Quantum Cryptography Market Size | 29.8% CAGR Forecast

Global Quantum Cryptography Market Size, Share & Analysis By Component (Hardware, Software), By Technology (QKD, Post-Quantum Cryptography), By Application (Defense, BFSI, Telecom), By End-User Industry Outlook, Cybersecurity Trends & Forecast 2025–2034

Report Overview

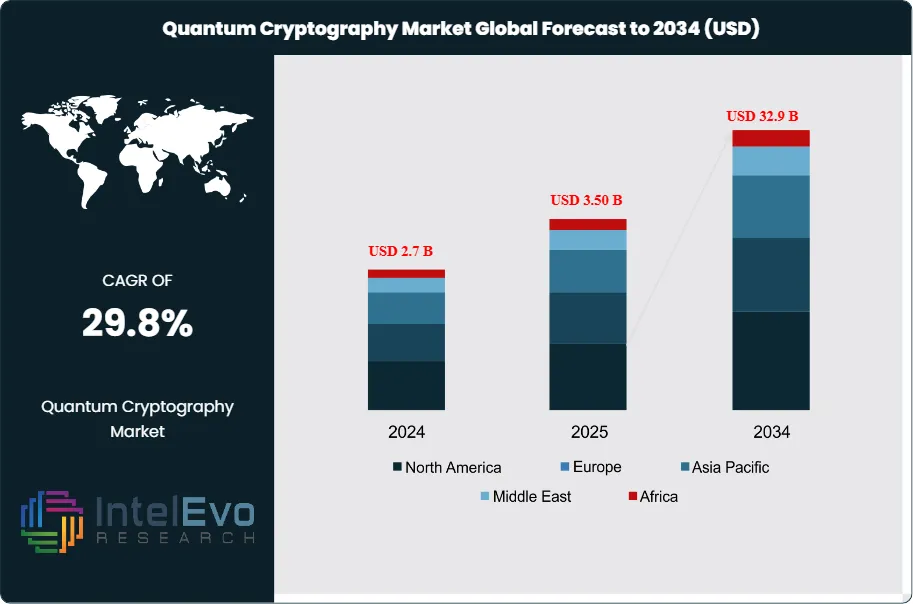

The Quantum Cryptography Market is valued at approximately USD 2.7 billion in 2024 and is projected to reach nearly USD 32.9 billion by 2034, expanding at a powerful CAGR of about 29.8% from 2025–2034. Growth is accelerating as governments, telecom operators, financial institutions, and defense agencies race to safeguard critical infrastructure from quantum-era cyber threats. With quantum key distribution (QKD) networks, satellite-based quantum communication, and post-quantum encryption gaining momentum, enterprises are investing heavily in next-gen cybersecurity frameworks. As national quantum initiatives scale across the U.S., EU, China, India, and Japan, quantum cryptography continues trending across cybersecurity, telecom, and deep-tech innovation platforms.

Get More Information about this report -

Request Free Sample ReportMarket scale is shifting from R&D pilots to early commercial rollouts as governments, telecom operators, banks, and critical infrastructure providers harden networks against “harvest now, decrypt later” risks. The current trajectory represents a >16× expansion over the forecast window, underpinned by accelerating procurement of quantum key distribution (QKD) systems, quantum-safe key management, and integration services that retrofit existing optical and IP networks. Demand is amplified by cloud migration and the surge in machine-to-machine traffic; in parallel, vendors are lowering total cost of ownership via turnkey appliances, managed QKD links, and satellite-enabled key delivery for long-haul use cases.

Multiple demand- and supply-side forces are at play. On the demand side, 81% of enterprises acknowledge material business impact if today’s cryptography were compromised, and 53% of security leaders expect quantum computers to break current public-key schemes within a decade—statistics that are catalyzing budget allocation for quantum-safe roadmaps. Adoption intent is likewise rising: 66% of organizations plan to implement quantum-safe controls by 2030, positioning 2026–2030 as a pivotal deployment phase. On the supply side, ecosystem maturation is visible in public listings and venture flows; for example, satellite-based quantum encryption players have attracted billion-dollar valuations, while public funding such as the U.S. Department of Energy’s USD 74 million grant in 2022 is accelerating testbeds, interoperability, and standards work.

Technological innovation is broadening addressable markets. Commercial offerings span discrete-variable and continuous-variable QKD, measurement-device-independent topologies that mitigate side-channel attacks, photonic integrated circuits that shrink costs, and quantum-secure network orchestration that automates key rotation across multi-vendor environments. Importantly, quantum cryptography is converging with post-quantum cryptography (PQC), enabling hybrid cryptographic stacks that blend QKD-derived keys with NIST-aligned algorithms for defense-in-depth and regulatory compliance.

Regionally, China leads on patenting activity with >4,000 filings and continues to scale metro-to-metro quantum backbones; the United States and Europe anchor standards, procurement, and defense-grade pilots; and Japan, South Korea, and Canada are advancing carrier-grade trials. Investment hotspots to watch include cross-border financial corridors, sovereign and defense networks, subsea landing stations, and cloud edge locations where cryptographic agility, automated key provisioning, and guaranteed low latency are mission-critical.

Key Takeaways

- Market Growth: The global Quantum Cryptography market is projected to reach USD 32.9 billion by 2034, expanding from roughly USD 2.7 billion in 2024 at a CAGR of 29.8% (2025–2034), propelled by “harvest-now-decrypt-later” risk mitigation, cloud proliferation, and critical-infrastructure modernization.

- Component: Hardware (QKD systems) led in 2023 with ~60.3% revenue share, reflecting capex on single-photon sources, detectors, and trusted nodes; accelerating adoption of photonic integrated circuits is compressing cost-per-kilometer and favoring turnkey deployments by vendors such as Toshiba, ID Quantique, and Thales.

- Application: Network security accounted for >53% of 2023 revenues as telecom backbones, financial exchanges, and sovereign networks prioritize quantum-grade key distribution for high-throughput links and low-latency trading corridors, outpacing endpoint and storage encryption use cases.

- Driver: Enterprise urgency is rising—81% of organizations anticipate medium–high business impact if current crypto is broken, and 66% plan to adopt quantum-safe controls by 2030—shifting pilots to funded roadmaps and multi-year migration programs across BFSI, defense, and healthcare.

- Restraint: High initial TCO and physics-driven range limits (typical fiber QKD spans ~100–200 km without trusted nodes) slow wide-area rollouts; interoperability and skills gaps add integration risk, elongating procurement cycles in cost-sensitive sectors.

- Opportunity: Hybrid QKD + post-quantum cryptography (PQC) architectures for cross-border financial messaging, subsea landing stations, and cloud interconnects represent the fastest-growing solution stack, with managed quantum-secure services expected to outpace overall market growth through 2030.

- Trend: Ecosystem momentum is accelerating via commercialization and public funding: the U.S. Department of Energy’s USD 74 million (2022) catalyzed testbeds, while satellite-based key delivery (e.g., Arqit) expands intercity and international coverage; 53% of cybersecurity leaders expect quantum computers to break today’s public-key schemes within 10 years, reinforcing near-term hybrid deployments.

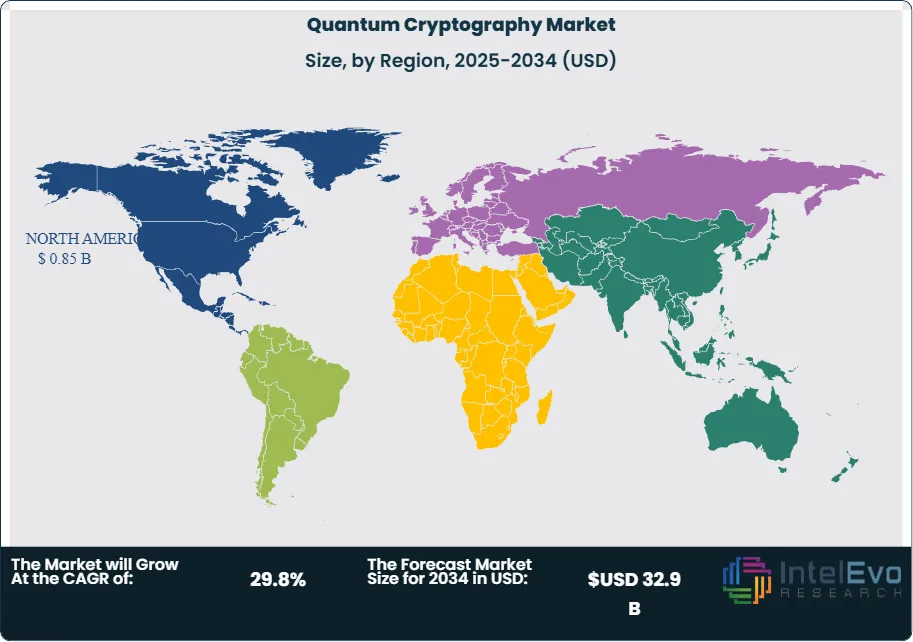

- Regional Analysis: North America led with ~31.6% share in 2023 on the back of robust R&D, defense procurement, and early carrier trials; China commands technology influence with >4,000 quantum-cryptography patent filings and expanding metro backbones; Europe advances standards and cross-border pilots, while Asia Pacific (ex-China) is the fastest-growing investment theater as Japan and South Korea scale carrier-grade trials and governments fund quantum-secure national networks.

Component Analysis

Hardware remains the economic anchor of quantum cryptography in 2025, underpinned by carrier-grade quantum key distribution (QKD) links, single-photon sources/detectors, and trusted-node infrastructure. After accounting for ~60.3% of revenue in 2023, hardware is projected to retain the lead through 2028 as operators expand metro rings and inter-data-center routes; capex is supported by sovereign programs and telecom modernization budgets. Cost curves are improving as photonic integrated circuits and compact QKD modules reduce footprint and power consumption, widening applicability from defense corridors to financial exchanges and cloud interconnects.

Software is the faster-growing layer as deployments scale from trials to production. Platforms for quantum-secure key orchestration, entropy management, policy automation, and hybrid QKD + post-quantum cryptography (PQC) stacks are forecast to outpace overall market CAGR (32.1% to 2033). Vendors increasingly monetize via subscriptions and managed services, integrating with KMIP/HSMs, SD-WAN, and zero-trust architectures to deliver cryptographic agility and lifecycle governance across heterogeneous networks.

Application Analysis

Network security remains the primary revenue pool, having contributed >53% of market value in 2023 and sustaining momentum in 2025 as “harvest-now, decrypt-later” risks elevate spend on key exchange for backbone, subsea landing, and cross-border corridors. Large banks, market infrastructure operators, and national CERTs are prioritizing quantum-secure links for low-latency trading, payments clearing, satellite backhaul, and mission-critical telemetry.

Database encryption and application security are emerging as the next wave as organizations harden data-at-rest and workload-to-workload communications. Adoption is catalyzed by cryptographic-agility mandates and rising compliance pressure; enterprises pilot deterministic key rotation and QKD-seeded secrets for HSMs, vaults, and microservices. Hybrid deployments that pair PQC at the application layer with QKD-derived keys for transport are set to expand addressable spend, particularly in regulated sectors and multi-cloud estates.

End-User

Government and defense continue to anchor demand—after capturing ~36% share in 2023—driven by secure command-and-control, diplomatic channels, and protection of critical infrastructure. Funding pipelines and multi-year procurement schedules in 2025 emphasize national quantum networks, red/black separation for classified domains, and interoperability testbeds; public grants (e.g., multi-tens-of-millions-dollar programs) de-risk early deployments.

BFSI is the fastest-commercializing private vertical as central banks, custodians, and exchanges pilot quantum-secure corridors for payments, CBDC experiments, and market data dissemination. Healthcare and life sciences prioritize protection of genomic and clinical data, while IT & telecom operators scale pilot footprints into metro clusters, offering quantum-secure services to enterprises. Aerospace and high-reliability industries explore satellite-assisted key delivery for beyond-line-of-sight links, creating niche but high-value use cases.

Regional Analysis

North America retains a leadership position into 2025—building on ~31.6% share in 2023—supported by deep R&D ecosystems, defense-led demand, and early carrier trials across Tier-1 operators. Regulatory scrutiny around critical-infrastructure resilience and data-sovereignty is accelerating production networks that combine QKD with PQC, with growth concentrated in the U.S. Northeast financial corridor and U.S.–Canada cross-border routes.

Europe advances rapidly on the back of EU-backed quantum communication initiatives and GDPR-aligned security mandates, with Germany, France, the Netherlands, and the Nordics standing out for cross-border pilots. Asia Pacific is the most dynamic growth theatre: China scales metro-to-metro backbones and leads in cumulative quantum-security patent filings, while Japan and South Korea progress carrier-grade trials and supply-chain partnerships. Latin America and the Middle East & Africa are earlier in adoption but show rising interest in sovereign networks, energy corridor protection, and secure satellite backhaul—opportunities likely to translate into double-digit regional CAGRs as financing and vendor ecosystems mature.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Hardware

- Software

By Application

- Network Security

- Database Encryption

- Application Security

By End-User

- Government and Defense

- BFSI

- Healthcare

- IT and Telecommunication

- Aerospace and Defense

- Other End-users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 2.7 B |

| Forecast Revenue (2034) | USD 32.9 B |

| CAGR (2024-2034) | 29.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Hardware, Software), By Application (Network Security, Database Encryption, Application Security), By End-User (Government and Defense, BFSI, Healthcare, IT and Telecommunication, Aerospace and Defense, Other End-users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Toshiba Corporation, Infineon Technologies AG, MagiQ Technologies (acquired by Raytheon Technologies Corporation), Qubitekk, Anhui Qasky Quantum Technology Co. Ltd., Microsoft Corp., NEC Corp., QuantumCTek Co., Ltd., ID Quantique, QuintessenceLabs, PQ Solutions, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date