Process Analytical Technology Market Size | 11.6% CAGR

Global Process Analytical Technology Market Size, Share & Analysis By Technique (Spectroscopy, Chromatography), By End-User (Pharma, Biotech), Industry Outlook, Regulatory Compliance Trends & Forecast 2025–2034

Report Overview

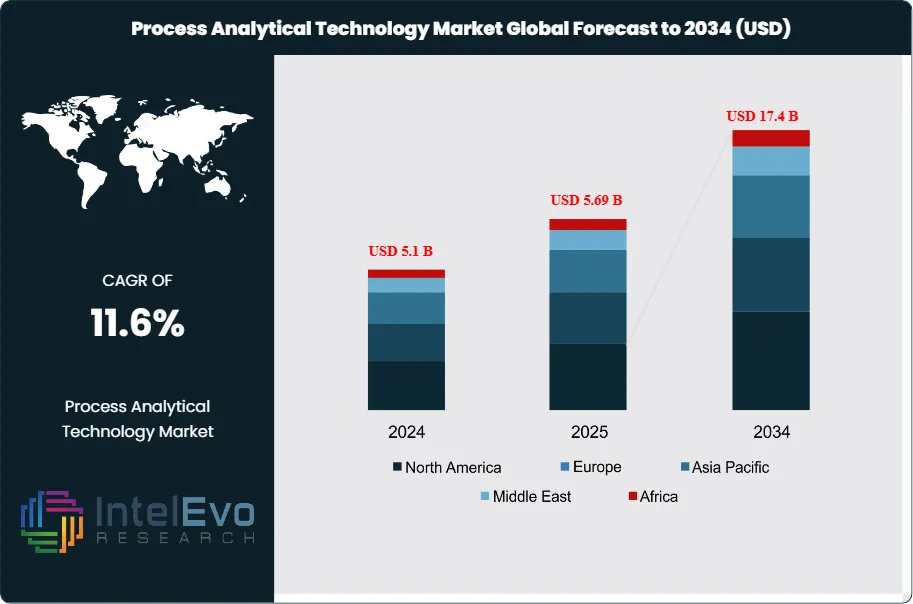

The Process Analytical Technology (PAT) Market is valued at approximately USD 5.1 billion in 2024 and is projected to reach nearly USD 17.4 billion by 2034, expanding at a strong CAGR of about 11.6% from 2025–2034. Growth is being fueled by the pharmaceutical industry’s accelerated shift toward continuous manufacturing, real-time quality assurance, and data-driven process optimization. As regulators such as the U.S. FDA, EMA, and PMDA push for enhanced process visibility and Quality-by-Design (QbD) adoption, PAT tools—ranging from spectroscopy and chromatography to advanced multivariate analytics—are becoming mission-critical. With AI-powered process control, digital twins, and Industry 4.0 integrations gaining momentum, the PAT market is rapidly trending across pharma, biotech, food processing, and specialty chemicals.

Get More Information about this report -

Request Free Sample ReportThe market has evolved significantly in recent years, driven by increasing demand for precision, efficiency, and compliance in industrial production. Originally adopted in pharmaceutical manufacturing to improve product consistency and regulatory compliance, PAT has now expanded across multiple sectors including chemicals, food and beverage, and biotechnology. The shift from batch to continuous manufacturing has further accelerated adoption, as companies seek real-time control over process variables to reduce waste and improve yield.

Demand-side factors are playing a key role in shaping growth. Industries are under mounting pressure to meet stringent quality standards while managing costs. This has elevated the need for real-time analytics and automated control systems. On the supply side, the availability of integrated PAT solutions—combining hardware, software, and analytics—is enabling faster deployment and reducing technical complexity. However, high upfront costs, legacy infrastructure, and regulatory constraints remain challenges to broader implementation, particularly in small and mid-sized enterprises.

Technological advancement is central to the market’s trajectory. The integration of artificial intelligence and machine learning is enabling predictive analytics, while cloud-based platforms are simplifying data access and remote monitoring. Key techniques such as near-infrared (NIR) spectroscopy, Raman spectroscopy, and chromatography are being enhanced through better sensors, faster processors, and smarter algorithms. These developments are shortening feedback loops, reducing downtime, and improving batch consistency.

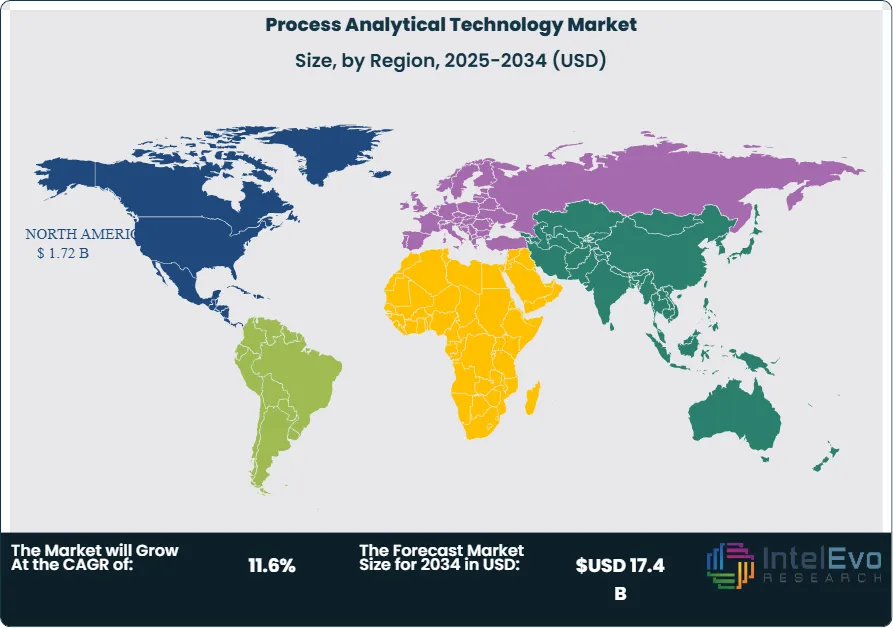

Regionally, North America holds a leading position due to strong regulatory mandates from the FDA and high investment in pharmaceutical R&D. Europe follows closely, driven by increasing adoption across the biotech and food processing sectors. Asia-Pacific is emerging as a high-growth region, supported by rising manufacturing output and expanding life sciences industries, particularly in China and India. Investors should monitor these markets closely, as infrastructure modernization and policy support are expected to create new opportunities.

The market’s outlook remains strong, with technological readiness, regulatory clarity, and industrial demand aligning to support sustained growth over the forecast period.

Key Takeaways

- Market Growth: The global Process Analytical Technology (PAT) market was valued at USD 5.1 billion in 2024 and is projected to reach approximately USD 17.4 billion by 2034, registering a robust CAGR of 11.6% during 2025–2034. Growth is primarily driven by rising demand for real-time process monitoring and quality assurance across manufacturing industries.

- Technology: Spectroscopy led the market in 2022, accounting for 43.1% of total revenue. Its dominance is driven by widespread adoption of NIR and Raman spectroscopy for non-destructive, real-time analysis in pharmaceutical and chemical production.

- Product Type: Analyzers represented the largest product segment in 2022 with a 32% revenue share, supported by growing use of sensor-based systems for in-process quality monitoring and batch consistency.

- Application: Large molecule analysis held the leading share among application types in 2022, reflecting increasing biologics production and the complexity of protein-based drugs requiring advanced monitoring techniques.

- Measurement Type: In-line measurement systems captured the largest revenue share of 42.5% in 2022. Their integration into production lines enables continuous process monitoring without sample extraction, reducing delays and enhancing efficiency.

- End Use: Pharmaceutical manufacturers accounted for 32.5% of market revenue in 2022, as regulatory pressure and demand for consistent product quality drive PAT implementation in drug development and manufacturing.

- Driver: Rising regulatory mandates from agencies like the FDA and EMA are compelling pharmaceutical firms to adopt PAT solutions. The need for real-time quality control in continuous manufacturing is accelerating demand.

- Restraint: High implementation costs and integration challenges with legacy systems are limiting adoption, particularly among small- and mid-sized manufacturers.

- Opportunity: The Asia-Pacific region presents a significant opportunity, supported by expanding pharmaceutical manufacturing in India and China. The region is projected to grow at a double-digit CAGR through 2032.

- Trend: Integration of AI and machine learning into PAT systems is gaining traction. Predictive analytics are being deployed to improve process efficiency and minimize deviations in real-time.

- Regional Analysis: North America led the global market in 2022 with a 33.8% revenue share, supported by strong R&D investment and early regulatory support. Asia-Pacific is the fastest-growing region, driven by industrial expansion and increasing government focus on manufacturing modernization.

Get More Information about this report -

Request Free Sample Report

Technology Analysis

As of 2025, spectroscopy remains the dominant technology in the global process analytical technology (PAT) market, accounting for approximately 43.1% of total revenue. This segment continues to lead due to its ability to deliver real-time insights into the chemical and physical attributes of materials across a range of industries. Technologies such as Fourier-transform infrared (FTIR) and near-infrared (NIR) spectroscopy are widely integrated into pharmaceutical and chemical manufacturing to ensure compliance, consistency, and efficiency. Their non-destructive nature and speed make them particularly well-suited for real-time monitoring in high-throughput production environments.

Chromatography is the second-largest segment and is expected to maintain steady growth, supported by a CAGR of 10.3%. Techniques such as high-performance liquid chromatography (HPLC), gas chromatography (GC), and ion chromatography (IC) are vital for separating and analyzing complex mixtures in biotech and pharma applications. As production processes become more complex, demand for robust analytical methods continues to rise, particularly in biologics and specialty chemicals.

Product & Service Analysis

Within the product and service segmentation, analyzers lead the global market with a 32% revenue share in 2022 and are expected to remain the most commercially valuable segment through 2030. These devices are essential in providing accurate, real-time measurements of process parameters such as pH, temperature, and chemical composition. Widespread use in pharmaceutical, chemical, and petrochemical industries supports their continued relevance.

The sensors and probes segment is projected to expand at a CAGR of 11.3%, driven by increasing integration of IoT-based process monitoring systems. As manufacturers seek greater visibility across production lines, demand for compact, durable, and high-sensitivity probes is growing. This shift is reinforced by trends in automation and continuous manufacturing, which require seamless data capture and control.

Application Analysis

The large molecule segment remains the largest application area within the PAT market. Its growth reflects the increasing complexity of biologic drug manufacturing, where precision monitoring is essential to ensure product efficacy and batch-to-batch consistency. Large molecules, including monoclonal antibodies, peptides, and nucleic acids, require stringent control during fermentation, purification, and formulation processes.

As the global pipeline for biologics expands, manufacturers are investing in PAT systems to reduce variability, lower production costs, and comply with regulatory standards. These technologies help maintain critical quality attributes (CQAs) and enable real-time release testing (RTRT), significantly reducing time-to-market for complex therapies.

Measurement Analysis

In-line measurement systems account for the largest share, capturing 42.5% of market revenue. These systems are integrated directly into production equipment, enabling continuous monitoring and control of key parameters without interrupting operations. This real-time capability supports higher yield, reduced waste, and faster response times to deviations in process performance.

The on-line segment is also expanding, with a projected CAGR of 11.3%. While on-line systems operate slightly downstream from the core process, they still offer significant benefits in terms of timely data acquisition and process control. Both measurement types are increasingly favored in industries shifting from batch to continuous production, particularly in pharma and specialty chemicals.

End-Use Analysis

Pharmaceutical manufacturers lead PAT adoption, holding a 32.5% revenue share as of 2022. Driven by regulatory frameworks such as the FDA’s Process Analytical Technology initiative and the push for continuous manufacturing, pharma companies are integrating PAT to monitor production lines, enhance quality assurance, and reduce operational costs.

The biopharmaceutical sector is the fastest-growing end-use category, supported by the increasing demand for biologics and personalized medicines. PAT tools are essential for managing bioprocesses such as cell culture and protein purification. As the global biologics market grows, PAT systems are becoming integral to ensuring consistent production of high-value therapeutic products.

Regional Analysis

North America remains the largest market, contributing 33.8% of global revenue, underpinned by strong regulatory support, high R&D expenditure, and early adoption of advanced manufacturing technologies. The U.S. leads regional growth, with widespread integration of PAT in both large pharmaceutical firms and emerging biotech players.

Europe follows closely, with Germany, France, and the United Kingdom serving as key markets due to the presence of advanced pharmaceutical infrastructure and supportive regulatory bodies. Asia Pacific is the fastest-growing region, driven by expanding drug manufacturing capacity in China, India, and Japan. Governments in these countries are investing in pharma modernization and encouraging local production, positioning the region as a high-potential PAT market through 2030 and beyond.

Market Key Segments

By Technology

- Spectroscopy

- Molecular Spectroscopy

- Atomic Spectroscopy

- Mass Spectrometry

- Chromatography

- High-Performance Liquid Chromatography

- Gas Chromatography

- Others

- Particle Size Analysis

- Others

By Product & Service

- Analyzers

- Sensors & Probes

- Samplers

- Software & Services

By Application

- Small Molecules

- Large Molecules

- Manufacturing Applications

- Other Applications

By Measurement

- Off-line Measurement

- In-line Measurement

- At-line Measurement

- On-line Measurement

By End User

- Pharmaceutical Manufacturers

- Biopharmaceutical Manufacturers

- Contract Research and Manufacturing Organizations

- Other End Users

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 5.1 B |

| Forecast Revenue (2034) | USD 17.4 B |

| CAGR (2024-2034) | 11.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Technology (Spectroscopy (Molecular Spectroscopy, Atomic Spectroscopy), Mass Spectrometry, Chromatography (High-Performance Liquid Chromatography, Gas Chromatography, others), Particle Size Analysis, Others), By Product & Service (Analyzers, Sensors & Probes, Samplers, Software & Services), By Application (Small Molecules, Large Molecules, Manufacturing Applications, Other Applications), By Measurement (Off-line Measurement, In-line Measurement, At-line Measurement, On-line Measurement), By End User (Pharmaceutical Manufacturers, Biopharmaceutical Manufacturers, Contract Research and Manufacturing Organizations, Other End Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Agilent Technologies Inc., Mettler-Toledo International Inc., Shimadzu Corporation, Emerson Electric Co., Sartorius AG, Bruker Corporation, Danaher Corporation, Hamilton Company, Repligen Corporation, ABB Ltd., PerkinElmer Inc., Carl Zeiss AG |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Process Analytical Technology Market

Published Date : 05 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date