Pushbutton Industrial Wireless Remote Control Market Size | 12.6% CAGR

Global Pushbutton Industrial Wireless Remote Control Market Size, Share & Analysis By Type (Handheld, Stationary), By Application (Industry & Logistics, Construction Crane, Mobile Hydraulics, Forestry, Mining), Industrial Safety Regulations, Automation Trends & Forecast 2025–2034

Report Overview

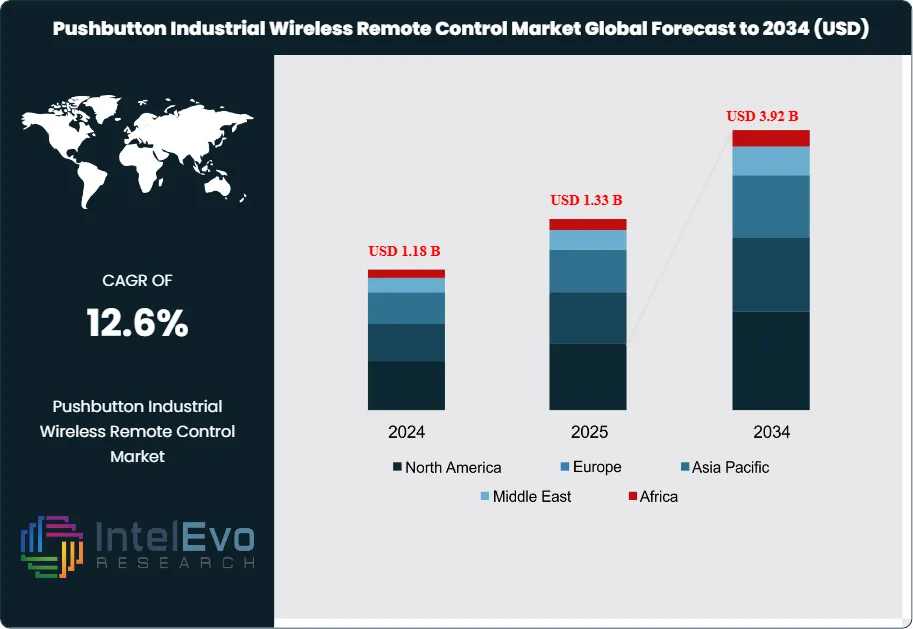

The Pushbutton Industrial Wireless Remote Control Market is valued at approximately USD 1.18 billion in 2024 and is projected to reach nearly USD 3.92 billion by 2034, expanding at a CAGR of around 12.6% during 2025–2034. Demand is accelerating as factories, ports, warehouses, and construction sites adopt wireless control systems to enhance operator safety, mobility, and equipment efficiency. Continuous shifts toward Industry 4.0, predictive maintenance, and real-time telemetry are further driving adoption. With rising automation investments and labor-safety regulations, wireless remotes are evolving from optional upgrades to mission-critical components across global industrial operations.

Get More Information about this report -

Request Free Sample ReportModern wireless remotes now integrate diagnostics, anti-interference FHSS, and secure OTA updates—transforming traditional cranes and hoists into smart, connected assets. The next decade will see rapid penetration across APAC and Europe as industries prioritize ergonomics, uptime, and digital-ready hardware. The segment is emerging as a key enabler of safe, efficient, and future-proof industrial environments.

This trajectory reflects a steady shift from wired pendants and manual controls toward untethered, operator-centric interfaces that raise throughput, enhance safety, and trim lifecycle costs. Historically, adoption accelerated alongside factory automation and modern material-handling upgrades; in the last three years, demand has benefited from labor scarcity, stricter safety expectations, and the retrofit cycle in cranes, hoists, and mobile plant. On current estimates, more than half of new crane control packages specified for brownfield projects now include wireless options, and retrofit kits account for a rising share of unit volumes as operators seek faster payback (typically 12–24 months depending on utilization).

Growth is underpinned by clear demand-side advantages—reduced operator fatigue, faster line changeovers, and safer standoff distances—and supply-side improvements in RF reliability and battery endurance. Contemporary systems deploy frequency-hopping spread spectrum in crowded 2.4 GHz/915 MHz bands, add dual-processor architectures with redundant emergency-stop, and meet functional-safety targets (e.g., SIL2/PLd) that are increasingly referenced in procurement. Digitalization is reshaping the category: OEMs are embedding diagnostics and usage telemetry for condition-based maintenance; secure over-the-air updates shorten service windows; and gateways that natively speak PROFINET, EtherNet/IP, and CANopen simplify integration. Early AI features, such as anomaly detection on signal quality or operator behavior, are emerging, with pilot programs indicating double-digit reductions in nuisance stops.

Headwinds include spectrum congestion in dense industrial parks, cybersecurity expectations (AES-level encryption and certificate management are becoming table stakes), and interoperability gaps across multi-brand fleets. Hardware input inflation and RF component lead-times, while easing, remain a planning risk; in cyclical end markets (construction, mining), capex deferrals can compress order intake quarter-to-quarter.

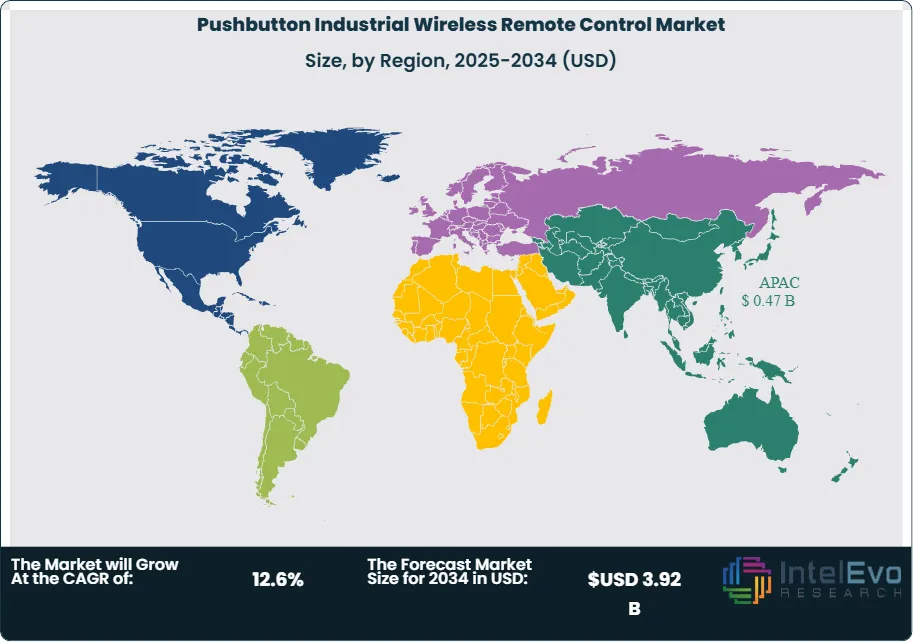

Regionally, Asia-Pacific is the volume engine—supported by warehouse automation and port investments—and is expected to contribute ~48% of incremental demand through 2032. Europe remains a high-specification market where stringent machinery safety norms sustain premium ASPs, while North America’s retrofit wave in overhead cranes and intralogistics facilities keeps growth resilient. Investment hotspots include e-commerce fulfillment, metals handling, shipyards, and modular construction yards—segments where wireless pushbutton controls consistently deliver measurable productivity and safety gains, reinforcing the market’s double-digit growth runway.

Key Takeaways

- Market Growth: The global Pushbutton Industrial Wireless Remote Control market was valued at USD 1.18 billion in 2024 and is projected to reach USD 3.92 billion by 2034 at a CAGR of 12.6% (2025–2034), propelled by factory automation, safety compliance, and labor-scarcity driven retrofits.

- Application: Cranes & hoists lead with ~45% revenue in 2024, underpinned by high retrofit activity in overhead traveling cranes and gantries where wireless control lifts throughput 8–15% and extends safe standoff distances; mobile hydraulics and lifting platforms are the next largest use cases.

- Sales Channel: Aftermarket/retrofit accounts for ~55% of unit shipments, as brownfield facilities prioritize quick-payback upgrades; typical ROI is 12–24 months depending on utilization and shift patterns, outpacing new-build OEM cycles.

- Technology: 2.4 GHz FHSS systems hold ~50% share, favored for global license-free operation and robust coexistence, while 868/915 MHz platforms capture ~30% on regional compliance and extended range; safety-rated architectures (PLd/SIL2) are increasingly standard in EU and North America bids.

- Driver: Demonstrable productivity and safety gains—faster changeovers and fewer near-misses—are accelerating adoption; facilities report 5–10% reduction in unplanned stops after migrating from wired pendants, alongside lower operator fatigue and maintenance.

- Restraint: RF congestion and cybersecurity demands raise TCO; interference in dense industrial parks and stricter encryption/certificate management can add 5–7% to deployment costs and lengthen qualification cycles for multi-brand fleets.

- Opportunity: Asia-Pacific intralogistics, ports, and e-commerce fulfillment are set to outgrow the market at ~13–14% CAGR, adding an estimated ~USD 875 million in incremental value through 2032; greenfield warehouse builds and port electrification amplify demand for rugged, IP-rated pushbutton sets.

- Trend: Digitalized remotes with telemetry, OTA updates, and multi-protocol gateways (PROFINET/EtherNet-IP/CANopen) are scaling; shipments of telemetry-enabled models are expected to exceed 40% by 2027, with early AI analytics reducing nuisance trips and service calls by double digits.

- Regional Analysis: Asia-Pacific leads with ~40% of 2024 revenues and ~48% of incremental growth to 2032; Europe maintains premium ASPs driven by stringent machinery safety norms, while North America benefits from a robust retrofit wave in metals handling and 3PL warehouses; Latin America and MEA expand from a smaller base at ~12%+ CAGR on construction and mining capex.

Type Analysis

Handheld and stationary pushbutton wireless remotes address different operational profiles, and together they underpin a market estimated at roughly USD 1.33 billion in 2025, on a double-digit growth trajectory toward 2032. Stationary systems (wall- or pedestal-mounted) continue to command the larger revenue share (~58% in 2025), benefiting from simple architectures, low installation complexity, and suitability for environments where wiring retrofits are impractical (e.g., grain handling, fixed conveyors, lighting/PLC actuation). Their higher average selling prices (ASPs) and safety-rated options (PLd/SIL2) sustain value, particularly in regulated facilities.

Handheld units, while smaller in revenue (~42%), lead on volumes (≈65% of shipments) as operators prioritize mobility, clear lines of sight, and safer standoff distances for cranes, hoists, and mobile plant. Increasing ruggedization (IP65/67), extended battery life, and frequency-hopping spread spectrum at 2.4 GHz/915 MHz have expanded use cases; consequently, handheld devices are growing faster (~13–14% CAGR through 2030) versus ~9% for stationary. Leading vendors—including HBC-radiomatic, Autec, Tele Radio, Hetronic, and Magnetek—are integrating diagnostics and multi-protocol gateways to narrow the ASP gap while elevating functionality.

Application Analysis

Construction crane deployments remain the single largest application, accounting for an estimated ~43% of 2025 revenues, driven by retrofits on overhead traveling cranes and gantries where wireless control improves load positioning and reduces hook time. Sites report 8–15% throughput uplift and fewer near-miss incidents after migrating from wired pendants, reinforcing premium adoption of dual-processor E-stop and redundant RF architectures. OEM fitment rates continue to rise, with telemetry-enabled crane remotes projected to surpass 40% of shipments by 2027.

Industry & logistics is the fastest-growing application cluster (~14% CAGR, 2025–2030), supported by e-commerce fulfillment, automated storage/retrieval systems, and cross-dock modernization. Wireless pushbuttons accelerate changeovers, gate management, and line starts/stops while minimizing cabling downtime, producing 5–10% reductions in unplanned stops in brownfield plants. Mobile and mining applications contribute ~22% of 2025 revenues; despite cyclical capex, demand is buoyed by safety mandates in surface mining, IP67 enclosures, and intrinsically safe options for energy and aggregates.

End-Use Analysis

Adoption is concentrated in manufacturing and warehousing, which collectively represent ~52% of market revenues in 2025 as facilities digitize material handling, assembly cells, and intralogistics flows. Rapid payback—typically 12–24 months—and interoperability with PROFINET, EtherNet/IP, and CANopen strengthen the business case for multi-shift operations.

Construction and infrastructure account for roughly ~28%, with project-based demand tied to tower/portal cranes, precast yards, and modular construction sites where wireless controls mitigate line-of-sight risks and reduce spotter labor. Mining, energy, and utilities contribute ~15%, prioritizing high-reliability links, fall-back channels, and extended-range handhelds for winches, drills, and hydraulics; here, uptime and functional safety credentials outweigh ASP sensitivity. The remaining share spans agriculture, shipyards, and municipal services.

Regional Analysis

Asia Pacific leads on scale, capturing ~40% of 2025 revenues and an outsize share of incremental demand through 2032, propelled by warehouse automation in China, India, and Southeast Asia, as well as port electrification and metals handling. Localized manufacturing and competitive pricing accelerate upgrades across mid-tier facilities, pushing APAC growth into the ~13–14% CAGR range.

North America holds ~34% with robust retrofit cycles in overhead cranes, 3PL hubs, and metals fabrication; cybersecurity baselines (AES-class encryption, certificate management) and safety specifications sustain premium ASPs. Europe accounts for ~21%, with steady replacements under stringent machinery safety norms and early adoption of telemetry/OTA capabilities. Latin America and the Middle East & Africa remain smaller but rising (combined ~5%), supported by construction, mining, and energy projects; here, rugged IP-rated handhelds and simplified commissioning are key differentiators for vendors expanding channel reach.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments:

By Type

- Handheld

- Stationary

By Application

- Industry & Logistics

- Construction Crane

- Mobile Hydraulics

- Forestry

- Mining

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 1.18 B |

| Forecast Revenue (2034) | USD 3.92 B |

| CAGR (2024-2034) | 12.6% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Handheld, Stationary), By Application (Industry & Logistics, Construction Crane, Mobile Hydraulics, Forestry, Mining) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tele Radio, Hetronic, NBB Controls+Components GmbH, AUTEC, HBC Radiomatic GmbH, SCANRECO, Omex Control Systems ULC, Danfoss, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Pushbutton Industrial Wireless Remote Control Market

Published Date : 26 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date