Ride-Sharing Apps Market Size, Trends & Forecast 2034 | 12.9% CAGR

Global Ride-Sharing Apps Market Size, Share, Analysis Report By Type (Car Rental, E-hailing, Station-based Mobility, Car Sharing), Vehicle Type (CNG/LPG Vehicle, Electric Vehicle, Micro-mobility Vehicle, ICE Vehicle), Business Model (B2C, P2P, B2B), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

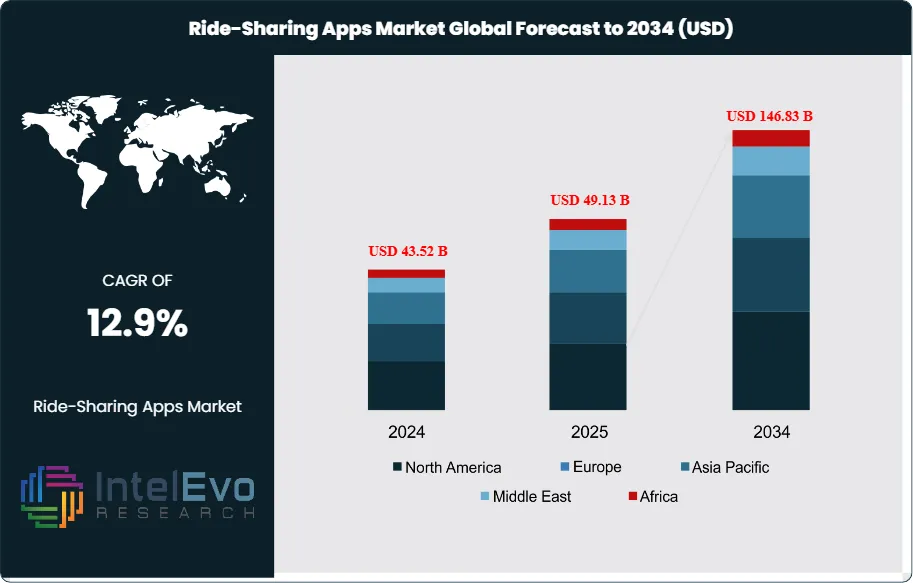

The Ride-Sharing Apps Market size is projected to reach approximately USD 146.83 Billion by 2034, up from USD 43.52 Billion in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034. The market’s growth is driven by the rising demand for cost-efficient, convenient, and eco-friendly urban transportation solutions, coupled with the integration of AI, IoT, and real-time data analytics in mobility services. Increasing smartphone penetration, the rise of electric and autonomous ride-sharing fleets, and government support for sustainable urban mobility are further fueling industry expansion. As consumer preferences shift toward shared mobility ecosystems, ride-sharing apps are set to revolutionize the future of transportation — merging digital connectivity, sustainability, and smart city innovation into one seamless experience.

Get More Information about this report -

Request Free Sample ReportThe ride-sharing apps market represents a transformative segment of the global transportation industry, leveraging digital platforms to connect passengers with drivers through mobile applications. This market encompasses various service models including e-hailing services, car rental platforms, station-based mobility solutions, and car-sharing networks. The market's growth is primarily driven by increasing urbanization, smartphone penetration, changing consumer preferences toward on-demand mobility solutions, and the growing emphasis on sustainable transportation alternatives. Key factors influencing market dynamics include regulatory frameworks, fuel price fluctuations, traffic congestion in urban areas, and the integration of advanced technologies such as artificial intelligence and GPS tracking systems.

The market landscape is characterized by intense competition among established players and emerging startups, each striving to capture market share through innovative service offerings, competitive pricing strategies, and expansion into new geographical territories. Technological advancements, including the development of autonomous vehicles, electric vehicle integration, and enhanced safety features, continue to reshape the industry. Additionally, the market faces challenges related to driver classification issues, regulatory compliance across different jurisdictions, and the need for sustainable business models that balance profitability with affordable pricing for consumers.

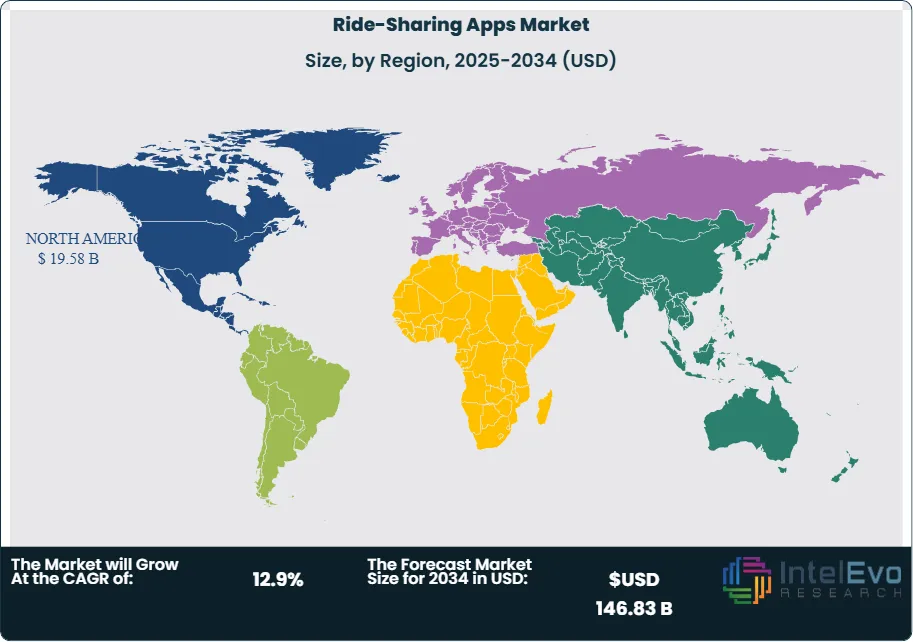

The Asia-Pacific region dominates the global ride-sharing apps market, accounting for the largest market share due to high population density, rapid urbanization, and significant smartphone adoption rates in countries like China, India, and Southeast Asian nations. North America and Europe follow as major markets, driven by established technological infrastructure and high disposable income levels, while emerging markets in Latin America, Africa, and the Middle East present substantial growth opportunities due to increasing internet penetration and urban mobility challenges.

The COVID-19 pandemic significantly impacted the ride-sharing industry, causing a dramatic decline in demand during lockdown periods as travel restrictions and safety concerns reduced mobility. However, the market demonstrated resilience by adapting to new consumer needs through enhanced safety protocols, contactless payment systems, and diversification into delivery services. The pandemic accelerated the adoption of hygiene measures, driver health screening, and vehicle sanitization practices, while also highlighting the importance of flexible mobility solutions as public transportation usage declined.

Key Takeaways:

- Market Growth: The Ride-Sharing Apps Market is expected to reach USD 146.83 Billion by 2034, driven by increasing urbanization, technological advancement, and changing consumer mobility preferences toward shared and on-demand transportation solutions.

- Type Dominance: E-hailing remains the largest and fastest-growing segment due to its unmatched convenience and scalability. The segment benefits from strong brand recognition and extensive driver networks.

- Vehicle Type Dominance: Despite the sustainability push, internal combustion engine (ICE) vehicles continue to dominate fleets in many regions, offering a readily available and cost-effective mobility solution.

- Business Model Dominance: Business-to-Consumer (B2C) models lead the market as established platforms directly engage end-users with intuitive apps, promotions, and loyalty programs.

- Driver: The surge in smartphone adoption and internet penetration significantly boosts ride-sharing app usage. Consumers increasingly expect on-demand, cashless mobility services as part of modern urban lifestyles.

- Restraint: Stringent regulations and compliance requirements impose operational burdens and increase costs for ride-sharing providers, especially when expanding into new regions.

- Opportunity: Electrification of ride-sharing fleets represents a major growth opportunity, with governments incentivizing green vehicles and consumers demanding sustainable transport.

- Trend: Integration of micro-mobility options, such as e-scooters and bikes, into ride-sharing apps is gaining traction, appealing to last-mile connectivity needs.

- Regional Analysis: Asia-Pacific leads the global market, driven by large urban populations and rapid technology adoption. North America and Europe follow, with high disposable incomes and favorable infrastructure supporting adoption.

Type Analysis:

E-hailing has cemented itself as the preferred ride-sharing mode worldwide. This segment allows users to book rides in real time, track drivers, and make digital payments—all within a single app. Companies like Uber, Didi Chuxing, and Grab dominate this space due to their robust platforms, competitive pricing, and massive driver networks. E-hailing is highly scalable, adapting to fluctuating demand across peak and off-peak hours. Innovations such as dynamic pricing, ride-pooling, and AI-powered routing have improved efficiency and customer satisfaction. Consequently, E-hailing is forecast to maintain its lead as more consumers shift away from private vehicle ownership.

Vehicle Type Analysis:

ICE Vehicle Leads With nearly 55% Market Share In Ride-Sharing Apps Market, Although alternative powertrains are on the rise, ICE vehicles still represent the bulk of ride-sharing fleets globally. They offer cost advantages, widespread availability, and established refueling infrastructure. Many emerging economies lack sufficient charging stations to support mass electrification, making ICE vehicles the practical choice for drivers. However, regulatory pressures and fuel price volatility pose long-term risks to this segment. As a result, companies are gradually piloting hybrid and electric models while maintaining a core ICE fleet to meet immediate demand.

Business Model Analysis:

The Business-to-Consumer model dominates because it delivers a seamless, user-friendly experience through direct engagement. B2C ride-sharing apps attract customers with intuitive interfaces, transparent fare estimates, and personalized offers. This approach also fosters brand loyalty and repeat usage through subscription plans and referral programs. Major players invest heavily in marketing and partnerships to expand their user bases. The B2C segment’s continued growth hinges on platform innovation and consistent service quality, ensuring customer retention in an increasingly competitive market.

Region Analysis:

North America Leads With more than 45% Market Share In Ride-Sharing Apps Market, Asia-Pacific dominates the global ride-sharing market, accounting for approximately 45-50% of global market share, driven by massive population centers, rapid smartphone adoption, and supportive regulatory environments in key markets like China, India, and Southeast Asia. The region benefits from high population density in urban areas, making ride-sharing economically viable and attractive to both drivers and passengers. Government initiatives promoting shared mobility and smart city development further accelerate market growth.

North America represents the second-largest market, characterized by high per-capita income, advanced technological infrastructure, and early adoption of ride-sharing services. European markets emphasize regulatory compliance and environmental sustainability, driving adoption of electric and hybrid vehicles within ride-sharing fleets. Latin America, Africa, and the Middle East present emerging opportunities with growing smartphone penetration, urbanization trends, and increasing demand for affordable transportation alternatives.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Service Type

- Carpooling

- E-Hailing

- Car Rental

- Station-Based Mobility

- Peer-to-Peer (P2P) Sharing

By Vehicle Type

- Cars

- Two-Wheelers (Motorbikes & Scooters)

- Electric Vehicles (EVs)

- Autonomous Vehicles (AVs)

- Others (Shuttles, Vans)

By Business Model

- B2C (Business-to-Consumer)

- P2P (Peer-to-Peer)

- B2B (Corporate Ride-Sharing)

- Subscription-Based Ride-Sharing Models

By Payment Mode

- In-App Payments

- Digital Wallets

- Credit/Debit Cards

- Cash Payments

By End User

- Individual Commuters

- Corporate Users

- Tourists and Travelers

- Government & Institutional Transport

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 49.13 B |

| Forecast Revenue (2034) | USD 146.83 B |

| CAGR (2025-2034) | 12.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Service Type (Carpooling, E-Hailing, Car Rental, Station-Based Mobility, Peer-to-Peer (P2P) Sharing), By Vehicle Type (Cars, Two-Wheelers (Motorbikes & Scooters), Electric Vehicles (EVs), Autonomous Vehicles (AVs), Others (Shuttles, Vans)), By Business Model (B2C (Business-to-Consumer), P2P (Peer-to-Peer), B2B (Corporate Ride-Sharing), Subscription-Based Ride-Sharing Models), By Payment Mode (In-App Payments, Digital Wallets, Credit/Debit Cards, Cash Payments), By End User (Individual Commuters, Corporate Users, Tourists and Travelers, Government & Institutional Transport) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Gett, Uber Technologies Inc., BlaBlaCar, Lyft Inc., Revel, Via Transportation Inc., Zoox Inc., Grab, Didi Chuxing Technology Co. Ltd., ANI Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date