Specialty Generics Market Forecast 2024–2034 | Growth & Trends

Global Specialty Generics Market Size, Share & Analysis By Application/Therapy Area (Oncology, Immunology), By Distribution Channel (Specialty Pharmacy, Retail Pharmacy, Hospital Pharmacy, Other Distribution Channels), By Dosage Form, Industry Outlook, Patent Expiry Trends & Forecast 2025–2034

Report Overview

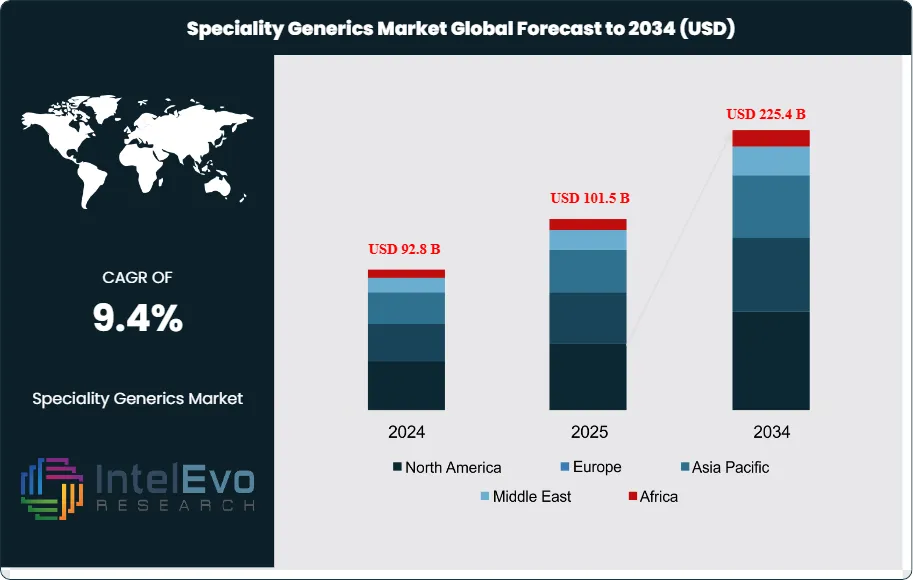

The Specialty Generics market is valued at USD 92.8 billion in 2024 and is projected to reach approximately USD 225.4 billion by 2034, reflecting a robust CAGR of about 9.4% during 2025–2034. Growth is accelerating as healthcare systems worldwide push for cost-effective therapies in oncology, autoimmune disorders, and complex chronic diseases. Increasing patent expiries and rising demand for high-quality, affordable specialty formulations are reshaping competitive dynamics. With biologics-adjacent generics, advanced delivery systems, and regulatory fast-track pathways gaining traction, specialty generics are emerging as a key engine of pharmaceutical affordability and global market expansion.

Get More Information about this report -

Request Free Sample Report

Over the past decade, specialty generics have transitioned from a niche segment to a central pillar in the broader generics industry. Demand has grown steadily as healthcare systems face mounting pressure to reduce costs while maintaining access to complex treatments. Specialty generics, which include off-patent versions of high-cost branded drugs used to treat chronic and life-threatening conditions, are increasingly seen as viable alternatives. This shift is especially pronounced in oncology, autoimmune diseases, and hepatitis C—areas where treatment costs are high and patient populations are expanding.

One of the most critical demand-side drivers is the aging global population. Individuals aged 65 and older now account for over 10% of the world population, with projections suggesting continued growth through 2032. This demographic is disproportionately affected by chronic conditions such as cancer, arthritis, and cardiovascular diseases, increasing the reliance on specialty medicines. On the supply side, several pharmaceutical companies are deepening their specialty generics portfolios through strategic acquisitions and licensing deals. However, brand loyalty, complex manufacturing requirements, and low-margin structures remain formidable barriers for new entrants.

Despite these challenges, the outlook remains strong. Regulatory pathways for generic approvals have become more streamlined in key markets such as the U.S. and Europe, encouraging faster market entry and broader adoption. Meanwhile, advances in formulation technologies and biosimilar development are expanding the scope of what qualifies as a specialty generic, further widening the addressable market.

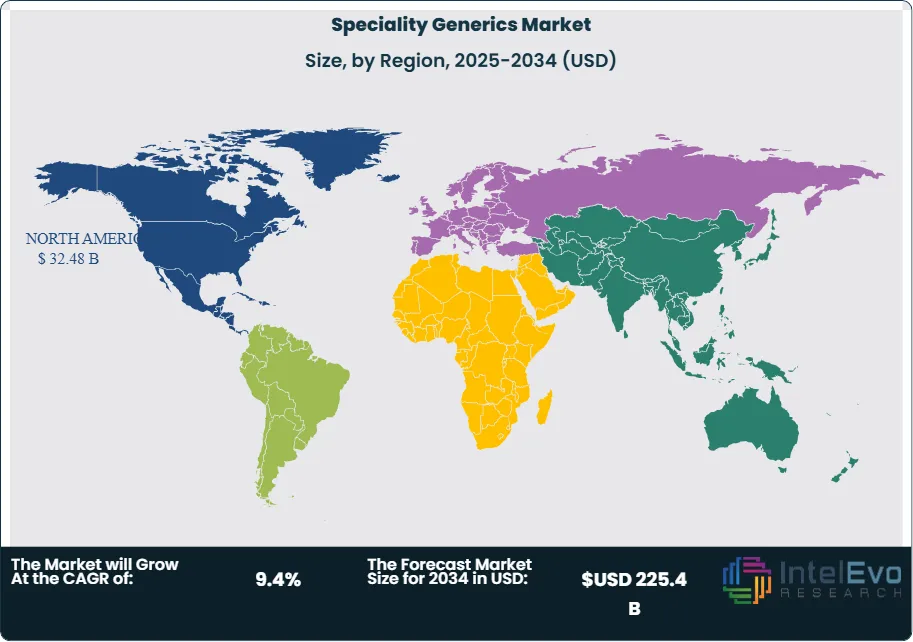

North America currently holds the dominant market share, driven by favorable reimbursement structures, a high burden of chronic disease, and strong distribution networks. However, Asia-Pacific is emerging as a key growth region. Countries like India and China are seeing increased domestic demand and rising manufacturing capabilities, attracting investor interest.

As cost-containment pressures intensify globally, specialty generics will continue to gain strategic importance for payers, providers, and manufacturers. The ability to scale production while navigating regulatory and pricing complexities will define the next wave of market leaders.

Key Takeaways

- Market Growth: The global Specialty Generics market is projected to reach USD 225.4 billion by 2034, up at USD 92.8 billion in 2024, growing at a CAGR of 9.4% from 2023 to 2032. Growth is driven by rising chronic disease prevalence and increased demand for cost-effective alternatives to branded specialty drugs.

- Route of Administration: Injectables account for the largest revenue share in the market, supported by their high bioavailability and widespread use in oncology, autoimmune diseases, and chronic infections.

- Application: Inflammatory diseases represent a major revenue-contributing segment, with rising incidence rates of conditions such as rheumatoid arthritis and Crohn’s disease pushing demand for targeted specialty generics.

- Driver: The global rise in chronic conditions like cancer, hepatitis C, and cardiovascular disorders is a key demand-side driver. Over 60% of adults in the U.S. live with at least one chronic illness, accelerating adoption of specialty generics in long-term treatment plans.

- Restraint: High entry barriers, including complex manufacturing, stringent regulatory pathways, and low pricing margins, limit participation by smaller companies and slow new product launches.

- Opportunity: Asia-Pacific is emerging as a high-growth region, expected to grow at a CAGR above 10% through 2032. Increasing healthcare expenditure, expanding generics production capabilities, and unmet treatment needs make it an attractive destination for investment.

- Trend: Leading manufacturers are focusing on advanced drug delivery technologies and biosimilar development to expand their specialty generics portfolios. Companies like Teva and Sandoz are actively acquiring assets to accelerate market access and broaden therapeutic offerings.

- Regional Analysis: North America remains the largest regional market, accounting for over 35% of global revenue in 2022, driven by favorable reimbursement policies and high chronic disease burden. Meanwhile, Latin America and Asia-Pacific are gaining traction due to improving healthcare infrastructure and rising generic drug acceptance.

Type Analysis

Injectables continue to lead the specialty generics market by revenue, accounting for the largest share in 2025. Their clinical advantages—rapid onset of action and improved bioavailability—make them a preferred option for treating complex conditions such as cancer and autoimmune diseases. These attributes contribute to stronger patient adherence, particularly in hospital settings and long-term care.

Looking ahead, the injectables segment is expected to register the highest CAGR through 2032, driven by a surge in regulatory approvals and broader adoption across oncology, neurology, and chronic disease treatments. Increased market penetration in both developed and emerging regions is expanding patient access to affordable alternatives. Major players are accelerating filings for injectable generics as patents on high-cost biologics and specialty drugs expire, further fueling growth.

Application Analysis

Inflammatory conditions represent the most lucrative application segment in the specialty generics landscape. Rising incidence of disorders such as rheumatoid arthritis, ulcerative colitis, and psoriasis has sustained strong demand for biologic and biosimilar treatments. Specialty generics provide cost-effective alternatives to high-priced branded therapies, encouraging healthcare providers and payers to support their uptake.

While inflammatory diseases dominate revenue, oncology is projected to be the fastest-growing application through 2032. Lifestyle risk factors—tobacco use, poor diet, alcohol consumption—and aging demographics have contributed to rising cancer diagnoses globally. As a result, demand for affordable chemotherapy agents and supportive therapies is accelerating. Specialty generics offer a viable pathway to expand cancer treatment access while alleviating pressure on healthcare budgets.

Distribution Channel Analysis

Specialty pharmacies maintain the largest market share in the distribution of specialty generics in 2025. Their infrastructure allows for streamlined handling of complex therapies that often require patient education, temperature control, and strict inventory management. Manufacturers and payers increasingly favor specialty pharmacies due to their cost-efficiency, regulatory compliance, and ability to ensure medication adherence.

The segment is also experiencing consistent growth, supported by partnerships with insurers and pharmacy benefit managers. Lower distribution costs compared to traditional retail outlets, combined with the increasing availability of specialty generics for high-cost therapies, enhance ROI for stakeholders. Specialty pharmacies’ ability to facilitate rapid delivery and provide tailored patient services continues to strengthen their market position.

Regional Analysis

North America remains the dominant regional market for specialty generics, contributing over 35% of global revenue in 2025. Favorable regulatory frameworks, high incidence of chronic diseases, and advanced healthcare infrastructure support broad adoption. The U.S. Food and Drug Administration (FDA) continues to accelerate generic approvals under programs like the Generic Drug User Fee Amendments (GDUFA), encouraging manufacturers to expand product pipelines.

Asia Pacific is the fastest-growing region, projected to expand at a double-digit CAGR through 2032. Rising healthcare spending, an expanding middle class, and ongoing regulatory reforms are key growth drivers. India and China, in particular, are investing in domestic generic production to meet high demand for cost-effective treatments. This shift is creating attractive opportunities for both local and international players to establish or scale operations in the region.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Injectables

- Oral Drugs

By Application

- Oncology

- Inflammatory Conditions

- Hepatitis C

- Multiple Sclerosis

- Other Applications

By Distribution Channel

- Specialty Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

- Other Distribution Channels

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 92.8 B |

| Forecast Revenue (2034) | USD 225.4 B |

| CAGR (2024-2034) | 9.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Injectables, Oral Drugs), By Application (Oncology, Inflammatory Conditions, Hepatitis C, Multiple Sclerosis, Other Applications), By Distribution Channel (Specialty Pharmacy, Retail Pharmacy, Hospital Pharmacy, Other Distribution Channels) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Teva Pharmaceutical Industries Ltd., Viatris Inc., Novartis AG (Sandoz Group AG), Hikma Pharmaceuticals PLC, Mallinckrodt Pharmaceuticals, Bausch Health Companies Inc., Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Amneal Pharmaceuticals LLC, Apotex Corp., Endo Pharmaceuticals Inc., Fresenius Kabi Brasil Ltda, STADA Arzneimittel AG, Pfizer, Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date