Pressure Sensitive Adhesives Market Size & Forecast 2034 | 4.4% CAGR

Global Pressure Sensitive Adhesives Market Size, Share, Analysis Report By Chemistry (Silicone, Acrylic, Rubber), Technology (Hot Melt, Water-based, Radiation-Cured, Solvent-based), Application (Labels, Graphics, Tapes), End-Use (Automotive and Transportation, Medical and Healthcare, Electronics, Consumer Goods, Building and Construction, Packaging), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

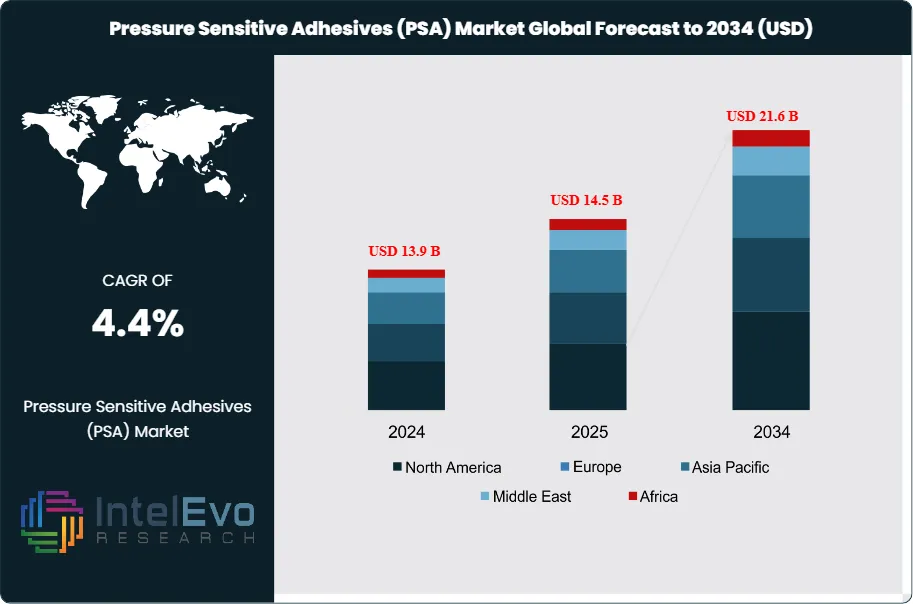

The Pressure Sensitive Adhesives (PSA) Market size is projected to reach approximately USD 21.6 Billion by 2034, up from USD 13.9 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034. This growth is driven by the increasing demand for lightweight bonding solutions, eco-friendly adhesive formulations, and high-performance tapes and labels across industries such as automotive, electronics, packaging, and construction. The market is also witnessing strong R&D investments toward bio-based and solvent-free PSA technologies, aligning with global sustainability trends. With expanding applications in medical devices and electric vehicles (EVs), the PSA market is set to play a crucial role in the future of industrial manufacturing and smart materials innovation.

Get More Information about this report -

Request Free Sample ReportPressure Sensitive Adhesives (PSAs) are a class of adhesives that form a bond when light pressure is applied to marry the adhesive with the adherend. They do not require water, solvent, or heat activation to exert a strong holding force on various substrates. PSAs are widely used in applications such as labels, tapes, graphics, and protective films across industries including packaging, automotive, electronics, healthcare, and construction.

The rise in e-commerce and demand for convenient packaging solutions have propelled the use of PSAs due to their quick bonding and ease of application. In the automotive sector, PSAs are used for bonding trims, emblems, and insulation materials, contributing to vehicle light weighting efforts. Similarly, the electronics industry employs PSAs for assembling components, providing insulation, and bonding displays. The growing emphasis on sustainability has led to the development of bio-based PSAs derived from renewable resources like starch, soy, and vegetable oils. These adhesives offer comparable performance to traditional PSAs while reducing environmental impact. Advancements in PSA technology, such as the development of nanotechnology-based functional PSAs and UV-curable adhesives, are expanding the application scope of PSAs.

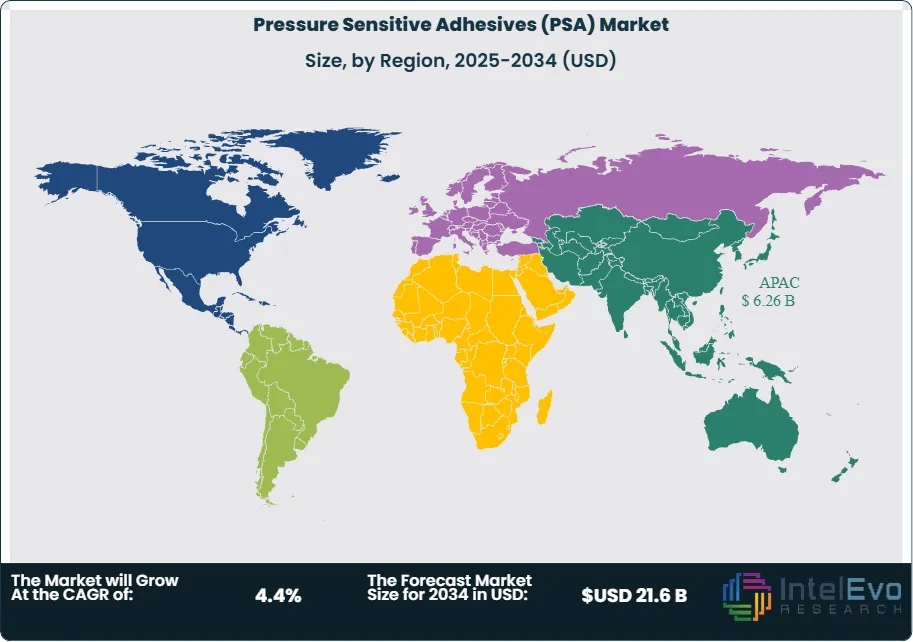

The Asia-Pacific region leads the global PSA market, accounting for the largest share due to its robust industrial base, rapid urbanization, and growing demand in packaging, automotive, and electronics sectors. Countries like China and India are significant contributors, with increasing investments in infrastructure and manufacturing. North America and Europe follow, driven by technological advancements and sustainability initiatives. Emerging markets in Latin America and the Middle East & Africa are expected to witness substantial growth, fueled by rising industrialization and consumer demand.

The COVID-19 pandemic had a mixed impact on the PSA market. While sectors like automotive and construction experienced a downturn due to lockdowns and supply chain disruptions, the packaging and healthcare industries saw increased demand for PSAs. The surge in e-commerce and the need for medical supplies like tapes and labels contributed to the resilience of the PSA market during the pandemic. Post-pandemic, the market is recovering, with growth driven by resumed industrial activities and continued demand in key application areas.

Key Takeaways:

- Market Growth: The 3D bioprinting for organ regeneration market is expected to reach USD 21.6 Billion by 2034, growing at a robust CAGR of 4.4%, driven by diverse applications across industries and ongoing technological advancements.

- Chemistry Dominance: Acrylic-based PSAs dominate the market due to their excellent balance of adhesion, transparency, and cost-effectiveness. Silicone-based adhesives, while costlier, are projected to see significant growth because of their superior performance in high-temperature and sensitive applications.

- Technology Dominance: Water-based PSAs dominate the market due to their eco-friendliness, regulatory compliance, and cost-effectiveness. Meanwhile, hot melt PSAs are expected to witness strong future growth driven by demand in packaging, hygiene, and automotive sectors.

- Application Dominance: Labels dominate the pressure sensitive adhesives market due to their extensive use in packaging, logistics, and product identification. Tapes are anticipated to experience strong future growth, especially in construction, automotive, and electronics applications.

- End-Use Dominance: Packaging leads the pressure sensitive adhesives market due to its extensive use in labeling, sealing, and product branding across various industries. However, the automotive and transportation segment is projected to witness the fastest growth, fueled by the rising demand for lightweight and high-performance adhesive solutions in modern vehicles.

- Driver: The increasing demand from packaging, automotive, and electronics sectors is propelling growth in the pressure sensitive adhesives market. Additionally, the rise in e-commerce and the need for lightweight, easy-to-apply adhesives are enhancing market adoption.

- Restraint: Environmental concerns related to solvent-based PSAs and stringent VOC emission regulations hinder market expansion. Moreover, fluctuations in raw material prices affect production costs, impacting small and medium manufacturers.

- Opportunity: The push for sustainable and bio-based adhesives offers major growth opportunities. Additionally, the proliferation of flexible electronics and medical devices opens up new application areas for advanced PSAs.

- Trend: Technological advancements in hot-melt and UV-curable PSAs are revolutionizing the market. Simultaneously, the adoption of smart labels and tamper-evident packaging in logistics and retail is becoming widespread.

- Regional Analysis: The Asia-Pacific region dominates the global pressure sensitive adhesives market due to its strong manufacturing base, rising industrialization, and high demand from packaging, automotive, and electronics sectors. North America and Europe hold significant shares driven by technological advancements and sustainability trends. Meanwhile, the Middle East & Africa and Latin America are projected to show robust future growth due to rising infrastructure and consumer goods demand.

Chemistry Analysis:

Acrylic Leads With more than 50% Market Share In Pressure Sensitive Adhesives Market, Acrylic PSAs are widely used in labels, tapes, and graphics due to their strong adhesion to a variety of substrates, resistance to UV and oxidation, and affordability. These adhesives offer long-lasting bonding for indoor and outdoor use, making them popular across packaging, automotive, and consumer goods industries. Their water-based or solvent-based variants also align with environmental compliance, further strengthening their market presence.

Silicone PSAs, though representing a smaller share due to high costs, are gaining traction in sectors like electronics, aerospace, and healthcare. Their ability to adhere to low-energy surfaces, maintain bond strength in extreme temperatures, and exhibit chemical resistance makes them ideal for demanding environments. As high-tech applications expand, the demand for silicone adhesives is expected to rise.

Technology Analysis:

Water-based PSAs lead the market as they utilize water as a carrier instead of solvents, making them environmentally safe and compliant with stringent VOC regulations. These adhesives offer excellent adhesion, ease of cleanup, and cost-effectiveness, making them highly favored in packaging, graphics, and paper industries. Their versatility and low toxicity have led to widespread adoption, particularly in developed markets like North America and Europe where environmental norms are strict.

Hot melt PSAs are solid at room temperature and become tacky upon heating. They offer fast-setting, high tack strength, and are ideal for high-speed production lines in packaging, hygiene products (like diapers), and automotive assemblies. Their solvent-free nature also aligns with green manufacturing goals, and advancements in polymer blends are enhancing their temperature and moisture resistance—making this segment the fastest growing.

Application Analysis:

Labels represent the largest application segment in the PSA market. Their widespread use in consumer goods, food and beverage, pharmaceuticals, and logistics has solidified their market leadership. Pressure-sensitive labels are favored for their ease of application, clarity, durability, and compatibility with various substrates. The growth of e-commerce, which relies heavily on shipping and product tracking, continues to drive label demand globally. Additionally, compliance labeling in healthcare and chemicals sectors supports steady usage.

Tapes are increasingly used for both industrial and consumer purposes. Their roles in automotive (for attaching trims and emblems), electronics (for insulation and assembly), and construction (sealing and bonding) are expanding rapidly.

End-Use Analysis:

Packaging dominates the PSA market because of its essential role in labeling, sealing, tamper-proofing, and branding. The rise in global e-commerce, FMCG products, pharmaceuticals, and food delivery services has drastically increased the need for efficient, cost-effective, and high-speed adhesive solutions. Pressure sensitive adhesives are preferred for their quick tack, clean removability, and compatibility with a range of packaging materials. These adhesives ensure clear labeling and secure packaging across logistics chains, reducing operational costs and improving brand visibility. Automation in packaging lines also supports the adoption of PSAs for seamless integration.

Automotive and Transportation is the fastest-growing segment in the PSA market. With the global shift towards lightweight vehicle design, electric vehicles (EVs), and fuel-efficient cars, manufacturers are increasingly replacing mechanical fasteners with PSAs.

Region Analysis:

Asia-Pacific Leads With over 45% Market Share In Pressure Sensitive Adhesives Market. Asia-Pacific leads the pressure sensitive adhesives market, primarily due to rapid industrialization, population growth, and high demand from sectors like packaging, automotive, and consumer electronics. Countries like China, India, Japan, and South Korea serve as key production and consumption hubs. The booming e-commerce sector and expansion of manufacturing capacities, particularly in China and India, are pushing the demand for PSAs in labeling, sealing, and assembling.

North America holds a strong market share owing to the presence of major PSA manufacturers, ongoing R&D, and widespread application in automotive, healthcare, and construction. The region benefits from consumer demand for smart packaging, clean labeling, and medical adhesives.

Europe emphasizes eco-friendly and bio-based PSAs, driven by stringent environmental regulations and high adoption in automotive and healthcare segments. Germany, France, and the UK are significant contributors due to their industrial maturity and innovation.

Latin America and Middle East & Africa are emerging markets with increasing demand for packaged goods, medical products, and consumer electronics. Urbanization, rising disposable income, and infrastructure development contribute to the rising adoption of PSAs.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

By Type

- Acrylic Pressure Sensitive Adhesives

- Rubber-Based Pressure Sensitive Adhesives

- Silicone Pressure Sensitive Adhesives

- Polyurethane-Based Pressure Sensitive Adhesives

- Others (EVA, Modified Resins, etc.)

By Technology

- Water-Based

- Solvent-Based

- Hot Melt

- Radiation Cured (UV-Cured and EB-Cured)

By Application

- Tapes

- Labels

- Graphics and Signage

- Medical & Hygiene Products

- Automotive Components

- Electronics Assembly

- Construction & Building Materials

- Others (Footwear, Aerospace, etc.)

By End-Use Industry

- Packaging

- Automotive & Transportation

- Electronics & Electrical

- Construction

- Healthcare

- Consumer Goods

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 13.9 B |

| Forecast Revenue (2034) | USD 21.6 B |

| CAGR (2025-2034) | 4.4% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Acrylic Pressure Sensitive Adhesives, Rubber-Based Pressure Sensitive Adhesives, Silicone Pressure Sensitive Adhesives, Polyurethane-Based Pressure Sensitive Adhesives, Others), By Technology (Water-Based, Solvent-Based, Hot Melt, Radiation Cured (UV-Cured and EB-Cured)), By Application (Tapes, Labels, Graphics and Signage, Medical & Hygiene Products, Automotive Components, Electronics Assembly, Construction & Building Materials, Others), By End-Use Industry (Packaging, Automotive & Transportation, Electronics & Electrical, Construction, Healthcare, Consumer Goods, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Henkel AG and Co. KGaA, Advance Tapes International Limited, H.B. Fuller Company, Eastman Chemical Company, Arkema, 3M, Nitto Denko Corporation, Sika AG, Exxon Mobil Corporation, Ashland Inc., Pidilite Industries Ltd., Illinois Tool Works Inc, Momentive Performance Materials Inc., Tesa SE, Franklin International Inc., Wacker Chemie AG, DuPont de Nemours Inc., Helmitin Adhesives, Avery Dennison Corporation, DIC Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Pressure Sensitive Adhesives Market

Published Date : 04 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date