Global Propylene Oxide Market to Hit $40.2B by 2034 | CAGR 6.2%

Global Propylene Oxide Market Size, Share, Analysis Report Type (Polyether Polyols, Propylene Glycol, Glycol Ethers, Others), Application (Construction, Automotive, Packaging, Textiles, Electronics, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

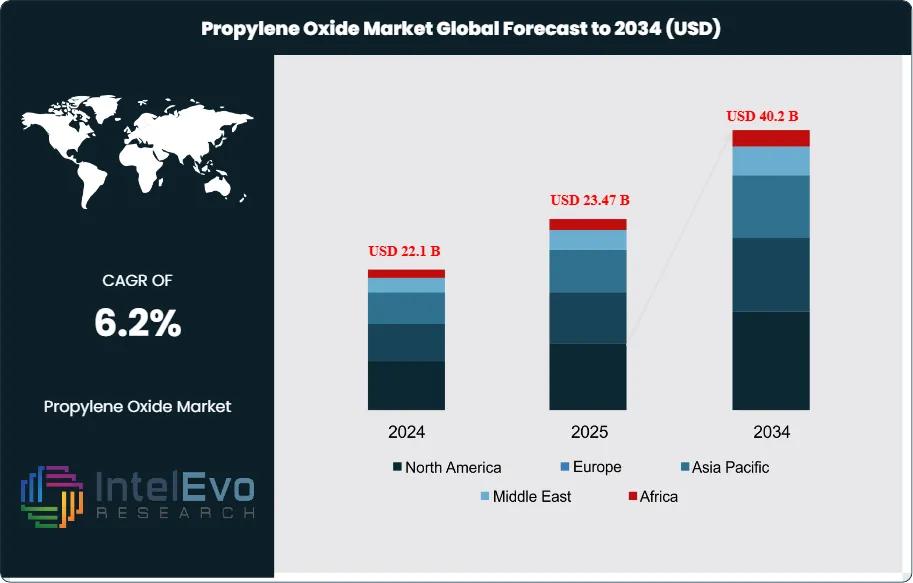

The Global Propylene Oxide Market size is expected to be worth around USD 40.2 Billion by 2034, up from USD 22.1 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2024 to 2034. The Global Propylene Oxide Market is a crucial segment of the global chemicals industry, centered on the production and application of propylene oxide—a highly reactive, colorless, and volatile organic compound. Propylene oxide serves as a key intermediate in the synthesis of polyether polyols (the main building block for polyurethane foams), propylene glycol, and glycol ethers. These downstream products are indispensable in a wide array of industries: polyurethane foams are used extensively for insulation in construction, cushioning in automotive and furniture, and packaging; propylene glycol finds applications in food additives, pharmaceuticals, cosmetics, and de-icing fluids; while glycol ethers are important solvents in paints, coatings, and electronics.

Get More Information about this report -

Request Free Sample ReportThe market’s robust growth is primarily driven by the surging demand for lightweight, energy-efficient, and durable materials, especially in emerging economies experiencing rapid urbanization and industrialization. The construction sector, in particular, is a major consumer, as green building standards and energy efficiency regulations fuel the adoption of advanced insulation materials. The automotive industry also contributes significantly, leveraging polyurethane foams for lightweighting and comfort, which in turn supports fuel efficiency and emission reduction goals. Technological advancements—most notably the adoption of the HPPO (hydrogen peroxide to propylene oxide) process—are transforming the industry by offering higher yields, lower emissions, and reduced waste compared to traditional methods, aligning with global sustainability trends.

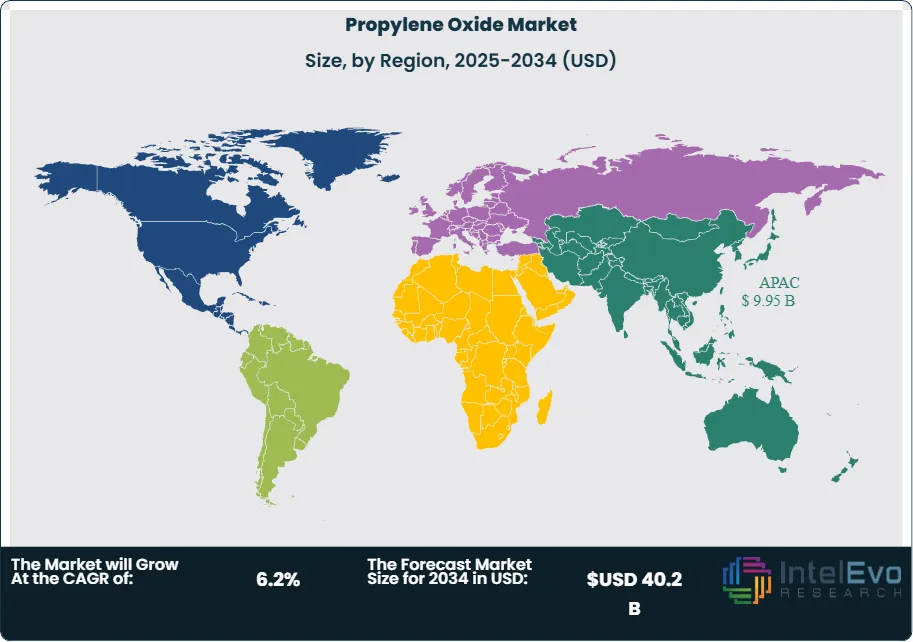

Segmentation of the market is typically based on type (polyether polyols, propylene glycol, glycol ethers, and others), application (construction, automotive, packaging, textiles, electronics, and more), and region (Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa). Polyether polyols dominate the type segment, accounting for over 60% of total propylene oxide consumption, while construction remains the largest application area, followed by automotive and packaging. Regionally, Asia-Pacific leads the market with more than 45% share, propelled by massive investments in infrastructure, manufacturing, and the presence of major polyurethane producers in China, India, and Southeast Asia. North America and Europe maintain significant shares, supported by mature end-use industries and a strong focus on sustainable, regulatory-compliant production technologies. Latin America and the Middle East & Africa are emerging as high-growth regions, driven by infrastructure development and increasing demand for advanced materials.

The COVID-19 pandemic initially posed significant challenges, disrupting global supply chains, halting construction and automotive production, and causing a temporary dip in demand. However, the market demonstrated resilience, rebounding as economic activity resumed and governments prioritized infrastructure and green recovery initiatives. The pandemic also accelerated the adoption of digitalization and automation in chemical manufacturing, improving operational efficiency and supply chain management. Geopolitical factors continue to play a pivotal role in shaping the market landscape. Trade tensions, especially between major economies, can lead to raw material price volatility and impact the cost structure of propylene oxide production. Environmental regulations are becoming increasingly stringent, particularly in Europe and North America, compelling manufacturers to invest in cleaner, more efficient technologies and to adopt circular economy principles. Additionally, regional policies on data localization, cross-border trade, and foreign investment can influence the pace and direction of capacity expansions and technology transfers. As the industry moves forward, the integration of green chemistry, ongoing R&D in bio-based and low-emission technologies, and strategic capacity expansions in high-growth regions are expected to define the next phase of development for the global propylene oxide market.

Key Takeaways

- Market Growth: The market is expected to reach USD 40.2 Billion by 2034, driven by robust demand for polyurethane foams, ongoing technological innovation, and a global shift toward sustainability.

- Type Dominance: Polyether polyols production is the leading segment, accounting for over 60% of total propylene oxide consumption, due to its critical role in manufacturing flexible and rigid polyurethane foams.

- Application Dominance: The construction sector is the largest application area, utilizing polyurethane foams for insulation, sealants, and adhesives, followed by automotive and packaging.

- Drivers: Key growth drivers include the rising need for lightweight, energy-efficient materials, expansion in end-use industries, and advancements in eco-friendly production technologies.

- Restraints: Market growth is challenged by raw material price volatility, stringent environmental regulations, and the high capital investment required for new production facilities.

- Opportunities: The market is poised for expansion through the development of bio-based propylene oxide, adoption of green chemistry, and capacity expansions in emerging economies.

- Trends: Notable trends include the shift toward sustainable production methods, integration of circular economy practices, and increased R&D in bio-based and low-emission technologies.

- Regional Analysis: Asia-Pacific leads with over 45% market share, driven by rapid industrialization and infrastructure growth, while North America and Europe maintain strong positions with a focus on sustainability and advanced manufacturing.

Type Analysis

Polyether Polyols Lead With Over 60% Market Share in Propylene Oxide Consumption, Polyether polyols are the dominant type segment, as they are the primary feedstock for polyurethane foams. These foams are essential for insulation, cushioning, and structural applications in construction, automotive, and furniture industries. The versatility, durability, and energy efficiency of polyether polyols make them indispensable for modern manufacturing.

Propylene glycol is the second-largest segment, widely used as a solvent, humectant, and antifreeze in food, pharmaceuticals, and personal care products. Glycol ethers and other derivatives serve as solvents and intermediates in paints, coatings, cleaning agents, and electronics. The dominance of polyether polyols is expected to continue, supported by ongoing demand for energy-efficient and lightweight materials in both developed and emerging markets.

Application Analysis

Construction Sector Dominates Propylene Oxide Applications, The construction industry is the largest application segment, accounting for over 35% of global demand. Polyurethane foams derived from propylene oxide are extensively used for thermal insulation, soundproofing, sealants, and adhesives in buildings and infrastructure projects. The drive for energy-efficient buildings and green construction standards further accelerates demand.

The automotive sector follows, leveraging polyurethane foams for lightweight components, seating, and interior parts, which help improve fuel efficiency and passenger comfort.

Packaging uses flexible and rigid foams for protective packaging solutions, while textiles and electronics utilize propylene oxide derivatives for fibers, coatings, and insulating materials. The increasing focus on sustainability and energy efficiency across these sectors continues to drive market growth.

Regional Analysis

Asia-Pacific Leads With Over 45% Market Share in Propylene Oxide Market, Asia-Pacific is the dominant region, driven by rapid industrialization, urbanization, and the expansion of end-use industries in China, India, and Southeast Asia. The region benefits from large-scale investments in infrastructure, manufacturing, and construction, as well as the presence of major polyurethane producers.

North America and Europe follow, with mature markets and a strong emphasis on sustainable production technologies and regulatory compliance. These regions are also at the forefront of adopting advanced manufacturing processes and green chemistry solutions.

Latin America and the Middle East & Africa are emerging as growth regions, supported by infrastructure development, increasing demand for advanced materials, and growing manufacturing sectors.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Type:

- Polyether Polyols

- Propylene Glycol

- Glycol Ethers

- Others

Application:

- Construction

- Automotive

- Packaging

- Textiles

- Electronics

- Others

Region:

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 23.47 B |

| Forecast Revenue (2034) | USD 40.2 B |

| CAGR (2025-2034) | 6.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type: (Polyether Polyols, Propylene Glycol, Glycol Ethers, Others), Application: (Construction, Automotive, Packaging, Textiles, Electronics, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Dow Chemical Company, BASF SE, LyondellBasell Industries Holdings B.V., Royal Dutch Shell Plc, Huntsman Corporation, Repsol S.A., Sumitomo Chemical Co. Ltd., SKC Co., Ltd., INEOS Group, AGC Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date