Run-of-River Hydroelectricity Market Size USD 49.6B & 6.3% CAGR

Global Run-of-River (ROR) Hydroelectricity Market Size, Share & Renewable Energy Outlook By Capacity (Small, Medium, Large), By Technology, By Application (Grid, Off-Grid), Environmental Impact Analysis, Regional Policy Landscape, Investment Trends, Key Developers & Forecast 2025–2034

Report Overview

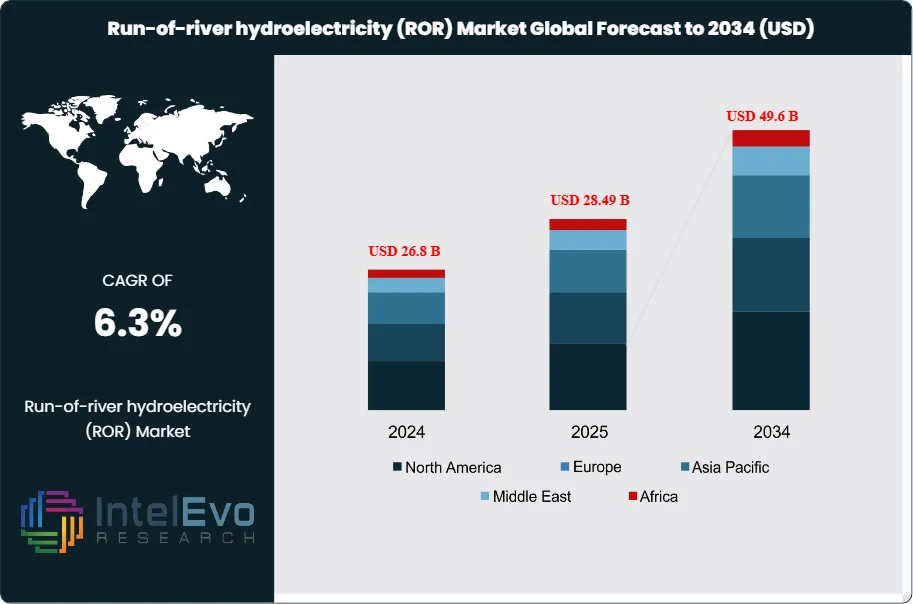

The Run-of-River (ROR) Hydroelectricity Market is estimated at USD 26.8 billion in 2024 and is projected to reach approximately USD 49.6 billion by 2034, registering a CAGR of about 6.3% during 2025–2034. Growth is supported by national decarbonization targets, rising grid-stability requirements, and continued investment in low-impact renewable generation. Run-of-river projects benefit from predictable output profiles, long-tenor power purchase agreements, and improving economics driven by turbine efficiency gains and digital operations. In parallel, repowering of aging hydro assets, expansion in emerging markets, and increased availability of green financing instruments are reinforcing the role of ROR hydro as a reliable baseload complement to variable solar and wind capacity.

Get More Information about this report -

Request Free Sample ReportROR plants use the natural flow of rivers; they avoid large reservoirs. You get predictable output in basins with steady hydrology. In 2021–2022, ROR generation rose by almost 70 TWh, up nearly 2%, reaching about 4,300 TWh. Developers added 32 GW of new hydro capacity in that period; this was 40% above the five‑year average. China drove roughly three quarters of the net increase. The pipeline remains healthy through 2030 as countries push clean power targets and seek grid inertia from synchronous machines.

Demand-side drivers are clear. Utilities need firm, low-carbon supply to meet peak evening demand. Carbon prices and volatile gas markets improve ROR project economics. Typical capacity factors land near 30% to 55% depending on river seasonality. LCOE ranges around USD 45 to 110 per MWh in mature sites. On the supply side, modular turbines and standardized civil works shorten build times by 3 to 6 months. However, permitting and biodiversity rules extend lead times in OECD markets. Hydrological risk is rising with climate variability; multiyear droughts can cut output by 5% to 10%. Grid interconnection queues and inflation in steel and concrete add cost pressure; EPC prices rose 8% to 12% from 2021 levels.

Technology is improving reliability and yields. AI-based inflow forecasting can raise annual energy by 1% to 3%. Digital twins and condition-based maintenance cut unplanned downtime by 10% to 15%. Variable-speed generators improve part‑flow efficiency. Fish-friendly runners and nature-based fish passages reduce ecological impacts and speed approvals. Run-of-river storage hybrids with small ponds smooth daily fluctuations and support mini‑grids.

Asia Pacific leads new capacity and manufacturing depth. China, India, Nepal, and Southeast Asia host the largest project stacks. Latin America offers bankable sites in Colombia, Peru, and Chile under stable PPA frameworks. Europe focuses on repowering and small schemes in the Alps and Nordics. North America advances relicensing and upgrades rather than greenfield builds. Africa presents emerging hotspots along the Nile, Congo tributaries, and Ethiopian basins. If you target near-term investments, watch river basins with proven hydrology, existing grid corridors, and clear fish passage standards. If you prefer de-risked returns, pursue repowering and uprates that add 5% to 12% output with limited civil works.

Key Takeaways

- Market Growth: The Generative AI in Waste Management market is estimated at USD 0.9 billion in 2025 and is projected to reach USD 5.6 billion by 2030. This implies a 39% CAGR driven by EPR policies, labor constraints, and multimodal AI that cuts contamination and service costs.

- Application: Smart sorting and quality control leads with 34% revenue in 2025. AI vision paired with GenAI reporting lifts bale purity by 5–10 percentage points and reduces manual QA effort by 30–50%, with deployments from AMP Robotics, TOMRA, Greyparrot, and Machinex.

- End Use: Municipal solid waste operators account for 58% of spend in 2025. Scale of curbside programs and citizen interactions favors GenAI copilots for service requests, contamination notices, and dynamic routing used by WM, Republic Services, Veolia, and SUEZ.

- Driver: Regulatory pressure anchors demand. The EU targets 55% municipal recycling by 2025 and 65% by 2035; California SB 54 mandates 25% source reduction by 2032. You gain measurable ROI as GenAI automates EPR reporting and claim management.

- Restraint: Data security and integration slow rollouts. In 2024 enterprise surveys, about 30% cite data governance as the top barrier; 25–35% of pilots stall at system integration. Inference and orchestration can add 8–12% to operating costs without edge deployment and caching.

- Opportunity: On-truck multimodal analytics is set to exceed USD 1.2 billion by 2030 at a 44–48% CAGR. You can cut route miles 10–15% and reduce contamination claims 20–30% using camera streams plus GenAI copilots for real-time flags and customer messaging.

- Trend: Synthetic data and large multimodal models improve long-tail detection. Operators report 3–7 point accuracy gains from synthetic imagery and 40–60% faster incident summarization with GenAI; early moves involve NVIDIA Metropolis partners and cloud stacks from Microsoft, Google Cloud, and AWS.

- Regional Analysis: North America leads with 38% of 2025 revenue on high MRF automation and EPR momentum. Europe holds 32% with strong compliance use cases; Asia Pacific posts the fastest growth at 44% CAGR through 2030, led by China, Japan, South Korea, Singapore, and India smart-city programs.

Turbine Type Analysis

Kinetic turbines remain the anchor of run-of-river deployments in 2025. They account for about 56% of global revenue, supported by low-head, low-flow suitability and shorter civil works. On a 2025 market base of roughly USD 26.8 billion, kinetic solutions represent near USD 15.0 billion. You see the strongest use in Asia Pacific and Europe where repowering and small hydro additions dominate permitting pipelines.

Reaction turbines, including Francis and Kaplan, hold close to 30% of 2025 spend. They fit medium to higher head sites and deliver high efficiencies in the 88–93% range with variable pitch options. Propeller turbines capture about 9–10% where flow variability is limited and costs must be contained. The remainder sits in Crossflow, Pelton, and niche designs used in mountainous micro-sites and retrofit channels. Suppliers scaling these categories include Voith, Andritz, GE Vernova, Dongfang Electric, and Harbin, with digital monitoring and fish-friendly runners now standard specifications.

Capacity Analysis

Small projects up to 10 MW continue to lead in 2025 with about 46% share of new commissioned capacity. Governments favor these assets for community power and faster permitting. Typical CAPEX runs USD 2.0–3.5 million per MW depending on head, access, and environmental measures. You benefit from shorter timelines. Many projects achieve 18–30 months from notice-to-proceed to first power.

Medium systems from 10 to 100 MW contribute around 38–40% in 2025. They serve regional grids and industrial corridors with better economies of scale and firming value. Large projects above 100 MW represent 14–16% and move more slowly due to ecological studies and resettlement risk. Looking ahead to 2030, small assets are set to expand at about 6–7% CAGR, adding 12–14 GW globally, while medium projects track near 5–6% CAGR on grid reinforcement programs and basin-level planning.

End use Analysis

Industrial offtakers remain the dominant end-use segment with about 66–68% share in 2025. Mines, metals, pulp and paper, and agro-processing rely on steady output and long-tenor PPAs that match asset life. Behind-the-meter setups and wheeling contracts reduce exposure to fuel volatility and carbon costs. You secure cost visibility and Scope 2 progress when pairing ROR with demand management.

Residential and commercial users account for the balance. Residential adoption centers on village mini-grids and community hydro with capacity factors in the 30–45% range. Commercial consumption covers campuses, resorts, and municipal facilities that seek stable tariffs and green certificates. Growth in these segments tracks concessional finance, feed-in tariffs, and grid interconnection reforms that trim soft costs by 5–10%.

Regional Analysis

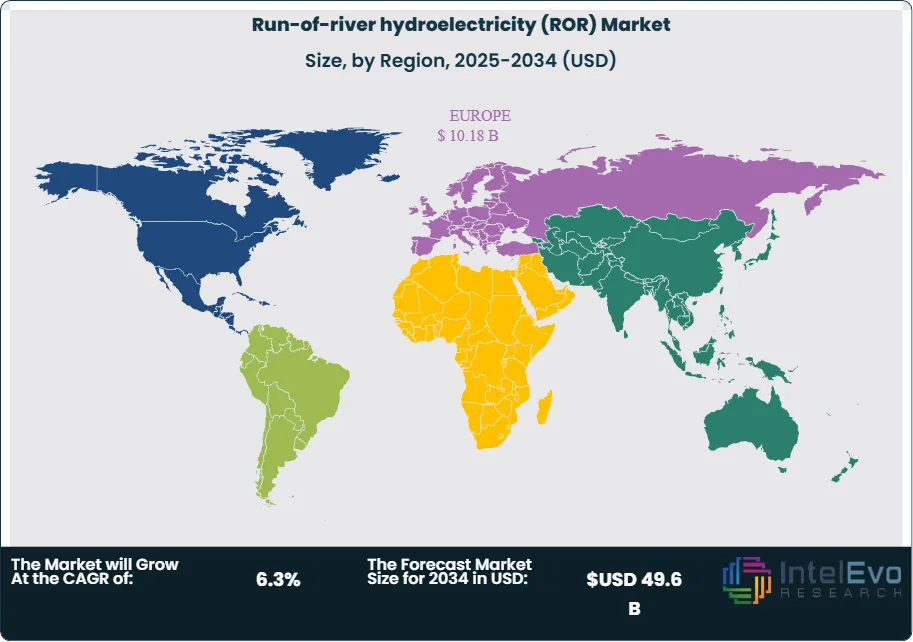

Europe continues to command a large share, estimated at 37–38% in 2025, equal to roughly USD 10.0–10.3 billion. Activity concentrates on repowering in the Alps and Nordics and on small schemes across Central and Eastern Europe. Repowering lifts annual energy 3–8% through runner upgrades, variable-speed drives, and digital O&M. Strict biodiversity rules slow greenfield timelines but enhance asset bankability once permitted.

North America holds about 20–22% in 2025, driven by Canadian refurbishments and U.S. relicensing that adds capacity without major new impoundments. Asia Pacific posts the fastest expansion at 7–8% CAGR through 2030. China, India, Nepal, and Southeast Asia are set to add 18–22 GW by 2030 on rural electrification and grid-balancing needs. Latin America grows 5–6% CAGR with opportunities in Colombia, Peru, and Chile under stable PPA frameworks.

The Middle East and Africa remain smaller today but form visible pipelines along the Nile basin, Ethiopian highlands, and East African Rift Rivers. Early projects benefit from blended finance and regional interconnectors. You should watch corridors with proven hydrology, existing transmission, and clear fish passage standards, as these factors shorten development cycles and improve financing terms.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Turbine Type

- Kinetic Turbine

- Reaction Turbine

- Propeller Turbine

- Others

By Capacity

- Small

- Medium

- Large

By End use

- Industrial

- Residential

- Commercial

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 26.8 B |

| Forecast Revenue (2034) | USD 49.6 B |

| CAGR (2024-2034) | 6.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Turbine Type (Kinetic Turbine, Reaction Turbine, Propeller Turbine, Others), By Capacity (Small, Medium, Large), By End use (Industrial, Residential, Commercial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Market Key Players, GE Energy, China Three Gorges Corporation, IHI Corporation, Andritz Hydro, Sinohydro Corporation, ABB Ltd, Gerdau S.A., Alstom Hydro, China Hydroelectric Corporation, CPFL Energia S.A. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Run-of-river hydroelectricity (ROR) Market

Published Date : 25 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date