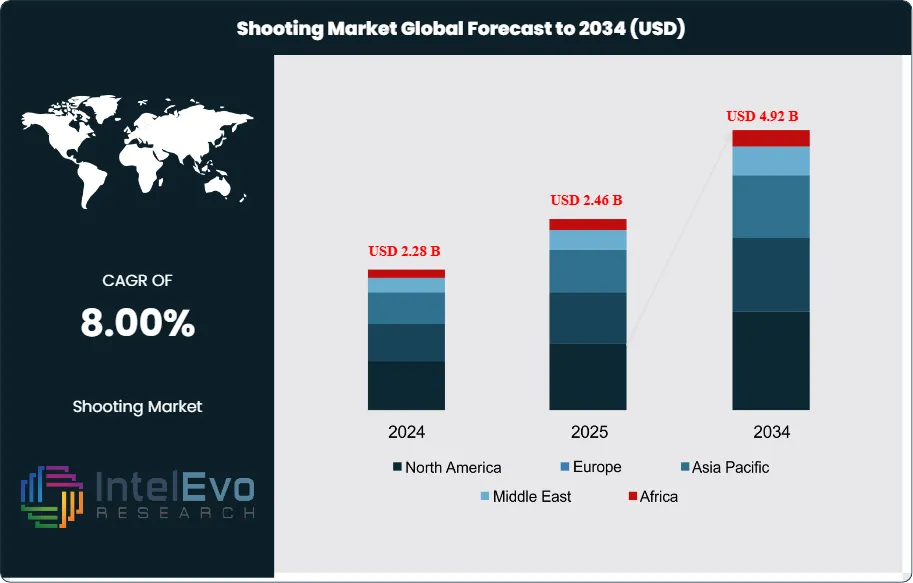

Shooting Market Size, Share to Reach $4.92 Billion by 2034 | 8.00% CAGR

Global Shooting Market Size, Share, Analysis ,Forecast Report By Product Type (Air Rifles, Air Pistols),By Shooting Type (Indoor Shooting, Outdoor Shooting), By Target Type (Moving Targets, Fixed Targets, Reactive Targets), By Application Type (Recreational Shooting, Military Training, Competitive Sports, Hunting) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

The Shooting Market size is expected to be worth around USD 4.92 Billion by 2034, from USD 2.28 Billion in 2024, growing at a CAGR of 8.00% during the forecast period from 2024 to 2034. The shooting market encompasses a comprehensive ecosystem of products, services, and infrastructure supporting recreational shooting, competitive sports, military training, and law enforcement activities.

Get More Information about this report -

Request Free Sample ReportThis market includes firearms (air rifles, air pistols, shotguns), ammunition, shooting accessories, shooting ranges, targets, and related equipment designed to serve diverse shooting disciplines including hunting, clay shooting, target practice, and tactical training. The market serves multiple end-user segments ranging from recreational enthusiasts and competitive athletes to professional military personnel and law enforcement agencies, creating a multifaceted industry with varying product requirements and performance specifications.

The shooting market is experiencing robust growth driven by increasing urbanization and rising participation in recreational shooting activities among city residents. Key growth catalysts include technological advancements in smart gun technology, precision targeting systems, and enhanced safety features that improve user experience and operational efficiency. The market benefits from growing female participation in both indoor and outdoor shooting activities, expanding the demographic base and creating new market opportunities. Additionally, government initiatives at state and federal levels are encouraging citizen participation in recreational and competitive shooting sports, particularly targeting younger demographics to boost market revenues.

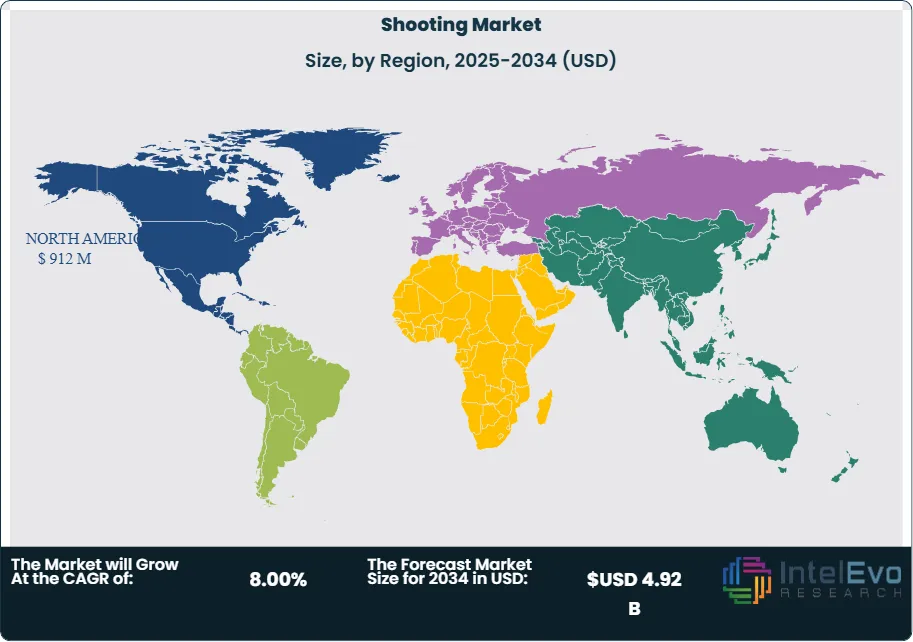

North America dominates the global shooting market, generating a significant revenue. This leadership position is reinforced by the United States accounting for more than 60% of the global firearms market, supported by substantial defense spending and a strong constitutional framework protecting firearm ownership rights. The Asia-Pacific region presents the fastest-growing market segment, driven by rising disposable incomes, growing interest in outdoor sports, and government initiatives promoting recreational activities. Europe maintains significant market presence due to established hunting cultures and renowned manufacturers, particularly in countries like Spain, Italy, and Germany.

The COVID-19 pandemic initially created supply chain disruptions and operational challenges for shooting ranges and training facilities due to lockdown measures and social distancing requirements. However, the pandemic ultimately accelerated interest in personal security and self-defense, leading to increased firearm ownership and shooting sports participation. The crisis highlighted the importance of accessible training facilities and drove innovation in safety protocols and facility management systems within shooting ranges and training centers.

Rising geopolitical tensions and security concerns have significantly influenced shooting market dynamics, particularly in defense and law enforcement segments. International trade restrictions and export controls on advanced firearms technology have created opportunities for domestic manufacturers while challenging global supply chains. Additionally, increasing personal security concerns driven by various global conflicts have boosted civilian demand for firearms and related training services, contributing to overall market expansion.

Key Takeaways

- Market Growth: The Shooting Market is expected to reach USD 4.92 Billion by 2034, fueled by urbanization trends and increased recreational shooting participation among city dwellers, supported by technological innovations in smart gun systems, precision targeting, and enhanced safety features.

- Product Type Dominance: Air Rifles leads the segment, primarily due to accessibility, lower regulatory barriers, and beginner-friendly characteristics.

- Shooting Type Dominance: Outdoor shooting leads market share due to traditional preferences and accessibility.

- Target Type Dominance: Fixed Targets dominate the segment market share, driven by cost-effectiveness and training standardization.

- Application Type Dominance: Military Training holds the largest share, owing to defense spending and professional requirements.

- Driver: Key drivers accelerating growth include increasing urban participation in shooting sports and rising female participation, which boost market expansion through demographic diversification and enhanced accessibility.

- Restraint: Growth is hindered by high installation costs for advanced shooting facilities and stringent safety regulations, which create challenges such as capital barriers and operational complexity.

- Opportunity: The market is poised for expansion due to opportunities like technological integration in smart guns and emerging market penetration, which enable enhanced functionality and geographic diversification.

- Trend: Emerging trends including electronic scoring systems and augmented reality integration are reshaping the market by improving user experience and training effectiveness.

- Regional Analysis: North America leads owing to established shooting culture and defense spending. Asia-Pacific shows high promise due to rising disposable incomes and government sports promotion initiatives.

Product Type Analysis:

Air rifles represent the leading product category within the shooting sports market, primarily attributed to their widespread accessibility and minimal regulatory restrictions that make them appealing to newcomers in the shooting community. These firearms serve as an optimal introduction for novice shooters due to their user-friendly design and inherent safety features. The versatility of air rifles allows them to be utilized across various shooting disciplines, while their cost-effective operation and reduced maintenance requirements compared to traditional powder-based firearms make them an economical choice for both individual enthusiasts and professional training establishments. This combination of affordability, safety, and adaptability has solidified air rifles' position as the preferred option for those seeking to enter the shooting sports arena.

Shooting Type Analysis:

Outdoor shooting represents the predominant segment within the shooting sports market, commanding the largest market share due to shooters' longstanding preference for natural environments and the well-established network of outdoor shooting facilities. This market leadership is attributed to the inherent advantages of outdoor ranges, including their ability to accommodate diverse shooting disciplines with greater operational flexibility. The popularity of outdoor shooting is further reinforced by the significantly lower costs associated with developing and maintaining outdoor facilities compared to indoor alternatives, along with reduced regulatory complexities that streamline operations.

Target Type Analysis:

Fixed targets maintain the leading position in the target segment, highlighting their essential contribution to standardized training programs and economical range operations. These stationary targets deliver consistent and reliable training experiences while requiring minimal upkeep, making them suitable across various shooting disciplines. Their market predominance is strengthened by regulatory bodies' preference for standardized training methodologies and the significant economic benefits they offer to shooting range operators. The appeal of fixed targets lies in their ability to reduce operational complexity and minimize equipment expenses, creating a cost-effective solution that supports both training consistency and business profitability in the shooting sports industry.

Application Type Analysis:

Military Training Leads With over 55% Market Share In Shooting Market. Military training applications hold the dominant position in the market, demonstrating the significant government commitment to enhancing defense capabilities and meeting professional training standards. This segment creates substantial demand for premium-quality, robust equipment designed to endure rigorous use while satisfying stringent performance criteria. The military sector's market leadership is sustained by steady budget commitments, extended procurement agreements, and the vital importance of firearms training within national security frameworks. The consistent investment in military training infrastructure reflects the strategic priority placed on maintaining well-trained armed forces, positioning this segment as the primary driver of market growth and technological advancement in the shooting training industry.

Region Analysis:

North America Leads With more than 40% Market Share In Shooting Market. North America holds the commanding position in the global market, establishing its leadership through the United States' constitutional provisions that support firearm ownership rights, extensive defense expenditures that represent a dominant portion of worldwide firearms spending, and a deeply rooted shooting culture that encompasses recreational, competitive, and professional sectors. This regional supremacy is further strengthened by sophisticated manufacturing infrastructure, well-established distribution channels, and robust consumer demand fueled by traditional hunting practices and personal protection considerations.

Meanwhile, the Asia-Pacific region emerges as the most rapidly expanding market, driven by growing household wealth, governmental programs encouraging sports engagement, and heightened enthusiasm for outdoor leisure pursuits across nations including China, India, and various Southeast Asian countries where economic advancement is creating expanded middle-class demographics with increased recreational spending power.

Europe continues to maintain a substantial market footprint through its longstanding hunting heritage, high-end equipment production capabilities, and comprehensive regulatory systems that facilitate controlled market expansion, with particular strength in Germany, Italy, and Spain where hunting and competitive shooting traditions are deeply woven into the cultural fabric.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Air Rifles

- Air Pistols

Shooting Type

- Indoor Shooting

- Outdoor Shooting

Target Type

- Moving Targets

- Fixed Targets

- Reactive Targets

Application Type

- Recreational Shooting

- Military Training

- Competitive Sports

- Hunting

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.28 B |

| Forecast Revenue (2034) | USD 4.92 B |

| CAGR (2025-2034) | 8.00% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Air Rifles, Air Pistols),Shooting Type (Indoor Shooting, Outdoor Shooting), Target Type (Moving Targets, Fixed Targets, Reactive Targets), Application Type (Recreational Shooting, Military Training, Competitive Sports, Hunting) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Royal Range USA, ACTION TARGET, Range Systems, Spire Ranges, Mobile Range Technologies, Phoenix Range, REGUPOL Germany GmbH & Co. KG, GEBIM S.R.L., ARMI PERAZZI S.p.A. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Shooting Market?

The global Shooting Market is expected to grow from USD 2.28 Billion in 2024 to USD 4.92 Billion by 2034, expanding at a CAGR of 8.00%. Explore trends and forecasts.

Who are the major players in the Shooting Market?

Royal Range USA, ACTION TARGET, Range Systems, Spire Ranges, Mobile Range Technologies, Phoenix Range, REGUPOL Germany GmbH & Co. KG, GEBIM S.R.L., ARMI PERAZZI S.p.A.

Which segments covered the Shooting Market?

Product Type (Air Rifles, Air Pistols),Shooting Type (Indoor Shooting, Outdoor Shooting), Target Type (Moving Targets, Fixed Targets, Reactive Targets), Application Type (Recreational Shooting, Military Training, Competitive Sports, Hunting)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date