Private Tutoring Market Size, Share & Growth Forecast to 2034 | 7.8% CAGR

Global Private Tutoring Market Size, Share & Analysis By Type (Academic, Non-Academic), By Delivery Mode (Online, Offline), By End-User (Preschool and Primary Students, Middle School Students, High School Students, College Students), EdTech Integration, Pricing Models & Forecast 2025–2034

Report Overview

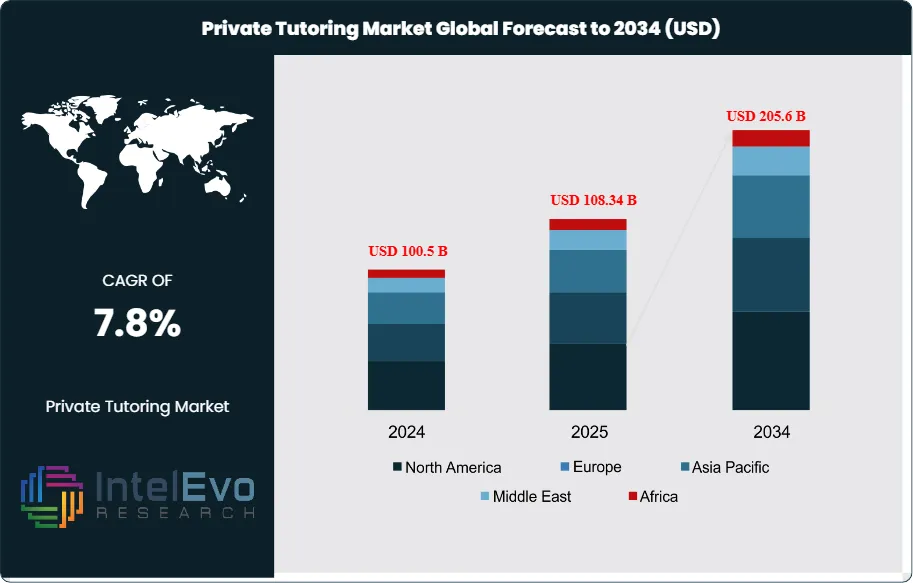

The Private Tutoring Market size is expected to reach approximately USD 100.5 billion in 2024 and around USD 205.6 billion by 2034, up from USD 93.6 billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. This steady expansion reflects the sector’s critical role in meeting the rising demand for personalized learning solutions in an increasingly competitive academic landscape. The market’s evolution is marked by the growing integration of technology, the increasing emphasis on supplemental education, and the cultural prioritization of academic excellence across key regions.

Get More Information about this report -

Request Free Sample ReportPrivate tutoring, which provides individualized academic support outside the classroom, has gained prominence as students and parents seek tailored approaches to strengthen subject mastery and improve overall performance. The sector has benefitted significantly from advancements in digital learning platforms, offering flexible scheduling, remote access, and adaptive learning capabilities. This transformation has not only expanded the market’s reach but also positioned digital tutoring as a scalable solution to bridge accessibility gaps, particularly in underserved regions.

Key growth drivers include the global focus on STEM education, the rapid rise in internet penetration, and heightened parental investment in extracurricular learning. However, challenges remain, especially in mature markets such as the United States, where tutoring adoption is relatively low—only 15% of students currently participate, and just 2% access high-quality support. This imbalance underscores untapped potential for providers to expand offerings and address systemic accessibility issues.

In terms of delivery modes, offline tutoring continues to dominate with approximately 74% market share, while online tutoring accounts for 26%. Despite this disparity, online platforms are gaining momentum at an accelerated pace, spurred by the post-COVID normalization of remote learning. This segment is emerging as a focal point for innovation, with opportunities tied to AI-driven adaptive learning tools, interactive platforms, and mobile-first solutions that enhance engagement and learning outcomes.

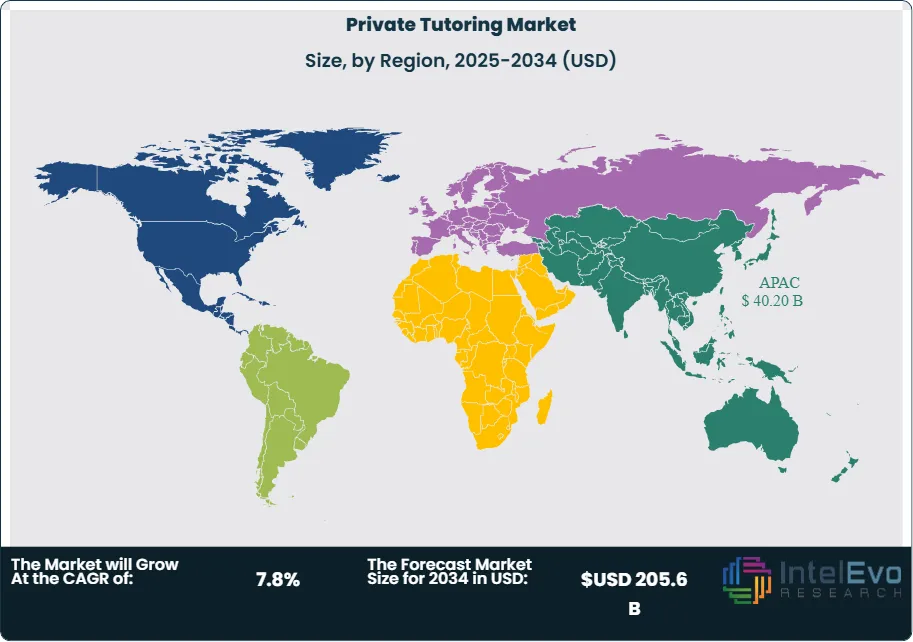

Regionally, Asia Pacific leads the market with a commanding 39.2% share, equivalent to USD 36.69 billion in 2023, supported by its vast student population and strong educational culture. Meanwhile, emerging economies in Latin America, the Middle East, and Africa are increasingly viewed as investment hotspots, driven by rising household spending on education and growing adoption of digital tutoring models.

Overall, the private tutoring industry is undergoing a profound shift, balancing traditional in-person sessions with the scalability of digital platforms. As technology integration deepens and demand for personalized learning accelerates, the market is positioned for sustained, long-term growth.

Key Takeaways

- Market Growth: The Global Private Tutoring Market is anticipated to expand from USD 93.6 billion in 2023 to nearly USD 205.6 billion by 2034, reflecting a CAGR of 7.8% between 2025 and 2034. Expansion is fueled by intensifying academic competition, a rising preference for personalized learning, and the continued shift toward digital education models.

- Type: Academic tutoring dominated in 2023 with 67.6% of total revenues, largely due to strong demand for subject-focused support in mathematics, sciences, languages, and exam preparation. This category continues to anchor market growth as education systems worldwide emphasize STEM and standardized testing outcomes.

- Delivery Mode: In-person tutoring remained the most widely adopted approach in 2023, securing a 72.5% share, as parents value direct interaction and structured guidance. Nevertheless, online tutoring is scaling quickly, supported by post-pandemic acceptance of virtual learning, better internet infrastructure, and the convenience of flexible scheduling.

- End User: High school students accounted for 40.5% of the market in 2023, reflecting their critical stage in preparing for competitive examinations and university admissions. This group is expected to remain the largest consumer segment, with tutoring often viewed as a strategic investment in securing future opportunities.

- Driver: Rising global emphasis on STEM proficiency and competitive exam readiness continues to accelerate demand. In Asia Pacific especially, growing household spending on supplemental education is amplifying adoption rates.

- Restraint: Penetration remains low in mature economies such as the United States, where only about 15% of students use tutoring services and fewer than 2% receive premium-quality support. This limited adoption underscores untapped potential but also represents a growth bottleneck.

- Opportunity: Digital innovation—particularly adaptive AI learning tools, mobile-first tutoring platforms, and real-time performance tracking—offers significant headroom for growth, especially in underserved emerging markets where access to quality educators remains constrained.

- Trend: The market is undergoing a structural shift toward hybrid tutoring ecosystems that blend offline engagement with online platforms. The rising participation of younger, digitally skilled tutors is accelerating the integration of interactive technologies and shaping more engaging student experiences.

- Regional Analysis: Asia Pacific led the market in 2023 with a 39.2% share, equivalent to USD 36.69 billion, supported by a large student base and strong cultural commitment to education. Meanwhile, Latin America, the Middle East, and Africa are seeing faster adoption, propelled by rising household incomes, improving digital connectivity, and educational reforms.

Type Analysis

As of 2025, academic tutoring continues to dominate the global private tutoring market, holding more than two-thirds of total share. This leadership reflects the rising demand for structured, curriculum-aligned support in core subjects such as mathematics, science, and languages. The intensifying competition for admission into top universities and the growing importance of standardized examinations further reinforce the need for academic-focused tutoring services. Parents and students alike are increasingly viewing supplemental academic coaching as essential to maintaining a competitive edge in today’s education-driven economies.

In contrast, the non-academic tutoring segment, while comparatively smaller, is experiencing steady momentum. This category covers extracurricular domains such as arts, music, sports, and life-skills coaching, which are gaining importance as education systems worldwide adopt more holistic approaches. Shifting parental priorities and recognition of the value of creative and interpersonal skills in the future workforce are expected to accelerate demand for non-academic tutoring. Although it represents a smaller portion of market revenues, this segment is poised for long-term expansion as schools and families emphasize balanced development beyond academics.

Together, both academic and non-academic categories highlight the sector’s dual growth trajectory, where rigorous academic support remains central, but complementary learning pathways are gradually gaining market share. This reflects a broader trend of personalized education shaping the future of the tutoring industry.

Delivery Mode Analysis

Offline tutoring retained a commanding position in 2025, representing over 70% of the global market. Its dominance underscores the enduring preference for face-to-face interaction, where students benefit from immediate feedback, structured learning routines, and stronger tutor-student engagement. In many regions, particularly in Asia and parts of Europe, cultural expectations and trust in in-person learning environments continue to anchor offline tutoring’s strength.

That said, the online tutoring segment has emerged as the fastest-growing channel, propelled by widespread digital adoption, improved internet connectivity, and technological innovations such as AI-driven adaptive platforms. Online tutoring offers unmatched accessibility and cost-efficiency, enabling learners from diverse geographies to access quality instruction. Post-pandemic normalization of virtual learning has further legitimized this delivery mode, opening opportunities for global platforms and startups to scale rapidly.

Looking ahead, while offline tutoring is expected to maintain its lead in the near term, the growth momentum of online services is likely to narrow the gap. Hybrid models that blend physical and digital interactions are also gaining traction, catering to families seeking flexibility without compromising quality.

End-User Analysis

High school students represent the largest share of private tutoring demand in 2025, accounting for more than 40% of total market revenues. This dominance reflects the critical importance of secondary education in shaping career trajectories, particularly through competitive exams, advanced coursework, and university entrance assessments. Parents view tutoring at this stage as a strategic investment to improve academic performance and secure better admission outcomes, reinforcing high school tutoring as the market’s cornerstone.

Other segments, while smaller, fulfill distinct needs. Preschool and primary students often receive tutoring to build foundational literacy and numeracy skills, laying the groundwork for future learning. Middle school learners, facing a more complex curriculum, increasingly require targeted academic support to transition smoothly into secondary education. Meanwhile, college students represent a niche but vital segment, relying on tutoring for professional exam preparation, specialized subject guidance, and skills enhancement aligned with career goals.

Overall, demand across all age groups is expanding as educational pressures rise worldwide, though high school tutoring is expected to remain the most influential category due to its direct impact on academic and career outcomes.

Regional Analysis

Regionally, Asia Pacific continues to lead the global private tutoring market in 2025, capturing close to 40% of total revenues. The region’s dominance is supported by a large student population, strong cultural emphasis on academic achievement, and a rapidly expanding middle class willing to invest heavily in education. Countries such as China, India, and South Korea remain central to this growth, with technology-enabled tutoring platforms gaining significant traction alongside traditional coaching centers.

North America demonstrates robust demand, particularly in standardized test preparation, advanced placement tutoring, and digital learning adoption. Europe mirrors these patterns, with high uptake in language tutoring and exam readiness programs, supported by widespread digital infrastructure. The Middle East and Africa are emerging as high-growth regions, where government-led education reforms and private-sector investments—especially in Gulf nations—are fostering rapid adoption of tutoring services. Latin America, meanwhile, is benefiting from advancements in digital learning platforms and policy initiatives aimed at improving educational accessibility, making tutoring increasingly mainstream across diverse income groups.

Collectively, these regional dynamics underscore a globally expanding market where Asia Pacific maintains clear dominance, but emerging regions such as the Middle East, Africa, and Latin America are becoming critical growth frontiers for investors and service providers.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Academic

- Non-Academic

By Delivery Mode

- Online

- Offline

By End-User

- Preschool and Primary Students

- Middle School Students

- High School Students

- College Students

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 100.5 B |

| Forecast Revenue (2034) | USD 205.6 B |

| CAGR (2024-2034) | 7.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Academic, Non-Academic), By Delivery Mode (Online, Offline), By End-User (Preschool and Primary Students, Middle School Students, High School Students, College Students) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Educomp Solutions Ltd., Sylvan Learning, Kumon Institute of Education Co., Chegg, Inc., Kaplan Inc., Action Tutoring, Ambow Education Holding Ltd., TAL Education Group, Mathnasium LLC |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Private Tutoring Market?

The Private Tutoring Market is projected to grow from USD 100.5 Billion in 2024 to USD 205.6 Billion by 2034, at a CAGR of 7.4%. Rising demand for personalized learning, technology-enabled tutoring, and academic competitiveness is driving strong global market expansion across key education regions.

Who are the major players in the Private Tutoring Market?

Educomp Solutions Ltd., Sylvan Learning, Kumon Institute of Education Co., Chegg, Inc., Kaplan Inc., Action Tutoring, Ambow Education Holding Ltd., TAL Education Group, Mathnasium LLC

Which segments covered the Private Tutoring Market?

By Type (Academic, Non-Academic), By Delivery Mode (Online, Offline), By End-User (Preschool and Primary Students, Middle School Students, High School Students, College Students)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date