Self-Checkout System Market Size, Trends & Forecast 2034 | 10.9% CAGR

Global Self-Checkout System Market Size, Share, Analysis Report By Component (Services ,Systems), By Type (Cashless ,Cash-based), By Application (Supermarkets and Hypermarkets ,Convenience Stores ,Department Stores ,Others),Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

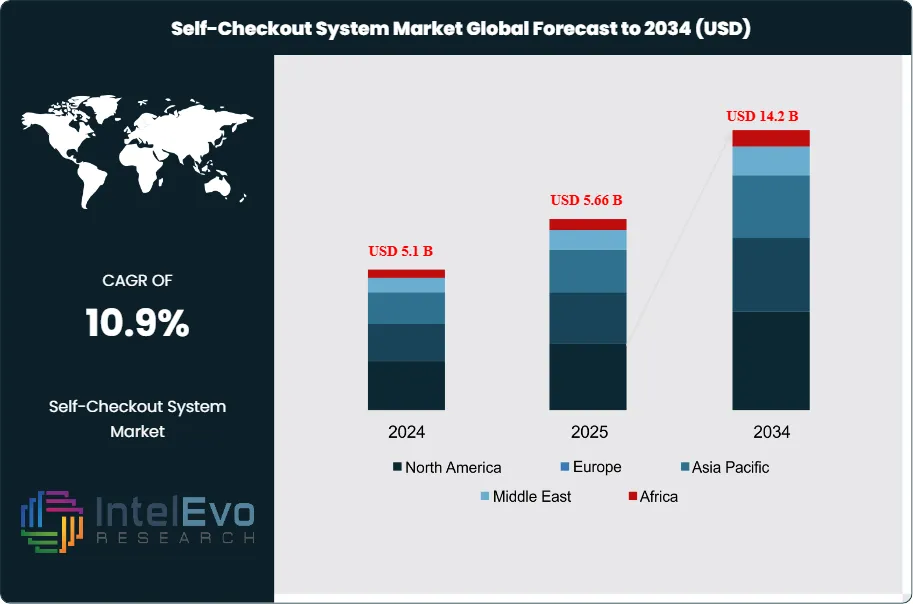

The Self-Checkout System Market size is projected to reach USD 14.2 billion by 2034, rising from USD 5.1 billion in 2024, growing at a CAGR of 10.9% during the forecast period from 2025 to 2034. The growth of the market is driven by increasing demand for contactless shopping experiences, AI-powered retail automation, and enhanced customer convenience across supermarkets, hypermarkets, and specialty stores. As global retailers embrace digital transformation, self-checkout systems are emerging as a key enabler of efficiency, cost savings, and improved customer satisfaction. The trend toward smart retail ecosystems and seamless checkout technology continues to reshape the retail landscape — making self-checkout solutions one of the fastest-growing retail tech innovations globally.

Get More Information about this report -

Request Free Sample ReportThe self-checkout system market represents a rapidly evolving segment within the retail technology landscape, characterized by automated point-of-sale solutions that enable customers to scan, bag, and pay for merchandise without traditional cashier assistance. The market size stood at USD 5.48 billion in 2024 and is projected to grow at a CAGR of 15.5% during the forecast period, driven by increasing consumer demand for convenience, operational efficiency requirements, and the accelerating digital transformation of retail environments. Key factors influencing market growth include rising labor costs, the need for reduced waiting times, technological advancements in artificial intelligence and machine learning, and the growing preference for contactless shopping experiences that emerged prominently during the COVID-19 pandemic.

The market's expansion is further supported by the integration of advanced technologies such as computer vision, RFID scanning, mobile payment systems, and biometric authentication, which collectively enhance user experience and operational reliability. AI-driven self-checkout systems are bolstering the growth of retail stores, with market players like Diebold Nixdorf unveiling new technology for cashierless registers, leveraging AI to mitigate shrinkage, verify age for liquor purchases, and expedite transactions. Additionally, the increasing penetration of smartphones and digital payment methods has created a conducive environment for cashless self-checkout solutions, while the expansion of modern retail formats across emerging economies presents significant growth opportunities.

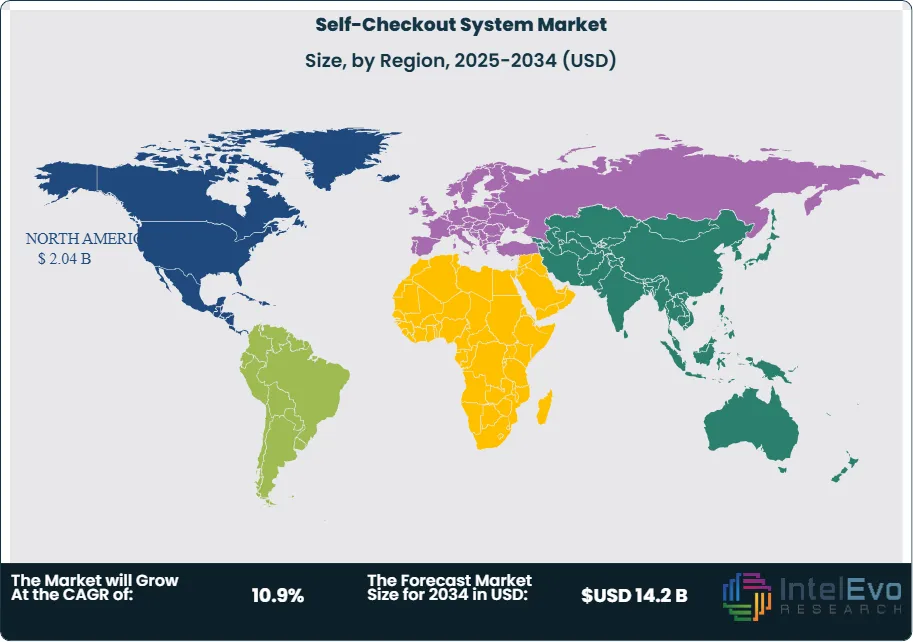

Regional Analysis: The Asia Pacific self-checkout systems market is growing rapidly at a CAGR of over 15% from 2025 to 2030, driven by the expansion of modern retail formats, rising urbanization, and increasing consumer preference. North America continues to lead the global market due to early adoption of retail automation technologies, high consumer acceptance rates, and presence of major market players, while Europe follows closely with significant investments in retail digitalization.

COVID-19 Impact: The COVID-19 pandemic significantly accelerated the market as businesses prioritized contactless solutions to enhance safety and minimize human interaction. The increased shift towards contactless payment options during the COVID-19 pandemic has further driven the market, as retailers sought to reduce physical contact points and address consumer safety concerns while maintaining operational efficiency during lockdowns and social distancing measures.

Regional Conflicts and Trade Tariffs: The ongoing trade tensions between major economies have created challenges for global supply chains in the self-checkout system market, particularly affecting the procurement of electronic components and hardware from different regions. Tariffs on technology goods and semiconductors have increased manufacturing costs for system integrators and may impact pricing strategies for end-users. However, these challenges have also encouraged regional manufacturing capabilities and partnerships, leading to more localized supply chains and potentially reduced dependency on single-source suppliers, which could enhance market resilience in the long term.

Key Takeaways:

- Market Growth: The Self-Checkout System Market is expected to reach USD 14.2 billion by 2034, due to factors such as retailers prioritize automation, cost reduction, and improved shopper satisfaction. Increasing adoption in supermarkets, hypermarkets, and large department stores is particularly notable, while cashless payment integration further propels expansion.

- Component Dominance: Systems constitute the largest component segment, driven by the rising preference for integrated kiosks with advanced scanning, weighing, and payment capabilities. Hardware sales outpace services due to the capital-intensive nature of deployment and the need for continuous upgrades.

- Type Dominance: Cashless self-checkout solutions are increasingly dominant because of the proliferation of mobile wallets, NFC, and QR code payments. Consumers appreciate faster transaction processing and reduced waiting times, leading retailers to phase out cash-based machines in high-traffic locations.

- Application Dominance: Supermarkets and hypermarkets remain the largest application segment as these retailers typically have the highest transaction volumes and strong incentives to optimize labor costs. The scale of operations justifies the investment in multiple lanes of self-checkout systems.

- Driver: The push for contactless, seamless shopping experiences and the need to address labor shortages are the primary drivers of market growth. Retailers are leveraging self-checkout to improve customer throughput and operational efficiency.

- Restraint: High upfront investment and concerns over theft and shrinkage are major restraints. Smaller retailers, in particular, find the cost barrier challenging to overcome without substantial ROI projections.

- Opportunity: Advancements in AI-powered loss prevention and customer assistance create significant opportunities for vendors. Emerging markets with modernizing retail infrastructure present additional growth prospects.

- Trend: Integration with digital wallets and facial recognition is a prominent trend. Additionally, modular self-checkout pods designed for smaller stores and convenience formats are gaining traction.

- Regional Analysis: North America leads due to technological readiness, consumer acceptance, and significant retailer investments. Europe and Asia Pacific follow, with strong growth potential in emerging economies.

Component Analysis:

Systems are the cornerstone of self-checkout deployments. These integrated solutions include touchscreen displays, barcode scanners, weighing scales, and payment terminals. Large supermarkets and hypermarkets often invest in multiple units per store to handle high customer throughput. The ability to customize hardware configurations to support advanced payment options, such as digital wallets and biometrics, has increased the appeal of systems over standalone services. Furthermore, frequent hardware refresh cycles and evolving security standards necessitate ongoing upgrades, driving recurring demand. As the retail sector becomes more digitized, systems continue to account for the majority of market revenue.

Type Analysis:

Cashless self-checkout systems lead the market segment due to their alignment with evolving consumer payment preferences and operational advantages. These systems support credit cards, debit cards, mobile payments, and contactless transactions, offering faster processing times and reduced cash handling requirements. The cashless segment's dominance is further reinforced by the COVID-19 pandemic's acceleration of contactless payment adoption. However, the cash-based segment dominated the market with the highest revenue share in 2024, driven by consumer preference for traditional payment methods among certain demographics, indicating regional variations in payment preferences and the continued relevance of cash-accepting systems in specific markets.

End User Analysis:

Supermarkets and Hypermarkets Leads With over 55% Market Share In Self-Checkout System Market. Supermarkets and hypermarkets represent the largest application segment for self-checkout systems due to their high transaction volumes, diverse product ranges, and significant potential for labor cost optimization. These large-format retail stores benefit from the scalability of self-checkout solutions and their ability to handle peak shopping periods more efficiently. The segment's dominance is supported by the widespread adoption rates, with grocers having a 96% adoption rate for self-checkout systems. Convenience stores and department stores follow as secondary application segments, each with specific requirements for compact, efficient self-checkout solutions tailored to their operational models.

Region Analysis:

North America Leads With more than 40% Market Share In Self-Checkout System Market. North America leads the global self-checkout system market due to several strategic advantages including early technology adoption, high consumer acceptance rates, and the presence of major market players such as NCR Corporation, Diebold Nixdorf, and Toshiba Global Commerce Solutions. The region's market leadership is reinforced by advanced retail infrastructure, widespread digital payment adoption, and significant investments in retail automation technologies. In North America, the market sees demand for advanced self-checkout systems with features such as mobile payment integration, biometric authentication, and enhanced security measures.

The Asia Pacific region demonstrates the fastest growth potential, growing significantly at a CAGR of over 15% from 2025 to 2030, driven by the expansion of modern retail formats, rising urbanization, and increasing consumer preference. Countries like China, India, and Japan are experiencing rapid retail modernization, creating substantial opportunities for self-checkout system deployment. Europe maintains a strong position with significant investments in retail digitalization and sustainability initiatives driving adoption.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Offering

- Hardware

- Software

- Services

By Model Type

- Cash Model

- Cashless Model

By Mounting Type

- Standalone

- Wall-Mounted

- Mobile

By End User

- Retail (Supermarkets, Hypermarkets, Convenience Stores)

- Hospitality (Hotels, Restaurants, Cafes)

- Healthcare

- Transportation (Airports, Metro, Bus Terminals)

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 5.66 B |

| Forecast Revenue (2034) | USD 14.2 B |

| CAGR (2025-2034) | 10.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Offering (Hardware, Software, Services), By Model Type, Cash Model, Cashless Model), By Mounting Type (Standalone, Wall-Mounted, Mobile), By End User (Retail (Supermarkets, Hypermarkets, Convenience Stores), Hospitality (Hotels, Restaurants, Cafes), Healthcare, Transportation (Airports, Metro, Bus Terminals), Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM Corporation ,Diebold Nixdorf, Incorporated ,Honeywell International Inc. ,ePOS HYBRID ,CCL Technology ,Fujitsu ,OLEA Kiosk. ,Gilbarco Veeder-Root Company. ,ITAB ,Toshiba Global Commerce Solutions ,MetroClick ,NCR Corporation ,StrongPoint ,Pyramid Computer GMBH |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date