Radiotherapy-Induced Nausea Treatment Market Size | 7.1% CAGR

Global Radiotherapy-Induced Nausea and Vomiting Treatment Market Size, Share & Clinical Outlook By Drug Class (5-HT3 Antagonists, NK1 Receptor Antagonists, Corticosteroids), By Indication (Cancer Type, Radiation Dose), By Route of Administration, By End User (Hospitals, Oncology Centers), Regional Analysis, Key Players, Treatment Advances, Market Dynamics & Forecast 2025–2034

Report Overview

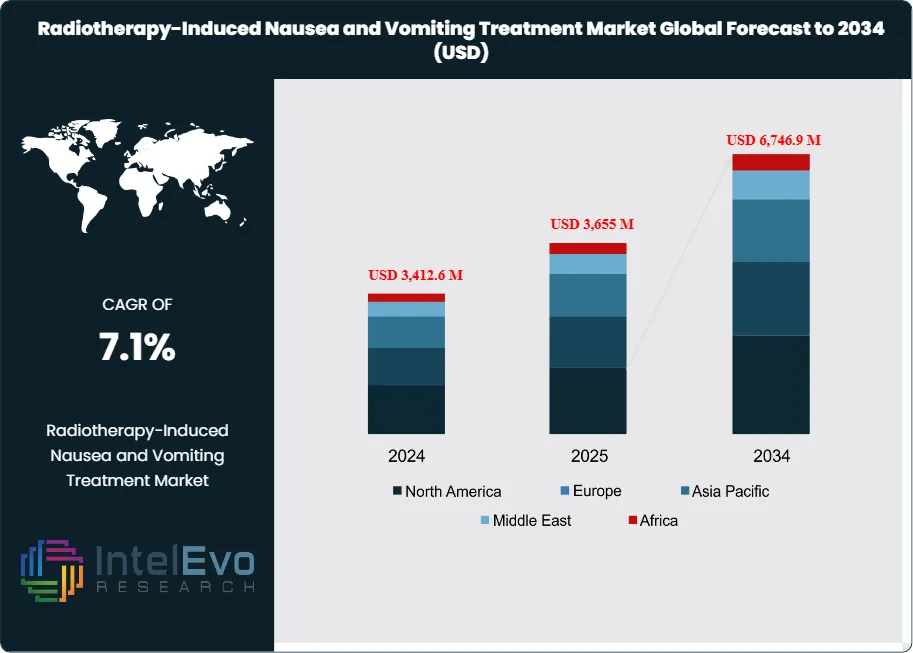

The Radiotherapy-Induced Nausea and Vomiting (RINV) Treatment Market is estimated at USD 3,412.6 million in 2024 and is projected to reach approximately USD 6,746.9 million by 2034, registering a CAGR of about 7.1% during 2025–2034. Growth is supported by rising global cancer incidence, longer radiation therapy courses, and expanding use of supportive care medications to improve treatment adherence and patient quality of life.

Get More Information about this report -

Request Free Sample ReportAlthough cancer treatment outcomes have improved significantly, managing radiation-induced nausea and vomiting remains a persistent clinical challenge. Radiotherapy targeting sensitive regions such as the brain, abdomen, gastrointestinal tract, and liver continues to trigger nausea in a substantial portion of patients, with studies indicating that over 40% experience moderate to severe symptoms. While typically less acute than chemotherapy-related effects, radiation-associated nausea still negatively affects patient well-being and tolerance to prolonged treatment regimens.

Radiation therapy protocols often span six to eight weeks, sometimes involving up to 40 treatment sessions, which can lead to cumulative discomfort and persistent gastrointestinal symptoms. In severe cases, nausea and vomiting contribute to delayed sessions, dose interruptions, or early discontinuation of therapy. Clinical research suggests that nearly one-third of patients undergoing radiation experience symptoms significant enough to disrupt treatment continuity, underscoring the importance of effective prophylactic and on-demand antiemetic strategies.

The expanding cancer burden is a major structural driver of market growth. Nearly 20 million new cancer cases were reported globally in 2022, with incidence expected to rise further as populations’ age, particularly across Asia and Europe. In response, pharmaceutical manufacturers are accelerating the development of targeted antiemetic therapies originally designed for chemotherapy-induced nausea, extending their use into radiation-specific settings. However, reimbursement restrictions and prescribing guidelines in countries such as Germany and France continue to limit access to newer agents, resulting in uneven adoption across regions.

Innovation in drug formulation and delivery is reshaping treatment preferences. Rapid-dissolving oral films, extended-release injectables, and combination antiemetic regimens are gaining traction due to improved patient compliance and ease of administration. At the same time, advances in radiation planning—supported by automation and artificial intelligence—enable clinicians to better predict toxicity risk and personalize preventive care. Despite demonstrated benefits, these technologies remain unevenly implemented due to cost, infrastructure, and regulatory barriers.

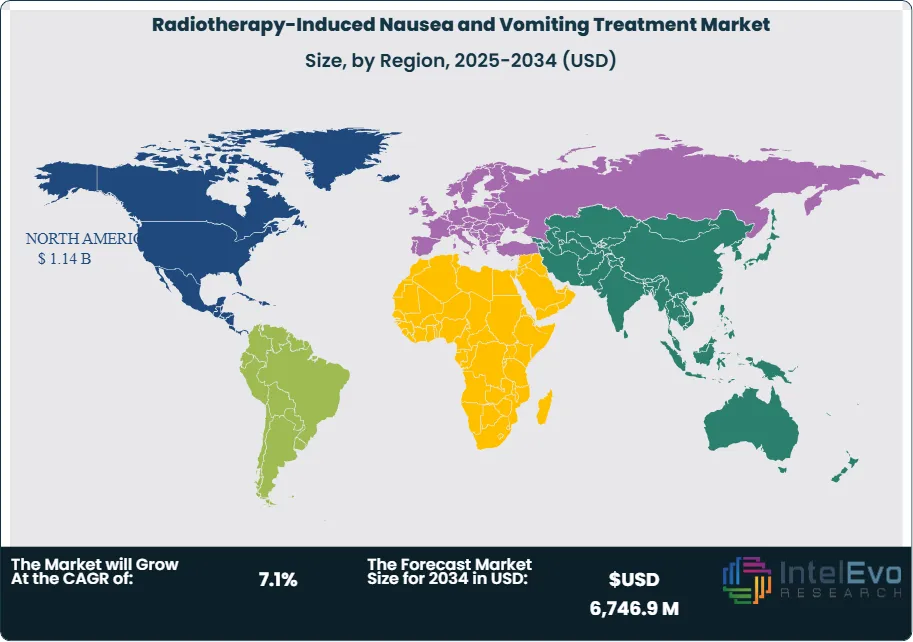

Regionally, North America remains the leading market, driven by early adoption of novel therapies, strong oncology research funding, and advanced radiation infrastructure. The United States alone accounted for over 38% of global revenue in the most recent year. Meanwhile, Southeast Asia and the Middle East are emerging as high-growth regions, supported by expanding healthcare investment and wider installation of modern radiotherapy systems. As cancer care increasingly shifts toward integrated treatment pathways that combine radiation therapy with proactive symptom management, demand for RINV treatments is expected to strengthen steadily over the next decade, improving patient outcomes while reducing system-level costs.

Key Takeaways

- Market Growth: The global Radiotherapy-Induced Nausea and Vomiting Treatment market reached USD 3,412.6 million in 2024 and is expected to hit USD 6,746.9 million by 2034, registering a CAGR of 7.1%. Rising global cancer incidence and prolonged radiotherapy regimens are key demand drivers.

- Treatment Type: Prophylactic treatments led the market with a 71.4% share in 2023. Preventive administration is preferred in clinical protocols to reduce acute episodes and improve treatment adherence.

- Drug Class: 5-HT3 receptor antagonists accounted for 53.7% of global market share in 2023. Their clinical safety profile and effectiveness in managing acute nausea position them as the first-line treatment.

- Distribution Channel: Hospital pharmacies held over 53.7% market share in 2023. Centralized procurement, higher patient volume, and institutional trust contribute to their dominance.

- Patient Demographic: Adults made up more than 68.3% of treatment demand in 2023. This is linked to higher radiotherapy rates in adult oncology, especially among those aged 50 and above.

- Driver: Rising cancer prevalence is a primary growth factor. Over 19.9 million new cancer cases were reported in 2022, increasing the need for supportive therapies during radiation cycles.

- Restraint: Adverse effects from antiemetic drugs, including constipation and headaches, reduce patient compliance. This challenge may limit broader adoption despite clinical necessity.

- Opportunity: NK1 receptor antagonists are gaining traction. Their ability to reduce delayed-phase symptoms and improve patient quality of life positions this class for accelerated uptake through 2034.

- Trend: Manufacturers are developing long-acting and fast-dissolving formulations to enhance compliance. Companies are investing in oral thin films and injectables that align with outpatient care models.

- Regional Analysis: North America led with USD 1,140.9 million in revenue in 2023, driven by structured oncology protocols and high per capita healthcare spending. Asia-Pacific is the fastest-growing region, supported by expanding cancer screening programs and increased access to radiation infrastructure.

Treatment Type

By 2025, preventing nausea and vomiting during radiation therapy remains the primary approach - holding more than 71% of the worldwide market. Doctors favor this method because it works well also increasingly include it in standard care plans. Treatments given before radiation - often a simple step - help patients feel better by lessening sickness. Because of this, people are more likely to continue their care as planned. Hospitals now focus on starting these helpful treatments, following advice from experts worldwide who believe preventing problems is superior to just dealing with them when they arise.

When prevention fails - especially for those most vulnerable or on strong medication - treatments to handle sudden flare-ups become vital, yet they represent a less significant share of overall healthcare spending. Though used somewhat rarely, people still need these treatments - particularly where standard preventatives aren’t readily available. Better emergency medications, ones that work quickly alongside minimal drawbacks, might broaden their application among groups at higher risk.

Drug Class

By 2025, medications blocking the 5-HT3 receptor still led the way - over half the market at 53.7%. They kept that position because they reliably eased sudden sickness, particularly alongside radiation treatment for the belly or head. Ondansetron, granisetron, and similar drugs stayed the go-to initial choice thanks to their track record of being safe and approved worldwide.

Interest grows in drugs blocking the NK1 receptor, especially when used alongside others. They really help with lingering sickness - doctors suggest them more often for radiation therapy causing significant nausea. Steroids boost treatment when paired with other drugs, however extended use brings unwanted consequences. While not widespread, benzodiazepines still have a place – they help ease anxiety for those facing lengthy radiation.

Distribution Channel

By 2025, hospital pharmacies controlled more than half - 53.7% - of medicine distribution, largely because medicines were managed from one place plus cancer units needed drugs fast. Treatment facilities liked using hospitals for medications since everything worked together, allowing nurses to give drugs right away alongside radiation therapy.

Neighborhood drugstores remain vital for many people getting healthcare outside of hospitals - especially where checkups happen often. Getting repeat prescriptions filled is simple there, so they’ve held steady. Meanwhile, internet pharmacies are gaining traction as more folks turn to them. Folks are increasingly dealing with medication issues themselves, so buying supplies online - with shipping right to their door - is becoming a big deal. Expect this trend to keep climbing, likely by more than 7% each year until 2030, particularly in cities throughout Asia-Pacific but also North America.

Patient Demographics

Most people getting RINV treatment are adults - over 68% as of 2025. Grown-ups simply get more solid tumor cancers, alongside regular radiation therapy when they turn fifty. Because treatments can be lengthy and strong for them, managing nausea becomes especially important.

Though children’s healthcare represents just over 30 percent of the overall market, it’s slowly getting bigger. Better cancer treatments for kids alongside a greater focus on how they feel during those treatments mean more doctors are using support therapies – things like nausea medicine made specifically for them. Companies are now making medicines that taste better or dissolve easily, helping young people actually take their prescriptions.

Regional

In 2025, North America dominated the worldwide RINV treatment landscape - its value surpassing $1.14 billion. This position stems from strong cancer screenings, readily available radiation therapy centers, alongside substantial health care investment. Furthermore, leading drug companies based in the U.S. fuel both cutting-edge development and broader access to treatments that combat nausea.

Across Europe, a large portion of the market remains strong, bolstered by government support for healthcare alongside well-organized approaches to cancer treatment. For instance, Germany and France actively encourage using medicines to prevent nausea - particularly when treatments carry higher risks.

The Asia Pacific area expands quickest - expect growth exceeding ten percent yearly until 2030. Because cancer treatment centers improve in China, India, moreover Japan, people increasingly seek ways to manage radiation therapy’s unpleasant results, boosting needs for medication that helps with nausea. Across Latin America, also the Middle East plus Africa, the market is growing at a reasonable pace. Healthcare changes supported by governments, alongside greater opportunities to receive cancer care, slowly mean more people in city hospitals can get RINV treatments.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Treatment Type

- Prophylactic Treatment

- Rescue Treatment

Drug Class

- 5-HT3 Receptor Antagonists

- NK1 Receptor Antagonists

- Corticosteroids

- Benzodiazepines

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Patient Demographics

- Adults

- Pediatrics

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3,412.6 M |

| Forecast Revenue (2034) | USD 6,746.9 M |

| CAGR (2024-2034) | 7.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Treatment Type (Prophylactic Treatment, Rescue Treatment), Drug Class (5-HT3 Receptor Antagonists, NK1 Receptor Antagonists, Corticosteroids, Benzodiazepines), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), Patient Demographics (Adults, Pediatrics) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Fresenius Kabi AG, CinnaGen Co., TESARO (a GSK company), Amgen Inc., Kyowa Kirin Co. Ltd., Mylan N.V., Heron Therapeutics Inc., Baxter International Inc., Merck & Co. Inc., Helsinn Healthcare SA |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Radiotherapy-Induced Nausea and Vomiting Treatment Market

Published Date : 22 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date