Rental Apps for Real Estate Market Size & Forecast 2034 | 12.9% CAGR

Global Rental Apps for Real Estate Market Size, Share, Analysis Report By Property Type (Commercial, Residential), Platform (Web-Based Platform, Mobile Application), Rental Duration (Long-Term Rentals, Short-Term Rentals), End-Use (Businesses & Organizations, Individual Consumers), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

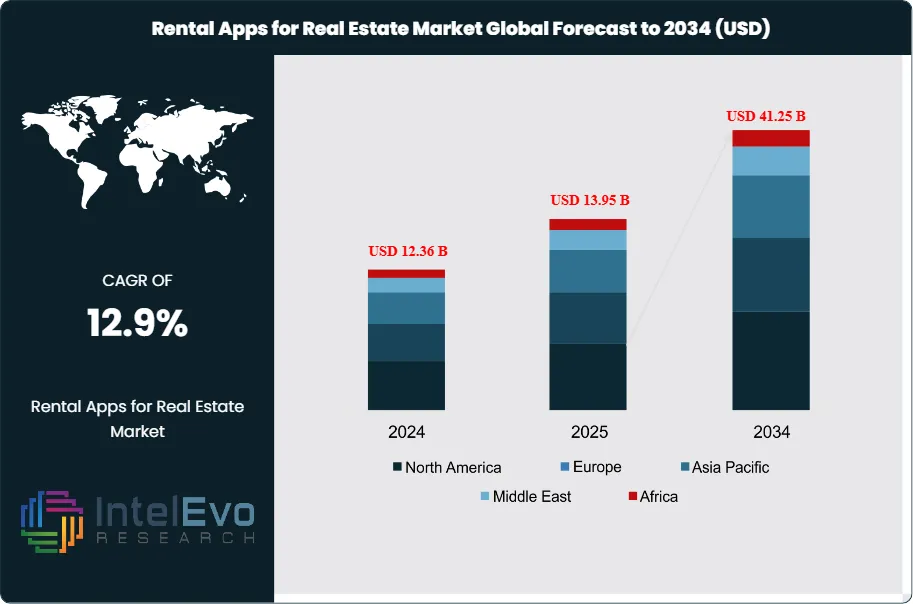

The Rental Apps for Real Estate Market size is projected to reach approximately USD 41.25 Billion by 2034, up from USD 12.36 Billion in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034. This growth is driven by the rapid adoption of digital property management solutions, the rise of AI-driven tenant matching systems, and the increasing reliance on mobile-first real estate platforms among millennials and Gen Z renters. With expanding urbanization and cross-border rental activity, rental apps are reshaping how landlords, brokers, and tenants interact — making real estate more transparent, efficient, and data-driven. The integration of AI, blockchain, and predictive analytics will further enhance user trust and streamline property transactions, propelling the market to new heights.

Get More Information about this report -

Request Free Sample ReportThe rental apps market for real estate has undergone substantial transformation over the last decade. Rental apps defined as software platforms designed to connect property owners and tenants for residential or commercial rentals have streamlined transactions, improved visibility, and democratized property access. These solutions typically include Web-Based Platforms and Mobile Applications, providing features like virtual tours, payment gateways, and AI-powered recommendations. Factors driving growth include the rise of mobile internet penetration, demand for short-term rentals, and heightened consumer preference for seamless, contactless renting experiences. Additionally, demographic shifts especially millennial and Gen Z consumers prioritizing flexibility have accelerated platform adoption.

Several elements impact the market: regulatory frameworks, which vary across regions; platform trust and security concerns, critical for user engagement; and rapidly evolving technology, such as machine learning algorithms that personalize property suggestions. Furthermore, fluctuations in housing affordability, urban migration, and the expansion of gig economy lifestyles contribute to sustained demand for rental applications, especially those catering to short-term and individual consumer segments.

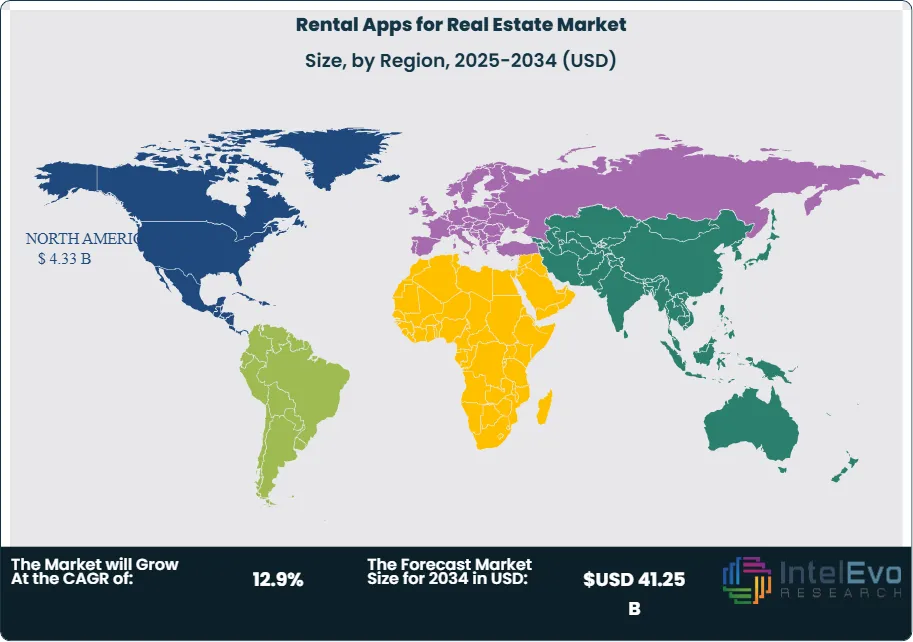

Regionally, North America leads the rental apps market, attributed to high smartphone usage, large volumes of rental transactions, and the prominence of platforms like Zillow, Trulia, and Airbnb. Europe follows closely, with strong growth in Germany and the UK, while Asia Pacific is an emerging frontier propelled by urbanization and technological adoption.

COVID-19 significantly impacted the market, catalyzing digital adoption as in-person property tours declined. Short-term rentals saw volatile demand due to lockdowns, while long-term rentals and relocation services remained resilient. Platforms adapted by offering virtual viewings, flexible cancellations, and enhanced cleaning protocols, establishing lasting shifts in consumer expectations.

Key Takeaways

- Market Growth: The Rental Apps for Real Estate Market is expected to reach USD 41.25 Billion by 2034, driven by the convergence of technological innovation, shifting consumer preferences, and increased demand for flexible leasing arrangements.

- Property Type Dominance: Residential rental apps dominate the market due to a surge in demand for both long-term and short-term accommodations, especially among millennials and young professionals. The preference for digital-first solutions and remote transactions has further consolidated this segment’s strength.

- Platform Dominance: Mobile applications have outpaced web platforms, as consumers increasingly prefer accessing listings, completing transactions, and communicating with landlords via smartphones. Mobile-first design and intuitive user interfaces have cemented their popularity.

- Rental Duration Dominance: Short-term rentals, led by platforms like Airbnb, have captured significant market share. Consumers favor the flexibility and convenience these services offer, whether for business travel, relocation, or tourism.

- End-Use Dominance: Individual consumers represent the largest end-user group, as private tenants seek a wide variety of property types and durations through convenient digital channels. Platforms tailor experiences to individual needs, strengthening this segment.

- Driver: Technological advancements, including AI-powered recommendations, virtual tours, and integrated payment solutions, are key growth drivers. The growing comfort with digital platforms and the demand for frictionless experiences further propel market adoption.

- Restraint: Data security concerns and fragmented regulations pose significant restraints. Issues related to user privacy, platform liability, and local compliance often slow market penetration, particularly across multiple jurisdictions.

- Opportunity: Rising urbanization in emerging economies presents massive untapped potential. Additionally, the growing popularity of hybrid work models fuels demand for short-term and flexible rental solutions.

- Trend: Sustainability and eco-conscious rentals are becoming influential trends. Many platforms are promoting energy-efficient listings and socially responsible practices to attract environmentally minded consumers.

- Regional Analysis: North America dominates the market owing to its mature technological ecosystem, high smartphone penetration, and established rental culture. Europe follows, with strong adoption in metropolitan areas, while Asia Pacific shows high growth potential, especially in India and Southeast Asia.

Property Type Analysis:

Residential Leads With nearly 60% Market Share In Rental Apps for Real Estate Market. Residential rental apps are the backbone of the digital real estate ecosystem. They cater to a vast audience of renters looking for apartments, single-family homes, and co-living spaces. Platforms such as Zillow, Redfin, and Trulia have become household names, enabling tenants to compare listings, schedule virtual tours, and finalize leases entirely online. This segment’s dominance is underpinned by affordability challenges in homeownership, which push consumers toward rentals, and by shifting lifestyle preferences that prioritize mobility and convenience. Short-term rentals also fall under residential but differ in purpose and duration, which has allowed platforms like Airbnb and Nestpick to carve out distinct niches.

Platform Analysis:

Mobile applications have revolutionized how property rentals operate. Most major players have invested heavily in mobile-first experiences, recognizing that renters increasingly rely on their smartphones for search, communication, and payments. Apps offer advanced features such as location-based search, push notifications about new listings, and secure messaging between landlords and tenants. The convenience of instant access to property data and the ability to complete transactions on-the-go have made mobile platforms the preferred channel. Additionally, mobile apps often integrate customer reviews, fostering transparency and trust—essential factors driving adoption.

Rental Duration Analysis:

Short-term rentals represent one of the most dynamic and fast-growing areas of the rental apps market. Platforms such as Airbnb have transformed vacation stays and temporary housing, enabling property owners to monetize underutilized spaces. Travelers and remote workers benefit from flexible durations and a broad range of property types, from city apartments to rural cabins. COVID-19 caused short-term rentals to fluctuate dramatically, but the rebound has been strong, with demand recovering faster than traditional hotels in many regions. As hybrid work models become more common, consumers are expected to maintain their preference for short-term, flexible accommodations.

End-Use Analysis:

Individual consumers dominate end-use segments by volume. Unlike businesses and organizations that rent primarily for corporate housing, individuals account for the majority of residential and short-term leases. They often prioritize convenience, affordability, and a wide selection of properties. Rental apps targeting individual consumers focus on creating seamless experiences with features like instant booking, secure payment, and tenant screening. The growth of this segment is also driven by demographic trends, such as millennials delaying homeownership and the rise of digital nomads seeking flexible living arrangements.

Region Analysis:

North America Leads With more than 35% Market Share In Rental Apps for Real Estate Market. North America leads the global rental apps market due to several convergent factors including advanced technological infrastructure, high smartphone penetration rates, established venture capital funding, and mature real estate markets that readily embrace digital innovation. The United States specifically dominates with sophisticated PropTech ecosystems in major metropolitan areas like San Francisco, New York, and Austin. Canada contributes significantly through tech-forward cities like Toronto and Vancouver, where government initiatives support digital real estate transformation.

Europe represents the second-largest market, driven by progressive regulatory frameworks, strong consumer protection laws, and high internet penetration rates. Countries like Germany, United Kingdom, and Netherlands lead European adoption through comprehensive digital infrastructure and tech-savvy populations. The European market emphasizes data privacy compliance and sustainable housing solutions, creating unique opportunities for specialized applications.

Asia-Pacific emerges as the fastest-growing region, fueled by rapid urbanization, expanding middle-class populations, and increasing smartphone adoption. China and India lead this growth through massive urban migration, government smart city initiatives, and venture capital investment in PropTech solutions. The region's diverse regulatory environments create both opportunities and challenges for market expansion.

Get More Information about this report -

Request Free Sample ReportKey Market Segment:

By App Type

- Property Rental Listing Apps

- Tenant Management Apps

- Real Estate Brokerage Apps

- Vacation and Short-Term Rental Apps

- Property Investment Apps

- Hybrid Real Estate Apps

By Platform Type

- Android

- iOS

- Web-based Platforms

- Cross-platform and Cloud-based Solutions

By Property Type

- Residential Rentals

- Commercial Rentals

- Industrial and Warehouse Properties

- Co-Living and Shared Spaces

- Vacation and Short-Term Rentals

By Rental Duration

- Long-Term Rentals

- Short-Term Rentals

By Deployment Mode

- Cloud-Based

- On-Premises

By End User

- Property Owners and Landlords

- Real Estate Agents and Brokers

- Tenants and Renters

- Property Management Companies

- Real Estate Investors

By Application

- Businesses & Organizations

- Individual Consumers

By Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 13.95 B |

| Forecast Revenue (2034) | USD 41.25 B |

| CAGR (2025-2034) | 12.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By App Type (Property Rental Listing Apps, Tenant Management Apps, Real Estate Brokerage Apps, Vacation and Short-Term Rental Apps, Property Investment Apps, Hybrid Real Estate Apps), By Platform Type (Android, iOS, Web-based Platforms, Cross-platform and Cloud-based Solutions), By Property Type (Residential Rentals, Commercial Rentals, Industrial and Warehouse Properties, Co-Living and Shared Spaces, Vacation and Short-Term Rentals), By Rental Duration (Long-Term Rentals, Short-Term Rentals), By Deployment Mode (Cloud-Based, On-Premises), By End User (Property Owners and Landlords, Real Estate Agents and Brokers, Tenants and Renters, Property Management Companies, Real Estate Investors), By Application (Businesses & Organizations, Individual Consumers) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Airbnb Inc., Nestpick GmbH, Zillow Group Inc., RentHop Inc., Move Inc., Rentberry Inc., Trulia Inc., PropertyNest Inc., Redfin Corporation, StreetEasy LLC, Apartment Finder LLC, RentPath LLC, Compass Inc., Homesnap Inc., Zumper Inc., Oodle Inc., Apartments.com LLC, Roomster Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Rental Apps for Real Estate Market

Published Date : 04 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date