RFID Tags Market Size USD 41.8B & 9.9% CAGR Forecast 2034

Global RFID Tags Market Size, Share & Technology Analysis By Type (Passive, Active, Semi-Passive), By Frequency (LF, HF, UHF), By Application (Retail, Logistics, Healthcare, Industrial), By End User, Global Adoption Trends, Key Players & Forecast 2025–2034

Report Overview

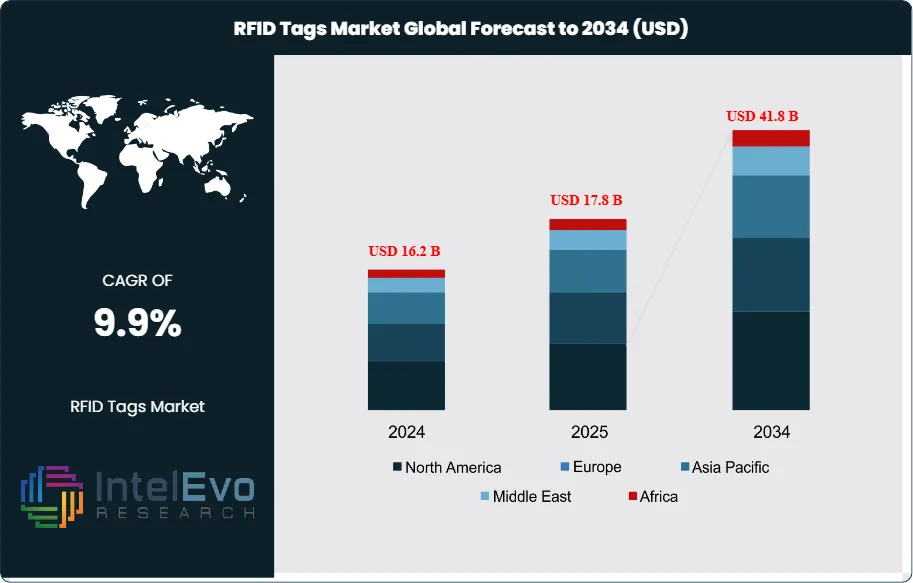

The RFID Tags Market is estimated at USD 16.2 billion in 2024 and is projected to reach approximately USD 41.8 billion by 2034, registering a CAGR of about 9.9% during 2025–2034. Growth is underpinned by large-scale deployment of item-level tagging across retail, logistics, healthcare, and manufacturing, supported by declining tag costs and expanding interoperability standards.

Get More Information about this report -

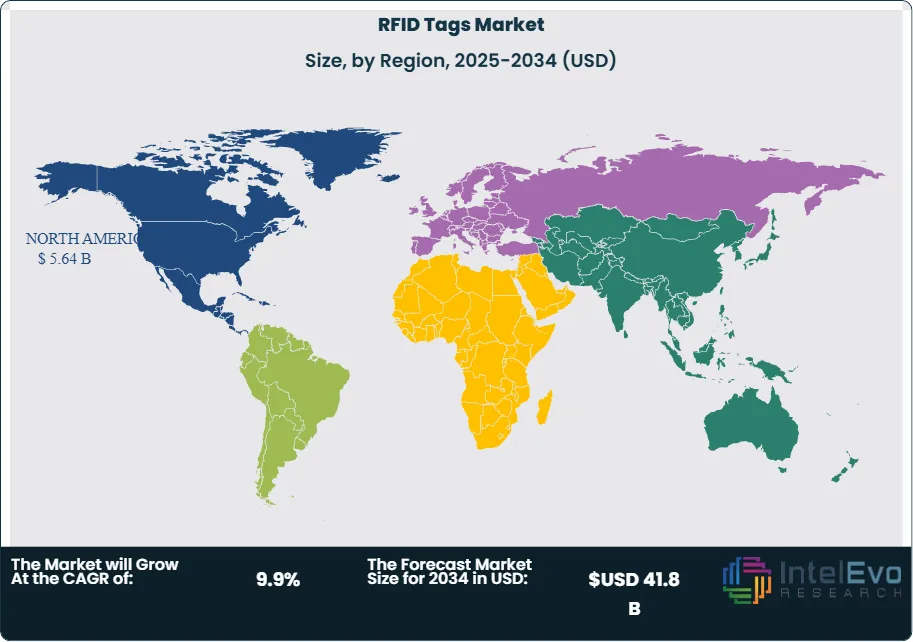

Request Free Sample ReportThe market expanded steadily between 2020 and 2023 as retailers, logistics operators, healthcare providers, and automotive manufacturers embedded RFID tags to improve inventory accuracy and reduce shrinkage. In 2023, North America led the market with a 34.8% share, generating approximately USD 4.9 billion in revenue, driven by early adoption in retail apparel, omnichannel fulfillment, and asset-intensive industries. Europe remained resilient, supported by growing apparel and industrial deployments, while Asia Pacific emerged as the fastest-growing region on the back of manufacturing upgrades in China and India and rising investments in public and private logistics infrastructure.

Demand is anchored in measurable operational and financial benefits. Industry data indicate that 52% of RFID tags are deployed for traceability and efficiency, with implementations delivering up to a 93% reduction in inventory management costs, a 60% decline in losses, and inventory accuracy improvements exceeding 25%. Retailers such as Inditex have highlighted unknown product losses of up to 0.8% of sales (around €100 million), while Grupo Éxito reported dramatic reductions in inventory costs and shrinkage following RFID rollout. These quantifiable gains continue to justify large-scale, multi-site implementations.

On the supply side, passive UHF RFID tags dominate global volumes, supported by economies of scale that have pushed high-volume inlay prices below USD 0.10 per unit. Active and battery-assisted tags address specialized use cases such as long-range tracking, cold-chain monitoring, and high-value asset management. Widespread adoption of standards including EPC Gen2, ISO/IEC 18000-6C, and the RAIN RFID ecosystem ensures interoperability, enabling enterprises to scale deployments across geographies and applications with reduced vendor lock-in.

Hardware and system capabilities continue to advance, expanding RFID’s addressable market. Vendors are introducing ruggedized readers and specialized tags designed for metal surfaces, high temperatures, and outdoor environments. For example, ID Tech Solutions launched the IDT 87 UHF reader in July 2024, targeting mine gates, factory entrances, and weighbridges in India. Integration with IoT platforms, AI-driven analytics, and cloud-based event management systems is further extending RFID adoption into smart manufacturing, automated warehouses, and city-scale logistics networks.

Looking ahead, near-term growth pools include apparel, pharmaceuticals, cold-chain logistics, automotive parts, and parcel delivery networks. Asia Pacific—particularly India—along with select Middle Eastern logistics hubs, is expected to attract the highest investment activity over the next decade. However, key risks remain, including upfront system costs, legacy IT integration challenges, RF performance issues near metal and liquids, spectrum and data-privacy compliance, and end-of-life materials management. Vendors that combine low-cost tags, robust hardware, and analytics-driven platforms will be best positioned to capture sustained growth through 2034.

Key Takeaways

- Market Growth: The market will grow from USD 16.2 billion in 2024 to USD 41.8 billion by 2034. This implies a 9.9% CAGR, driven by item-level retail deployments, logistics automation, and healthcare asset tracking.

- By Tag Type: Passive tags led with a 71.4% share in 2023 due to low unit cost and broad use cases. Inlay prices commonly fall below USD 0.10, which supports large-scale rollouts.

- By Frequency: UHF tags held 58.1% share in 2023 as they support long-range portal reads and high throughput. RAIN RFID standards enable interoperability across supply chains.

- Driver: Deployments lift inventory accuracy by 25.4% and cut inventory management costs by up to 93%, with losses down 60%. 52% of tags target traceability and efficiency, which sustains repeat spending.

- Restraint: Upfront system cost and integration complexity slow multi-site rollouts. Adoption remains early in parts of Europe, with only 22.58% of Spanish firms using RFID post production; GDPR penalties can reach 4% of global turnover.

- Opportunity: The market will add USD 21.3 billion in incremental value over 2023–2033. Healthcare and pharma tracking, cold chain, and India’s logistics upgrades present near-term wins you can target.

- Trend: IoT and AI-enabled analytics are shifting RFID to real-time event management in the cloud. Vendors are releasing outdoor readers such as ID Tech Solutions’ IDT-87 in July 2024, while smaller on-metal and high-temperature tags broaden use cases.

- Regional Analysis: North America led with a 34.8% share and USD 4.9 billion revenue in 2023. Asia Pacific is set to grow fastest on manufacturing and logistics investments in China and India; you should watch India and select Middle Eastern hubs, while Europe shows steady scaling with Spain’s 22.58% adoption signaling runway.

Type Analysis

Passive RFID tags remain the volume and value anchor in 2025. They held about 71.4% share in 2023 and are on track to stay above 70% through 2027 as inlay prices frequently sit below USD 0.10. Apparel, parcel, and warehouse deployments account for the bulk of units, with tens of billions of RAIN RFID tags shipped globally each year. You can expect continued migration from barcodes to item-level tagging across general merchandise and pharmaceuticals.

Active RFID tags deliver lower unit volumes but higher revenue per device. Typical prices range from USD 5 to USD 50 depending on battery life, sensors, and ruggedness. Growth concentrates in high-value asset tracking, cold chain, RTLS in hospitals, and yard management. Battery-assisted passive tags bridge the gap for cold chain and metal-rich environments and are set to outpace the broader market with low-teens CAGR through 2030.

Looking ahead, passive tags should grow in line with the market near 9 to 10% CAGR, supported by retailer mandates and logistics automation. Active tags are poised for faster gains in healthcare and industrial campuses where location accuracy and condition monitoring justify higher spend.

Frequency Analysis

UHF RFID tags continue to lead by a wide margin. They captured 58.1% share in 2023 and are likely to exceed 60% by 2025 as 860 to 960 MHz systems deliver longer read ranges and high throughput. Regulatory bands such as FCC 902 to 928 MHz and ETSI 865 to 868 MHz underpin global rollouts. UHF remains the preferred choice for portals, dock doors, and conveyor-based reads.

HF tags, including NFC at 13.56 MHz, hold steady in consumer and security use cases. With billions of NFC-enabled smartphones in use, HF supports ticketing, payments, and brand authentication at the item level. You gain reach into consumer engagement programs while maintaining short read ranges for controlled interactions.

LF tags serve access control, livestock identification, and vehicle immobilizers. They offer robust performance near metal and liquids, though read ranges are short. Growth remains modest and specialized, with deployments concentrated in regulated identification and industrial environments.

End-Use Industry Analysis

Transportation and logistics will account for the largest incremental spend through 2030. Operators deploy UHF at gates and cross-docks to raise throughput and shrink lead times. Studies indicate 52% of RFID tags target traceability and efficiency, with users reporting up to a 93% cut in inventory management costs and a 60% drop in losses after rollout.

Retail held over 25.3% share in 2023 and expanded its footprint in 2025 as omnichannel fulfillment scales. Item-level tagging raises inventory accuracy by 25.4% and reduces shrink. Inditex reported unknown losses near 0.8% of sales, or around EUR 100 million, highlighting the savings potential when you track every item across stores and DCs.

Healthcare adoption accelerates on medication tracking, surgical kit management, and RTLS for equipment and patients. Hospitals favor active and battery-assisted tags for room-level accuracy and condition monitoring, supporting double-digit growth. Agriculture and other industries add steady demand for livestock tagging, returnable transport items, and MRO parts bins.

Regional Analysis

North America led with 34.8% share and USD 4.9 billion revenue in 2023. Based on the market trajectory, regional revenues are set to approach USD 5.8 to 6.0 billion in 2025 as retailers broaden mandates and parcel networks expand automation. Healthcare providers scale RTLS and pharmacy tracking, reinforcing recurring spend on tags and readers.

Europe advances on manufacturing and automotive use cases. Surveys show 94% of European decision-makers expect RFID to be critical for supply chain visibility within five years. Adoption remains uneven by country; in Spain, 22.58% of firms use RFID after production, pointing to significant runway. Compliance needs and data governance shape deployments across the EU and UK.

Asia Pacific delivers the fastest CAGR through 2030 on manufacturing upgrades in China, retail and logistics adoption in India, and regional e-commerce growth. Latin America sees traction in apparel and grocery, with cases such as Grupo Éxito reporting a 93% drop in inventory costs and a 60% decline in losses. The Middle East and Africa gain momentum in GCC logistics hubs and national ID and access programs, creating targeted opportunities for you in ports, airports, and industrial parks.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Passive RFID Tags

- Active RFID Tags

By Frequency

- Ultra-High Frequency (UHF) RFID Tags

- Low-Frequency (LF) RFID Tags

- High-Frequency (HF) RFID Tags

By End-Use Industry

- Transportation and Logistics

- Retail

- Agriculture

- Healthcare

- Other End-Use Industrie

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 16.2 B |

| Forecast Revenue (2034) | USD 41.8 B |

| CAGR (2024-2034) | 9.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type, Passive RFID Tags, Active RFID Tags, By Frequency, Ultra-High Frequency (UHF) RFID Tags, Low-Frequency (LF) RFID Tags, High-Frequency (HF) RFID Tags, By End-Use Industry, Transportation and Logistics, Retail, Agriculture, Healthcare, Other End-Use Industrie |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | CoreRFID Ltd., Impinj, Inc., Zebra Technologies Corporation, HID Global Corporation, SATO Holdings Corporation, NXP Semiconductors N.V., Applied Wireless, Inc., RF Code, Inc., Alien Technology, LLC, Avery Dennison Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date