Progressive Web Apps Market Growth & Digital Trends| 32.2% CAGR

Global Progressive Web Apps Market Size, Share & Analysis By Component (Platform, Services), By Enterprise Size (Large Enterprises, SMEs), By Application (Social Media, E-commerce and Retail, Media and Entertainment, Travel and Tourism, BFSI, Healthcare, Education, Others), By Deployment, Industry Outlook, Performance Optimization Trends & Forecast 2025–2034

Report Overview

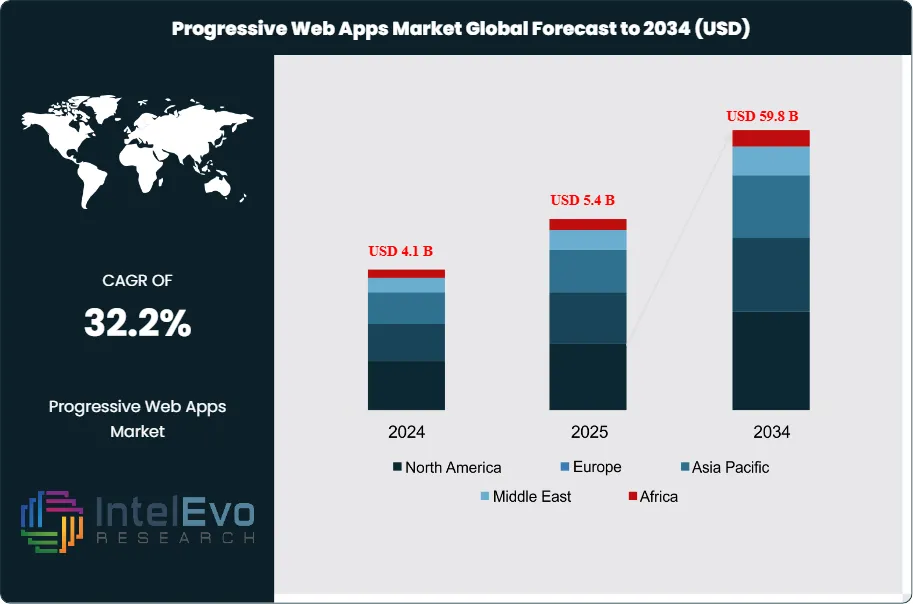

The Progressive Web Apps (PWA) market is valued at USD 4.1 billion in 2024 and is projected to reach approximately USD 59.8 billion by 2034, reflecting a powerful CAGR of about 32.2% during 2025–2034. Growth is accelerating as businesses prioritize low-latency, app-like web experiences without the cost of native app development. PWAs enable faster load times, offline functionality, and seamless cross-device performance—making them a preferred choice for e-commerce, BFSI, media, and enterprise platforms. As mobile-first interaction becomes the global norm, PWAs are reshaping digital transformation strategies and emerging as a dominant force in next-generation web development.

Get More Information about this report -

Request Free Sample ReportPWAs represent a structural shift in how digital platforms are built and delivered. They combine the accessibility of web pages with the functionality of mobile applications, offering offline access, push notifications, and seamless updates without requiring app store downloads. As smartphone penetration surpasses 50% of the global population and mobile web traffic dominates user behavior, PWAs have become a preferred channel for businesses seeking fast, reliable, and responsive user experiences.

Adoption is accelerating in sectors such as e-commerce, finance, and digital media, where performance and conversion metrics are closely tied to mobile experience. Companies deploying PWAs report a 36% improvement in conversion rates and a 180% increase in user engagement compared to traditional apps. User behavior supports this shift, with 70% of consumers favoring PWAs for their ease of access and 80% choosing to pin them to their home screens. Cost efficiency is another driver.

PWAs reduce development overhead by enabling a single application to run across platforms, removing the need for separate iOS and Android builds. Browser technologies such as service workers and Web App Manifests have made this possible, but inconsistent support across browsers still presents a limitation, particularly for feature-rich applications. While native apps remain the benchmark for high-performance mobile tasks, PWAs are gaining ground in markets where connectivity is unstable or user acquisition budgets are constrained.

Regional growth is strongest in Asia Pacific and Latin America, where mobile-first internet use is widespread and the appetite for lightweight, high-functionality platforms is high. The market remains largely underpenetrated, with only 54,000 active websites globally using PWA frameworks. As browser compatibility improves and enterprise adoption rises, the gap between PWAs and native apps will narrow further. Security is another differentiator. PWAs report 60% fewer vulnerabilities than native alternatives, a factor increasingly prioritized in compliance-focused sectors. As businesses seek scalable, secure, and performance-oriented digital solutions, PWA adoption is expected to expand significantly through 2034.

Key Takeaways

- Market Growth: The global Progressive Web Apps (PWA) market is projected to reach USD 59.8 billion by 2034, up from USD 4.1 billion in 2024, registering a CAGR of 32.2% from 2025 to 2034. Growth is driven by rising smartphone penetration, demand for faster mobile experiences, and cost advantages over native app development.

- Platform: The Platform segment led the market in 2023 with over 57% share, supported by widespread use of frameworks like Angular, React, and Vue.js that simplify cross-platform development for web and mobile.

- Enterprise Size: Large enterprises accounted for more than 54% of global PWA adoption in 2023. Their focus on customer retention, performance optimization, and cost-efficiency made PWAs a strategic choice for digital transformation across retail, banking, and services.

- Application: 11applications captured 18.5% of the market in 2023. PWAs in this segment improve load speeds, reduce data usage, and increase user engagement in bandwidth-constrained environments.

- Driver: PWA performance advantages are driving adoption. Companies report up to 36% higher conversion rates and a 180% boost in user engagement, supported by features like offline access, push notifications, and faster load times.

- Restraint: Limited browser compatibility remains a barrier. Inconsistent support for PWA features across Safari, older Android browsers, and legacy enterprise environments restricts functionality and user experience.

- Opportunity: Emerging markets in Asia Pacific and Latin America offer strong potential due to mobile-first internet behavior and lower access to high-end devices. PWAs meet the need for fast, lightweight, and install-free applications in these regions.

- Trend: Security is becoming a key differentiator. PWAs show 60% fewer vulnerabilities than native apps, increasing their appeal in regulated sectors such as finance, healthcare, and public services.

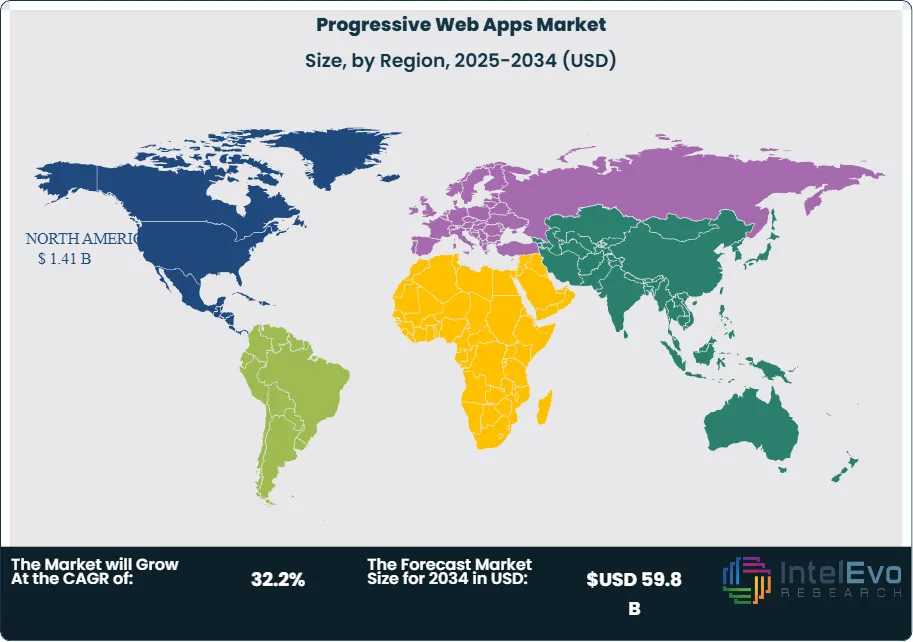

- Regional Analysis: North America led the global market in 2023 with over 34.5% share, driven by high digital adoption and enterprise investment in PWA frameworks. Asia Pacific is gaining momentum, supported by mobile-first ecosystems and increasing deployment across e-commerce and service industries.

Component Analysis

As of 2025, platforms remain the dominant force in the global Progressive Web Apps (PWA) market, holding over 57% of the total market share. This is largely due to the demand for development environments that support fast, responsive applications across devices and operating systems. Businesses increasingly rely on platform-based tools to deploy PWAs that deliver consistent performance with offline functionality, push notifications, and quick load times. Open-source tools such as Google Lighthouse and Microsoft’s PWA Builder continue to lower barriers to entry, supporting widespread adoption across development teams.

The shift to cloud infrastructure has further reinforced platform dominance. Cloud-based platforms support continuous integration and delivery, enable faster updates, and reduce operational complexity. For enterprises aiming to accelerate time-to-market while managing digital experiences at scale, platforms offer a flexible and cost-efficient solution. Their modular architecture also allows companies to iterate quickly and align app performance with evolving user expectations.

Enterprise Size Analysis

Large enterprises accounted for more than 54% of global PWA deployment in 2025. Their preference stems from the need to deliver scalable, secure, and high-performing digital solutions across geographies and user segments. With greater financial resources and digital infrastructure, large companies can fully integrate PWA capabilities—offline access, background sync, and push notifications—into complex customer-facing applications. These capabilities are especially valuable in sectors such as banking, retail, and media, where user engagement drives revenue.

PWA adoption among large enterprises also reflects a strategic focus on reducing long-term development and maintenance costs. Unlike native apps, PWAs allow companies to manage a single codebase across platforms, simplifying updates and minimizing user friction. Analytics and real-time performance monitoring are additional advantages, enabling organizations to fine-tune user experiences and gain insights into digital behavior. These factors position PWAs as a core component of enterprise digital transformation initiatives.

Application Analysis

The social media segment led PWA application adoption in 2025, contributing over 18.5% of the market. User experience is central to this sector, and PWAs support faster load times, real-time updates, and offline access—all essential for maintaining engagement in high-traffic environments. As mobile devices remain the primary access point for social platforms, companies are investing in PWAs to reduce latency, increase session times, and support broader geographic reach, including regions with inconsistent internet access.

Beyond social media, sectors such as e-commerce and streaming are also scaling PWA adoption. For example, JD.ID in Indonesia recorded a 53% increase in mobile conversion rates and a 200% rise in installations after switching to a PWA format. Media platforms like Hulu experienced a 27% lift in return visits within months of their transition. These outcomes underscore the technology’s value in improving performance metrics that directly impact revenue, especially in markets with mobile-first audiences.

Regional Analysis

North America held the largest share of the global PWA market in 2025, accounting for over 34.5% of revenue, driven by established digital infrastructure and strong enterprise adoption. Major U.S. tech companies—including Google, Microsoft, and Meta—have embedded PWA support into their platforms, accelerating both developer interest and end-user acceptance. High smartphone penetration and advanced cloud infrastructure further support the region’s lead in PWA deployment.

Asia Pacific, however, presents the most significant growth potential. With rising mobile internet use and expanding e-commerce ecosystems, countries like India, Indonesia, and Vietnam are adopting PWAs as cost-effective alternatives to native apps. Latin America is also emerging as a key region, where local startups and service providers turn to PWAs to improve reach without heavy investment. As browser compatibility continues to improve, adoption will likely spread deeper into healthcare, education, and public sector services across emerging markets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Platform

- Services

By Enterprise Size

- Large Enterprises

- SMEs

By Application

- Social Media

- E-commerce and Retail

- Media and Entertainment

- Travel and Tourism

- BFSI

- Healthcare

- Education

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 4.1 B |

| Forecast Revenue (2034) | USD 59.8 B |

| CAGR (2024-2034) | 32.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Platform, Services), By Enterprise Size (Large Enterprises, SMEs), By Application (Social Media, E-commerce and Retail, Media and Entertainment, Travel and Tourism, BFSI, Healthcare, Education, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DockYard Inc., OutSystems, Meta, Enonic AS, Google, IBM Corporation, GoodBarber, Cloud Four, Inc., Svelte, Microsoft, Alokai (former Vue Storefront), Other key players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date