Ready-to-Cook Food Market Size, Growth & Forecast | 8.7% CAGR

Global Ready-to-Cook (RTC) Food Market Size, Share & Analysis By Type (Frozen Foods, Instant Noodles, Instant Pasta, Instant Soup, Ready-To-Mix, Others), By Packaging (Boxes, Bags, Pouches, Cans, Trays, Others), By End-User (Households, Food Service Industry, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others), Urbanization Impact, Convenience Food Trends, Regional Consumption & Forecast 2025–2034

Report Overview

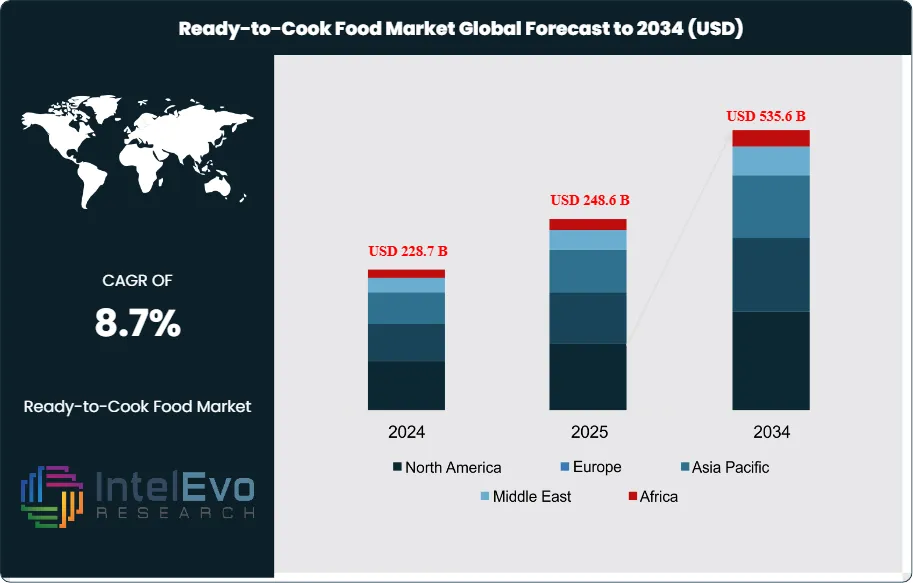

The Ready-to-Cook (RTC) Food Market size is expected to be worth around USD 535.6 billion by 2034, from USD 228.7 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. This is set for strong growth as consumers increasingly seek convenient meal options that offer speed, flavor, and quality. This growth highlights a change in eating habits driven by rising urbanization, busy lifestyles, more dual-income households, and greater acceptance of premium frozen and chilled products. Modern retail, e-commerce, and quick-commerce platforms have also increased the availability of RTC foods, making them accessible to households in both developed and emerging markets.

Get More Information about this report -

Request Free Sample ReportThe market includes a wide range of products that meet various consumer needs. Frozen ready-to-cook meals are still the largest segment, accounting for about 45–50% of global value thanks to their extended shelf life and consistent quality from technologies like IQF and sous-vide. Chilled meal kits are becoming more popular because they offer pre-portioned ingredients and simpler cooking methods. Ambient RTC products, like noodle packs, pasta kits, soups, and instant meal boxes, provide affordability and convenience for everyday consumers. A growing part of the market is focused on health-oriented products, including high-protein, plant-based, low-sodium, preservative-free, and gluten-free options. This reflects a shift toward more nutrition-conscious choices.

Market dynamics are shaped by various strong drivers and limitations. Demand largely stems from the need for convenience, consistent taste, and restaurant-style meals made at home. Improvements in manufacturing and food preservation, such as automated marination, portioning, and high-pressure processing, are enhancing quality and reducing labor costs for producers. Meanwhile, the rise of online grocery shopping, direct-to-consumer subscriptions, and fast delivery services has broadened access for consumers and supported repeat purchases. However, the industry faces challenges like fluctuations in raw material prices, especially for wheat, oils, and poultry, which can squeeze profit margins. Dependence on cold-chain logistics also presents a challenge in cost-sensitive areas, while strict regulations on food labeling, additives, and packaging waste raise compliance demands. Competition from private-label brands is intensifying, especially in Europe and North America, putting further pressure on prices.

Despite these challenges, the market presents significant opportunities across different regions and product types. The Asia Pacific region is becoming the strongest growth driver, bolstered by rising incomes, rapid urbanization, and the growth of modern trade channels. Functional RTC products—such as immunity-boosting, high-fiber, probiotic-rich, and low-sodium meal options—are increasingly popular among health-conscious consumers and are expected to be key for future innovation. The growing focus on sustainability is creating new prospects for brands that invest in eco-friendly packaging, traceable sourcing, and clean-label formulations. As manufacturing technologies improve, companies are more frequently using AI-driven forecasting, smart packaging, and sensor-based quality control to refine supply chains and build consumer trust.

The COVID-19 pandemic had a significant and lasting impact on the RTC market. During lockdowns, consumers relied more on packaged and easy-to-prepare meals, accelerating market growth and causing a permanent shift toward home cooking with convenience. E-commerce adoption rose sharply, leading brands to enhance digital engagement, improve supply chain reliability, and expand their distribution networks. Although the market initially faced supply disruptions and raw material shortages, demand stabilized from 2022 to 2024, reinforcing the category's long-term importance. In addition to the pandemic's effects, regional conflicts and trade tensions have affected logistics and commodity markets. The Russia–Ukraine conflict, for example, disrupted global wheat and edible oil supplies, while energy price fluctuations impacted cold-chain transport costs. Stricter regulations in the EU, China, and North America have also influenced formulation, packaging, and trade practices. Despite these external challenges, the RTC sector remains resilient, supported by diverse sourcing strategies, investments in automation, and a continued consumer preference for convenient, high-quality meal options.

Key Takeaways

- Market Growth: The global Ready-to-Cook (RTC) food market is projected to reach USD 535.6 billion by 2034, expanding at a 8.7% CAGR (2025–2034) from an estimated USD 228.7 billion in 2024; growth is anchored by convenience-seeking households, urbanization, and portfolio premiumization.

- Product Type: Frozen RTC led in 2024 with a 35.3% value share, outpacing instant noodles/pasta due to superior shelf life, consistent quality, and cold-chain penetration; leading brands include Conagra, Nomad Foods, McCain, Ajinomoto, and Nestlé (regional variants).

- Distribution Channel: Supermarkets/hypermarkets accounted for 46.3% of sales in 2024, reflecting trust in curated assortments and in-store promotions; online grocery/quick-commerce, while smaller, is capturing a disproportionate share of incremental growth in major metros.

- Driver: Household adoption is decisive—households represented 59.4% of end-use in 2024—as busy consumers trade preparation time for ready-marinated proteins, sauce kits, and frozen entrées; expanding SKUs in ethnic and restaurant-style formats further lift basket values.

- Restraint: Input-cost volatility (wheat, edible oils, and poultry) and cold-chain energy inflation tighten economics, with typical category gross margins compressing ~100–150 bps during commodity spikes; rising compliance costs from labeling and packaging-waste regulations add further pressure.

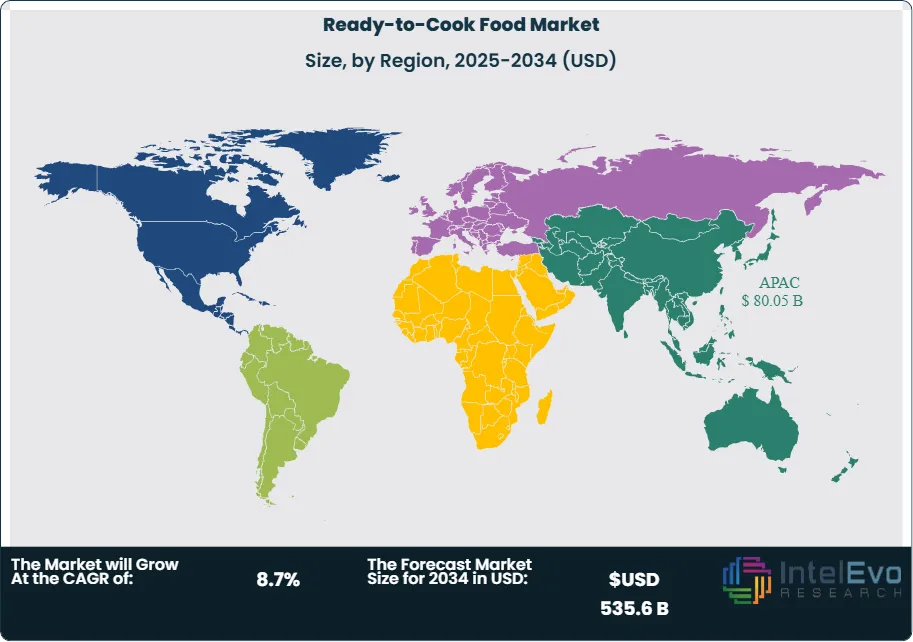

- Opportunity: Asia Pacific (APAC)—already at a 35% global revenue share in 2024—is the prime expansion arena, driven by modern trade and D2C scale-up; at high-single-digit to low-double-digit growth, APAC could contribute ~USD 90–100 billion of incremental category value by 2034.

- Trend: Health-forward innovation is reshaping mix—clean-label, high-protein, gluten-free, and plant-based RTC lines are growing at double-digit rates and often command 8–12% price premia; AI-enabled demand forecasting and automated portioning/packaging are reducing waste and improving case-fill.

- Regional Analysis: APAC is the growth engine (share 35%), while North America and Europe remain profit centers with strong private-label participation and premium frozen offerings; emerging hotspots include Tier-2 Asian cities and Middle-Eastern markets where cold-chain and modern retail are scaling rapidly.

Type Analysis

Frozen foods remain the anchor of the ready-to-cook (RTC) portfolio in the 2025+ outlook, building on a >35% value share in 2024 and benefiting from deeper cold-chain penetration, improved quality (IQF, sous-vide), and microwaveable tray formats that cut prep time to under 10 minutes. Category leaders—such as Conagra, Nomad Foods, McCain, Ajinomoto, and Nestlé—are expanding premium entrées and ethnic lines, supporting mix upgrade and resilient price realization even amid input-cost volatility.

Instant noodles continue to be the volume engine across Asia and parts of Latin America, prized for affordability and speed; premium SKUs with air-dried noodles, higher protein, and lower sodium are gaining traction, lifting average selling prices. Instant pasta maintains steady demand in North America and Europe where family multipacks and fortified variants (whole grain, added fiber) defend share. Instant soup remains a counter-seasonal, comfort-led segment with portion-controlled sachets and cup formats sustaining repeat purchase. Ready-to-mix (RTM) products—including batter, breading, and baking mixes—bridge convenience with a “homemade” feel and are seeing high-single-digit growth as consumers seek time savings without sacrificing customization. The “Others” bucket (e.g., meal kits, pre-marinated proteins) is a hotspot for innovation, often commanding 8–12% price premia for clean-label or functional claims.

Packaging Analysis

Carton boxes held 27.4% share in 2024 and remain the workhorse for noodles, pasta, and kit formats thanks to stackability, billboard space for nutrition/QR transparency, and e-commerce durability. Lightweighting and higher recycled fiber content (FSC-certified boards) are improving sustainability credentials while preserving shelf presence.

Bags and pouches are scaling as cost-efficient, space-saving formats; resealable pouches in sauces and seasoning kits enhance portion control and reduce waste, supporting trade-up. Cans retain relevance for ambient soups/pastas where long shelf life is critical, while CPET/PP trays dominate single-serve frozen meals due to oven/microwave compatibility and leak resistance. Packaging suppliers (Amcor, Mondi, Huhtamaki) are accelerating mono-material designs and PCR incorporation, with leading RTC brands targeting double-digit PCR content mid-decade to meet retailer and regulatory mandates.

End-User Analysis

Households are the demand backbone—59.4% share in 2024, with adoption sustained by dual-income families, smaller households, and urban professionals seeking sub-15-minute meal solutions. Premium frozen entrées, plant-forward kits, and clean-label sauces are lifting basket values, while price-laddered ranges preserve accessibility in inflationary periods.

Food service is a growing secondary user, leveraging RTC components to standardize taste, speed service, and stabilize labor—central kitchens, QSRs, and caterers report throughput gains and reduced prep variability. “Others” (institutions, travel retail, healthcare) are expanding use of portion-controlled RTC lines to manage nutrition and minimize waste, supporting steady mid-single-digit segment growth.

Distribution Channel Analysis

Supermarkets/hypermarkets remain the primary route-to-market with a 46.3% share in 2024, underpinned by breadth of assortment, cold-chain capacity, and strong private-label participation. In-aisle adjacencies (sauces, sides) and themed promotions continue to drive trial and trade-up.

Convenience stores play a critical proximity role for noodles, soups, and single-serve meals, particularly in transit hubs and dense urban areas. Online retailers—including quick-commerce—are capturing an outsized share of incremental growth as cold-chain last-mile improves; subscription bundles for frozen entrées and RTM kits are lifting retention and forecast accuracy. Specialty stores focus on premium, organic, gluten-free, or regional cuisines, sustaining higher unit margins and discovery for emerging brands.

Regional Analysis

Asia Pacific is the growth engine with a ~35% global share in 2024 and sustained outperformance through 2030, powered by urbanization, rising disposable incomes, and modern trade expansion in China, India, and Southeast Asia. Domestic champions (Nissin, ITC, Indofood) and multinational players are investing in localized flavors, halal/vegetarian certifications, and regional cold-chain to unlock Tier-2 city demand.

North America and Europe are mature but profitable, supported by premium frozen offerings, private-label depth, and clean-label reformulations; inflation-driven at-home substitution continues to support volume resilience. Latin America and the Middle East & Africa are emerging opportunity corridors where improving retail infrastructure and youth demographics favor noodles, RTM, and value frozen lines; targeted capex in cold-chain and localized packaging is expected to underpin high-single-digit growth across select markets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Frozen Foods

- Instant Noodles

- Instant Pasta

- Instant Soup

- Ready-To-Mix

- Others

By Packaging

- Boxes

- Bags

- Pouches

- Cans

- Trays

- Others

By End-User

- Households

- Food Service Industry

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 228.7 B |

| Forecast Revenue (2034) | USD 535.6 B |

| CAGR (2024-2034) | 8.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Frozen Foods, Instant Noodles, Instant Pasta, Instant Soup, Ready-To-Mix, Others), By Packaging (Boxes, Bags, Pouches, Cans, Trays, Others), By End-User (Households, Food Service Industry, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | MTR Foods Pvt. Ltd., TataQ, Kohinoor Foods Ltd., Godrej Agrovet Ltd., Reg al Kitchen Foods Ltd., Bakkavor Foods Ltd., DARSHAN FOODS Pvt. Ltd., ITC Ltd., Nestlé S.A., Nomad Foods Limited, IndianFarm Foods Pvt. Ltd., Ty son Foods, Inc., Pink Harvest Farms, Raised & Rooted, Tasty Tales, Hindustan Unilever Ltd., Maiyas Beverages and Foods Pvt. Ltd., iD Fresh Food (India) Pvt. Ltd., Bambino Agro Industries Ltd., McCain Foods Ltd., Desai Foods Pvt Ltd., TOPCHOP, Tat Hui Foods Pte. Ltd., Regal Kitchen Foods Ltd. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date