Specialty Aluminas Market Size, Growth & Forecast 2034 | 4.1% CAGR

Global Specialty Aluminas Market Size, Share, Analysis Report By Type (Aluminium Trihydroxide (ATH), Calcined Alumina, Boehmite, Activated Alumina, Reactive Alumina, Fused Alumina, Others), Application (Refractory Materials, Ceramics, Abrasives, Polishing, Catalyst, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

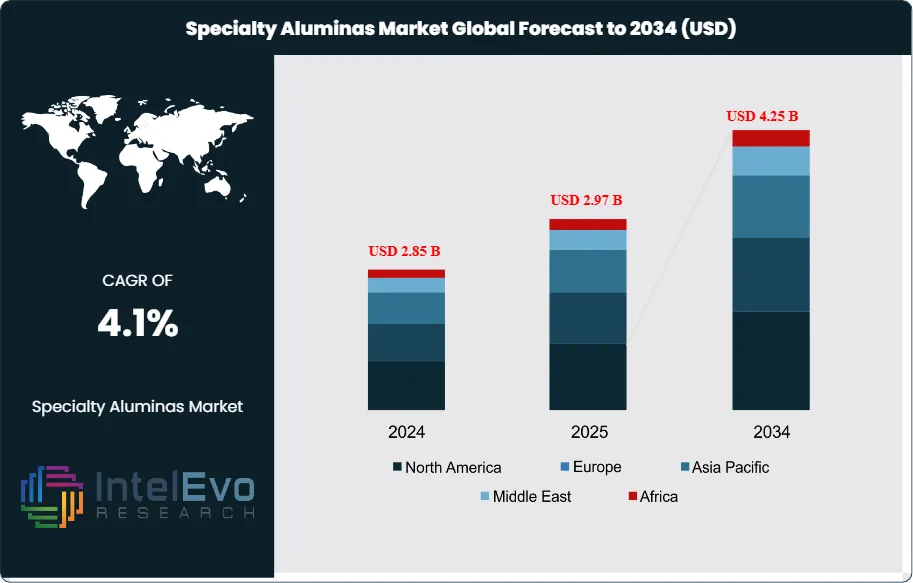

The global specialty aluminas market is set for significant growth. Its value is expected to increase from USD 2.85 billion in 2024 to about USD 4.25 billion by 2034. This growth, with a steady CAGR of 4.1%, is mainly driven by rising demand for high-performance materials in the automotive, electronics, and renewable energy sectors. As industries focus more on lightweight components and sustainable manufacturing, specialty aluminas—including aluminum trihydroxide (ATH), calcined, and activated types—are becoming essential due to their excellent thermal stability, hardness, and chemical resistance.

Get More Information about this report -

Request Free Sample ReportThe market is also seeing benefits from a shift toward eco-friendly and high-purity materials in advanced engineering. These aluminas are key components for refractories, catalysts, and high-tech ceramics, significantly impacting the fields of aerospace and electronics. With an increased focus on specialized uses like polishing agents and abrasives, the specialty alumina sector is poised to remain a vital part of the advanced materials landscape, connecting raw resource processing with next-generation technology.

North America currently leads the specialty aluminas market, attributed to its advanced industrial base, significant investments in research and development, and stringent environmental regulations promoting the use of high-performance materials. The region's focus on technological innovation and sustainability further propels market growth. Asia-Pacific follows closely, with countries like China, India, and Japan experiencing rapid industrialization and infrastructure development, leading to increased demand for specialty aluminas in various applications. The region's expanding electronics and automotive sectors also contribute to market expansion.

The COVID-19 pandemic initially disrupted the specialty aluminas market due to supply chain interruptions and reduced industrial activities. However, the market demonstrated resilience, with a rebound driven by the resumption of industrial operations and increased demand in sectors like healthcare and electronics, where specialty aluminas play a critical role. The pandemic also underscored the importance of supply chain diversification and the need for localized production, influencing strategic decisions in the industry.

Key Takeaways:

- Market Growth: The Specialty Aluminas Market is expected to reach USD 4.25 Billion by 2034, growing at a robust CAGR of 4.1% from 2024, owing to surge in industrial activities, particularly in emerging economies, coupled with technological innovations in manufacturing processes.

- Type Dominance: Calcined alumina leads the market by type, while low soda alumina is the fastest-growing segment, reflecting the material's critical role in high-temperature industrial processes and advanced applications.

- Application Dominance: Refractory materials dominate the application segment, with catalysts emerging as the fastest-growing application, driven by the increasing demand for specialty aluminas in chemical processing and environmental applications.

- Driver: The specialty aluminas market is driven by rising demand in refractory and ceramic applications due to rapid industrialization and infrastructure growth. Additionally, the expansion of high-tech industries such as EVs, electronics, and energy storage is boosting the need for advanced, high-performance aluminas.

- Restraint: High production costs and complex processing requirements limit the profitability and scalability of specialty aluminas. Environmental regulations and sustainability pressures further challenge manufacturers by increasing compliance and operational costs.

- Opportunity: There is a strong opportunity in developing flame-retardant and eco-friendly materials using aluminas like ATH, driven by safety and sustainability trends. Emerging applications in electronics, catalysts, and battery technologies also present significant growth avenues.

- Trend: Technological advancements are pushing the demand for high-purity aluminas in precision and electronic components. At the same time, a growing focus on circular economy and greener production practices is shaping the market’s future direction.

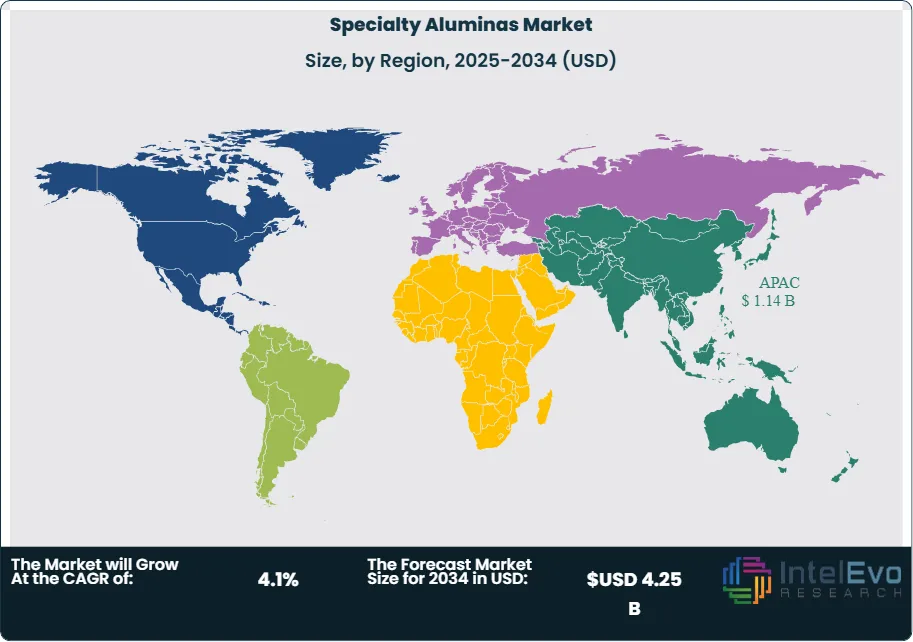

- Regional Analysis: Asia-Pacific leads the global specialty aluminas market, driven by strong industrial activity, rapid urbanization, and growing demand for high-performance materials in countries like China, India, and Japan. North America and Europe also hold significant market shares, owing to technological advancements and established manufacturing bases. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual growth, supported by infrastructure development and increasing investments in industrial processing.

Type Analysis:

Calcined alumina holds the dominant position in the specialty aluminas market due to its high thermal stability, hardness, and chemical resistance. It is widely used in refractory products, ceramics, and abrasives, making it essential for industries that require high-performance materials under extreme conditions. Its versatility and favorable cost-performance ratio further solidify its market leadership.

On the other hand, low soda alumina is the fastest-growing sub-segment, primarily due to its high purity and minimal sodium content, which is crucial in advanced applications such as electronic ceramics, LED substrates, and high-grade refractories. The growing demand from industries prioritizing precision, purity, and performance—particularly in energy storage, semiconductors, and aerospace—has fueled the adoption of low soda variants. As manufacturing technologies evolve, the need for high-specification aluminas is expected to increase, driving further growth in this segment.

Application Analysis:

Refractory Leads With the Market Share with over 35% in Specialty Aluminas Market. Refractory materials dominate the application landscape for specialty aluminas, largely due to their integral role in lining furnaces, kilns, and reactors across industries like steel, glass, and cement. Specialty aluminas such as calcined and reactive alumina provide excellent thermal insulation, corrosion resistance, and structural strength, making them indispensable in high-temperature industrial operations. The rising demand for durable refractory linings in energy-intensive sectors has sustained the strong market share of this application segment.

Meanwhile, catalysts represent the fastest-growing application segment. Activated alumina and boehmite are extensively used as catalyst supports in petroleum refining, gas processing, and emission control technologies. As global regulations on emissions and environmental sustainability tighten, industries are increasingly turning to alumina-based catalysts for efficient pollutant control and chemical conversion. The growth in green technologies and demand for cleaner industrial processes is accelerating the adoption of aluminas in catalytic applications, positioning this segment for significant future expansion.

Region Analysis:

Asia-Pacific Leads With the Market Share with over 40% in Specialty Aluminas Market. The Asia-Pacific region dominates the specialty aluminas market and is expected to maintain its leading position over the forecast period. This dominance is primarily fueled by extensive industrialization, rising construction activity, and the expanding electronics, automotive, and ceramics sectors. China, in particular, is a key consumer due to its large-scale manufacturing infrastructure and government-backed initiatives for energy efficiency and high-performance materials. India and Japan are also contributing significantly through rising demand in refractories, ceramics, and catalyst applications.

North America and Europe follow closely, benefiting from well-established industrial frameworks, environmental regulations driving demand for alumina-based catalysts, and growing investments in advanced ceramics and electronics. The presence of major players and research institutions further supports market development in these regions.

Latin America and Middle East & Africa, while currently smaller markets, are projected to see steady growth due to urban expansion, industrial upgrades, and a gradual shift toward high-temperature materials in key sectors.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- Calcined Alumina

- Activated Alumina

- Tabular Alumina

- Fused Alumina

- Aluminium Trihydroxide (ATH)

- Boehmite

- Reactive Alumina

- Other Specialty Grades

By Application

- Refractories

- Ceramics

- Polishing and Abrasives

- Catalysts and Adsorbents

- Paints & Coatings

- Others

By End-Use Industry

- Automotive

- Electronics

- Chemical & Petrochemical

- Construction

- Healthcare

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.97 B |

| Forecast Revenue (2034) | USD 4.25 B |

| CAGR (2025-2034) | 4.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type: Calcined Alumina, Activated Alumina, Tabular Alumina, Fused Alumina, Aluminium Trihydroxide (ATH), Boehmite, Reactive Alumina, Other Specialty Grades, By Application: Refractories, Ceramics, Polishing and Abrasives, Catalysts and Adsorbents, Paints & Coatings, Others, By End-Use Industry: Automotive, Electronics, Chemical & Petrochemical, Construction, Healthcare, Others |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Almatis, AluChem, Hindalco, Alteo Alumina, Traxys S.à.r.l., Axens Group, Huber Engineered Materials, Carborundum Universal Limited, Imerys Fused Minerals Villach GmbH, Nabaltec AG, Silkem d.o.o., NICHE Fused Alumina, MOTIM Electrocorundum Ltd., Sasol Germany GmbH, Resonac |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date