Social Audit Services Market Size, Share & Growth | ESG Compliance & Sustain

Global Social Audit Services Market Size, Share & Industry Analysis by Audit Type (Labor Standards, Health & Safety, Ethical Sourcing, Environmental & ESG Audits), by Service Model (Internal Audits, Third-Party Audits, Digital & Continuous Monitoring), by End-Use Industry (Manufacturing, Retail & Apparel, FMCG, Energy & Utilities, Technology, Healthcare), by Organization Size (SMEs, Large Enterprises), Regional Insights, Market Dynamics, Regulatory Landscape, Competitive Benchmarking, Key Players, Strategic Developments, and Forecast 2025–2034

Report Overview

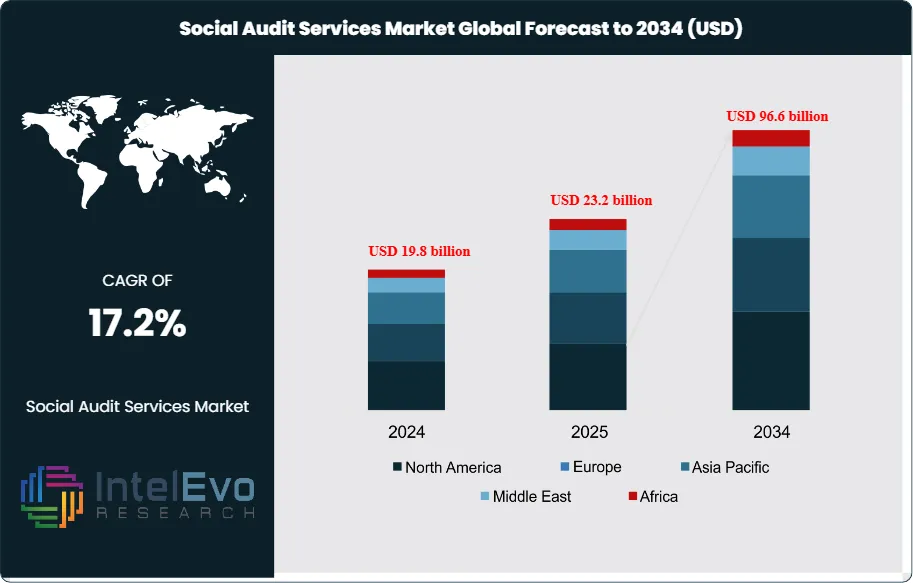

The Social Audit Services Market is estimated at USD 19.8 billion in 2024 and is on track to reach roughly USD 96.6 billion by 2034, implying a robust compound annual growth rate (CAGR) of 17.2% over 2025–2034. This rapid expansion is driven by rising ESG compliance requirements, stricter labor and supply-chain regulations, and growing pressure from investors and consumers for transparency and ethical business practices. Corporations across manufacturing, retail, and services are increasingly relying on third-party social audits to mitigate reputational risk, ensure regulatory alignment, and strengthen sustainability credentials. The integration of digital auditing platforms and real-time monitoring tools is further accelerating adoption, positioning social audit services as a core pillar of global corporate governance strategies.

Get More Information about this report -

Request Free Sample ReportThe market gains momentum as organizations intensify efforts to measure and disclose their social impact, regulatory compliance, and alignment with broader community and environmental expectations. Independent verification strengthens institutional accountability and supports stakeholders seeking credible visibility into corporate conduct. Rising emphasis on labor standards, environmental practices, human rights protection, and community development reinforces the strategic importance of social audits in global corporate governance frameworks.

Growing regulatory intervention accelerates market expansion. Governments expand welfare budgets and reinforce social-impact mandates, prompting enterprises to demonstrate responsible practices through structured audit processes. In the United States, the federal welfare expenditure of USD 1.101 trillion in 2023 reflects a sustained prioritization of social development, indirectly guiding businesses to integrate stronger oversight into their operational models. Initiatives such as the Biden–Harris Administration’s USD 7.8 million grant program to improve access to health and essential services further heighten expectations around transparency and measurable community contributions. These measures influence companies to adopt social auditing as a consistent compliance and risk-management tool.

Technology adoption enhances market sophistication. Audit providers increasingly deploy digital workflow platforms, AI-enabled data validation engines, and automated compliance mapping tools to improve accuracy and reduce assessment time. These capabilities increase audit throughput by an estimated 25–30% and lower reporting errors, helping organizations manage rising disclosure requirements. Digital integration also supports continuous monitoring models, which replace periodic manual reviews and create sustained demand for specialized audit services.

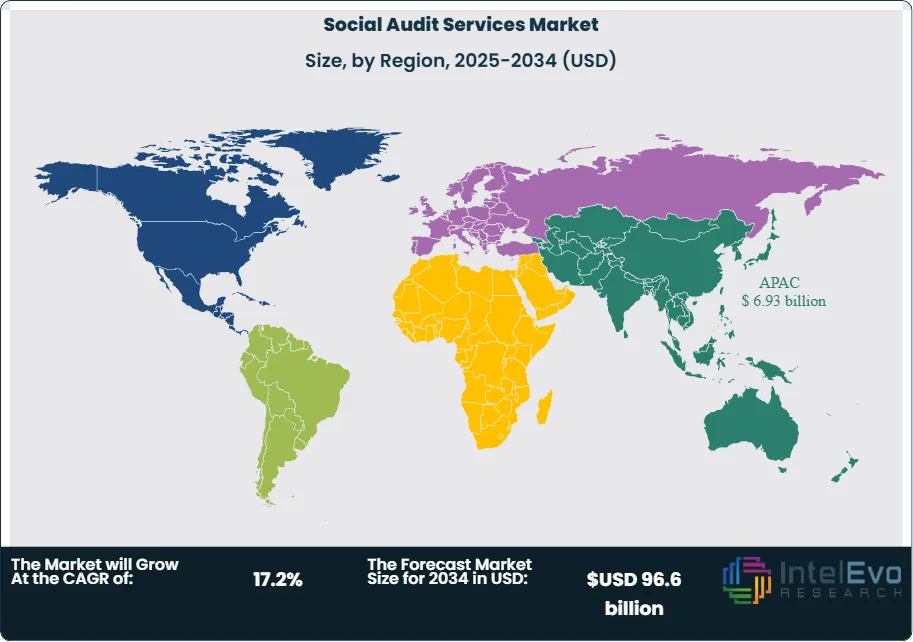

Regional investment patterns shape competitive dynamics. North America accounts for an estimated 38% of global revenue due to established regulatory systems and strong corporate reporting cultures. Europe follows with approximately 30% share, driven by stringent ESG disclosure directives. Asia-Pacific emerges as the fastest-growing region, expanding at a projected CAGR of over 19% as governments strengthen social-welfare programs and multinational enterprises localize sourcing and labor-compliance mechanisms. Large-scale public investments, such as Governor Hochul’s USD 17.2 million commitment to strengthen social-service support and New York City’s USD 2 billion affordable-housing program, create broader expectations for corporate participation in societal priorities, reinforcing long-term demand for social audit services.

Key Takeaways

- Market Growth: The Global Social Audit Services Market is projected to increase from USD 19.8 billion in 2024 to USD 96.6 billion by 2034, reflecting a CAGR of 17.2 percent driven by expanding regulatory scrutiny, ESG reporting, and stakeholder expectations for verified social impact. Service providers that align audit offerings with compliance, risk, and ESG agendas are positioned to capture the largest share of incremental spending.

- Audit Type: CSR-focused social audits held approximately 57.5 percent of market revenue in 2023, indicating that most spend currently centers on verifying ethical sourcing, labor standards, and environmental practices. Demand for CSR audits is expected to maintain double-digit growth as listed companies expand disclosure under ESG and supply-chain transparency rules.

- End User: Healthcare and pharmaceuticals accounted for about 44.2 percent of global social audit revenues in 2023, reflecting strict clinical, ethical, and patient-safety obligations. This segment is projected to grow at around 18 percent CAGR as regulators intensify scrutiny of patient access, clinical trials, pricing practices, and employee well-being.

- Driver: Government welfare spending and targeted social programs act as a structural demand driver, with national welfare budgets such as the USD 1.101 trillion allocation in the United States signaling long-term emphasis on social outcomes and accountability. Organizations increasingly commission independent social audits to validate alignment with these policy priorities and reduce compliance risk.

- Restraint: High audit costs and limited in-house expertise among small and mid-sized enterprises constrain adoption, with many organizations reporting that full-scope social audits can consume 3 to 5 percent of annual compliance budgets. Fragmented standards across regions also raise implementation complexity and extend audit timelines.

- Opportunity: Expansion in mental health programs and telehealth services creates a fast-growing audit niche, particularly in remote and underserved areas. By 2033, audits focused on mental health support systems and digital care channels are expected to represent more than 15 percent of healthcare-related social audit spend.

- Trend: Providers increasingly embed analytics, automated data checks, and digital evidence trails into social audit workflows, which can cut audit cycle times by 20 to 30 percent and improve traceability. Leading firms integrate survey data, HR systems, and supply-chain platforms to produce continuous, rather than periodic, social performance assessments.

- Regional Analysis: Asia Pacific held roughly 35 percent of global revenue in 2024, led by China and India where rapid industrialization and tighter labor and ESG regulations fuel adoption. North America and Europe together represent just over 50 percent share, but Asia Pacific is expected to post the fastest growth, with CAGRs estimated above 18 percent through 2034.

Type Analysis

Corporate Social Responsibility (CSR) audits remain the core of the social audit services portfolio in 2025. They accounted for around 57.5 percent of audit-type revenues in 2023 and continue to capture the majority of new mandates as boards tighten oversight of human rights, sourcing, and environmental practices. For organizations that report against ESG frameworks or operate in consumer-facing sectors, CSR audits are now a primary tool to validate claims, manage reputational risk, and respond to investor questions on supply-chain integrity.

Social and Quality Management audits form the second key pillar. They link social compliance, ethical behavior, and quality assurance across production and service delivery. These audits help organizations verify that suppliers and internal units align with both regulatory norms and customer specifications, particularly in food, healthcare, and consumer goods. Occupational Health and Fire Safety audits continue to expand as regulators increase inspections and penalties. They focus on incident prevention, emergency preparedness, and adherence to workplace safety codes, which can directly affect insurance costs and employee retention.

Ethical Trading, Social Impact Assessment, and Climatic Change Assessment audits now gain more budget share. Ethical Trading reviews fair wages, working hours, and responsible purchasing practices, which are central to brands that depend on contractor networks. Social Impact and climate-related assessments evaluate how projects affect communities and ecosystems and how operations align with decarbonization targets. The residual “Others” category includes emerging fields such as digital conduct, online harassment, and cyber-related social risk, which are becoming more relevant as operations and workforces move further into digital channels.

Application Analysis

Application-wise, social audit services in 2025 concentrate on three broad use cases. Compliance and regulatory assurance audits account for the largest share, especially in regulated sectors such as healthcare, food, and financial services. These assignments validate adherence to labor laws, safety codes, and environmental regulations and often feed directly into external disclosures or license renewals. For organizations with high compliance exposure, this is typically the first area where social audit budgets grow.

Supply-chain and vendor audits form the second major application cluster. Global brands increasingly request independent assessments of factories, farms, logistics providers, and service partners to manage social risk beyond their direct operations. This segment has grown at an estimated mid- to high-teens CAGR since 2020 as companies expand preferred-supplier programs that require periodic social audit clearance. A third application set focuses on workplace culture and employee well-being, including mental health programs, diversity and inclusion, and grievance mechanisms. In this area, demand is rising for audits that combine policy review with survey data and on-site verification to test how well corporate commitments translate into daily practice.

End-Use Analysis

End-use patterns in 2025 still show Healthcare and Pharmaceuticals as the single largest client group for social audit services. This segment represented roughly 44.2 percent of market revenues in 2023 and continues to scale spending as regulators intensify oversight of patient safety, clinical trials, data privacy, and employee welfare. In this context, social audits help reduce compliance failures, support accreditation, and reassure patients and payers about ethical standards.

Food and Beverage forms the next large cluster of demand. Companies in this sector use social audits to track labor practices in agriculture and processing, verify supplier certifications, and support claims around responsible sourcing. The Oil and Gas industry relies on social audits to manage community relations, environmental-impact expectations, and contractor practices in remote or sensitive locations. In Apparels and Footwear, social audits remain essential for monitoring multi-tier manufacturing networks and avoiding labor-rights controversies that can damage brand equity.

Telecom, Media, and Entertainment, along with a broad mix of “Other” industries, contribute a growing but more fragmented share. Telecom players focus on infrastructure siting, subcontractor conduct, and customer data handling. Media and Entertainment clients request audits related to content production, workplace conduct, and data protection. The “Others” group spans technology, logistics, retail, and professional services, demonstrating that social audit services have moved beyond a niche function and now sit within mainstream risk and ESG budgets across organizational value chains.

Regional Analysis

Regionally, Asia Pacific retains a leading position in the global market. It held around 35 percent share and an estimated value of USD 5.9 billion in the early 2020s and continues to grow faster than the global average as China, India, and Southeast Asian markets strengthen labor and environmental regulation. For companies with supply bases concentrated in this region, social audits have become a standard requirement for export readiness and access to international brands.

North America and Europe together account for slightly more than half of global spending, supported by mature ESG frameworks, mandatory reporting requirements, and strong pressure from investors and civil society. In these regions, social audits are now embedded into enterprise-wide risk management and supplier governance, with recurring contracts rather than one-off assessments. Latin America and the Middle East & Africa represent smaller shares today but register rising activity due to resource projects, infrastructure expansion, and growing expectations around human rights and community impact.

Across all regions, the outlook for 2025 and beyond points to sustained double-digit growth in social audit spending as reporting rules tighten and stakeholders demand verifiable evidence of corporate conduct. For organizations worldwide, this signals a structural shift: social audits are no longer optional reputation tools but core components of compliance, supply-chain management, and ESG strategy.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Audit Type

- Corporate Social Responsibility

- Social & Quality Management

- Occupational Health & Fire Safety

- Ethical Trading

- Social Impact Assessment

- Climatic Change Assessment

- Others

By End Users

- Healthcare & Pharmaceuticals

- Food & Beverage

- Oil & Gas

- Apparels & Footwear Industry

- Telecom

- Media & Entertainment

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 19.8 billion |

| Forecast Revenue (2034) | USD 96.6 billion |

| CAGR (2024-2034) | 17.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Audit Type, Corporate Social Responsibility, Social & Quality Management, Occupational Health & Fire Safety, Ethical Trading, Social Impact Assessment, Climatic Change Assessment, Others, By End Users, Healthcare & Pharmaceuticals, Food & Beverage, Oil & Gas, Apparels & Footwear Industry, Telecom, Media & Entertainment, Others |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DQS Cfs, TUV Rheinland, Intertek, HQTS Group Ltd., QIMA, SCS Global Services, SGS Group, CSR Company International, TUV Nord, Bureau |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Social Audit Services Market

Published Date : 08 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date