Small Satellites Market 2034 Size, Growth & Forecast | 15.2% CAGR

Global Small Satellites Market Size, Share & Analysis Type (Minisatellite, Microsatellite, Nanosatellite, Other Types), Application (Earth Observation & Remote Sensing, Satellite Communication, Science & Exploration, Mapping & Navigation, Space Observation, Other Applications), End-User (Commercial, Academic, Government & Military, Other End-Users)Industry Ecosystem, Launch Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

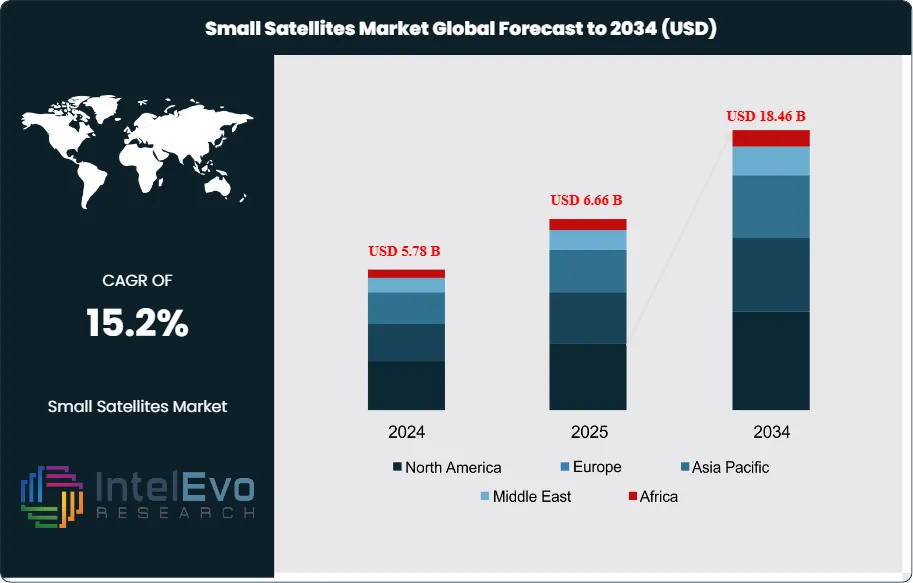

The Small Satellites Market was valued at approximately USD 5.78 Billion in 2024 and is projected to reach nearly USD 18.46 Billion by 2034, growing at an estimated CAGR of around 15.2% from 2025 to 2034. The surge in LEO constellation deployments, Earth observation missions, and commercial satellite-based connectivity is accelerating global demand. Falling launch costs, rideshare programs, and rapid advancements in miniaturized payload technologies are reshaping the aerospace ecosystem. Small satellites are entering a high-growth decade, powering next-gen communications, defense intelligence, and climate monitoring solutions.

Get More Information about this report -

Request Free Sample ReportWhat once served primarily as an academic proving ground has matured into essential infrastructure for both commercial operators and government agencies. Over the past decade, the appeal of lower mission costs, rapid development cycles, and constellation-based architectures for communications and Earth observation has widened the addressable market and eased entry for new participants across advanced and emerging economies alike.

Demand momentum is strongest where decision-makers require frequent, high-quality data. Industries such as agriculture, defense, and disaster management are turning to small-satellite constellations for high-resolution imaging and near-real-time services that improve situational awareness, optimize operations, and accelerate response times. On the supply side, continuing advances in component miniaturization, the expansion of launch rideshare programs, and sustained declines in launch prices are compressing time-to-orbit and improving program economics, encouraging broader adoption across the ecosystem.

Even as fundamentals strengthen, the operating environment is not without constraints. Regulatory uncertainty around radio-frequency spectrum access and the standards for orbital debris mitigation remains a persistent headwind, underscoring the need for clearer, globally coordinated rules to support long-term sustainability. Operational risks—including collision hazards in increasingly crowded orbits and the capital burden of replacing malfunctioning spacecraft—also require thoughtful risk management and insurance strategies.

Technology progress sits at the center of the market’s expansion thesis. More capable electric and chemical propulsion for small form factors, higher-efficiency solar arrays, and tighter payload integration are lifting performance while trimming lifecycle costs. The infusion of artificial intelligence and machine learning is beginning to reconfigure mission operations through onboard autonomy, smarter tasking, and predictive maintenance—capabilities that can extend asset lifetimes and enhance data quality. In parallel, digital platforms and analytics are turning raw satellite outputs into monetizable insights, particularly in Earth observation and emerging IoT connectivity use cases.

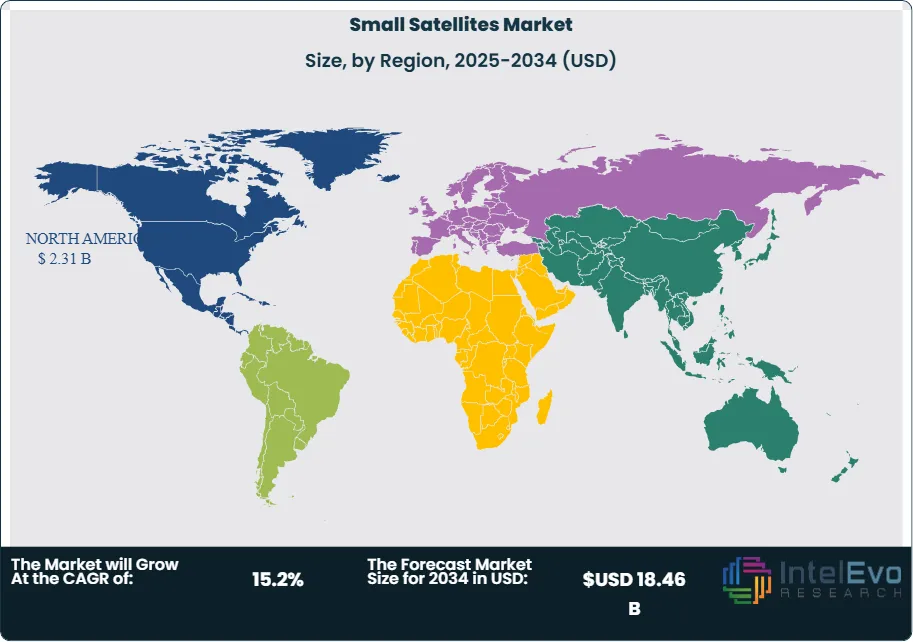

Regionally, North America retains market leadership on the back of sizable public programs and a deep pool of private capital. Europe continues to grow steadily, leveraging its scientific depth and comparatively well-developed regulatory frameworks. Asia-Pacific is the fastest-expanding theatre, propelled by robust government initiatives in China and India and an energetic cohort of commercial startups. Latin America and Africa are in earlier stages of market development but present compelling greenfield opportunities as satellite communications infrastructure scales out across underserved areas.

Taken together, these dynamics frame small satellites as one of the most attractive corners of the global space economy. With durable demand for timely, high-value data; favorable cost curves; and a strong innovation pipeline, the segment offers investors and industry stakeholders a clear path to long-duration growth through the forecast period.

Key Takeaways

- Market Growth: The global Small Satellites market was valued at USD 5.78 Billion in 2024 and is forecast to reach USD 18.46 Billion by 2034, expanding at a CAGR of 15.2%. Growth is fueled by rising demand for cost-effective space solutions, high-resolution imaging, and the rapid expansion of satellite constellations.

- By Product Type: Nanosatellites (<10 kg) accounted for over 56% of the market share in 2023, driven by their low manufacturing cost, rapid deployment cycles, and suitability for academic, commercial, and defense applications.

- By Application: Earth Observation & Remote Sensing held more than 45% of global revenue in 2023, supported by growing demand for real-time climate monitoring, disaster management, and precision agriculture data solutions.

- By End Use: The Commercial sector captured approximately 48% of the market in 2023, reflecting surging investments from private operators such as SpaceX, Planet Labs, and OneWeb, which are deploying large constellations for communications and imaging services.

- Driver: The proliferation of constellation-based deployments is accelerating market growth, with over 6,000 small satellites projected to be launched globally between 2024 and 2033, offering unprecedented coverage and connectivity.

- Restraint: Orbital debris and spectrum congestion remain critical challenges, with the European Space Agency estimating more than 36,000 trackable debris objects in orbit—posing risks of collision and increased regulatory oversight.

- Opportunity: Asia-Pacific is emerging as a high-growth region, expected to register a CAGR above 15% through 2033, led by expanding space programs in China and India, and growing participation from private aerospace startups.

- Trend: Technological integration of AI and machine learning for autonomous satellite operations is gaining traction, with early adoption by operators like Planet Labs enhancing data processing efficiency and extending satellite lifespans.

- Regional Analysis: North America remains the leading market, accounting for over 40% of revenue in 2023 due to strong NASA and Department of Defense investments, while Europe emphasizes regulatory-driven innovation. Emerging markets in Latin America and Africa are positioning themselves as future investment hotspots by expanding satellite communication infrastructure.

Type Analysis

By 2025, nanosatellites are expected to remain the leading type within the small satellites market, representing more than half of global deployments. Their compact size, low manufacturing costs, and rapid prototyping cycles make them particularly attractive for Earth observation, communications, and research missions. Universities, startups, and emerging space nations are increasingly leveraging nanosatellites as entry points into orbital capabilities, with companies such as Planet Labs operating fleets of nanosatellites for real-time Earth imaging. This dominance reflects their role as the most cost-efficient and versatile platform in the small satellite ecosystem.

Minisatellites, although smaller in number compared to nanosatellites, are gaining traction in missions that demand higher payload capacity and longer lifespans. With typical mass ranges between 100–600 kg, these satellites are used extensively for navigation, remote sensing, and advanced technology demonstrations. Their ability to accommodate more sophisticated instrumentation positions them as a critical choice for government space agencies and defense organizations seeking advanced capabilities.

Microsatellites (10–100 kg) serve as a balanced alternative, offering greater payload than nanosatellites while maintaining lower costs than minisatellites. They are increasingly deployed in clusters for communications, atmospheric research, and interplanetary testing. Meanwhile, other categories—such as picosatellites and femtosatellites—occupy specialized niches for technology validation, academic use, or highly customized missions, underscoring the flexibility and breadth of small satellite solutions.

Application Analysis

Earth Observation & Remote Sensing is projected to retain its dominance beyond 2025, accounting for nearly half of the global market value. Rising demand for high-resolution imaging to support agriculture, disaster management, and climate monitoring continues to fuel investments in this segment. Agencies like NASA and ESA, alongside private operators, are scaling fleets of Earth observation smallsats to provide near real-time geospatial intelligence.

Satellite Communication is another rapidly expanding application, particularly with the surge in demand for global broadband connectivity. Constellations such as SpaceX’s Starlink and OneWeb rely heavily on small satellites to deliver internet services to underserved regions. By 2030, communication-focused small satellites are expected to account for a significant share of launches, driven by aviation, maritime, and remote-area connectivity needs.

Science & Exploration, Mapping & Navigation, and Space Observation segments also represent notable opportunities. Microsatellites and minisatellites are being deployed for interplanetary research, GPS augmentation, and astronomical observation. Meanwhile, “Other Applications,” including educational missions, technology demonstrations, and experimental projects, highlight the adaptability of small satellites to niche innovations and the growing role of academic and non-profit organizations in space access.

End-Use Analysis

The commercial sector continues to be the most dynamic end-user, capturing close to 50% of global revenues in 2025. Private companies are driving satellite launches for broadband internet, Earth imaging, and data analytics, supported by reduced launch costs and the growing rideshare model. Firms like SpaceX, Planet Labs, and Astroscale exemplify the commercial push into large-scale smallsat deployment, making this the most competitive and capital-attractive segment.

Government and military agencies also remain major contributors, particularly in surveillance, reconnaissance, and secure communications. Small satellites are increasingly integrated into defense strategies, with the U.S. Space Force, India’s ISRO, and China’s CNSA accelerating investments in resilient and responsive space infrastructure. Their interest lies in cost-effective platforms that enhance national security while complementing larger, more expensive satellite systems.

Academic institutions play a critical role in fostering innovation, using nanosatellites and microsatellites for training, research, and experimental missions. CubeSat projects, often developed by universities, provide low-cost access to orbit and help bridge academic research with commercial and governmental applications. Other end-users, including NGOs and specialized research entities, further diversify demand, reinforcing the accessibility and inclusivity of the small satellites market.

Regional Analysis

North America remains the undisputed leader in 2025, commanding more than 40% of global revenues. The region benefits from strong government programs such as NASA, DARPA, and the U.S. Space Force, alongside a thriving commercial ecosystem led by SpaceX, Planet Labs, and Rocket Lab. Mature launch infrastructure and regulatory frameworks give North America a sustained competitive edge in smallsat deployment and commercialization.

Europe follows with a strong position, supported by the European Space Agency and national programs in Germany, France, and the UK. Investments in Earth observation, climate research, and telecom applications underpin the region’s robust pipeline. ESA’s Copernicus program and collaborations with private aerospace firms highlight Europe’s dual focus on sustainability and technological innovation.

Asia-Pacific is emerging as the fastest-growing region, with China, India, and Japan accelerating launches across commercial and governmental missions. China alone has launched hundreds of small satellites for communications and Earth observation, while India’s ISRO continues to offer cost-competitive launch services that attract global customers. Latin America and the Middle East & Africa, though smaller markets, are poised for growth as Brazil, Mexico, and the UAE expand their satellite initiatives. With young, tech-driven populations and increasing investments in digital infrastructure, these regions represent the next frontiers for small satellite adoption.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Type

- Minisatellite

- Microsatellite

- Nanosatellite

- Other Types

Application

- Earth Observation & Remote Sensing

- Satellite Communication

- Science & Exploration

- Mapping & Navigation

- Space Observation

- Other Applications

End-User

- Commercial

- Academic

- Government & Military

- Other End-Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 5.78 B |

| Forecast Revenue (2034) | USD 18.46 B |

| CAGR (2024-2034) | 15.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Minisatellite, Microsatellite, Nanosatellite, Other Types), Application (Earth Observation & Remote Sensing, Satellite Communication, Science & Exploration, Mapping & Navigation, Space Observation, Other Applications), End-User (Commercial, Academic, Government & Military, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Planet Labs Inc., Northrop Grumman Corporation, Airbus S.A.S., The Boeing Company, GomSpace, Thales Group, Sierra Nevada Corporation, Aerospace Corporation, Lockheed Martin Corporation, L3Harris Technologies Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date