Short-term Rental Apps Market Size, Share & Growth Forecast | 13.7% CAGR

Global Short-term Rental Apps Market Size, Share, Analysis Report By Rental Type (Property Rental, Tools & Machinery, Vehicle Rental, Others), Platform (Web-based Platform, Mobile Apps), End-Use (Businesses & Organizations, Individual Consumers) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

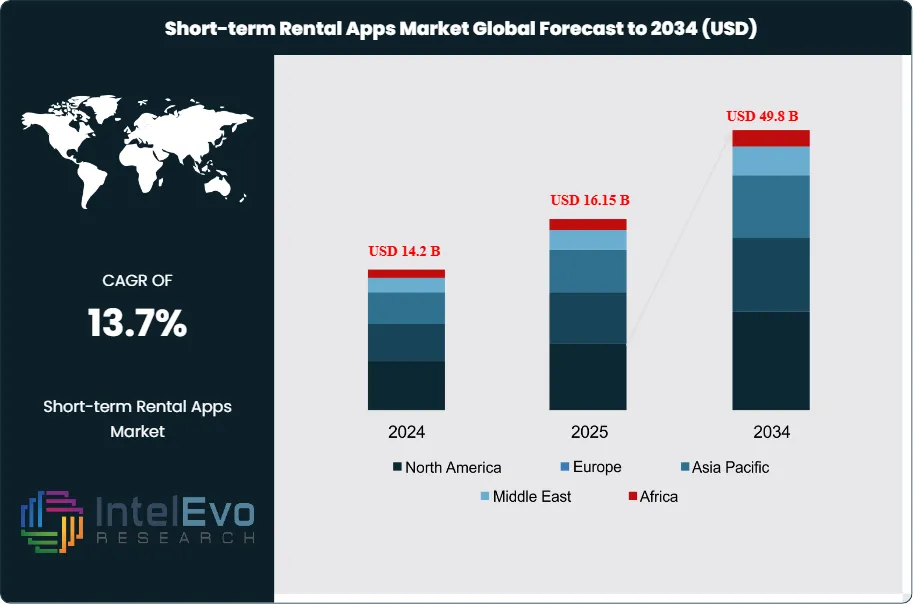

The Short-term Rental Apps Market size is expected to be worth around USD 49.8 Billion by 2034, up from USD 14.2 Billion in 2024, growing at a CAGR of 13.7% during the forecast period from 2025 to 2034. The market’s expansion is fueled by the growing popularity of the sharing economy, increasing digital adoption, and the rising preference for flexible accommodation and asset access solutions. Enhanced user experiences powered by AI, seamless digital payments, and cross-platform integration are transforming how consumers book and manage rentals globally. With travel recovery, urbanization, and millennial-driven demand for convenience, the short-term rental apps market continues to be one of the most dynamic and rapidly evolving digital ecosystems.

Get More Information about this report -

Request Free Sample ReportThe short-term rental apps market represents a dynamic and rapidly evolving sector within the broader sharing economy, encompassing digital platforms that facilitate the rental of various assets including properties, tools, machinery, and vehicles for brief periods.

This market has experienced remarkable growth driven by urbanization, increasing consumer preference for access over ownership, technological advancement, and changing lifestyle patterns among millennials and Gen Z consumers. The integration of artificial intelligence, machine learning, and enhanced user interfaces has significantly improved the booking experience, making short-term rentals more accessible and user-friendly than ever before.

Several key factors are shaping the market trajectory, including regulatory changes across major cities worldwide, the rise of remote work culture post-pandemic, and increasing demand for flexible accommodation options. The market is also influenced by economic factors such as inflation, interest rates, and consumer spending patterns, which directly impact both supply and demand dynamics. Additionally, sustainability concerns and the growing emphasis on experiences over material possessions have further propelled the adoption of short-term rental platforms across various demographic segments.

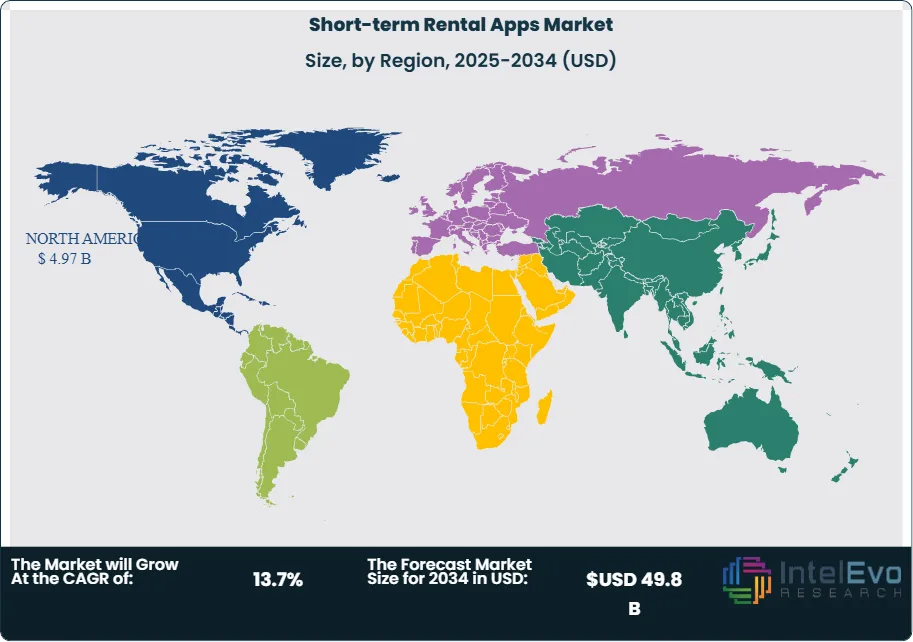

The regional analysis reveals North America as the dominant market with approximately 37-38% market share in 2024, driven by high smartphone penetration, advanced digital infrastructure, and strong consumer acceptance of sharing economy models. The region benefits from favorable regulatory environments in key markets and a well-established network of property owners and service providers. Europe follows as the second-largest market, with Asia-Pacific emerging as the fastest-growing region due to rapid urbanization and increasing disposable income.

The COVID-19 pandemic initially disrupted the short-term rental market significantly, with the pandemic reducing demand for rental properties while increasing supply. However, the market has shown remarkable resilience and adaptation, with many platforms pivoting to longer-term stays and domestic travel markets. The pandemic accelerated digital adoption and highlighted the importance of flexible accommodation options, ultimately contributing to the market's recovery and growth.

Regional conflicts between major economies and the implementation of tariffs on goods have created both challenges and opportunities for the short-term rental apps market. Trade tensions have led to increased business travel costs and regulatory uncertainties, affecting cross-border rental activities. However, these conflicts have also driven domestic tourism and local rental demand as international travel became more complex and expensive. Tariff-induced price increases have questioned tightly integrated supply chains across North America, impacting the cost structure of rental equipment and potentially affecting pricing strategies across platforms.

Key Takeaways

- Market Growth: The Short-term Rental Apps Market is expected to reach USD 49.8 Billion by 2034, propelled by digital transformation, evolving consumer behaviors, and the appeal of cost-efficient, flexible access to assets.

- Rental Type Dominance: Property rental remains the dominant segment, buoyed by the recovery of tourism, the popularity of remote work, and the appeal of alternative accommodations. Platforms like Airbnb and Zillow Group have set new standards for convenience, personalization, and trust in this space.

- Platform Dominance: Mobile apps are the preferred platform, driven by high smartphone penetration and app-centric user behavior. Features such as instant booking, in-app messaging, and digital payments have reinforced this dominance.

- End-Use Dominance: Individual consumers account for the majority of transactions, with demand driven by convenience, affordability, and lifestyle flexibility. Millennials and Gen Z, in particular, are significant contributors to this segment’s growth.

- Driver: Technological innovation including AI-powered recommendations, seamless payment solutions, and integrated communication tools has been a major driver of market adoption and differentiation.

- Restraint: Regulatory challenges around zoning laws, short-term rental restrictions, and taxation compliance have constrained market potential in certain jurisdictions, particularly in large urban centers.

- Opportunity: Emerging markets present lucrative opportunities, as increasing internet access and smartphone adoption fuel demand for affordable and flexible rental options across property, tools, and vehicles.

- Trend: A notable trend is the convergence of property and non-property rentals within unified platforms, enabling users to access multi-category rentals (housing, tools, vehicles) through a single interface.

- Regional Analysis: North America leads in revenue and innovation, while Europe focuses on regulatory harmonization and sustainability. Asia-Pacific, propelled by China and India, is the fastest-growing region, offering substantial untapped potential.

Rental Type Analysis

Property Rental Leads With over 60% Market Share In Short-term Rental Apps Market. Property rental remains the cornerstone of the short-term rental apps market. Platforms such as Airbnb, Zillow Group, Apartments.com, Nestpick, and Trulia have established strong brand recognition and consumer trust. These apps enable homeowners and property managers to monetize vacant spaces efficiently while providing consumers with an extensive array of accommodation choices—from budget apartments to luxury homes. The segment’s leadership is reinforced by several factors. Firstly, the hybrid work trend has driven sustained demand for temporary living arrangements, with professionals seeking flexible leases in multiple cities. Secondly, tourism recovery post-COVID has revitalized urban and resort markets, encouraging property owners to relist spaces previously withdrawn during the pandemic. Thirdly, digital tools—virtual tours, AI-powered pricing models, and automated guest vetting—have increased operational efficiency and reduced friction for hosts and renters alike.

However, the segment is not without constraints. Regulatory pushback, particularly in cities like New York, Paris, and Barcelona, has led to stricter compliance obligations, higher fees, and limitations on short-term rentals. These challenges necessitate platform investments in compliance infrastructure and legal support services. Nevertheless, growth prospects remain strong. The proliferation of specialty platforms like Roomster (for roommate matching) and premium offerings such as Airbnb Luxe demonstrates continued diversification and innovation within the property rental ecosystem.

Platform Analysis

The dominance of mobile apps is a defining characteristic of the market. Consumers increasingly prefer app-based solutions due to their convenience, personalization, and integration with digital wallets and social networks. Airbnb, Zillow, Redfin, Zumper, and Nestpick have invested heavily in mobile-first strategies, optimizing UX and adding features such as push notifications, voice search, and in-app messaging. The advantage of mobile apps lies in their ability to deliver a seamless end-to-end experience: discovery, booking, payment, and support are consolidated into a single interface. In addition, the prevalence of geo-location services allows users to find nearby rentals in real-time, enhancing spontaneous booking capability—particularly in vehicle and tool rental scenarios.

A critical growth driver for mobile apps is the rise of progressive web apps (PWAs) and lightweight solutions that cater to emerging markets with lower bandwidth and less expensive smartphones. As a result, even in regions where web platforms remain prevalent, mobile apps continue to erode market share through superior engagement and retention. Looking forward, the integration of augmented reality (AR) property tours and AI-driven recommendation engines will further differentiate mobile apps from traditional web platforms, cementing their leadership in the market.

End-Use Analysis

Individual consumers constitute the largest end-user segment by transaction volume and frequency. The segment’s growth reflects fundamental shifts in consumption patterns: rising demand for experiences over ownership, flexible work arrangements, and the appeal of cost-effective alternatives to traditional rentals and purchases. Millennials and Gen Z users drive much of this demand. They value transparency, instant gratification, and community-driven reviews—all features seamlessly delivered by short-term rental apps. Moreover, the normalization of peer-to-peer transactions has eroded historical trust barriers, fostering a vibrant ecosystem of supply and demand.

Platforms have responded with tailored solutions. For example, Airbnb Experiences integrates activities with accommodations, while Acme Tools and Lowe’s Tool Rental target DIY enthusiasts and hobbyists. Vehicle rental apps similarly cater to gig workers and freelancers who require transportation on an as-needed basis. As disposable income rises in emerging markets, the individual consumer segment is expected to diversify further, with localized apps and multilingual support unlocking new user bases. This trend reinforces the segment’s centrality to market expansion.

Region Analysis

North America Leads With more than 35% Market Share In Short-term Rental Apps Market. North America dominates the global short-term rental apps market with approximately 37-38% market share in 2024, primarily driven by the United States' mature sharing economy ecosystem and high digital adoption rates. The region benefits from established regulatory frameworks, advanced payment infrastructure, and strong consumer confidence in digital transactions. Key markets include major metropolitan areas such as New York, San Francisco, and Los Angeles, which attract both domestic and international travelers.

Europe represents the second-largest market, with countries like the United Kingdom, Germany, and France leading adoption. The region's diverse tourism landscape and well-developed transportation infrastructure support cross-border rental activities. However, varying national regulations regarding short-term rentals have created compliance challenges for platform operators.

Asia-Pacific is experiencing the fastest growth rate, fueled by rapid urbanization, increasing smartphone penetration, and rising disposable income levels. Countries like China, India, and Southeast Asian nations are witnessing significant market expansion, although regulatory environments remain fragmented. The region's young, tech-savvy population represents a substantial growth opportunity for platform operators.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Rental Type

- Property Rental

- Tools & Machinery

- Vehicle Rental

- Others

Platform

- Web-based Platform

- Mobile Apps

- Integrated Service Platforms

Business Model

- Peer-to-Peer (P2P) Model

- Business-to-Consumer (B2C) Model

- Aggregator Model

- Subscription-based Model

End-Use

- Businesses & Organizations

- Individual Consumers

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 16.15 B |

| Forecast Revenue (2034) | USD 49.8 B |

| CAGR (2025-2034) | 13.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Rental Type: (Property Rental, Tools & Machinery, Vehicle Rental, Others), Platform: (Web-based Platform, Mobile Apps), End-Use: (Businesses & Organizations, Individual Consumers) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Nestpick GmbH, Airbnb, Inc., RentHop, Inc., Zillow Group, Inc., Move, Inc., Bunnings, Trulia, Inc., Acme Tools, Redfin Corporation, Apartment Finder, LLC, Sunbelt Rentals, RentPath, LLC, Lowe’s Tool Rental, Homesnap, Inc., Herc Rentals, Zumper, Inc., Apartments.com LLC, United Rentals |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Short-term Rental Apps Market

Published Date : 16 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date