Smart Card Market Size, Share & Growth Forecast | 6.4% CAGR

Global Smart Card Market Size, Share & Analysis By Type (Contact Smart Cards, Contactless Smart Cards, Dual Interface Smart Cards), By Application (Banking and Financial Services, Telecommunications, Healthcare, Transportation, Government and Public Sector, Retail and Loyalty Programs), By End-User Industry Regions & Key Players – Secure Authentication Trends & Forecast 2025–2034

Report Overview

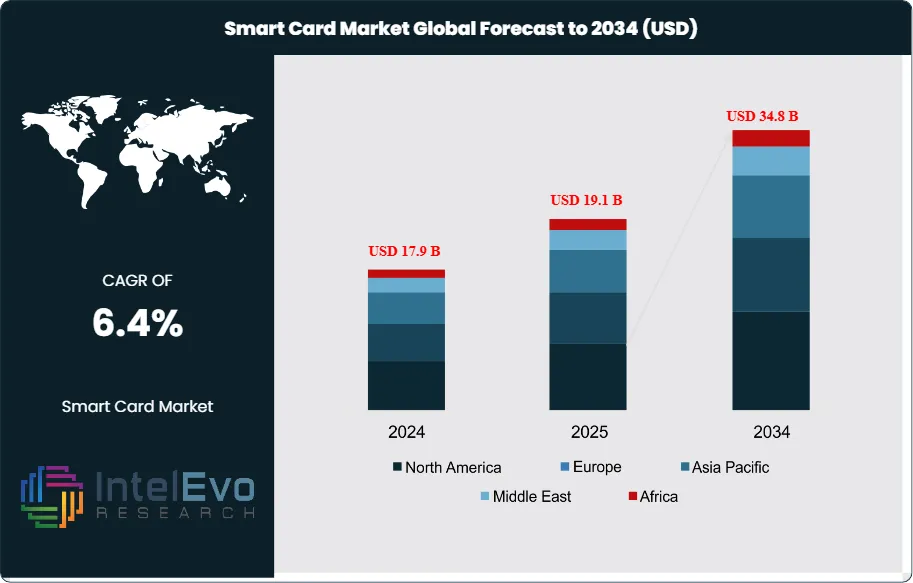

The Smart Card Market is expected to grow from USD 17.9 Billion in 2024 to approximately USD 34.8 Billion by 2034, expanding at a CAGR of around 6.4% during 2025–2034. Growing adoption of digital payments and secure authentication is driving the demand for smart card technology in banking, telecom, and public-sector services. Advancements in contactless and biometric smart cards are enhancing security and user experience across global transactions. Government-led digital identity programs and rising fintech penetration are accelerating market expansion worldwide. It driven by accelerating contactless payment adoption and enhanced security demands across digital ecosystems, offering strategic opportunities for financial institutions, governments, and technology integrators seeking secure identification solutions.

Get More Information about this report -

Request Free Sample ReportThe global smart card market landscape is experiencing robust transformation as enterprises and consumers increasingly embrace digital-first payment methodologies and secure authentication frameworks. Market evolution reflects a fundamental shift from traditional magnetic stripe systems toward sophisticated embedded integrated circuit architectures, with smart card technology now serving critical functions across banking, telecommunications, healthcare, transportation, and government sectors. The market's expansion trajectory demonstrates resilience despite economic uncertainties, supported by substantial transaction volume growth exceeding 2.6 billion units globally in 2022.

Growth drivers encompass multiple convergent forces reshaping payment infrastructure and identity management paradigms. Contactless payment systems have emerged as primary catalysts, with adoption rates reaching 36% of card transactions in the United States and 50% in Canada by 2023. The COVID-19 pandemic accelerated this transition, establishing hygiene-conscious payment preferences that continue driving market momentum. Enhanced security requirements against escalating cyber threats have positioned EMV-compliant smart cards as essential protective mechanisms, while government digitalization initiatives across emerging economies create substantial deployment opportunities.

Technological innovations are fundamentally reshaping smart card capabilities through advanced integration frameworks. Biometric authentication technology has achieved commercial viability, with fingerprint and facial recognition features providing sophisticated multi-factor security layers. Artificial Intelligence integration enables adaptive threat detection and predictive maintenance capabilities, enhancing operational reliability while reducing system downtime. Blockchain technology integration represents a paradigmatic advancement, enabling decentralized identity management and secure transaction authentication that addresses contemporary data sovereignty concerns.

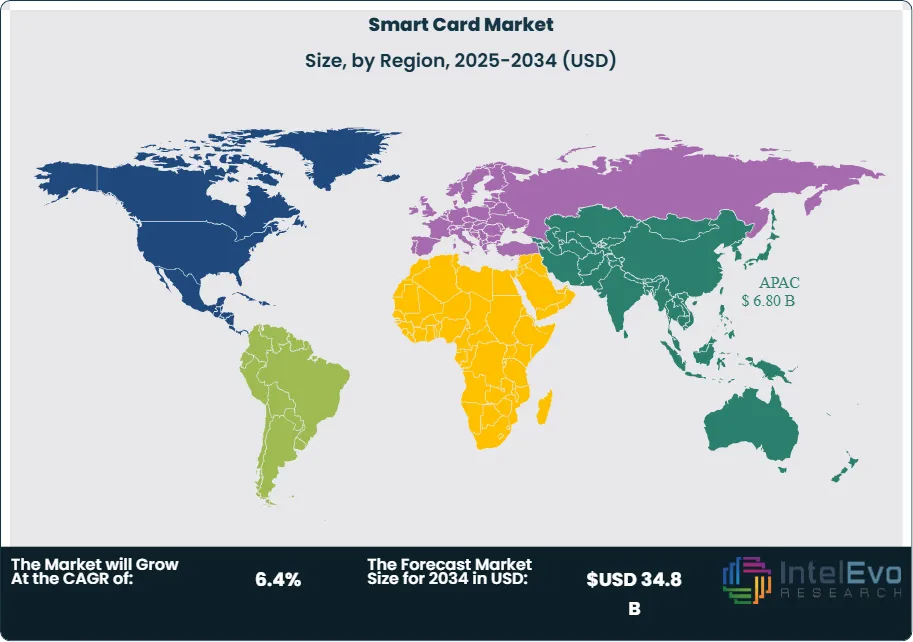

Regional market dynamics reveal distinct investment hotspots with varying adoption trajectories. Asia-Pacific maintains market leadership through concentrated manufacturing presence and favorable regulatory environments, particularly in China and India where smart card penetration in transportation sectors is projected to reach 78% by 2025. European markets demonstrate steady growth driven by eIDAS-2.0 wallet adoption initiatives and comprehensive e-governance programs, while North America exhibits accelerating contactless migration supported by robust financial infrastructure investments. Emerging markets in Latin America and Africa present significant expansion opportunities through mobile payment integration and smart city infrastructure development initiatives.

Key Takeaways

- Market Growth: The Smart Card Market is valued at USD 17.9 Billion in 2024 and projected to reach USD 34.8 Billion by 2034, registering a robust CAGR of 6.4% during the forecast period, primarily driven by accelerating contactless payment adoption and enhanced security requirements across digital payment ecosystems.

- Interface Type: Contactless smart cards dominate the market with 54% share in 2024, while dual-interface cards are experiencing rapid growth at 8.7% CAGR as issuers prioritize backward compatibility with legacy contact terminals without compromising tap-to-pay functionality.

- End-Use Application: The telecommunications sector maintains market leadership with over 41% share, driven by extensive SIM card demand from escalating global mobile phone users, while BFSI segment accounts for 32.5% revenue share through EMV-compliant card adoption and multi-factor authentication systems.

- Driver: Rising contactless payment adoption serves as the primary growth catalyst, with contactless transactions reaching 36% of card payments in the United States and 50% in Canada by 2023, accelerated by COVID-19 pandemic hygiene concerns and enhanced NFC/RFID security protocols.

- Restraint: High implementation costs and complex infrastructure requirements pose significant barriers, particularly affecting small businesses where 60% of European SMEs cite cost as the primary deterrent, while cybersecurity vulnerabilities and data privacy concerns create additional adoption hesitancy.

- Opportunity: Post-quantum cryptography integration represents a transformative growth opportunity as current public-key cryptography faces quantum computing vulnerabilities, with hybrid smart cards supporting both traditional and PQC algorithms facilitating smooth transition for finance, healthcare, and government sectors.

- Trend: Biometric authentication integration is revolutionizing smart card capabilities, with biometric-enabled cards expected to reach 20 million users by 2024 and the biometric card market growing at 80.1% CAGR, driven by fingerprint sensors, AI-powered fraud detection, and enhanced multi-factor security layers.

- Regional Analysis: Asia-Pacific dominates with 38% market share in 2023 through concentrated manufacturing presence and favorable regulatory environments, while North America holds 25% share driven by advanced financial infrastructure and government standardization initiatives, with Europe maintaining steady growth through EMV standards and e-governance programs.

Type Analysis

The smart card market demonstrates distinct segmentation patterns across interface technologies, with dual-interface solutions emerging as the fastest-growing category in 2025. Contactless smart cards maintain their leadership position, capturing 54% of global market share through widespread adoption in retail payment systems, public transportation networks, and access control applications. These cards leverage Near Field Communication (NFC) and Radio Frequency Identification (RFID) protocols to facilitate instantaneous data transmission, eliminating physical contact requirements while delivering enhanced transaction speeds and hygiene benefits that became particularly valued during the post-pandemic era.

Dual-interface smart cards are experiencing exceptional market momentum with a 15.8% compound annual growth rate, driven by enterprise demand for backward compatibility solutions. These hybrid systems integrate both contact and contactless functionalities within a single card architecture, enabling seamless interoperability across legacy terminal infrastructure while supporting modern tap-to-pay capabilities. Financial institutions and government agencies increasingly prefer dual-interface configurations for their versatility in multi-application deployments, from secure facility access to integrated payment processing systems.

Contact-based smart cards, while representing a smaller market segment, retain strategic importance in high-security environments where physical interface requirements provide additional protection against relay attacks and unauthorized access attempts. These cards remain prevalent in government identification programs, defense applications, and enterprise security systems where controlled access protocols and enhanced authentication measures are mandatory operational requirements.

Application Analysis

The telecommunications sector maintains its dominant position with 41% market share, supported by the universal deployment of Subscriber Identity Module (SIM) cards across global mobile communication networks. This dominance reflects the essential role of smart cards in subscriber authentication, network connectivity, and secure data storage for billions of mobile device users worldwide. The sector's growth trajectory is further accelerated by 5G network expansion, embedded SIM (eSIM) technology adoption, and increasing integration of smart cards with Internet of Things (IoT) devices requiring secure connectivity solutions.

Banking and Financial Services represents the second-largest application segment, accounting for 32.5% of market revenue through extensive EMV (Europay, Mastercard, and Visa) chip card deployment and contactless payment system adoption. Financial institutions are driving demand through enhanced security mandates, fraud reduction initiatives, and consumer preference shifts toward contactless transaction methods. The segment benefits from regulatory compliance requirements, particularly EMV migration mandates and PCI-DSS (Payment Card Industry Data Security Standard) implementation across global payment networks.

Healthcare applications are experiencing rapid expansion as medical institutions implement smart cards for patient identification, electronic health record access, and secure billing transactions. Smart card integration in healthcare environments addresses critical data privacy requirements while enabling efficient patient authentication, prescription management, and insurance verification processes. Government and public sector deployments continue growing through national identification programs, e-passport initiatives, and social benefit distribution systems that leverage smart card technology for secure citizen identity verification.

Regional Analysis

Asia-Pacific commands the largest market share at 38% in 2025, driven by concentrated manufacturing capabilities and favorable government digitalization policies across major economies including China, India, and Japan. China leads regional growth through extensive smart city initiatives, digital yuan central bank digital currency (CBDC) implementations, and consolidated banking sector smart card adoption programs. The country's strategic focus on contactless payment infrastructure and biometric authentication systems positions it as a global innovation hub for advanced smart card technologies.

India contributes significantly to regional expansion through large-scale government programs including the Aadhaar biometric identification system and Digital India initiatives that mandate smart card deployment across public services. The nation's rapidly growing mobile user base, estimated at over 1.2 billion subscribers, creates substantial demand for telecommunications-based smart cards while expanding digital payment ecosystems drive financial sector adoption.

North America maintains a 25% market share, supported by mature financial infrastructure and comprehensive government standardization initiatives. The region benefits from established EMV migration programs, advanced point-of-sale terminal deployments, and robust regulatory frameworks that promote secure payment technologies. European markets demonstrate steady growth through stringent data protection regulations, eIDAS-2.0 digital wallet adoption, and comprehensive e-governance programs that integrate smart card authentication across public and private sector applications.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Contact Smart Cards

- Contactless Smart Cards

- Dual Interface Smart Cards

By Application

- Banking and Financial Services

- Telecommunications

- Healthcare

- Transportation

- Government and Public Sector

- Retail and Loyalty Programs

- Other Applications

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 17.9 B |

| Forecast Revenue (2034) | USD 34.8 B |

| CAGR (2024-2034) | 6.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Contact Smart Cards, Contactless Smart Cards, Dual Interface Smart Cards), By Application (Banking and Financial Services, Telecommunications, Healthcare, Transportation, Government and Public Sector, Retail and Loyalty Programs, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IDEMIA, HID Global, STMicroelectronics, Sony Corporation, CPI Card Group, Giesecke+Devrient, Infineon Technologies, Samsung Electronics Co., Ltd., Gemalto (Thales Group), Oberthur Technologies (OT-Morpho), NXP Semiconductors, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Smart Card Market ?

The Smart Card Market is expected to grow from USD 17.9 Billion in 2024 to USD 34.8 Billion by 2034, at a CAGR of 6.4%. Rising digital payments, biometric authentication, and government-led identity programs are driving global smart card adoption across banking, telecom, and public services.

Who are the major players in the Smart Card Market ?

IDEMIA, HID Global, STMicroelectronics, Sony Corporation, CPI Card Group, Giesecke+Devrient, Infineon Technologies, Samsung Electronics Co., Ltd., Gemalto (Thales Group), Oberthur Technologies (OT-Morpho), NXP Semiconductors, Other Key Players

Which segments covered the Smart Card Market ?

By Type (Contact Smart Cards, Contactless Smart Cards, Dual Interface Smart Cards), By Application (Banking and Financial Services, Telecommunications, Healthcare, Transportation, Government and Public Sector, Retail and Loyalty Programs, Other Applications)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date