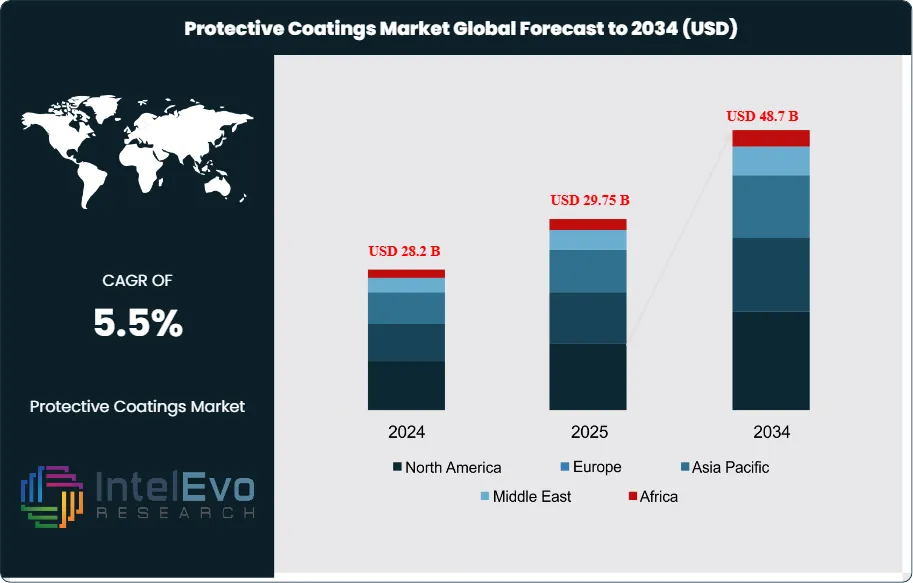

Global Protective Coatings Market to Hit $48.7B by 2034 | CAGR 5.5%

Global Protective Coatings Market Size, Share, Analysis Report By Type (Epoxy Coatings, Polyurethane Coatings, Acrylic Coatings, Alkyd Coatings, Zinc-Rich Coatings, Others), Application (Infrastructure & Construction, Oil & Gas, Marine, Power Generation, Automotive & Aerospace, Manufacturing, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

The Protective Coatings Market size is expected to be worth around USD 48.7 Billion by 2034, up from USD 28.2 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2024 to 2034. The protective coatings market is a dynamic and essential segment within the broader specialty chemicals and materials industry, encompassing advanced formulations designed to safeguard surfaces and structures from corrosion, abrasion, chemicals, UV radiation, and environmental degradation. Protective coatings are critical for extending the lifespan and performance of assets in industries such as oil & gas, marine, infrastructure, automotive, aerospace, power generation, and manufacturing. These coatings leverage innovations in resin chemistry, nanotechnology, and environmentally friendly additives to deliver high-performance solutions that meet increasingly stringent regulatory and sustainability requirements.

Get More Information about this report -

Request Free Sample ReportThe market’s growth is propelled by rising infrastructure investments, the need for asset maintenance and refurbishment, and the adoption of advanced, eco-friendly coating technologies. Integration with digital inspection tools, predictive maintenance systems, and smart coatings is further enhancing the value proposition of protective coatings in modern asset management strategies.

Several factors are driving the expansion and evolution of the protective coatings market. The primary driver is the global emphasis on infrastructure development and asset protection, as governments and private sector players invest in new construction, energy projects, and the maintenance of aging bridges, pipelines, and industrial facilities. The need to minimize downtime, reduce maintenance costs, and comply with environmental regulations is fueling demand for high-performance, long-lasting coatings. Advances in waterborne, powder, and high-solids coatings are enabling manufacturers to reduce volatile organic compound (VOC) emissions and improve worker safety. The growing focus on sustainability and circular economy principles is encouraging the development of coatings with lower environmental impact, longer service life, and easier recyclability. Cost-effectiveness, regulatory compliance, and the ability to deliver tailored solutions for specific end-use environments make protective coatings an attractive investment for asset owners and operators.

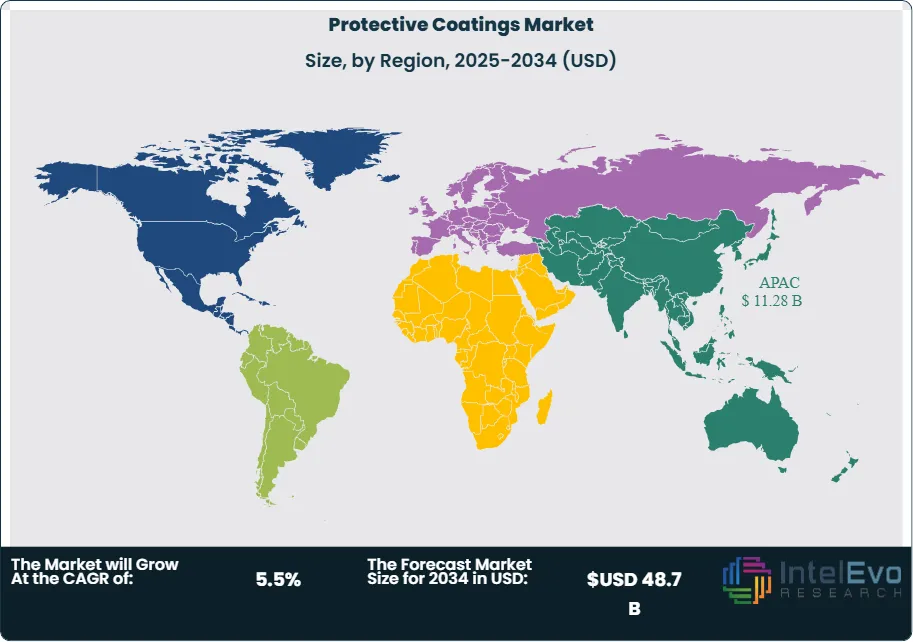

Regionally, the protective coatings market exhibits distinct growth patterns reflecting industrialization, climate conditions, regulatory frameworks, and infrastructure maturity. Asia-Pacific leads the market, accounting for over 40% of global share, driven by rapid urbanization, industrial expansion, and large-scale infrastructure projects in China, India, and Southeast Asia. North America and Europe follow, with mature construction, oil & gas, and transportation sectors, and a strong focus on regulatory compliance and sustainability. Latin America and the Middle East & Africa are emerging as high-growth regions, supported by investments in energy, mining, and infrastructure. The COVID-19 pandemic initially disrupted supply chains and delayed construction and maintenance projects, but the market rebounded as governments prioritized infrastructure stimulus and asset protection. Geopolitical factors, such as trade tensions, raw material price volatility, and evolving environmental regulations, continue to influence market dynamics and investment decisions.

Key Takeaways

- Market Growth: The Protective Coatings Market is expected to reach USD 48.7 Billion by 2034, driven by infrastructure investments, asset maintenance needs, and the adoption of advanced, sustainable coating technologies.

- Type Dominance: Epoxy coatings lead the market, valued for their superior adhesion, chemical resistance, and versatility across industrial and marine applications.

- Application Dominance: The infrastructure and construction sector is the largest application segment, utilizing protective coatings for bridges, highways, buildings, and public works, followed by oil & gas, marine, and power generation.

- Drivers: Key drivers include global infrastructure development, regulatory mandates for corrosion protection and VOC reduction, and the need for long-lasting, high-performance coatings.

- Restraints: Market growth is hindered by raw material price volatility, complex regulatory compliance, and the high cost of advanced coating systems.

- Opportunities: The market is positioned for expansion through the development of smart coatings, bio-based and low-VOC formulations, and increased demand in emerging economies.

- Trends: Notable trends include the shift toward waterborne and powder coatings, integration of digital inspection and predictive maintenance, and the adoption of self-healing and anti-microbial coatings.

- Regional Analysis: Asia-Pacific leads with over 40% market share due to rapid industrialization and infrastructure growth. North America and Europe maintain strong positions with a focus on sustainability and advanced manufacturing.

Type Analysis

Epoxy Coatings Lead With Over 35% Market Share in Protective Coatings: Epoxy coatings are the most dominant type in the protective coatings market, accounting for more than 35% of total market share. Their popularity stems from their outstanding adhesion to a wide variety of substrates, as well as their superior resistance to chemicals, abrasion, and moisture. These properties make epoxy coatings the preferred choice for environments where durability and long-term protection are critical. They are extensively used in industrial settings for coating pipelines, storage tanks, machinery, and equipment, as well as in marine applications for ships, offshore platforms, and port infrastructure. In infrastructure, epoxy coatings are vital for protecting bridges, highways, and concrete structures from corrosion and environmental degradation.

Polyurethane coatings are the next most significant segment, valued for their flexibility, UV resistance, and ability to retain gloss and color over time. These coatings are ideal for applications where both protection and aesthetics are important, such as in the automotive and aerospace industries, as well as for exterior architectural surfaces exposed to sunlight and weathering.

Acrylic, alkyd, zinc-rich, and other specialty coatings address specific needs. Acrylic coatings are known for their fast drying and color retention, making them suitable for decorative and maintenance applications. Alkyd coatings are often used for cost-effective protection in less demanding environments. Zinc-rich coatings are especially important for steel structures, providing sacrificial protection against corrosion. The market is also seeing the rise of hybrid and nanotechnology-enhanced coatings, which combine the strengths of multiple chemistries to deliver improved performance, such as self-healing, anti-microbial, or ultra-durable properties.

Application Analysis

Infrastructure and Construction Sector Dominates Protective Coatings Applications: The infrastructure and construction sector is the largest consumer of protective coatings, accounting for over 30% of global demand. Protective coatings are essential for extending the lifespan of critical infrastructure such as bridges, highways, tunnels, airports, and public buildings. These structures are constantly exposed to harsh weather, pollution, and mechanical stress, making them susceptible to corrosion, cracking, and surface degradation. High-performance coatings provide a barrier against these threats, reducing maintenance costs and ensuring safety and reliability.

In the oil & gas sector, protective coatings are crucial for safeguarding pipelines, storage tanks, refineries, and offshore platforms from aggressive chemicals, saltwater, and extreme temperatures. The failure of protective coatings in this sector can lead to costly leaks, environmental damage, and safety hazards.

Marine applications require coatings that can withstand constant immersion in saltwater, biofouling from marine organisms, and mechanical abrasion from waves and debris. Specialized marine coatings are formulated to resist these challenges, protecting ships, boats, and port infrastructure.

Other significant application areas include power generation (where coatings protect turbines, boilers, and cooling towers), automotive and aerospace (for vehicle bodies, components, and aircraft exteriors), and manufacturing (for machinery, equipment, and production facilities). Each sector has unique performance and regulatory requirements, driving the need for tailored coating solutions.

Regional Analysis

Asia-Pacific Leads With Over 40% Market Share in Protective Coatings Market, Asia-Pacific is the largest and fastest-growing region in the global protective coatings market, holding more than 40% of the total market share. This dominance is driven by rapid urbanization, industrialization, and massive infrastructure investments in countries like China, India, and Southeast Asia. The region is witnessing a surge in construction of bridges, highways, airports, and industrial facilities, all of which require advanced protective coatings to ensure longevity and performance. Additionally, the expansion of manufacturing bases and government initiatives to upgrade public infrastructure and energy security further boost demand.

North America and Europe are mature markets characterized by established construction, oil & gas, and transportation sectors. These regions place a strong emphasis on regulatory compliance, sustainability, and the adoption of advanced manufacturing standards. Stringent environmental regulations in these markets are accelerating the shift toward low-VOC, waterborne, and powder coatings.

Latin America and the Middle East & Africa are emerging as high-growth regions. Investments in energy, mining, and infrastructure projects are increasing, and there is a growing awareness of the importance of asset protection and maintenance. These regions offer significant opportunities for market expansion as industrialization and urbanization continue to progress.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Type

- Epoxy Coatings

- Polyurethane Coatings

- Acrylic Coatings

- Alkyd Coatings

- Zinc-Rich Coatings

- Others

Application

- Infrastructure & Construction

- Oil & Gas

- Marine

- Power Generation

- Automotive & Aerospace

- Manufacturing

- Others

Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 28.2 B |

| Forecast Revenue (2034) | USD 48.7 B |

| CAGR (2024-2034) | 5.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Epoxy Coatings, Polyurethane Coatings, Acrylic Coatings, Alkyd Coatings, Zinc-Rich Coatings, Others), Application (Infrastructure & Construction, Oil & Gas, Marine, Power Generation, Automotive & Aerospace, Manufacturing, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sherwin-Williams , PPG Industries , AkzoNobel , Nippon Paint , Axalta Coating Systems , BASF , Jotun , RPM International , Kansai Paint , Hempel |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date