Shooting Games Market Size, Growth Trends & Forecast | CAGR 7.9%

Global Shooting Games Market Size, Share & Gaming Industry Analysis By Platform (PC, Console, Mobile, Cloud Gaming), By Game Mode (Single Player, Multiplayer, Battle Royale), By Monetization Model, Esports Integration, AR/VR Adoption, Regional Player Base, Leading Publishers, Trends & Forecast 2025–2034

Report Overview

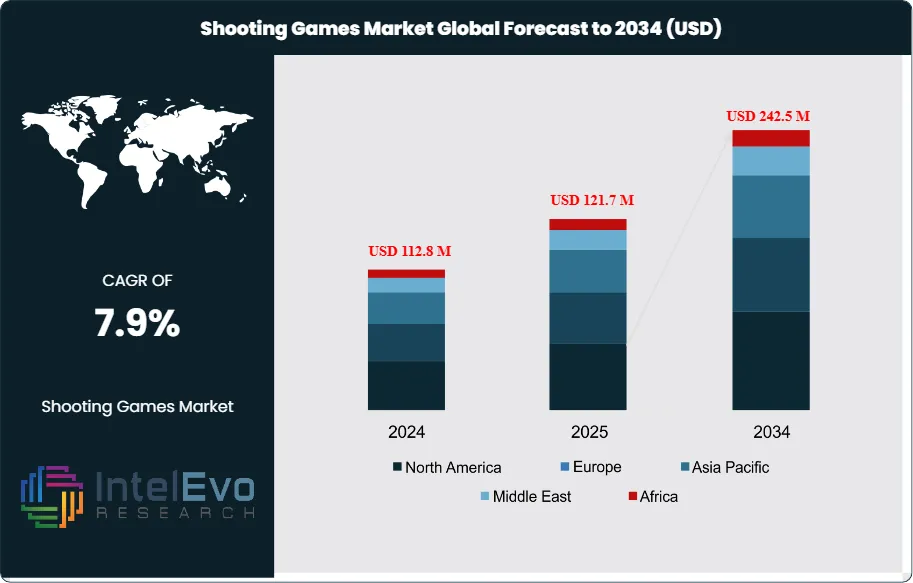

The Shooting Games Market is estimated at USD 112.8 million in 2024 and is projected to reach approximately USD 242.5 million by 2034, registering a compound annual growth rate (CAGR) of 7.9% during 2025–2034. This steady expansion is driven by the rising popularity of competitive multiplayer formats, the growth of esports ecosystems, and increasing engagement across console, PC, and mobile platforms. Advances in graphics engines, cross-platform play, and immersive technologies such as AR and VR are further enhancing user experience. In addition, strong community-driven content, live updates, and monetization through in-game purchases continue to sustain long-term player retention and revenue growth across global markets.

Get More Information about this report -

Request Free Sample ReportThe market has expanded steadily over the past decade, supported by rising consumer demand for competitive multiplayer formats and the integration of esports into mainstream entertainment. Shooter titles now account for a significant share of global gaming revenues, with growth accelerating as free-to-play models and in-game monetization broaden access and deepen engagement.

The market encompasses first-person shooters, third-person shooters, tactical formats, battle royale titles, and hybrid variants across PC, console, and mobile platforms. In-game purchases, downloadable content, weapon skins, and seasonal passes represent a growing share of revenue. Esports monetization adds another layer of opportunity, with tournaments and streaming platforms driving visibility and commercial returns. Popular franchises illustrate the scale of engagement: Counter-Strike 2 records more than 88,000 daily active players, while Call of Duty has peaked at nearly 491,000 concurrent participants.

Demand is reinforced by the global esports boom. The esports audience is projected to reach 544 million in 2024 and exceed 640 million by 2025. Events such as the Free Fire World Series, which drew 5.41 million viewers, and The International 2021, which offered a USD 40 million prize pool, highlight the commercial potential of shooter-based competitions. Viewer numbers in the millions translate into sponsorship, advertising, and media rights opportunities that sustain long-term growth.

Technology is reshaping adoption patterns. Advances in graphics, network infrastructure, and latency reduction enhance gameplay quality, while cloud gaming and streaming services expand accessibility. Mobile versions of leading titles are widening the player base, particularly in emerging markets. These shifts reduce entry barriers and create recurring revenue streams through microtransactions and live-service models.

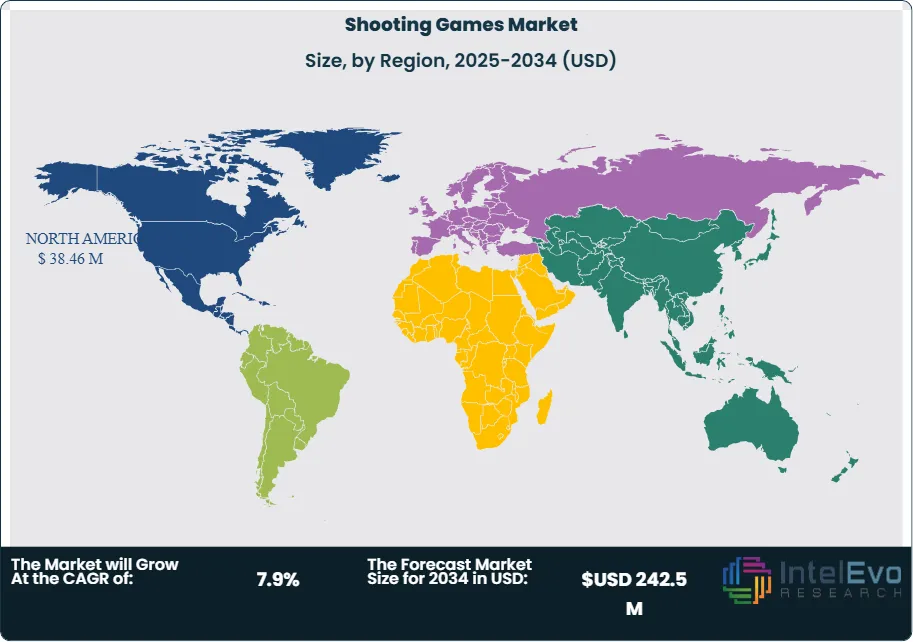

Regionally, North America leads with a 31% share, valued at USD 31.78 million in 2023, driven by strong console penetration and established esports ecosystems. Asia-Pacific dominates in audience size, accounting for 57% of global esports viewers, with China, South Korea, and Southeast Asia serving as critical growth hubs. Europe follows with 16% of the esports audience, supported by rising investment in competitive gaming infrastructure. For investors, Asia-Pacific offers scale, while North America and Europe provide high monetization potential, making them key markets to watch over the forecast horizon.

Key Takeaways

- Market Growth: The global Shooting Games Market was valued at USD 112.8 million in 2024 and is projected to reach USD 242.5 million by 2034, reflecting a CAGR of 7.9%. Growth is driven by esports expansion, free-to-play adoption, and rising in-game monetization.

- Game Type: First-Person Shooter (FPS) titles accounted for 38% of market share in 2023, supported by high engagement levels in franchises such as Counter-Strike and Call of Duty, which consistently attract hundreds of thousands of concurrent players.

- Platform: Console gaming led with 40% share in 2023, underpinned by strong hardware adoption in North America and Europe and the availability of exclusive shooter titles that sustain player loyalty.

- Driver: Esports growth is a key catalyst, with the global esports audience expected to reach 544 million in 2024 and surpass 640 million by 2025. Shooter-based tournaments such as the Free Fire World Series and The International generate multi-million-dollar prize pools and peak viewership above 5 million.

- Restraint: High development costs and reliance on continuous content updates limit profitability for smaller studios. AAA shooter titles often require budgets exceeding USD 100 million, creating barriers to entry and intensifying competition among established publishers.

- Opportunity: Mobile shooter games present a high-growth segment, particularly in Asia-Pacific, where mobile penetration exceeds 70%. Titles adapted for smartphones are expanding the player base and are expected to contribute significantly to revenue growth over the forecast horizon.

- Trend: Cloud gaming and streaming platforms are reshaping access, reducing hardware dependency, and broadening reach. Services such as Xbox Cloud Gaming and NVIDIA GeForce NOW are making high-quality shooter experiences available to wider audiences.

- Regional Analysis: North America led with 31% share in 2023, valued at USD 31.78 million, supported by high consumer spending and esports infrastructure. Asia-Pacific dominates in audience scale, accounting for 57% of global esports viewers, while Europe holds 16% share and is emerging as an investment hotspot for competitive gaming platforms.

Game Type Analysis

The global shooting games market in 2025 continues to be led by First-Person Shooter (FPS) titles, which account for approximately 38% of total revenues. Their dominance stems from immersive gameplay mechanics, advanced graphics, and strong multiplayer ecosystems that sustain long-term engagement. Flagship franchises such as Call of Duty and Counter-Strike remain central to this segment, with daily active player counts exceeding hundreds of thousands across platforms. The competitive nature of FPS games also aligns closely with esports, reinforcing their commercial strength.

Other categories contribute meaningfully to market diversity. Third-Person Shooter (TPS) games attract players who prefer broader field-of-view mechanics and tactical cover systems, making them popular in both casual and competitive settings. Battle Royale titles, which surged in popularity over the past five years, continue to expand their audience by offering large-scale survival formats that support up to 100 players per match. Tactical shooters, while smaller in share, appeal to players seeking realism and team-based strategy, with titles like Rainbow Six Siege maintaining strong esports visibility. Shoot ’em up (shmup) games remain niche but retain loyal communities, particularly in Asia, where retro-style gameplay still commands attention. Together, these sub-segments ensure a balanced ecosystem that caters to varied player preferences.

Platform Analysis

Consoles hold the largest share of the shooting games market in 2025, representing about 40% of global revenues. Their strength lies in high-performance hardware, exclusive franchise releases, and strong adoption in North America and Europe. Console ecosystems also benefit from subscription-based services such as Xbox Game Pass and PlayStation Plus, which increase accessibility to premium shooter titles.

PC gaming remains a close competitor, supported by advanced customization, superior graphics, and widespread adoption of esports titles. The segment benefits from strong uptake in Asia-Pacific, where internet café culture and competitive gaming communities remain influential. Mobile platforms, however, represent the fastest-growing category. With global smartphone penetration surpassing 75% in 2025, mobile shooters such as PUBG Mobile and Free Fire continue to attract massive audiences, particularly in emerging markets. Other platforms, including handheld devices and virtual reality, remain niche but are gaining traction as immersive technologies improve. Each platform plays a distinct role in shaping accessibility, monetization, and long-term engagement.

End-Use Analysis

Residential gaming remains the primary end-use segment, accounting for the majority of revenues as households increasingly invest in consoles, PCs, and mobile devices. The rise of home-based entertainment, accelerated by digital distribution and subscription models, has reinforced this trend.

Commercial applications are expanding, particularly through esports arenas, gaming cafés, and organized tournaments. These venues generate revenue not only from gameplay but also from sponsorships, advertising, and ticket sales. Industrial applications, though limited, include training simulations and defense-related gaming technologies, where shooter mechanics are adapted for tactical and operational training. While smaller in scale, this segment highlights the broader applicability of shooting game technologies beyond entertainment.

Regional Analysis

North America continues to lead the global market with a 31% share in 2025, valued at over USD 38.46 million. The region benefits from high consumer spending, advanced gaming infrastructure, and the presence of leading publishers and esports organizations. Major conventions and tournaments further reinforce its position as a hub for competitive gaming.

Asia-Pacific, however, represents the largest audience base, accounting for more than 55% of global esports viewership. Countries such as China, South Korea, and India are driving mobile shooter adoption, supported by rising smartphone penetration and affordable internet access. Europe follows with steady growth, supported by strong console adoption and expanding esports investments in markets such as Germany, the UK, and France. Latin America and the Middle East & Africa are emerging growth regions, where mobile platforms dominate due to affordability and accessibility. These regions are expected to post double-digit CAGR through 2030, making them attractive for publishers seeking new revenue streams.

This segmentation highlights a market that is both mature in developed economies and rapidly expanding in emerging regions, with platform diversification and esports integration shaping its long-term trajectory.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Game Type

- First-Person Shooter (FPS)

- Third-Person Shooter (TPS)

- Shoot ’em up (shmup)

- Battle Royale

- Tactical Shooter

By Platform

- PC (Personal Computer)

- Console

- Mobile

- Other Platforms

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 112.8 M |

| Forecast Revenue (2034) | USD 242.5 M |

| CAGR (2024-2034) | 7.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Game Type (First-Person Shooter (FPS), Third-Person Shooter (TPS), Shoot ’em up (shmup), Battle Royale, Tactical Shooter), By Platform (PC (Personal Computer), Console, Mobile, Other Platforms) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Rockstar Games, Ubisoft, Krafton, Gameloft (Vivendi), Activision Blizzard, Nexon, Valve Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date