Self-Storage and Moving Services Market Size, Growth & Forecast | CAGR of 7.5%

Global Self-Storage and Moving Services Market Size, Share & Urban Mobility Analysis By Service Type (Storage, Relocation, On-Demand), By End User (Residential, Commercial), Smart Storage Trends, Regional Expansion, Competitive Landscape & Forecast 2025–2034

Report Overview

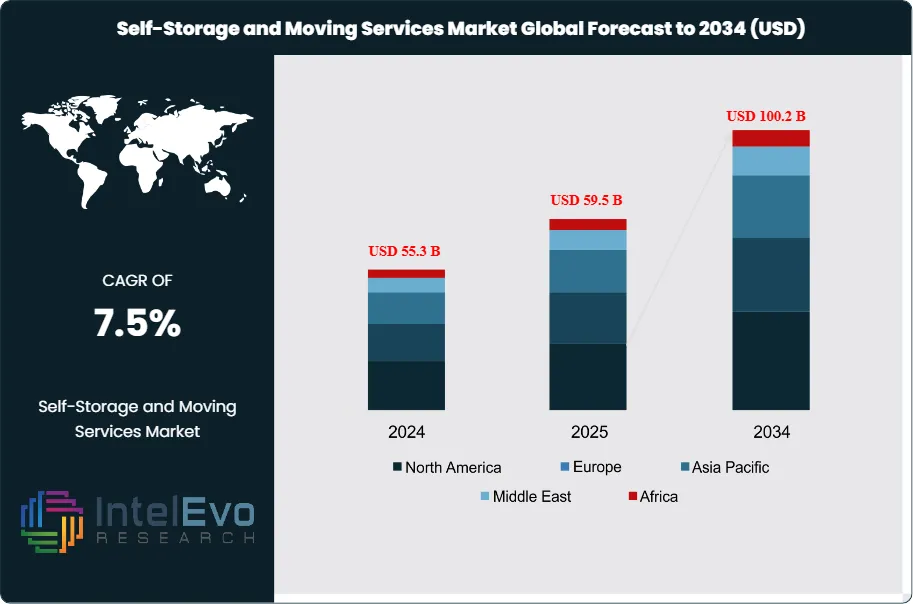

The Self-Storage and Moving Services Market is estimated at USD 55.3 billion in 2024 and is on track to reach roughly USD 100.2 billion by 2034, implying a compound annual growth rate (CAGR) of 7.5% over 2025–2034. This expansion is supported by rising urbanization, increased residential mobility, and the growing prevalence of smaller living spaces that drive demand for flexible storage solutions. Growth in e-commerce, corporate relocations, and lifestyle transitions such as downsizing and temporary housing further reinforce steady utilization rates across both self-storage facilities and professional moving services.

Get More Information about this report -

Request Free Sample ReportThe industry has expanded steadily over the past decade, supported by rising urbanization, smaller living spaces, and greater workforce mobility. Demand has shifted from being primarily residential to a balanced mix of personal and commercial use, with small businesses increasingly relying on storage and relocation services to manage inventory and logistics.

The market landscape reflects both maturity and expansion potential. In the United States, more than 52,000 self-storage facilities serve an estimated 14.5 million households, making it the most developed market globally. Europe and Asia-Pacific are emerging as growth hotspots, with rising urban density and housing constraints driving adoption. The United Kingdom, for example, has seen consistent demand, with nearly four in ten households reporting use of self-storage. In Asia, rapid urban migration in countries such as China and India is creating strong demand for affordable, flexible storage solutions.

Growth is underpinned by several demand-side drivers. Urban downsizing, cross-border relocations, and the rise of e-commerce are fueling storage requirements. On the supply side, operators are expanding capacity and introducing differentiated services such as climate-controlled units, advanced security systems, and integrated moving assistance. However, the market faces challenges including high real estate costs in metropolitan areas, regulatory constraints on land use, and competitive saturation in mature regions. Operators must balance pricing with service quality to maintain profitability.

Technology is reshaping the sector. Digital booking platforms, automated access systems, and AI-enabled inventory tracking are improving customer convenience and operational efficiency. Some providers are experimenting with mobile storage units and on-demand moving services, aligning with consumer expectations for flexibility. These advancements are expected to accelerate adoption, particularly among younger demographics and small enterprises.

For investors, North America remains the largest and most stable market, while Asia-Pacific offers the highest growth potential over the next decade. Secondary cities in Europe and Latin America also present opportunities as urbanization intensifies. The industry’s trajectory reflects broader demographic and housing trends, positioning self-storage and moving services as a critical enabler of mobility, convenience, and business continuity in the global economy.

Key Takeaways

- Market Growth: The global self-storage and moving services market was valued at USD 55.3 billion in 2024 and is projected to reach USD 100.2 billion by 2034, expanding at a CAGR of 7.5%. Growth is supported by urbanization, smaller housing units, and rising demand from both households and small businesses.

- Service Type: Self-storage accounted for 52.3% of total revenue in 2024, reflecting strong demand for flexible storage solutions among individuals and enterprises managing inventory overflow.

- Storage Type: Indoor storage represented 47.9% of the market in 2024, driven by the need for climate-controlled facilities to protect electronics, documents, and temperature-sensitive goods.

- End User: Residential customers held 62.7% of the market in 2024, underscoring the impact of downsizing, relocations, and lifestyle shifts toward smaller living spaces.

- Driver: Rising urban density and mobility are fueling demand. In the United States alone, more than 14.5 million households use self-storage, supported by over 52,000 facilities nationwide.

- Restraint: High real estate and operating costs in metropolitan areas limit expansion, with facility development costs reducing margins by up to 15% in saturated urban markets.

- Opportunity: Asia-Pacific presents the strongest growth potential, with urban migration in India and China expected to drive double-digit adoption rates. The region is forecast to outpace the global CAGR, creating attractive entry points for investors.

- Trend: Technology integration is reshaping the sector. Operators are deploying digital booking platforms, automated access, and AI-enabled inventory tracking, with early adopters reporting efficiency gains of up to 20%.

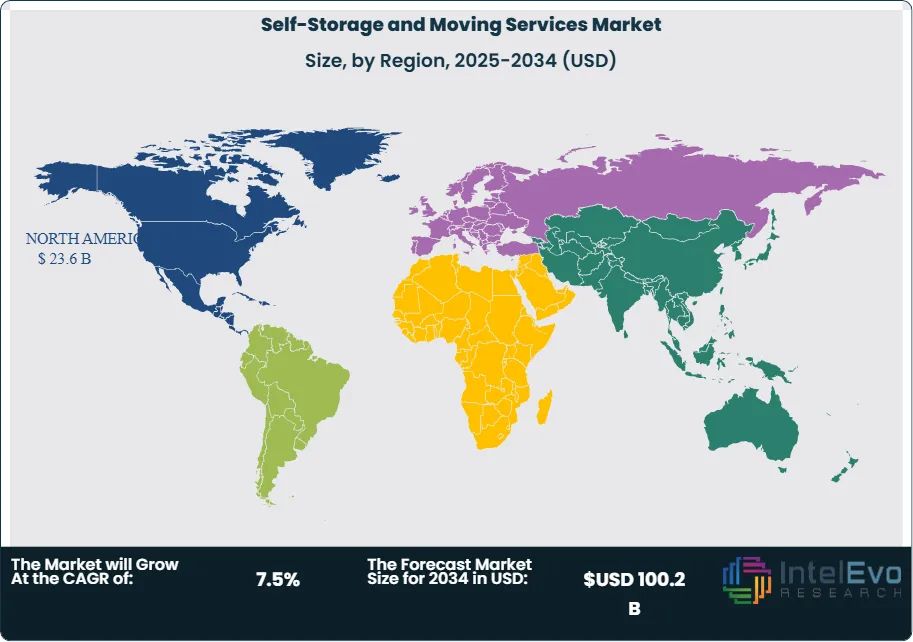

- Regional Analysis: North America led the market in 2024 with a 45.2% share, valued at USD 23.64 billion, supported by mature infrastructure and high household adoption. Asia-Pacific is projected to record the fastest CAGR through 2034, while Europe shows steady growth in secondary cities where storage penetration remains below 30%.

Service Type Analysis

Self-storage continues to dominate the global market in 2025, accounting for more than half of total revenues at 52.3%. The segment’s strength is linked to rising urban density, smaller living spaces, and the growing need for flexible storage among both households and small enterprises. Customers value the ability to rent units on short or long terms, with 24/7 access and cost efficiency compared to renting larger properties. This model has become particularly attractive in metropolitan areas where housing affordability pressures are high.

Moving services represent the second-largest category, holding 31.4% of the market. These services cover packing, loading, transportation, and unloading, providing convenience for individuals and businesses relocating across cities or regions. Demand is supported by workforce mobility and cross-border relocations, with service providers increasingly offering bundled packages that combine moving and storage. Packing services account for 9.2% of the market, reflecting heightened awareness of damage risks during transit. Professional packing has become a preferred add-on, particularly for high-value goods. Truck rental, with a 7.1% share, remains a cost-sensitive option for customers who prefer to manage moves independently, though it lacks the convenience and security of full-service offerings.

Storage Type Analysis

Indoor storage leads the market with a 47.9% share in 2025, supported by demand for secure, climate-controlled environments. These facilities are favored for storing electronics, documents, antiques, and personal valuables. Enhanced security features such as gated access, surveillance, and on-site staff further strengthen adoption. Outdoor storage follows with 29.1%, offering larger and more economical units suitable for vehicles, equipment, and bulk items that do not require climate control.

Climate-controlled storage accounts for 16.5% of the market. This segment is expanding as customers seek stable temperature and humidity conditions for sensitive goods, including artwork, medical supplies, and business archives. Vehicle storage represents 6.5% of the market, driven by urban households without sufficient parking space and by seasonal demand for recreational vehicles and boats. With rising restrictions on street parking in major cities, this segment is expected to see steady growth through 2030.

End-Use Analysis

Residential users remain the largest customer base, representing 62.7% of the market in 2025. The segment is driven by relocations, downsizing, and the need for temporary storage during housing transitions. Seasonal storage of furniture, sports equipment, and personal belongings also contributes to demand. Urbanization trends, particularly in Asia and Europe, continue to reinforce residential reliance on self-storage.

Commercial users account for 27.2% of the market. Small and medium-sized enterprises increasingly use storage facilities for inventory management, seasonal stock, and equipment. Many businesses also combine storage with truck rental to streamline logistics. Industrial users represent 10.1%, with demand centered on storing machinery, spare parts, and vehicles not in daily use. While smaller in share, the industrial segment is expected to expand as manufacturing and construction firms adopt flexible storage solutions to reduce fixed warehouse costs.

Regional Analysis

North America leads the global market with a 45.2% share in 2025, valued at approximately USD 23.6 billion. The region benefits from a mature infrastructure, high consumer adoption, and the presence of established operators. Frequent relocations, high disposable incomes, and a culture of convenience continue to support growth. The U.S. alone hosts more than 52,000 self-storage facilities, serving over 14 million households.

Europe is experiencing steady expansion, particularly in the UK, Germany, and France, where urban density and apartment living drive demand. The region’s market is also shaped by professional mobility and cross-border relocations. Asia Pacific is the fastest-growing region, supported by rising middle-class incomes, urban migration, and small business adoption. China and India are key growth engines, with double-digit CAGR projections through 2030.

Latin America and the Middle East & Africa remain smaller markets but present long-term opportunities. In Latin America, Brazil and Mexico are seeing increased adoption as urbanization accelerates. In the Middle East, the UAE and Saudi Arabia are emerging hubs, supported by expatriate populations and large-scale infrastructure projects. These regions are expected to attract investment as operators expand into underserved markets.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Service Type

- Self-Storage

- Moving Services

- Packing Services

- Truck Rental

By Storage Type

- Indoor Storage

- Outdoor Storage

- Climate-Controlled Storage

- Vehicle Storage

By End-User

- Residential

- Commercial

- Industrial

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 55.3 B |

| Forecast Revenue (2034) | USD 100.2 B |

| CAGR (2024-2034) | 7.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Service Type (Self-Storage, Moving Services, Packing Services, Truck Rental), By Storage Type (Indoor Storage, Outdoor Storage, Climate-Controlled Storage, Vehicle Storage), By End-User (Residential, Commercial, Industrial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SmartStop Self Storage, Bekins Van Lines, Public Storage, PODS Enterprises, CubeSmart, Rent-A-Space, Extra Space Storage, Moving APT, SpareFoot, U-Haul International, Two Men and a Truck, Life Storage |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Self-Storage and Moving Services Market

Published Date : 02 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date