channel Dominance: Supermarkets and hypermarkets remain the primary distribution channels, but online retail is experiencing the fastest growth.

- Driver: Key drivers accelerating growth include the demand for convenience, the rise of specialty diets (gluten-free, organic), and the expansion of the foodservice industry.

- Restraint: Growth is hindered by supply chain volatility, fluctuating raw material prices, and increasing competition from scratch baking and artisanal products.

- Opportunity: The market is poised for expansion due to opportunities like clean label innovation, emerging market penetration, and the development of fortified and functional flour mixes.

- Trend: Emerging trends including plant-based, high-protein, and allergen-free mixes are reshaping the market by enabling new product launches and catering to health-conscious consumers.

- Regional Analysis: North America and Europe lead owing to high bakery consumption and advanced infrastructure. Asia-Pacific shows high promise due to rapid urbanization and changing dietary habits.

Product Type Analysis

Bread Mixes and Cake Mixes Lead With Over 60% Market Share in the Prepared Flour Mixes Market. Bread mixes and cake mixes remain the cornerstone of the prepared flour mixes market. These products are widely used in commercial bakeries, foodservice outlets, and home kitchens for their convenience, consistency, and ability to deliver high-quality results with minimal effort. Bread mixes, including white, whole wheat, multigrain, and specialty blends, are essential for producing a variety of loaves, rolls, and artisan breads. Cake mixes, available in flavors such as chocolate, vanilla, and red velvet, enable the quick preparation of cakes, cupcakes, and muffins.

The segment’s leadership is reinforced by several factors. Firstly, the growing demand for fresh, high-quality baked goods in both retail and foodservice channels drives consistent usage of bread and cake mixes. Secondly, the rise of home baking, fueled by social media trends and the desire for homemade treats, has expanded the consumer base for these products. Thirdly, ongoing innovation in gluten-free, organic, and fortified mixes is attracting health-conscious and specialty diet consumers.

However, the segment is not without constraints. The increasing popularity of scratch baking, artisanal products, and “clean label” offerings has led to greater competition and the need for manufacturers to differentiate their products through quality, flavor, and nutritional value. Nevertheless, growth prospects remain strong, with the proliferation of premium, regionally inspired, and functional bread and cake mixes demonstrating continued diversification and innovation within the category.

End-Use Analysis

Foodservice Sector Dominates, But Home Baking Is Rising: The foodservice sector—including commercial bakeries, QSRs, hotels, and restaurants—remains the largest end-user of prepared flour mixes, accounting for a significant share of global demand. These establishments rely on prepared mixes to ensure product consistency, reduce labor costs, and streamline operations. The ability to produce large volumes of baked goods with uniform quality is critical for foodservice operators, making prepared flour mixes an indispensable ingredient.

The retail/home baking segment is experiencing rapid growth, driven by the increasing popularity of home baking, the influence of cooking shows and social media, and the desire for convenient, high-quality products. The COVID-19 pandemic accelerated this trend, with consumers seeking comfort, creativity, and self-sufficiency through baking. Manufacturers have responded by launching a wide range of retail-ready mixes, including single-serve, premium, and specialty options that cater to diverse consumer preferences.

Distribution Channel Analysis

Supermarkets and Hypermarkets Lead, Online Retail Surges: Supermarkets and hypermarkets remain the primary distribution channels for prepared flour mixes, offering consumers a wide selection of brands, flavors, and formats. These outlets benefit from high foot traffic, established supply chains, and the ability to promote new products through in-store displays and promotions.

Online retail is the fastest-growing channel, driven by the rise of e-commerce, direct-to-consumer (DTC) brands, and the convenience of home delivery. The pandemic accelerated online grocery shopping, with consumers increasingly purchasing flour mixes and other baking ingredients through digital platforms. Manufacturers are investing in e-commerce capabilities, subscription services, and digital marketing to capture this growing segment.

Specialty stores, convenience stores, and foodservice distributors also play important roles in the distribution of prepared flour mixes, particularly for premium, artisanal, and regionally inspired products.

Region Analysis

North America and Europe Lead, Asia-Pacific Is Fastest-Growing: North America and Europe dominate the global prepared flour mixes market, accounting for a combined market share of over 60% in 2024. These regions benefit from high per capita consumption of baked goods, advanced food processing infrastructure, and a strong presence of leading bakery chains and foodservice operators. The United States, Canada, Germany, France, and the United Kingdom are key markets, with consumers exhibiting strong preferences for convenience, quality, and variety in baked products.

Asia-Pacific is the fastest-growing region, propelled by rapid urbanization, rising disposable incomes, and the westernization of dietary habits. Countries such as China, India, Japan, and Australia are witnessing significant market expansion, driven by the growth of the foodservice sector, increasing home baking activity, and the introduction of innovative, locally inspired flour mixes. The region’s young, tech-savvy population and growing middle class represent substantial growth opportunities for manufacturers.

Latin America and the Middle East & Africa are emerging markets, with growing demand for convenient, affordable, and high-quality bakery products. Investments in local production, distribution networks, and marketing are unlocking new opportunities for prepared flour mix brands.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Bread Mixes

- Cake Mixes

- Pancake & Waffle Mixes

- Batter Mixes

- Gluten-Free & Specialty Mixes

- Others

End-Use

- Foodservice (Bakeries, QSRs, Hotels, Restaurants)

- Retail/Home Baking

Distribution Channel

- Supermarkets & Hypermarkets

- Online Retail

- Specialty Stores

- Convenience Stores

- Foodservice Distributors

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 24.13 B |

| Forecast Revenue (2034) | USD 41.2 B |

| CAGR (2025-2034) | 6.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Bread Mixes, Cake Mixes, Pancake & Waffle Mixes, Batter Mixes, Gluten-Free & Specialty Mixes, Others) End-Use (Foodservice (Bakeries, QSRs, Hotels, Restaurants), Retail/Home Baking) Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Convenience Stores, Foodservice Distributors) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | General Mills Inc., Pinnacle Foods Inc. (Conagra Brands), Kerry Group plc, Cargill, Incorporated, Nisshin Seifun Group Inc., Yihai Kerry Arawana Holdings Co., Ltd., GrainCorp Limited, AB Mauri (Associated British Foods), Lesaffre Group, Ardent Mills, ADM (Archer Daniels Midland Company), Raisio plc, Hodgson Mill, Chelsea Milling Company (Jiffy Mixes), Ulrick & Short Ltd, Bunge Limited, Interflour Group, Bakers Authority, Swiss Bake Ingredients Pvt. Ltd., Bob’s Red Mill Natural Foods |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Prepared Flour Mixes Market?

Global Prepared Flour Mixes Market set to grow at 6.3% CAGR, from USD 22.7 Bn in 2024 to USD 41.2 Bn by 2034. Explore trends, insights & growth factors.

Who are the major players in the Prepared Flour Mixes Market?

General Mills Inc., Pinnacle Foods Inc. (Conagra Brands), Kerry Group plc, Cargill, Incorporated, Nisshin Seifun Group Inc., Yihai Kerry Arawana Holdings Co., Ltd., GrainCorp Limited, AB Mauri (Associated British Foods), Lesaffre Group, Ardent Mills, ADM (Archer Daniels Midland Company), Raisio plc, Hodgson Mill, Chelsea Milling Company (Jiffy Mixes), Ulrick & Short Ltd, Bunge Limited, Interflour Group, Bakers Authority, Swiss Bake Ingredients Pvt. Ltd., Bob’s Red Mill Natural Foods

Which segments covered the Prepared Flour Mixes Market?

Product Type (Bread Mixes, Cake Mixes, Pancake & Waffle Mixes, Batter Mixes, Gluten-Free & Specialty Mixes, Others) End-Use (Foodservice (Bakeries, QSRs, Hotels, Restaurants), Retail/Home Baking) Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Convenience Stores, Foodservice Distributors)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date